TLDR: It depends on whether your debit card has an associated line of credit or overdraft protection and whether your debit card issuer reports such accounts to the credit bureaus. If your debit card does have overdraft protection or an associated line of credit, and the card’s issuer chooses to report it to the credit bureaus, then it can help your credit scores if the account is paid back on time, or it can lower your credit scores if it’s paid late or goes into default.

Debit cards, which look nearly identical to credit cards, are plastic versions of old-fashioned paper checks. The debit card connects directly to a deposit account and allows you to spend the amount of money, sometimes a bit more, that you have on deposit.

While debit cards look, feel, and are generally used like credit cards, they are certainly not the same. One of the differences is how and whether debit cards can have an effect on your credit scores.

When it comes to the question, “Does this impact my credit score?,” the answer includes whether the “this” will be reported to the credit reporting agencies.

After all, credit scores are entirely dependent on the information on your credit reports. If something is not on your credit reports, then it’s like the proverbial tree falling in the woods. Nobody cares because nobody saw or heard it.

Debit Cards May Affect Your Credit, But it’s Complicated

Whenever people ask whether using their debit cards can impact their credit scores, the answer is always “It depends.” In fact, the answer really is “It depends on a lot of things, and it’s complicated.”

A debit card is a method of payment using your own money. You didn’t borrow money or apply for a line of credit from which to draw using your debit card. Whatever money you’ve deposited in your checking account represents the funds you can use with your debit card.

A debit card is not an extension of credit, and the card’s activity is not reported to the credit reporting agencies. Credit cards and credit card balances are reported to the credit bureaus.

So the fact that you have a debit card and that you used it X times last month at a variety of retailers doesn’t matter to credit scoring models because that activity is not on your credit reports. In that respect, your debit card is entirely immaterial to your credit scores — as in, they don’t help or hurt your credit scores.

But that’s not where the story ends. Remember I indicated that it’s complicated? Some debit cards may actually end up on your credit reports, but only under very specific circumstances and only with certain aspects of the debit card relationship. In those cases, they can impact your credit scores.

Overdraft Protection and Lines of Credit Can Be Reported and Impact Your Credit Scores

If your debit card is backed by overdraft protection or a small line of credit, which acts as a safety net if you overdraw on the balance of your account, your bank or credit union is allowed to report that to the credit bureaus.

In this context, “allowed” means the credit reporting industry has provided a method and a standard by which financial services organizations can actually report or, more formally, “furnish” the debit card’s overdraft protection and associated lines of credit to the credit reporting agencies.

Lines of credit and overdraft protection are, in fact, forms of credit. And, because they are forms of credit, they can be furnished to the credit reporting agencies, they can end up on your credit reports, and they can affect your credit scores.

If you use your overdraft protection or a line of credit linked to your debit card account and you pay it back according to the terms you’ve agreed to with your bank, then that can show up as positive activity on your credit reports. And positive activity can be helpful to your credit scores.

But furnishing information to the credit bureaus is voluntary and requires that the bank or credit union have an account or formal relationship with one or more of the credit bureaus. That second criterion is almost a guarantee, as most banks and credit unions have credit bureau accounts.

But the fact that furnishing information to the credit bureaus is voluntary means that, even if you have a debit card with overdraft protection or an associated line of credit, it still may not end up on your credit reports. If your bank/credit union chooses not to report the account to the credit bureaus, it won’t have any impact on your credit scores, even though it’s a bona fide form of credit.

What Does a Debit Card Look Like on a Credit Report?

If your debit card is backed by overdraft protection or a line of credit and is reported to the bureaus, it’s going to look like an unused and inactive line of credit unless you go into an overdraft position with your debit card. This isn’t optimal because it means you’re writing bad checks or spending too much on your debit card.

You may also be paying a fee when you go into an overdraft position. In that scenario, your overdraft protection is going to have a balance equal to the overdrafted amount.

For example, if you have $300 of overdraft protection on your debit card, you should expect to see a $300 line of credit on your credit reports. If the line of credit has revolving terms, you should expect to see that as well. If your line of credit has open terms, meaning it would have to be paid back in full immediately if used, then you should expect to see that too.

The point is that not all overdraft protection/lines of credit are the same, so the credit reporting will also vary. Regardless of how it’s reported, accounts in good standing are generally good for your credit scores. If it’s in bad standing, then it’s generally bad for your credit scores.

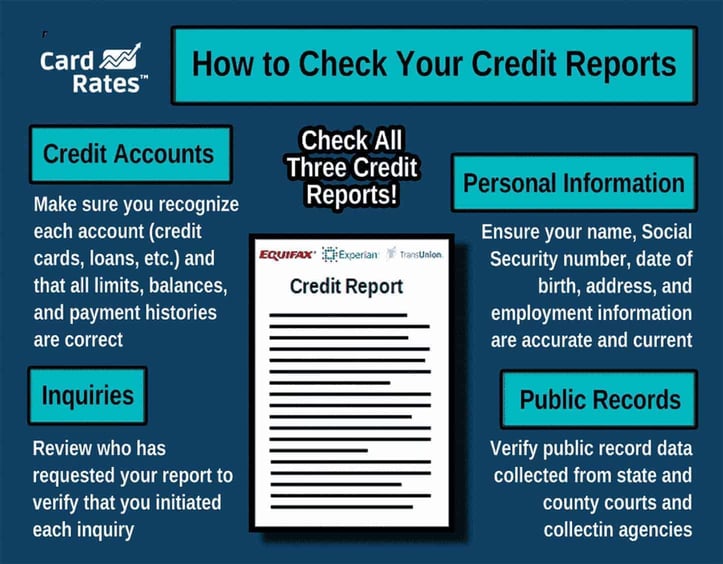

How Can I Tell if My Debit Card is on My Credit Reports?

The easiest way to verify whether your debit card’s overdraft/line of credit protection is on your credit reports is to check your credit reports. You can do that for free every week at www.annualcreditreport.com.

It’s probably a good idea for you to check all three of your credit reports because there’s no guarantee that your debit card issuer will report your overdraft/line of credit protection to none, one, two, or all three of the credit bureaus. Checking all three is free and will remove any doubts about the reporting of such account information and whether it’s in good standing.

In Sum

The issue of debit cards and credit scores depends on whether your debit card has an associated line of credit or overdraft protection and whether your debit card issuer reports such accounts to the credit bureaus.

Even if your debit card has overdraft protection or an associated line of credit, the card’s issuer can still choose not to report it to the credit bureaus. But if your debit card does have overdraft protection or an associated line of credit, and the card’s issuer does choose to report it to the credit bureaus, then it can help your credit scores if the account is paid back on time, or it can lower your credit scores if it’s paid late or goes into default.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![Credit Scores Needed for Chase Cards in [current_year] Credit Scores Needed for Chase Cards in [current_year]](https://www.cardrates.com/images/uploads/2019/05/credit-score-needed-for-chase-cards-feat.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For Scores Under 600 ([updated_month_year]) 7 Credit Cards For Scores Under 600 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Scores-Under-600.jpg?width=158&height=120&fit=crop)

![4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year]) 4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/charts.png?width=158&height=120&fit=crop)