Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

Nearly 600 million credit card accounts recorded in the US as 2023 closed, and the average consumer has nearly four credit cards each. But every person has preferences for the types of accounts they carry, though some are restricted to what their credit score determines they qualify for.

We commissioned a survey of more than 1,000 U.S. adults to learn more about the types of credit accounts Americans are opening and how those interests vary by age. The survey found that more than one-quarter of Americans (27%) plan to open a new credit card this year, and that number increases to 34% of Gen Z and 42% of millennials surveyed planning to open a new account in 2024.

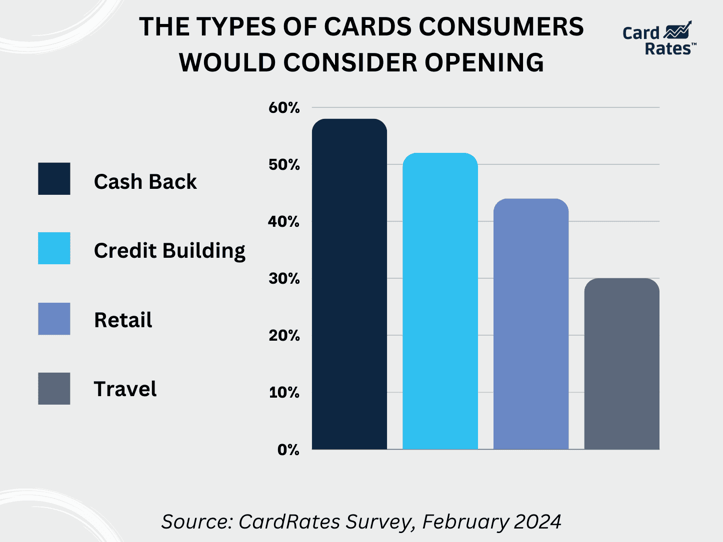

58% Favor Accounts With Cash Back Rewards

Of those who said they’ll look to get a new card this year, 58% of respondents favor credit cards offering cash back, 52% want a card to help them build their credit, 44% will seek a retail card such as an Amazon or Target account, and 30% will seek a travel card.

“I believe inflation and an unstable economy are among the driving forces behind Americans planning to open new card accounts,” said Ashley Fricker, Senior Editor with CardRates. “But with card debt already exceeding record levels, banks are tightening their approval criteria, and it may be more difficult for subprime consumers — those with recent late payments — to open new credit accounts. Still, for those who qualify and can commit to paying their balances off each month, a cash back card can be a valuable financial asset that can help them save money.”

The dollar value of rewards earned by general-purpose cardholders exceeded $40 billion for mass-market issuers in 2022, according to the Consumer Finance Protection Bureau (CFPB), and that number continues to grow. In fact, more than half (56%) of those surveyed said cash back would incentivize them to open a new credit card, and a greater number of survey participants (58%) said they would open a new credit card if it came with no annual fee.

Other perks survey participants said would prompt them to open a new card include:

- 40% – A low ongoing interest rate

- 38% – A large signup bonus

- 30% – 0% Balance transfers

- 22% – Travel rewards

- 12% – VIP access to events

The interesting takeaway here is that cards with travel rewards only appealed to 22% of respondents, yet the TSA reports that passenger volume is higher this year than at the same time last year.

However, a whopping 81% of respondents believe cash back and points are still worthwhile credit card rewards.

76% Say an Annual Fee is a Dealbreaker

Meanwhile, three-quarters of Americans (76%) surveyed say annual fees keep them from applying for a credit card. But when asked what amount of a credit card signup bonus would entice them to apply, 33% of respondents said $200-$300 is enough, followed by:

- 30% – $400-$600

- 17% – $750-$1,000

- 20% – Over $1,000

Interestingly, the lowest amount offered was the most enticing to consumers, perhaps because of the lower required spending amounts to achieve smaller bonuses.

In Conclusion

Credit card preferences in the United States reflect a dynamic interplay of economic factors, consumer behaviors, and industry trends. The survey found that a significant portion of Americans express intentions to open new credit accounts, and the appeal of cash back rewards stands out, with a majority of respondents favoring this benefit.

This finding emphasizes consumers’ desire for tangible financial incentives amidst concerns over inflation and economic uncertainty. Furthermore, the prominence of cash back rewards aligns with the substantial dollar value of rewards earned, as reported by the CFPB, which highlights its enduring appeal.

While cash back remains king, other incentives such as low ongoing interest rates and signup bonuses also influence consumers’ decision-making processes. Interestingly, despite the resurgence in travel, travel rewards cards were less favored among respondents.

Moreover, the survey sheds light on consumer attitudes toward fees and signup bonuses, with most respondents citing annual fees as a deterrent.

Methodology

A national online survey of 1,015 U.S. consumers, ages 18 and older, was conducted by Propeller Insights on behalf of CardRates.com in February of 2024. Survey responses were nationally representative of the U.S. population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.

![5 Best Credit Cards For 18-Year-Olds ([updated_month_year]) 5 Best Credit Cards For 18-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/18.png?width=158&height=120&fit=crop)

![8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year]) 8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-20-to-30-Year-Olds-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year]) 9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Credit-Cards-For-16-17-Year-Olds.jpg?width=158&height=120&fit=crop)