Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

As a result of inflation, stagnating salaries, and mass layoffs, among other economic factors, consumer spending has turned into a huge credit card problem. In the US, total credit card debt has risen from $770 billion in the first quarter of 2022 to $986 billion in the fourth quarter of 2022.1

Read below to learn why household debt has ballooned and what the average consumer can do about it.

-

Navigate This Article:

The Average Household Is $9,654 in Credit Card Debt

Credit card debt seems to be a growing problem for American families. Currently, the average US household owes $9,654, up 8.39% from the same period in 2022.2

| Q1 2022 | Q1 2023 | Change |

|---|---|---|

| $8,916 | $9,654 | +8.39% |

Having a credit card balance can make it hard for families to save and invest for their future. Credit card debt can be an anchor, weighing people down so they can’t focus on other financial goals. And because credit card debt has such high interest rates, borrowers can accrue hundreds or even thousands in interest fees.

Households Pay an Average of $1,380 in Annual Interest

When you carry a credit card balance, you’re usually charged a high interest rate. This can be very costly over time. In fact, US households carrying credit card debt will pay an average of $1,380 in interest in 2023.3

Here are the primary factors contributing to Americans’ high credit card balances and resulting interest charges:

High Inflation Outpacing Americans’ Incomes

Data from the Bureau of Labor Statistics found that inflation has outpaced American salaries. While income increased by 3% in May 2021, inflation increased by 5%.4 A year later, inflation also went up by 8.6% and wages only went up by 6.1%.

Growth of Wages vs. Inflation in the US in May of Each Year:

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Wages | 3.5% | 3% | 6.1% | 6% |

| Inflation | 0.1% | 5% | 8.6% | 3% |

The rate of inflation was also higher for many necessary items, making it impossible for consumers to avoid tightening their wallets. For example, in 2022, the cost of food increased by almost 10%. In 2023, food prices are projected to increase by 6.3%, making access to healthy food more difficult for the average American.

If salaries cannot keep up with inflation, then consumers will have a harder time covering their expenses. And while most consumers will try multiple cost-saving strategies, many will end up resorting to credit cards to bridge the gap.

Increasing Housing Costs

For most people, the biggest slice of their budget is their mortgage or rent payment. And since COVID, the cost of housing has risen far more than people’s salaries.

On average, rents increased by 15% from 2021 to 2022. In 2019, the median national monthly rent was $1,600, but skyrocketed to $2,002 by May 2022.5

The figures are even worse in major cities. Austin led the country with a 48% increase, while Nashville, Seattle, and Cincinnati saw 32% increases in housing costs. Out of the 50 largest metropolitan areas in the country, only three saw lower monthly rent figures.

When rents increase, people may be forced to move, which comes with its own share of expenses, or they can stay and pay more than they can afford.

Rising Interest Rates

The Federal Reserve increased interest rates seven times in 2022, and three times (so far) in 2023.6 And when the Fed raises rates, credit card companies respond.7

The average credit card interest rate rose from 14.51% APR in 2022 to 23.74% APR in 2023.8,9 But those with poor credit saw their average credit card interest rate climb closer to 27% APR.

| Date | Avg. Interest Rate (All Card Accounts) | Avg. Interest Rate (Accounts Assessed Interest) | Prime Rate |

|---|---|---|---|

| Feb. 2023 | 20.09% | 20.92% | 7.75% |

| Nov. 2022 | 19.07% | 20.40% | 6.95% |

| Aug. 2022 | 16.27% | 18.43% | 5.50% |

| May 2022 | 15.13% | 16.65% | 3.94% |

| Feb. 2022 | 14.56% | 16.17% | 3.25% |

| Nov. 2021 | 14.51% | 16.44% | 3.25% |

And while this isn’t a problem for cardholders who pay off their credit card balance in full every month, it does present a challenge to those who carry a balance from month to month.

When the interest rate on your credit card increases, you will pay more interest every month. This can make it harder to pay down the balance, lengthen your total debt payoff timeline, and increase the payoff amount.

For example, let’s say you had a $10,000 balance on a credit card with a 15% APR and a $300 monthly minimum payment. By the time you pay off the balance, you will have paid $3,017 in total interest.

But if the interest rate increases to 23% APR, you will pay $6,095 in total interest if you only make the minimum payments. That’s a difference of more than $3,000.

3 Ways to Reduce How Much Interest You Pay

You can employ strategies to lower your credit card interest rate if you’re frustrated with your interest charges. Read below to see how you can potentially get a better interest rate to help you pay down your balance.

Ask the Card Issuer for a Lower Rate

The easiest thing to do is to contact your credit card provider and ask them for a lower interest rate. You can do this for every credit card you have with a balance.

Call the main customer service hotline and simply ask the representative if you qualify for a lower interest rate. This should not result in a credit check so it will not hurt your credit score.

If they agree, ask when the new interest rate will take effect. If they say you already have the lowest interest rate possible, set a reminder on your phone to check back in a couple of months. Remember, it doesn’t cost you anything to call the credit card provider and ask for a lower rate.

Transfer Your Balance to a New Card

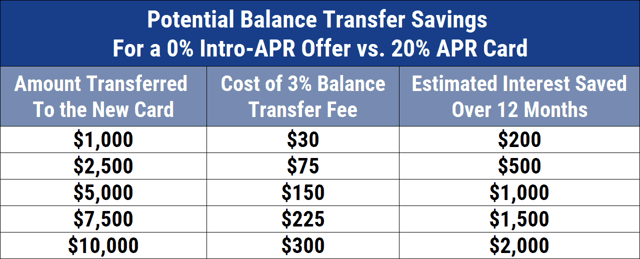

Some credit card companies offer a 0% APR deal if you transfer an existing balance to their card. These offers usually last between six and 21 months, depending on the card issuer and their internal policies.

During this time, interest will not accrue on your balance. Every dollar you pay will go toward the principal, so you can pay off your credit card balance faster. When the offer ends, the interest rate will switch to a regular interest rate based on current rates.

There is usually a balance transfer fee, often 3% to 5% of the amount transferred. For example, if you transfer a $10,000 balance, you may pay a $300 fee. Make sure to factor this in when calculating your total potential savings.

You typically have to be a new cardholder to qualify for the promotion. If you’re not sure about your eligibility, call the card provider and ask them whether you qualify.

Improve Your Credit

Your options are a bit more limited when you have bad credit. You may not qualify for a 0% APR balance transfer offer or a consolidation loan with a low interest rate.

The first step should be to make all of your bill payments, especially your loan and credit card payments, on time. Payment history counts for 35% of your FICO credit score. It doesn’t matter if you only pay the minimum every month, as long as you pay by the due date. Making payments early won’t give you an extra boost.

If you’re forgetful, you can sign up for automatic payments so the money will be automatically withdrawn from your account each month.

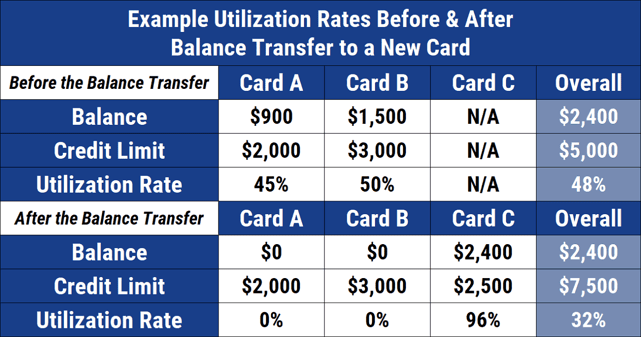

Next, work on decreasing your credit card utilization percentage, which is a part of the metric that makes up 30% of your credit score. The credit utilization percentage refers to the current credit card balance divided by the total credit limit.

The ideal credit utilization percentage should be 10% or less, but you can also earn a decent credit score with a percentage as high as 30%.

You can lower your credit utilization ratio by paying off your credit card balance. Start by focusing on the card with the highest interest rate to save the most money. Another way to lower the utilization percentage is to ask the credit card provider to increase your credit limit.

In Conclusion

If you have credit card debt, don’t despair. There are ways to reduce your balance, even if you’re still struggling to make ends meet.

Work on increasing your income, reducing expenses, and finding ways to lower your credit card interest rate. By employing multiple strategies, you can make a dent in your debt.

More Relevant Statistics:

- Average Credit Card Debt by Country

- Average Credit Card Debt by Year

- Average Credit Card Debt by Age

- Average Credit Card Debt by State

- Average Credit Card Debt in America

Data Sources:

1 https://www.newyorkfed.org/microeconomics/hhdc.html

2 https://wallethub.com/edu/cc/credit-card-debt-study/24400

3 https://www.nerdwallet.com/article/credit-cards/average-credit-card-debt-household

4 https://www.statista.com/statistics/1351276/wage-growth-vs-inflation-us/

5 https://www.redfin.com/news/redfin-rental-report-may-2022/

6 https://www.cbsnews.com/news/federal-reserve-interest-rates-2023-cbs-news-explains/

7 https://www.pbs.org/newshour/economy/federal-reserve-rate-hikes-likely-to-cause-a-recession-research-says

8 https://www.moneygeek.com/credit-cards/analysis/average-credit-card-interest-rates

9 https://www.investopedia.com/average-credit-card-interest-rate-5076674

10 https://wallethub.com/edu/cc/historical-credit-card-interest-rates/25577

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in American Households ([current_year]) Average Credit Card Debt in American Households ([current_year])](https://www.cardrates.com/images/uploads/2018/01/avgdebt.png?width=158&height=120&fit=crop)

![Average Credit Card Debt by Age in [current_year] Average Credit Card Debt by Age in [current_year]](https://www.cardrates.com/images/uploads/2023/05/CR-AverageCreditCardDebtbyAge.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt by State in [current_year] Average Credit Card Debt by State in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtbyState-1250X650.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt by Country in [current_year] Average Credit Card Debt by Country in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtbyCountry-1250X650.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in America in [current_year] Average Credit Card Debt in America in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtInAmerica-1250X650.jpg?width=158&height=120&fit=crop)