Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Starting adult life with a meager credit history or a low credit score is never an advantage. But there are financial pitfalls when parents try to get the ball rolling for their children ages 14-25 by adding them to their accounts as authorized users. FreeKick is a secured savings product from Austin Capital Bank that replaces the complexities of credit authorization with a structured deposit account that can build a lasting credit history for children without financial complications. FreeKick helps young people emerge into adulthood with a clean credit profile and a strong credit score.

A catch built into the credit industry puts children and young adults of the Gen Z generation at a disadvantage over more well-established consumers: you need credit to get credit. Lack of significant credit history or a credit score on the higher end of the scale can mean substantially elevated costs for millions of Gen Z consumers moving into financial independence and poised to make milestone credit purchases like homes and cars.

Many parents want to help their children get a healthy financial start to adulthood. The best-known approach to assisting children in building credit is for parents to add them to their accounts as authorized users.

Unfortunately, that comes with several pitfalls that can adversely impact family finances and even put children further behind at a crucial time in their financial life. And that makes the authorized user tradition ripe for disruption.

FreeKick, a secured savings product from Austin Capital Bank, is doing just that by replacing credit authorization with a set-it-and-forget-it deposit account that automatically builds a lasting credit history and a higher credit score for children without risking anyone’s finances.

Austin Capital Bank’s CEO, Erik Beguin, said he invented FreeKick to solve that problem for himself and his 19-year-old. Beguin is on a mission to inform families who may not understand the downsides of the credit authorization strategy until it’s too late.

The most consequential pitfall is that children lose their credit history as authorized users when their parents remove them from their accounts.

“The dirty little secret of the authorized user approach is you’re not actually building anything for your children — they’re just piggybacking on your credit,” Beguin said. “I basically built FreeKick for my family, and now I’m sharing it with every family in America.”

Parent-Sponsored Credit Building Based on Savings

Beguin founded Austin Capital Bank in 2006 to bring the benefits of community banking and financial services innovation to consumers in Central Texas. Gaining better credit history and a higher credit score through FreeKick lowers credit costs and can open doors for apartment rentals and reduced insurance premiums.

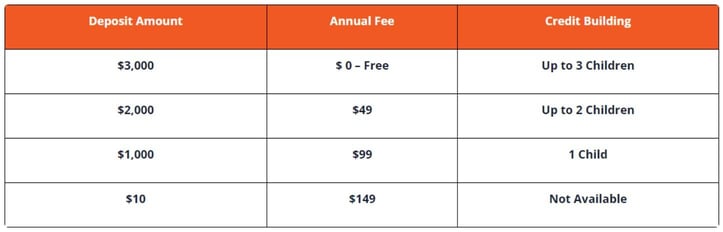

Parents deposit between $10 and $3,000 into a FreeKick savings account, and the system uses those funds to pay a $600 credit-builder loan on behalf of the child. Annually renewing the arrangement allows more credit history to accumulate. It’s a free service for those who make the $3,000 deposit; those who deposit a lower amount pay a small fee.

The piggybacking issue arises because when parents remove children from their accounts, the beneficial credit history they accrued disappears. If the child has had authorization for 10 years, a decade of credit history suddenly goes down the tubes. And because credit history comprises 15% of the FICO score, the child is now on the hook for markedly higher credit costs.

“You don’t want to coordinate with your child forever on using credit,” Beguin said. “The average consumer with an 800-plus FICO score has a ten-and-a-half-year credit history, so the sooner you start building, the better.”

The authorization strategy presents other obstacles. Parents must have a strong credit score to get the ball rolling. When a sudden financial bump results in past-due delinquency for the parent, it impacts the child, too. And then there’s the issue of children engaging in out-of-control spending for which there’s no remedy.

“If you’ve added your child as an authorized user to build their credit, and they use it irresponsibly, you can’t protest that the spending is unauthorized because you authorized it,” Beguin said.

Education Center Explains Credit Scores and Finances

No one wants to be in that situation. Another pitfall is that spending can disrupt careful plans to maintain credit utilization rates within optimal thresholds, unexpectedly impacting parents and children.

The authorized user strategy also creates complications because the three major US credit bureaus responsible for weighing various factors to derive scores don’t play by the same rules. Two of the three bureaus remove a trade line when it becomes delinquent. That may severely inconvenience the child when it’s time to pay for the next semester of college classes and their card gets rejected.

“It isn’t as simple as just adding your child as an authorized user, and they’ll have a great credit score,” Beguin said.

FreeKick makes everything about building credit for children easier. In keeping with Austin Capital Bank’s mission to grow the wealth of the communities it serves, FreeKick offers an Education Center to help parents and children understand that there’s a better way.

Education Center resources explain the credit score system and how establishing a strong credit profile for children and young adults leads to better approval rates, lower interest rates, and better terms.

The center offers copious financial literacy resources, including personal finance books for children, strategies to instruct young people about money and the financial system, and money games and teaching tools to help parents and children work toward a common financial goal.

It also offers good-natured advice for parents about financial topics that many often consider challenging, such as whether allowances are beneficial and how spending money is actually healthy for children. FreeKick is a credit-building tool but also an entry into higher-level financial competency for families.

“If you know all the rules of the game and how banking works, you set yourself up for success,” Beguin said.

Empowering Families to Build a Better Financial Future

Families rely on credit for financial flexibility and to manage big purchases that would otherwise be impossible. In the right hands, credit is a tool that improves the lives of consumers and fuels personal and community growth and progress.

But in the wrong hands, credit is a one-way street to financial and lifestyle impediments that prevent consumers from making the most of their potential and getting what they want out of life. That’s how vital FreeKick is for thousands of parents who want what’s best for their children and their finances simultaneously.

“You start building credit at 14, and you can run it until they’re 25 and end up with a 10-year trade line,” Beguin said. “Remember: 10 years is the magic number for people with an 800 credit score.”

All that’s required is a small initial investment and an annual renewal. FreeKick also pays 1% on deposits to sweeten the deal. Given that consumers have hundreds of billions sitting in checking accounts, savings accounts, and time deposits earning no interest, that’s a nice benefit. FreeKick also provides identity protection for up to two adult parents and six children with every plan.

“From birth to age 13, we’re protecting their identity,” Beguin said. “A million children have their identity stolen every year, and children are 50 times more likely to have their identity stolen than adults.”

According to the FreeKick website, good credit can help children save more than $200,000 during their lifetime. As of summer 2023, Beguin and the FreeKick team plan have expanded the system to encompass an entire family in one account.

“FreeKick helps you help your child arrive at adulthood with a clean credit profile and strong credit,” Beguin said. “That’s the foundation for a fantastic financial future.”

![5 Best Credit Cards for Authorized Users ([updated_month_year]) 5 Best Credit Cards for Authorized Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Authorized-Users.jpg?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year]) How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-build-business-credit1.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Single Parents ([updated_month_year]) 7 Best Credit Cards for Single Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Single-Parents.jpg?width=158&height=120&fit=crop)

![5 Credit Card Tips for New Parents ([updated_month_year]) 5 Credit Card Tips for New Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/10/shutterstock_1672923496-1.jpg?width=158&height=120&fit=crop)

![9 Best Prepaid Debit Cards For Teens & Parents ([updated_month_year]) 9 Best Prepaid Debit Cards For Teens & Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Best-Prepaid-Debit-Cards-For-Teens-Parents.jpg?width=158&height=120&fit=crop)