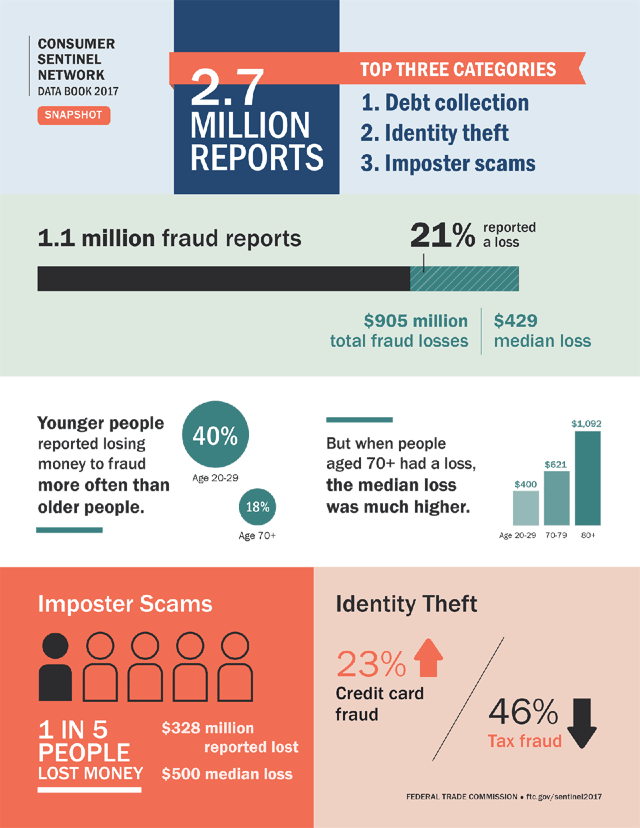

Credit card fraud is the most common type of identity theft, according to a Federal Trade Commission report. This type of fraud typically entails someone taking over a person’s existing credit card accounts and charging without permission or opening new accounts using someone else’s personal financial information.

In both cases, the crook escapes with the goods and the consumer is left dealing with the credit, financial, and psychological damage.

Protecting your credit card accounts and personal identity is imperative, and it begins with education. Here are 15 disturbing credit card fraud statistics to get you started.

1. The U.S. is #1 in Cases of Credit Card Fraud

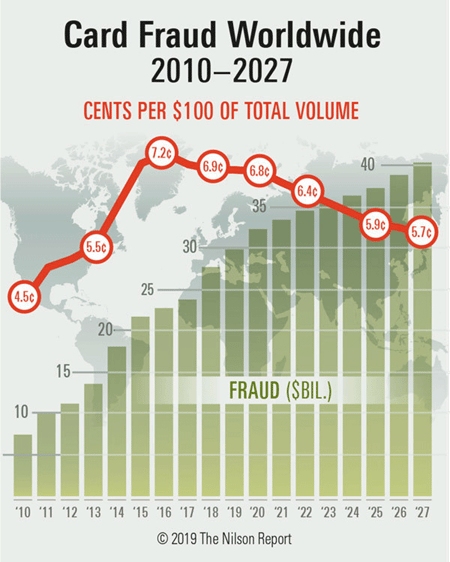

It’s great to be on top — unless it’s regarding credit card fraud. According to the latest Nilson Report, the United States eclipses every country on the planet as the most credit fraud-prone, with 38.6% of all reported card fraud losses in 2018.

And how much was lost in the illegal transactions? A cool $9.47 billion.

Remedy: Dispute fraudulent transactions as soon as you find out about them. As per the Fair Credit Billing Act, you are not financially responsible for unauthorized charges that exceed $50 as long as you dispute them within 60 days from the date you receive the bill. But most credit card issuers and retailers are sensitive to the plight of victims, and will usually waive all the fraudulent charges.

2. Crooks Take Advantage of Pandemics

Fraudsters don’t let an opportunity go to waste, and that includes situations where the country has shut down and consumers are vulnerable. The dollar amount of attempted fraudulent transactions rose 35% in April 2020 — in the midst of the global pandemic — according to the Fidelity National Information Services Inc., a banking fraud detection company.

Remedy: The primary reason for the uptick in credit card fraud during a shut-down is increased online shopping. So, make sure you only use your credit card on trusted and secure websites. Never click on emails and texts from retailers offering promotions and instead go directly to the company websites.

Before entering your credit card account information to make the purchase, look at the web address in the browser bar. It should start with “https” and include a gray padlock symbol. If it doesn’t, the e-commerce site isn’t secure, and your data can be more easily pilfered. And avoid shopping from public wifi hotspots, because your information can be grabbed by someone else on the network.

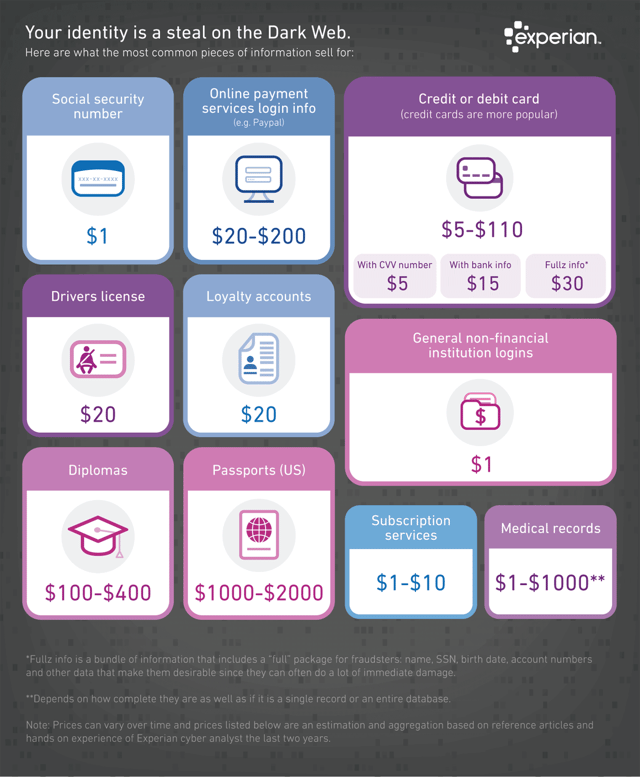

3. Your Credit Card Data is Cheap

Crooks can steal thousands of dollars before a fraudulent transaction is detected, so the cost to purchase your account data is well worth the price to fraudsters.

According to Experian, credit and debit card account information sells on the dark web (hard-to-find websites and forums that thieves create as a marketplace for many types of illegal activity) for a mere $5 with the CVV number and up to $110 if it comes with all the bank information, including your name, Social Security number, date of birth, complete account numbers, and other personal data.

Remedy: Consider enrolling in an identity theft monitoring service. These services continually scan the wide expanse of the dark web for information about you that may be for sale. If it finds anything, the company will immediately send out an alert.

At that stage, you can contact your credit card issuer and explain what you’ve discovered. Your card issuer will change the account numbers and send you a replacement credit card.

4. Fraudsters are More Likely to Be Males in Their 30s

The 2019 United States Sentencing report found that 75.1% of credit card offenders are males with an average age of 34. The report also found that 38.7% were Black, 31.7% were Hispanic, 24.2% were White, and 5.3% were Other races.

Remedy: There’s no reason to look askance at this demographic. Just don’t assume that a person who doesn’t look the part of “crook” isn’t one.

Protect your credit cards and personal information no matter where you are and who you’re with. Keep all of your credit cards in a safe place, and reduce paper trails by having all your credit and banking correspondence sent to you electronically.

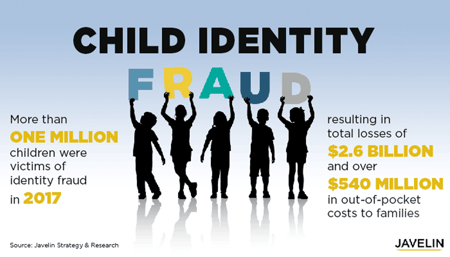

5. Relatives Commit 18% of Identity Fraud Cases Against Minors

According to a 2019 Javelin Strategy & Research report, more than 1 million children in the U.S. were victims of identity theft, and of those, two-thirds were younger than 8 years old. Even worse, 18% of identity fraud cases against minors were committed by a relative — most often a parent.

The aggregate cost to deal with the damage is enormous. Families paid $540 million in out-of-pocket expenses to rectify the issues.

Remedy: If you are at all suspicious that your minor child’s identity has been used to open accounts, check his or her consumer credit report immediately. A credit report will be generated when a Social Security number is used to obtain credit cards and loans, so if someone has committed fraud against your child, you’ll soon find out and can clear it up. You may also consider contacting the police to file a police report against the perpetrator.

6. California & Georgia Experience the Most Identity Theft Incidents

California has the highest number of identity theft incidences (of which credit card fraud is the most typical), and Georgia has the most cases per capita, according to a 2019 Federal Trade Commission report.

Remedy: If you live in these states there’s no reason to move — just take action. It is your right and responsibility to view your own credit reports so you can detect fraud, but it also takes time. If you don’t have it to spare, you may want to invest in a private credit monitoring service, such as LifeLock or Identity Guard.

While these companies can’t stop fraud from occurring, they do lay down roadblocks and will alert you to suspicious activity in real time. After that, they will guide you to resolutions.

7. Fraudsters Prefer to Open New Accounts

It’s important to safeguard your existing credit card accounts from being used by other people, but today’s crooks find them less desirable than your personal information that can be used to open new credit cards. The 2020 Federal Trade Commission study discovered that 88% of credit card fraud in 2019 consisted of thieves opening new accounts.

Remedy: When it comes to identity theft, the most valuable piece of information is your Social Security number. With it, thieves can open accounts in your name, so locking down that number is crucial.

You’ll want to make it as difficult as possible for criminals to steal your information. The Social Security Administration offers free cybersecurity protection to all consumers. When you enroll, it will add another layer of protection between you and cybercriminals.

8. Fraudulent Card Payments are Most Common During Holiday Shopping Season

The days between Black Friday and Cyber Monday have become targets for fraudulent credit card payments, according to a 2019 DigitalTransactions.net report. Suspicious transactions during the five-day holiday shopping weekend rose 29% from the same period the previous year. And 63% of suspected fraudulent transactions during the busy shopping weekend came from mobile devices, up from 57% the year before.

Remedy: Slow down! The holidays can be hectic, making you less likely to ensure the sites you’re shopping on are legitimate and secure. To streamline the process, try to stick to just a few online retailers and use only one or two credit cards. Then if fraud does occur, you won’t have to do as much legwork to fix the problem.

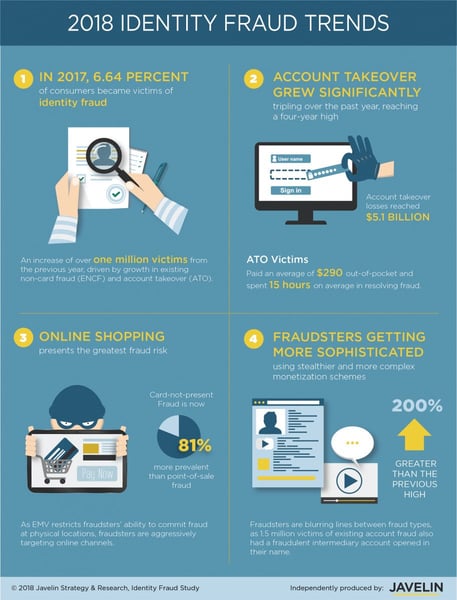

9. Card-Not-Present (CNP) Fraud is Most Prevalent

When you envision a credit card thief, you may picture someone using your card to pay for things at a department store counter. That’s an increasingly rare occurrence, according to a 2018 study by Javelin Strategy & Research.

Transactions that take place online and over the phone, called card-not-present, represent the greatest risk of fraud. Card-not-present (CNP) fraud is now 81% more prevalent than point-of-sale fraud.

Remedy: Card-not-present fraud is pretty much out of your control as a consumer, since the responsibility falls on the retailers and credit card issuers. They have to make sure all transactions are legitimate. Technology is coming to the rescue, though.

For example, you may have to verify your identity with multifactor authentication, in which you verify your identity by receiving a code on your mobile device to allow a transaction to go through. Encryption and tokenization are used to ensure that accounts kept on digital wallets are safe.

10. Fraud Against Texas Seniors is a Third-Degree Felony

It can be hard to find and prosecute fraudsters, but some states take credit card crime more seriously than others — especially if the victim is a senior. In fact, when credit card fraud is committed against an elderly person in the Lone Star State, it is automatically bumped up to a third-degree felony, and penalties can range from two to 10 years in prison with fines of up to $10,000.

Remedy: Understand the identity theft laws in your state. Some are more lenient than others. Check out the National Conference of State Legislators summary of each state’s criminal penalties, restitution, and identity theft passport laws (which help victims recover from the crime).

It’s important to manage your expectations. You may want someone who stole thousands of dollars in your name to go to prison for many years, but that may not happen.

11. The Odds of Being a Victim of Fraud Are High (and Increase with Age)

An Ascent study of American credit card habits found that more than a third of Americans have had their identity stolen and have been victims of credit card fraud. The likelihood increases as you age, too. The breakdown on who has been hit by fraudsters: millennials 33.1%, generation X 37.6%, and baby boomers 42.6%.

Remedy: Have each of your current credit card issuers send you a text or email every time a transaction is made. Most will happily oblige. This way you’ll automatically know if someone else is using one of your existing accounts. Also, check your credit report on a regular basis by logging onto annualcreditreport.com.

You’ll receive one free report from each of the credit reporting agencies once a year. You can stagger them so you never have to pay. For example, get your Experian report in January, your TransUnion report in May, and your Equifax report in August.

If you see accounts on your reports that you never applied for, you can dispute them on one of the credit reporting agencies’ websites to have them removed. As with the fraud alert, you only need to contact one agency as it will notify the other two.

12. Over 1.6+ Billion Records Were Compromised Between 2005 and 2019

You’ve probably heard national news reports about large data breaches, where credit card and identity information is stolen from retailers using malicious software and other nefarious techniques. The problem is that the public only hears about the biggest breaches, such as what happened to Marriott International when malicious hackers absconded with the data of about 500 million customers.

But according to the Identity Theft Resource Center’s most recent Data Breach Report, there have been an astonishing 10,818 such breaches accounting for more than 1.6 billion compromised records between January 1, 2005, and August 31, 2019.

Remedy: Once your information is exposed it can be put up for sale and purchased. If you think you may become a fraud victim because of a data breach, contact one of the three major credit bureaus (Equifax, TransUnion, or Equifax) to add a fraud alert to your credit report. The other two will be notified.

This alert will warn lenders that you’re a potential victim, and they will have to contact you before granting a new account. If your accounts have already been compromised or you want to take more extreme measures, freeze your credit files. You will have to contact each of the credit reporting agencies, but it will make your credit information inaccessible. Then make sure you monitor your credit accounts and credit reports often, looking for any fraudulent activity.

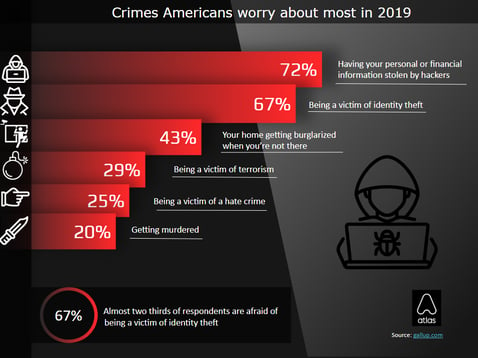

13. People Worry More About Identity Theft than Murder

According to the latest Atlas VP research, U.S. consumers are far more worried about their identity being hacked (and having to deal with issues such as credit card fraud) than they are of getting murdered. The primary reason for this concern is the high number of data breaches and the prevalence of hacking as well as the feelings of vulnerability.

Remedy: Maintain perspective! Yes, you may very well be hit by a fraudster, even after doing your best to protect yourself against it, but all the damage that a person can cause is fixable.

You won’t have to pay for a crook’s charges, you can purge your credit report of false information, and take even stronger measures against fraud making it even more unlikely to happen again.

It can take time and energy, but the fact is you can overcome credit card fraud. Compared to bodily harm or untimely death, there is no comparison.

14. Credit Card Fraud Occurrences Have Risen 161%

The Atlas VPN research paper includes other alarming statistics on fraud. Credit card fraud increased from 17,236 reports in the first quarter of 2015 to 45,120 reports in the same quarter of 2020. That’s an increase of 161.7%. Why? It’s a lucrative business.

Remedy: Thieves depend on being able to operate in the dark. The fewer people who know about fraud and protective measures, the more they can get away with their crimes.

That’s why you need to become a mouthpiece for accurate information. Share what you’ve learned about how to protect your credit cards and identity with your family members, friends, and colleagues.

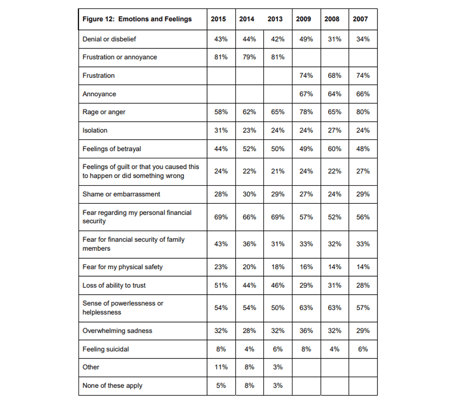

15. Emotional Impacts of Being a Fraud Victim Are Intense

Whether someone uses your credit card without your permission or your identity was used to open new accounts, chances are high you’ll feel the blues afterward. According to an Identity Theft Resource Center report, victims experience a wide array of emotional reactions.

Of those polled, 54% reported a sense of helplessness or powerlessness, 69% felt fearful over their personal financial safety, and 42% said they felt fear for the financial security of their family members.

Remedy: In addition to applying all the identity theft precautionary techniques and remedies, talk about your concerns with people who understand. Do not hesitate to discuss your anxiety, anger, and fear with a professional if you’ve been a victim of fraud.

A counselor or therapist can guide you through this tough time, as can someone from one of the nonprofit organizations set up to help consumers overcome the impact of fraud, such as the Identity Theft Resource Center.

The Numbers Are Striking, But Knowledge is Power

Credit card fraud is clearly something to take seriously. The numbers are striking. Knowledge, however, is power.

All the preceding statistics and facts should motivate you to stay on top of your accounts and keep an eye on your credit reports. Don’t let thieves easily get away with crime.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![21 Startling Credit Card Data Breach Statistics ([current_year]) 21 Startling Credit Card Data Breach Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Credit-Card-Data-Breach-Statistics.jpg?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![11 Surprising Teen Credit Card Statistics ([current_year]) 11 Surprising Teen Credit Card Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Teen-Credit-Card-Statistics.jpg?width=158&height=120&fit=crop)

![18 Revealing Credit Card Ownership Statistics ([current_year]) 18 Revealing Credit Card Ownership Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Revealing-Credit-Card-Ownership-Statistics.jpg?width=158&height=120&fit=crop)

![21 Eye-Opening Student Debt Statistics ([current_year]) 21 Eye-Opening Student Debt Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_674141887.jpg?width=158&height=120&fit=crop)