Carrying over credit card debt from one month to the next is a common practice among American credit card holders. But life has become more expensive due to inflation, and many consumers are charging the things they want and need instead of paying cash.

But unless a cardholder repays the balance in full when the bill comes in, compound interest will be added to the unpaid balance as it rolls over to the next month. This means you will pay more than you borrowed, and it will take you longer to pay off your balance.

The Federal Reserve Bank of New York reported credit card debt topped $986 billion in the first quarter of 2023, with American households owing their share of $9,654.1,2

-

Navigate This Article:

Americans Collectively Owe $986 Billion in Card Debt: Here’s How That Breaks Down by State

If you owe money on your cards, the balances you’re holding may be higher or lower than those of people in your community. Comparing and contrasting the numbers can give you insight into where you stand with the rest of the country, based on your location.

LendingTree analyzed the credit reports of its users to find the average credit card debt in each state in 2022.3 Here is how the data breaks down in order of highest to lowest balances.

| State | Average Credit Card Debt Per Person (2023) |

|---|---|

| Connecticut | $9,408 |

| New York | $9,165 |

| New Jersey | $9,044 |

| Rhode Island | $8,728 |

| Texas | $8,701 |

| Florida | $8,573 |

| Hawaii | $8,556 |

| Maryland | $8,463 |

| Massachusetts | $8,405 |

| Alaska | $8,185 |

| Colorado | $8,011 |

| Delaware | $7,993 |

| Nevada | $7,905 |

| Georgia | $7,790 |

| California | $7,758 |

| Illinois | $7,756 |

| North Dakota | $7,714 |

| Virginia | $7,663 |

| Maine | $7,518 |

| Utah | $7,489 |

| New Hampshire | $7,415 |

| Vermont | $7,368 |

| Washington | $7,365 |

| Minnesota | $7,217 |

| Arizona | $7,213 |

| Wyoming | $7,098 |

| South Carolina | $7,063 |

| North Carolina | $6,955 |

| Nebraska | $6,900 |

| Kansas | $6,762 |

| Michigan | $6,744 |

| Oregon | $6,682 |

| Pennsylvania | $6,620 |

| Missouri | $6,599 |

| Louisiana | $6,475 |

| Alabama | $6,453 |

| Oklahoma | $6,401 |

| Ohio | $6,394 |

| South Dakota | $6,367 |

| New Mexico | $6,367 |

| Iowa | $6,315 |

| Tennessee | $6,240 |

| Montana | $6,160 |

| Arkansas | $6,117 |

| Wisconsin | $6,090 |

| Idaho | $6,073 |

| Mississippi | $6,035 |

| West Virginia | $6,008 |

| Indiana | $5,642 |

| Kentucky | $5,408 |

These balances are even more alarming than they first appear because the added interest can be so expensive. In February 2023, the Federal Reserve Bank of St. Louis reported that the average credit card APR on accounts with balances incurring interest was 20.92%.4

Connecticut Has the Highest Average Credit Card Debt: $9,408

Because Connecticut has a high average household income — $100,639 for a household of two earners5 — residents tend to have higher than average credit card debt. Credit card limits are based not just on credit scores, but also on the amount a borrower can afford to repay, i.e., their income and outstanding debt.

So if you have the means to make at least the minimum payments on a high credit limit, the credit card issuer may provide a greater level of charging power.

Kentucky Has the Lowest Average Credit Card Debt: $5,408

Kentucky not only has one of the lower median incomes in the United States — $66,902 for a two-earner household5 — it also has the lowest average credit card debt. Consequently, the credit limits will follow suit.

The less money you can afford to pay, the less you will be able to borrow. The end result is a smaller credit limit and lower debt.

How Card Debt Correlates to Credit Scores in Each State

There is a strong correlation between how much someone owes in credit card debt and their credit scores.

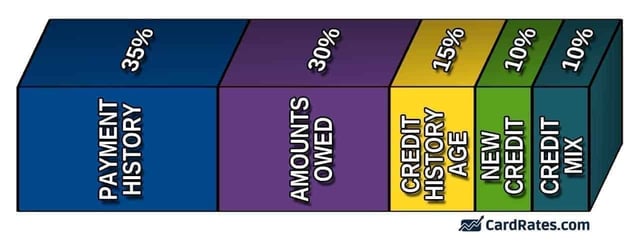

Credit scoring companies, such as FICO, weigh some information on a credit report heavier than others. Credit utilization is second only to payment history as the most important credit scoring factor.

The amount of debt you carry comprises 30% of your FICO score.

The less you owe on your credit cards as compared to the amount you can borrow, the broader your credit utilization will be. That results in a better credit score because it indicates you are not over-borrowing to make ends meet.

Conversely, if you have used up all or most of your credit card limit, your credit scores are likely to be lower because lenders see that as an overreliance on borrowing to get by.

The common rule of thumb is to have at least 70% of your balance available. So if you have a credit card with a $1,000 limit, revolving no more than $300 on that card is recommended to achieve a high credit score. If the total of your credit limits on all cards is $10,000, the total of your revolving debt should be under $3,000.

That’s why the high and low scores per state begin to make sense. The average credit score in the US in 2022 was 714.6

In Connecticut, the state with the highest average credit card debt, it was 725, so better than the national average. On the other hand, credit scores for Kentucky averaged 702, far lower than the national average.

| State | Average Credit Score in 2022 |

|---|---|

| Alabama | 691 |

| Alaska | 723 |

| Arizona | 712 |

| Arkansas | 694 |

| California | 721 |

| Colorado | 730 |

| Connecticut | 725 |

| Delaware | 714 |

| District of Columbia | 716 |

| Florida | 707 |

| Georgia | 694 |

| Hawaii | 732 |

| Idaho | 727 |

| Illinois | 719 |

| Indiana | 712 |

| Iowa | 729 |

| Kansas | 721 |

| Kentucky | 702 |

| Louisiana | 689 |

| Maine | 728 |

| Maryland | 716 |

| Massachusetts | 732 |

| Michigan | 718 |

| Minnesota | 742 |

| Mississippi | 680 |

| Missouri | 712 |

| Montana | 731 |

| Nebraska | 731 |

| Nevada | 702 |

| New Hampshire | 734 |

| New Jersey | 724 |

| New Mexico | 699 |

| New York | 721 |

| North Carolina | 707 |

| North Dakota | 733 |

| Ohio | 715 |

| Oklahoma | 693 |

| Oregon | 732 |

| Pennsylvania | 723 |

| Rhode Island | 723 |

| South Carolina | 696 |

| South Dakota | 734 |

| Tennessee | 702 |

| Texas | 693 |

| Utah | 730 |

| Vermont | 736 |

| Virginia | 721 |

| Washington | 735 |

| West Virginia | 700 |

| Wisconsin | 735 |

| Wyoming | 723 |

To extrapolate: Connecticut residents may carry more debt than residents of Kentucky, but they may have much broader credit utilization ratios.

How Balance Transfer Cards Can Help

No matter where you live in the country, if you are burdened with expensive credit card bills because the interest fees are eroding your payments, a solution may be closer than you think. A balance transfer credit card that offers a 0% APR for a limited period can help.

With a 0% APR balance transfer card, you can move your existing debt to the new card account. This will give you a fixed number of months to repay the transferred balance with no finance fees added to the debt.

Most accounts charge a transfer fee of between 2% and 5% of the balance, but the final savings can be tremendous. The 0% time frame is currently anywhere between 12 months and 21 months.

For example, let’s say you have a $5,000 credit card balance with a 21% APR. Your goal is to pay the entire debt off in 15 months.

- If you keep your debt with the original card, you would need to make monthly payments of $381 to reach your goal. The total interest paid would be $728.

- If you transfer the balance to a credit card that gives you 0% APR for 15 months and charges 2% of the balance as a fee ($100), the monthly payment would drop to $340. You would get out of debt within that same time frame with no interest paid whatsoever. You would save $628 in interest and the monthly payments would be $41 lower.

To qualify for a 0% APR balance transfer card, you usually have to have a good credit score. Check your score before applying, and if yours is on the low side (below 700), you can use the following strategies to help bring it up:

- Always pay the accounts listed on your credit reports on time. Delinquencies will drag your scores down, but they can be offset with a stream of timely payments.

- If the amount of debt you have is hurting your credit utilization ratio, either pay some of it down first or ask the credit card issuer if they will agree to a higher credit limit. This will lower your credit utilization ratio.

- Do not apply for credit products unless you really need them. Too many hard inquiries, especially when your scores are already low, can negatively affect credit scores.

In Conclusion

Whether your credit card balance is higher or lower than the average for your state, what is most important is that you achieve your own financial health. Debt that is accumulating interest and the accompanying payments robs money from your budget.

Take action to drive the debt down, even if you don’t use a balance transfer credit card.

Once you’re back in the black, plan on keeping it that way. Only charge when you’re certain that you can pay the balance in full by the time the bill rolls in. When you do, you won’t have to worry about debt or interest — and you can be sure that you are feeding your credit reports positive information that will result in high credit scores.

More Relevant Statistics:

- Average Credit Card Debt by Country

- Average Credit Card Debt by Year

- Average Credit Card Debt by Household

- Average Credit Card Debt by Age

- Average Credit Card Debt in America

Data Sources:

1https://www.newyorkfed.org/microeconomics/hhdc

2https://wallethub.com/edu/cc/credit-card-debt-study/24400

3https://www.lendingtree.com/credit-cards/credit-card-debt-statistics/

4https://fred.stlouisfed.org/series/TERMCBCCINTNS

5https://www.justice.gov/ust/eo/bapcpa/20230401/bci_data/median_income_table.htm

6https://www.experian.com/blogs/ask-experian/what-is-the-average-credit-score-in-the-u-s/

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in American Households ([current_year]) Average Credit Card Debt in American Households ([current_year])](https://www.cardrates.com/images/uploads/2018/01/avgdebt.png?width=158&height=120&fit=crop)

![Average Credit Card Debt by Age in [current_year] Average Credit Card Debt by Age in [current_year]](https://www.cardrates.com/images/uploads/2023/05/CR-AverageCreditCardDebtbyAge.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt by Country in [current_year] Average Credit Card Debt by Country in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtbyCountry-1250X650.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt By US Household in [current_year] Average Credit Card Debt By US Household in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtbyHousehold-1250X650.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in America in [current_year] Average Credit Card Debt in America in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtInAmerica-1250X650.jpg?width=158&height=120&fit=crop)