There are a few circumstances when a credit card may be closed even when an outstanding balance remains on the account. As nice as it would be for the debt to disappear with the terminated credit line, the cardholder remains liable for the balance until it is paid.

Here is how and why a card with an amount still due can be closed, what it means to your credit rating, and how you can deal with the balance you owe (and the rewards balance that’s owed to you) appropriately.

You Are Still Liable For The Balance

Whether you close the account or the credit card company does, the balance will remain your responsibility until you’ve either satisfied the debt or have taken radical action, such as filing for Chapter 7 bankruptcy. If you file for bankruptcy, you can include the unsecured debt in the bankruptcy, and when the case is fully discharged, you will be formally absolved of paying it.

If the debt is still with the original credit card issuer, though, the issuer will continue to send you the statements with the amount you owe and the minimum requested payment. You have the option to pay at least the minimum due or to send more. This process will continue until the debt is paid off.

The primary cardholder is still liable for any remaining balance of a closed credit account.

However, if you were seriously delinquent on the account and the credit card issuer sold the balance to a third-party collection agency, you now owe the third-party debt collector.

Most collection agencies expect the debt it purchased to be paid all at once rather than in a series of installments, but you can probably break up the debt into a few payments. Another option is debt settlement. Many third-party collectors will settle the debt for less than the amount due.

These companies usually buy accounts for a percentage of their value, so you may be able to negotiate what you repay. If you offer more than what they paid and they accept, you can get a big break on what you owe.

Just keep in mind that a forgiven debt of over $600 is typically considered income by the IRS, so you may have to fill out forms 1099-A and 1099-C and pay taxes on the forgiven amount.

Why & How to Close A Card Account With a Balance

As the primary credit card account owner, you have control over the account while it is in good standing. That means that you have adhered to the terms of the original agreement — you’re not behind on payments, the account is not in default, and the balance is not over the credit limit.

Some credit card issuers allow cardholders to close an account with a remaining balance, though it may be more of a suspension of use until the debt is fully repaid.

So why would you take such action when nothing is going wrong? There are a few reasons:

- Avoid temptation. Maybe you don’t want access to the credit line anymore because you don’t trust yourself to keep the debt down.

- Simplified card management. Every credit card requires monitoring, so you may want to reduce the number of accounts you have to manage.

- The interest rate is rising. Even for well-managed accounts, issuers can decide to increase the APR. They do have to give you 45 days before it goes into effect, though, so you may choose to close the card and concentrate on repayment.

- Stop paying an annual fee. Many credit cards waive the annual fee in the first year, so if that fee is coming due, closing the card can stop it from being added to what you owe. Or maybe you have been paying the fee every year and you think it’s too high and would prefer a different account that doesn’t charge so much. In either case, it’s wise to ask the issuer if it can be waived before ending the arrangement.

Contact your issuer and ask what its policy is regarding closing an account with a balance due instead of just ignoring the credit line and tucking the card into a shoebox hidden in a back closet and removing the account information from all mobile devices. It may be as simple as making a verbal request, and you won’t have to justify the decision to the representative.

Reasons a Credit Card Issuer May Close a Credit Card With a Balance

On the other hand, the account may not be in good standing. You may have missed a few (or more) payment cycles, and, if so, the credit card issuer may see it as a red flag signaling that you’re in financial trouble.

The concern would be that you will start to use the rest of the credit line and then not pay at all. To prevent that from happening, the issuer may close the account.

An issuer may close your account if you’ve missed payments or otherwise appear to be in financial distress that would cause you to miss future payments.

Another reason an issuer may take preemptive action and close the card is that your debt exceeds the allowable charging limit. That can happen when you’ve maxed out the credit line and then skipped a payment cycle so late fees were added.

Over-limit fees may also have been applied in that situation. And interest will be assessed on the balance, which will cause your balance to go even further over the limit. This too is a warning to an issuer that your finances may not be in healthy shape, so it may decide to pull your charging rights and close the card.

How a Closed Card With a Balance Impacts Credit Reports & Credit Scores

Credit card issuers regularly furnish the three major credit reporting agencies — TransUnion, Equifax, and Experian — with details about your account activity. Therefore, if you closed the account yourself, it may read as “account closed by consumer.” If the issuer took that action, it may be noted as “account closed at credit grantor’s request.”

Neither notation is factored into a credit score and will have no impact on your credit scores.

The credit issuer will continue to report the account’s history as well as your current payments. If you made all your payments on time while the account was active, that information will usually show up for 10 years. But there is no statute preventing that information from remaining longer or even indefinitely after the balance is repaid.

If your credit reports do show late payments or other derogatory information, the account can only show up on your report for seven years, as per the Fair Credit Reporting Act set forth by federal law.

But the balance you have on the card, and therefore your credit reports, can have a damaging effect on your credit scores when the account is closed. That’s because FICO and VantageScore, the two largest credit scoring companies, factor in the amount you owe on your credit cards relative to your total available credit limits.

If the card is closed, there will no longer be an available credit limit on that account. Consequently, losing access to the credit line will affect your credit utilization ratio when there is outstanding credit card debt.

A credit utilization ratio is the percentage of your available credit you’ve used. If your utilization ratio is too high (generally perceived as more than 30% of the available limit) you may appear to other lenders as a credit risk. Therefore, your scores may take a hit.

Still, as long as you continue to send your payments when you should, your scores will likely recover with that good behavior. As the other accounts you have and use become older over time, those too will help your scores.

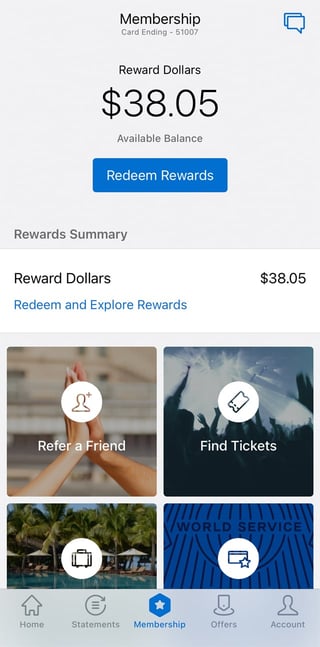

Claim Your Rewards Balance Before It’s Too Late

If your credit card account has a rewards program and you’ve accumulated points, miles, or cash back, you’ll need to handle getting what’s owed to you the right way so you don’t lose what you’ve earned.

Remember to redeem any rewards owed to you.

Before you close the card on your own, contact your credit card issuer and ask that they send you a check for the value of the rewards. The issuer may also redeem your rewards with a statement credit or make a cash transfer to your checking or savings account.

You may be able to make purchases through the issuer’s shopping portal or redeem your rewards for travel, too. But move fast — some issuers will nullify the rewards if you wait too long to make the request (often 30 to 60 days).

Be aware that you may lose the rewards if the credit card issuer cancels your card because the account is not in good standing. Other reasons the issuer may refuse to hand you over the rewards are that it suspects you have committed fraud, or that you didn’t follow the rules of the rewards program.

If you do decide to go the bankruptcy route, you’ll probably have to forfeit all those precious points, miles, and cash you’ve built up.

Strategize What You’ll Do After Repayment

If you care about building and maintaining high credit scores, it is extremely important to continue to make your payments on time. Payment history is the most important factor in both credit scoring models, so even when the account is closed, paying your bills on time will always work in your favor.

After you make your final payment, the paid balance will then be reflected on your credit report and the billing statements will stop being mailed to you. Review your credit reports to make sure the account is listed correctly, and then check your credit scores to see where you stand.

If you want to open new credit cards at that point, scan the wide variety of cards available to an individual with the credit rating you’ve achieved. With a perfect payment pattern on multiple accounts over a long period, you may qualify for the best cards on the market!

Once you have identified the right card for your credit rating and needs, apply and use the card to your advantage. Only charge what you can and will repay in full by the due date or very soon thereafter so as not to acquire another balance that you’ll have to pay off.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year] How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year]](https://www.cardrates.com/images/uploads/2017/06/how-to-transfer-credit-card-balance.jpg?width=158&height=120&fit=crop)

![What is a Credit Card Balance? Transfer to 0% ([updated_month_year]) What is a Credit Card Balance? Transfer to 0% ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/what-is-a-credit-card-balance.jpg?width=158&height=120&fit=crop)

![What is a Balance Transfer Credit Card? ([updated_month_year]) What is a Balance Transfer Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/What-is-a-Balance-Transfer-Credit-Card-Feat.jpg?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)