Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Almost every developed and emerging country uses credit cards these days. But when you look below the surface, credit card use varies significantly from country to country, and the countries with the highest credit card debt may surprise you.

If you’re interested in learning about how different nations use credit cards, keep reading to see which have the biggest balances.

-

Navigate This Article:

Average Credit Card Debt Among Countries With the 10 Largest Economies

Unfortunately, the United States tops the list of median credit card debt compared to the countries with the largest Gross Domestic Product (GDP).

Here’s how countries with the 10 highest GPDs rank in terms of median credit card debt, per the latest data we could find for each country, converted to USD:1-4

| Country | Average Debt (USD) |

|---|---|

| United States | $5,910 |

| Japan | $2,900 |

| United Kingdom | $2,316 |

| Germany | $2,052 |

| Canada | $1,604 |

| China | $1,728 |

| France | $1,616 |

| Italy | $811 |

| Brazil | $497 |

| India | $302 |

The US Has the Highest Median Credit Card Debt — $5,910

In the countries with the highest GDP, the US takes the cake when it comes to median credit card debt. Rising interest rates have contributed to high credit card balances, while inflation has also made it more difficult for Americans to afford their expenses.

India Has the Lowest Median Credit Card Debt — $302

Compared to other countries with high GDPs, India has the lowest median credit card balance. That said, it’s difficult to compare credit card use in other countries with credit card use in the US, particularly countries where the cost of living is much lower.

In India, the cost of living is 81% less expensive than it is in the US,5 so it makes sense that their median usage is lower than that of other countries.

Credit Card Use in Foreign Countries

The world average for credit card penetration, which refers to the percentage of the adult population that have credit cards, is 24.4%. In Canada, credit card use was 82% in 2021 — the highest in the world.6

Japan’s credit card penetration was almost 70%, which is slightly higher than in the US. The United Kingdom had a 62% rate, while Italy was at 57.8%. In Germany, 56.6% of consumers have credit cards.

Other countries with large economies have lower credit card usage rates. In Brazil, only 40.4% of adults use credit cards, while the usage rates were 39.7% and 37.8% in France and China, respectively.

5 Ways Americans Can Reduce What They Owe

Struggling to knock out your credit card debt? Here are some tips and tricks to pay down your balance while minimizing the interest owed.

Apply For a Balance Transfer Card

High interest rates are one reason people struggle to pay off credit card debt. When you have a high interest rate, a large percentage of your payment will go toward the accrued interest — not the principal.

To maximize how much you’re paying toward the principal, you can apply for a new credit card with a 0% APR on balance transfers. These special offers only last for a limited period of time, usually between six and 21 months. During that time, interest will not accrue.

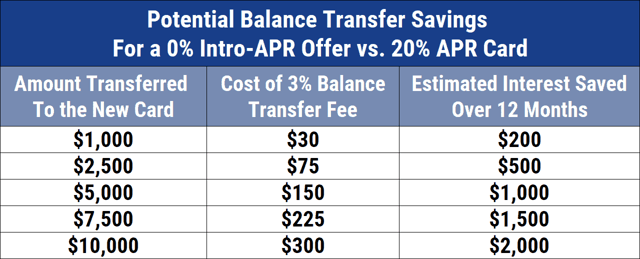

When you transfer an existing balance to a new card, you will likely have to pay a balance transfer fee. This fee is usually 3% or 5% of the amount transferred, depending on the card. For example, if you transfer $5,000, you could pay $150 to $250 in fees.

But here’s how much you could save by transferring your balance: Let’s say you qualify for a 0% APR offer for 18 months. You transfer a $5,000 balance from your card with 20% APR. If you can pay off the entire balance in 18 months, you would save $907 in interest charges.

If you have multiple balances on different cards, you may be able to transfer all of them onto your new card to help consolidate payment obligations, as long as the credit limit is high enough.

Request an Interest Rate Reduction

If you don’t qualify for a 0% APR balance transfer offer, you can still try to decrease your credit card interest rate by calling the credit card provider.

Make a list of all the credit cards you have with a current balance and divide them by provider. Next, take an afternoon to sit down and contact each company to ask them for a lower interest rate.

Take out a Debt Consolidation Loan

Sometimes you can get a lower interest rate with a debt consolidation loan than with a credit card. A debt consolidation loan is essentially a personal loan that is used to pay off existing debt, including credit cards.

Terms for debt consolidation loans usually range from 24 to 60 months, depending on the lender. These loans have fixed interest rates, while credit cards have variable interest rates. Monthly payments will stay the same for the entire term.

Interest rates for debt consolidation loans will vary depending on the loan amount, repayment term, and your personal credit score. The higher your score, the better rate you will receive. Also, longer terms will usually have higher rates, while shorter terms usually have lower rates.

Make sure to choose a term with monthly payments you’re comfortable making. If you choose a term with a high monthly payment and end up not being able to afford those payments, you’ll be in a worse position than if you had not consolidated at all.

Debt Relief Services

If your credit card debt is unmanageable and you’re considering bankruptcy, try using a debt relief service first. A qualified debt relief company can negotiate the terms of your debt directly with the lender or credit card provider.7

The debt relief company will then put you on its own payment plan that you must adhere to. Using a debt relief service can save you money, but there are some critical downsides.

A debt relief service should be your last resort because using one can negatively affect your credit score. And it may be unable to work with all your loan providers.

Better Your Credit

When you have excellent credit, the world is your oyster. You’ll be eligible for a wider range of loan products, including 0% APR balance transfer offers and debt consolidation loans with low interest rates.

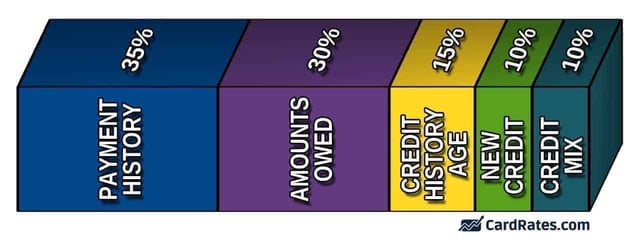

Improving your credit isn’t as hard as it seems. The first step is to make all of your bill payments, especially loan payments, on time. Your payment history counts for 35% of your credit score — the single largest factor.

Even one late payment can negatively affect your score by more than 100 points.8 Only payments that are 30 days late or more will be reported to credit bureaus.

The credit utilization percentage — the amounts you owe — is the second-biggest credit scoring factor accounting for 30% of your credit score. This refers to how much credit you’re currently using compared to the total credit limit.

For example, if you have a $6,000 balance on a card with a $7,000 credit limit, then your utilization percentage is 85%.

The maximum credit utilization percentage you should have is 30%, but having less than 10% will help you get the highest possible credit score. You can improve your utilization by reducing your credit card debt or by increasing your credit limit. To do the latter, call your credit card provider and ask them for a higher credit limit.

The credit card company may run a credit check before approving the new limit. If you are approved, you should immediately see a higher credit limit. If you are denied, then you can ask again in six months.

In Conclusion

Credit cards can be a helpful tool — but they can also be harmful to your credit and cost you thousands in interest charges.

If you already have a high credit card balance, you can minimize the damage by finding a lower interest rate, using a debt consolidation loan, or by applying for a balance transfer card. And don’t forget, try to address the behavior that got you into credit card debt in the first place.

More Relevant Statistics:

- Average Credit Card Debt by Age

- Average Credit Card Debt by Year

- Average Credit Card Debt by Household

- Average Credit Card Debt by State

- Average Credit Card Debt in America

Data Sources:

1 https://www.experian.com/blogs/ask-experian/state-of-credit-cards/

2 https://financialpost.com/executive/executive-summary/credit-card-debt-inflation-equifax

3 https://moneynerd.co.uk/average-credit-card-debt-by-age/

4 https://shiftprocessing.com/credit-card-debt/

5 https://livingcost.org/cost/india/united-states

6 https://www.statista.com/statistics/675371/ownership-of-credit-cards-globally-by-country/

7 https://www.consumerfinance.gov/ask-cfpb/what-are-debt-settlementdebt-relief-services-and-should-i-use-them-en-1457/

8 https://www.credit.com/blog/one-late-payment-hurt-credit-scores/

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in American Households ([current_year]) Average Credit Card Debt in American Households ([current_year])](https://www.cardrates.com/images/uploads/2018/01/avgdebt.png?width=158&height=120&fit=crop)

![Average Credit Card Debt by Age in [current_year] Average Credit Card Debt by Age in [current_year]](https://www.cardrates.com/images/uploads/2023/05/CR-AverageCreditCardDebtbyAge.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt by State in [current_year] Average Credit Card Debt by State in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtbyState-1250X650.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt By US Household in [current_year] Average Credit Card Debt By US Household in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtbyHousehold-1250X650.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in America in [current_year] Average Credit Card Debt in America in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtInAmerica-1250X650.jpg?width=158&height=120&fit=crop)