Qualifying for small payday loans online is easy and the fastest way to get a loan to hold you over until your next paycheck. With the online lending networks below, you can submit a loan request for a small payday loan or a larger installment loan that you can repay over time with an affordable monthly payment.

Either loan option takes only minutes to qualify for — and the best part is that each network partners with lenders that specialize in bad credit loan products.

After you submit your payday loan application, you may receive multiple loan offers to choose from. Every offer will have a unique loan term, interest rate, loan amount, and monthly payment. Take your time deciding which loan offer is best for you.

Best Overall | More Payday Loans | FAQs

Best Overall Small Payday Loan Online

MoneyMutual offers multiple loans and helps borrowers find a direct lender that can meet their needs and budget. Whether you seek online payday lenders or a small personal loan with a longer repayment term, this network has an online loan option for you.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- Not available in NY or CT

More Payday Loan Options to Consider

The online lender networks below work just like MoneyMutual — you’ll submit a single loan request that the network forwards to every direct lender it partners with. No matter what time of the day or night, each lender can make a near-instant loan decision.

This means you’ll receive an email within minutes of submitting your loan request that may contain multiple loan offers for you to compare.

2. CashUSA.com

- Loans from $500 to $10,000

- All credit types accepted

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

Your online loan application with CashUSA will take less than five minutes to complete. You can get a signature loan or a payday advance loan from this network of lenders.

If you’re looking for a larger loan, CashUSA may be for you. Qualified applicants may receive a loan with up to 72 months (six years) to repay. A small online payday loan will have a much shorter repayment term.

3. BillsHappen®

- Quick loans of up to $5,000

- Submit one form to receive multiple options without harming your credit score

- All credit ratings welcome to apply

- Requires a driver's license, bank account, and SSN

- Get your funds as soon as tomorrow

The lenders that partner with BillsHappen can make a direct deposit of your online payday loan or signature loan funds into your checking account as soon as the next business day. Some lenders offer instant bank account deposits for an additional fee.

The payday advance loan options from this network are far more affordable than a traditional cash advance. Instead of sky-high interest rates that can climb to as much as 400%, BillsHappen’s lenders charge a two-digit annual percentage rate for most loan types.

4. CreditLoan®

- Loans from $250 to $5,000 available

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad Credit OK

- More than 750,000 customers since 1998

Every payday lender that partners with CreditLoan can offer small loan options for any borrower who has a bad credit score. These lenders provide fast loan approval and processing and can put money in your bank account by the next business day.

Although some of these lenders work in the payday lending industry, your credit score may help you qualify for an installment loan that has a more affordable interest rate. You’ll get a better idea of which loan you qualify for when the network conducts a soft credit check under your name as part of the loan request process.

- Loan amounts range from $500 to $10,000

- Compare quotes from a network of lenders

- Flexible credit requirements

- Easy online application & 5-minute approval

- Funding in as few as 24 hours

Bad Credit Loans maintains a network of lenders that offer several loan options — including secured and unsecured personal loans. This network also has payday loan partners that offer cash advance loans that can be deposited directly into your bank account.

This network has a long history of finding loan options for just about every bad credit borrower. In fact, the network claims that it can typically find a loan for you even if you’ve been turned down by a bank, credit union, or another lender.

- Loan amounts range from $1,000 to $35,000

- All credit types welcome to apply

- Lending partners in all 50 states

- Loans can be used for any purpose

- Fast online approval

- Funding in as few as 24 hours

PersonalLoans.com can help you find a small personal loan or a longer-term signature loan. But you can also connect with a payday loan provider if you only need a small payday loan to get you to your next payday.

Your interest rate will be determined by your credit score, the lender you work with, and the type of loan you accept. Payday advance loans may come with a higher interest rate than that of a traditional loan but will have more forgiving loan approval criteria.

- Loan amounts range from $100 to $1,000

- Short-term loans with flexible credit requirements

- Compare quotes from a network of lenders

- 5-minute approvals and 24-hour funding

- Minimum monthly income of $1,000 required

- Current employment with 90 days on the job required

Your payday loan application only takes minutes to complete on CashAdvance.com. Once approved, you can have money in your account by the next business day — or faster for an additional fee if this is an emergency loan.

Cash advance loans often have a substantially higher interest rate when compared with installment loans. Only use this type of loan as a last resort during an emergency. Otherwise, you’ll likely end up owing much more than you borrowed.

What is a Payday Loan?

A payday loan — otherwise known as a cash advance loan — is a short-term loan that is designed to act as a bridge to your next payday. As a result, online payday lenders expect repayment in full, typically within seven to 30 days.

This isn’t a traditional loan that allows you to satisfy your debt through a series of monthly payments. Online payday loans are often far more expensive than personal loans.

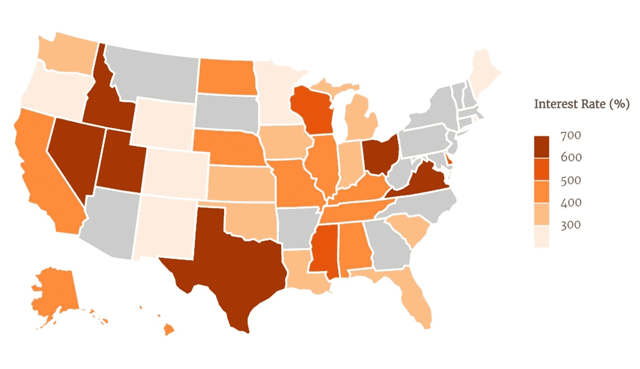

You can expect to pay a finance charge of around $15 for every $100 you borrow, which can amount to an APR of over 400%. And some states allow interest rates much higher than that, as pictured in the following map (gray states indicate where payday loans are illegal):

If you cannot repay the loan on time, the lender may roll your debt into a new loan with a penalty charge and a higher interest rate. This can result in thousands of dollars in finance charges for a small loan of only a few hundred dollars and is why loan rollovers aren’t allowed in every state.

That’s why we only recommend a payday loan if you have no other option and desperately need money fast. These loans may not require a credit check for approval if you can provide proof of enough income to repay the loan on time. Still, this convenience comes at a high cost.

Even if you have poor credit, you may still qualify for a more affordable personal loan through the online lending networks listed above.

How Can I Borrow Money Instantly?

The online lending networks listed above use automated underwriting to give instant prequalification decisions to most applicants. Once you complete your loan paperwork, you can have money in your account by the next business day. Some lenders offer instant payouts for an additional fee.

If you need an instant cash loan with an immediate payout, your best bet is to research secured loans in your area. Examples of a secured loan include a title loan or a pawnshop loan.

A secured loan requires collateral to guarantee your loan. For example, you’ll need to hand over your vehicle’s title to acquire a title loan. If you don’t repay the debt on time, the lender will repossess your vehicle and sell it.

While these loans may be quick and convenient, they’re often very expensive and put all of the risk in your hands. That’s why we suggest personal loans if you need quick, affordable cash.

What’s the Difference Between a Personal Loan and a Payday Loan?

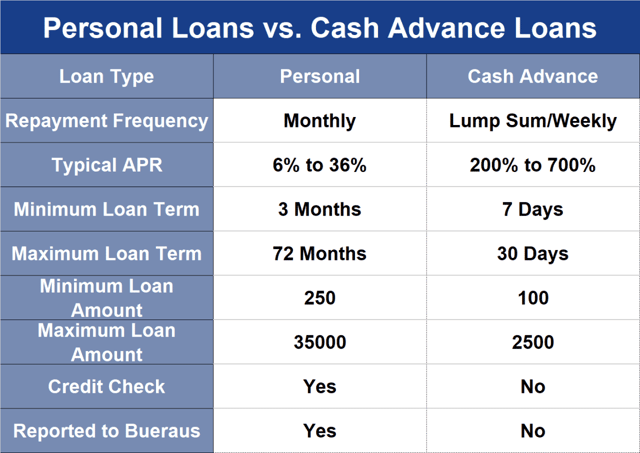

A personal loan is a type of installment loan that allows you to repay your debt over a series of monthly payments. A payday loan is a short term loan that requires repayment in full by your next payday.

Personal loans are more affordable because they charge a lower interest rate and finance fees. The best loan terms go to borrowers who have a good credit history, which is reviewed by the lender through a credit check.

Payday loans don’t always require a credit check. These loans are designed for bad credit borrowers, and lenders charge substantially higher rates on payday advances to offset the risk they are taking.

And since payday loans have a shorter repayment term, you may not be able to borrow more than $500 or so at a time. Personal loans, on the other hand, may provide as much as $10,000 or more, with up to 72 months to repay the debt.

How Much Can I Borrow With a Payday Loan?

The amount you’re able to borrow with a payday loan will depend on your state’s laws and your income. Some states allow payday loan amounts of just $300, whereas other states allow loans of up to $1,000.

Most payday loan lenders base your loan amount on how much the lender thinks you can afford to repay when your next paycheck arrives. That said, most payday loans max out around $1,200.

The amount you can borrow depends on the lender you work with and the state you live in. Some states set caps on the amount you can borrow through a payday loan.

If you need more than that and can prove sufficient income, you may be able to negotiate a larger loan with your lender. But due to the high finance charges associated with payday advances, a personal loan is a much smarter and affordable loan option than a cash advance loan.

Research the Best Small Payday Loans Online

You can often find small payday loans online that will approve you with just about any credit score. Just remember that a cash advance loan is expensive and risky — if you can’t repay the debt as agreed, interest fees will continue to accrue until the debt is satisfied.

Before you accept one of these loans, submit a loan request to the online lending networks above. These networks may provide you with the cash advance loan you need, but you may also qualify for a personal loan with a more affordable interest rate, a larger loan amount, and a longer repayment term.

That means more money in your pocket and less stress on your monthly budget.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Instant-Approval Payday Loans Online ([updated_month_year]) 7 Instant-Approval Payday Loans Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/09/Instant-Approval-Payday-Loans-Online.jpg?width=158&height=120&fit=crop)

![7 Payday Loans Online With Same-Day Approval ([updated_month_year]) 7 Payday Loans Online With Same-Day Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Payday-Loans-Online-Same-Day-Approval.jpg?width=158&height=120&fit=crop)

![7 Best Payday Loans For Bad Credit ([updated_month_year]) 7 Best Payday Loans For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Best-Payday-Loans-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![5 Best Online Personal Loans for Bad Credit ([updated_month_year]) 5 Best Online Personal Loans for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/loan.png?width=158&height=120&fit=crop)

![7 Small Loans For Bad Credit Online ([updated_month_year]) 7 Small Loans For Bad Credit Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Small-Loans-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![11 Easiest Online Loans ([updated_month_year]) 11 Easiest Online Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/07/shutterstock_443859163.jpg?width=158&height=120&fit=crop)

![7 Best Same-Day Loans Online ([updated_month_year]) 7 Best Same-Day Loans Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Same-Day-Loans-Online.jpg?width=158&height=120&fit=crop)

![7 Car Loans Easy to Get Online ([updated_month_year]) 7 Car Loans Easy to Get Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Car-Loans-Easy-to-Get.jpg?width=158&height=120&fit=crop)