Your credit reports are filled with information about your financial experiences. But have you ever wondered how all that highly sensitive information about your personal accounts end up on your credit reports in the first place? You certainly didn’t give anyone explicit permission to share your information. None of us did.

Add to that the fact that some of your accounts appear on your credit reports and others do not. It can all be very confusing.

The good news is that the system isn’t as random as it may seem on the surface. There are reasons as to why certain accounts show up on credit reports and others do not.

Explanation #1: Credit Reporting is Entirely Voluntary

Banks, lenders, and other types of creditors voluntarily send or furnish details about your debts to the credit reporting agencies. No law or other legal requirement mandates creditors supply information to Experian, TransUnion, Equifax, or any other consumer reporting agency. It’s a choice they make to be what’s formally referred to as a data furnisher.

Yet many creditors choose to share information with the credit reporting agencies each month even though it isn’t required. It’s the stick in the carrot-and-stick metaphor, meaning if you don’t manage your credit properly, you’ll be punished by having that information appear on your credit reports.

So, why do so many companies volunteer to share your and their information with a third-party credit bureau?

- Credit reporting encourages customers to pay on time.

- Customers may be less likely to default on their debts.

- The more information credit reports contain, the more valuable they are to lenders.

- A company’s ability to report positive information to the credit bureaus may be a selling point to potential customers who want to build credit.

- The credit bureaus incentivize lenders to report information to their databases.

Every company that relies on credit reports and credit scores to evaluate consumer applications benefits from the data lenders report to the credit bureaus. The more information a lender has on how you have managed your credit obligations in the past, the better able it is to predict how you’ll handle your accounts in the future.

Simply put, it helps lenders make more informed decisions when they can see how well you’ve managed credit with other lenders.

Credit reports and credit scores help lenders measure the risk of loaning people money. They help to answer the question, “How likely are we to be paid back?”

Even your existing lenders see value in your credit reports. Credit card issuers, for example, may evaluate your credit reports and scores monthly (called an account management review) to make sure your credit risk level stays the same over time.

It takes considerable effort and cost for a company to furnish information to the credit reporting agencies every month. As such, some creditors may opt to avoid the hassle entirely. Other creditors may sign up to report information to one or two of the major credit bureaus, but not to all three.

Explanation #2: The Credit Bureaus Have to Accept A Lender’s Information

Credit reporting is a two-way street, a handshake if you will. In other words, just because a company wants to report information to Equifax, TransUnion, or Experian, certainly doesn’t mean the credit reporting agencies must honor the request.

For a company to furnish your account data to a credit bureau, it must first apply for service with the credit bureau(s) and then be approved. And, if a company wants to furnish data to all three major credit bureaus, it will have to submit three separate applications, one per credit bureau.

Businesses must apply with each credit bureau separately to be a data furnisher.

A creditor will need to jump through several hoops during the application process, including submitting to an on-site inspection. Even then the application isn’t guaranteed to be approved.

If a credit bureau approves a company’s application, that company must sign a subscriber agreement that details what the data furnisher can and cannot do.

For example, a data furnisher may be prohibited from asking a credit bureau to delete negative but accurate accounts simply because a consumer pays his or her debt. This restriction is common in the debt collection industry.

Also, if a data furnisher violates the terms of its agreement with a credit bureau, the bureau may suspend or terminate the company’s account. In other words, the creditor would no longer be allowed to submit account information to the credit bureau and have it included on consumer credit reports. And whatever information they have already furnished would be deleted.

Explanation #3: Creditors Must Follow the Rules

Let’s assume that a creditor wants to report information to a credit bureau and the credit bureau decides to accept it. Both parties have rules they must follow. In fact, the minute a lender reports information to your credit reports it opens them up to liability, yet another reason why not all lenders choose to report to all the credit bureaus.

The Fair Credit Reporting Act (FCRA), which has been around since the early 1970s, regulates the credit reporting industry. This statute defines what credit reporting agencies and data furnishers can do when it comes to your credit information.

An account may not show up on your credit reports for several legal reasons, even if a creditor furnishes that information to a credit bureau.

- The account is too old. The FCRA places credit reporting time limits on most types of negative credit information. For example, a collection account can only stay on your credit report for up to seven years. The same holds true for late payments, repossessions, defaults, settlements, and foreclosures. Seven years is the limit.

- An error has occurred. Per the FCRA, you’re allowed to contact the credit bureaus and dispute any accounts you believe to be incorrect. If you dispute an account and the credit bureau’s investigation rules in your favor, the credit bureau will delete the item from your credit report, or otherwise correct the error.

- The account cannot be verified by the furnisher. The FCRA also mandates that information — whether it’s positive or negative — be verifiable. This means that if you have an account on your credit reports and the credit bureaus cannot verify the accuracy of the information, it will be removed.

Many states have their own laws when it comes to credit reporting as well.

Most Lenders Have Relationships With All 3 Bureaus

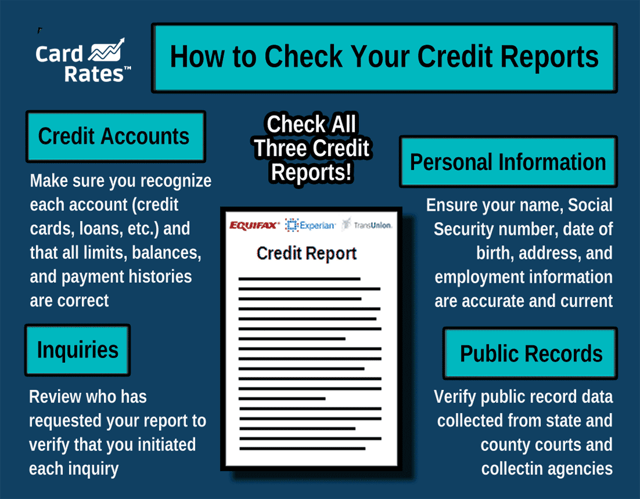

You should be as concerned with the accounts that show up on your credit reports as with any missing information. If you’re not sure which accounts are included on your credit reports and which accounts are missing, start by checking your three credit reports as soon as possible.

This process is free and can be done as often as weekly from www.AnnualCreditReport.com.

When you’ve reviewed your three credit reports, you’ll know the entire inventory of what appears on those reports. If you notice information is missing, such as a loan or a credit card, and you want that information on your credit reports, you can ask the lender to begin furnishing it to the credit bureaus — but it is not obligated to comply.

You cannot force the lender to report your account information because you have no right under any federal or state statute in that respect. But that certainly doesn’t mean you’re entirely out of luck. You can choose to refinance the loan or move your credit card business to a lender that does report to all three of the credit bureaus.

Finding a lender or credit card issuer that reports to all three credit bureaus is not difficult. In fact, most large, mid-sized, and smaller lenders have relationships with all of the credit bureaus. As such, you should be able to get the information added to your credit reports after a little work on your end to move around balances or take your business elsewhere.

“You need the right kind of computer systems and secured data access,” said Rod Griffin, director of public education at Experian. “We often audit the organizations that report to us on-site to make sure their systems are secure. The cost of doing so is prohibitive for an individual.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![How to Freeze Your Credit Reports in [current_year] How to Freeze Your Credit Reports in [current_year]](https://www.cardrates.com/images/uploads/2018/10/CR-Cool.png?width=158&height=120&fit=crop)

![4 Best Online Bank Accounts With Instant Debit Cards ([updated_month_year]) 4 Best Online Bank Accounts With Instant Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/The-Best-Online-Bank-Accounts-With-Instant-Debit-Cards.jpg?width=158&height=120&fit=crop)