Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

If you’ve ever gotten an unfamiliar alert from your credit card company or you’ve seen a transaction on your credit statement that you don’t recognize, there’s a possibility that your credit card account has been compromised. In clearer terms, your account may have been hacked by a fraudster.

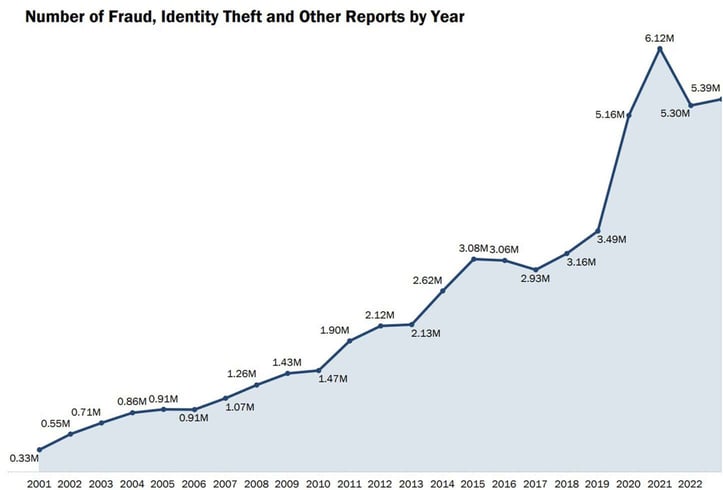

First things first, don’t panic. If you’ve been the victim of credit card fraud, then you’re now a member of a very large and non-exclusive club of credit card holders. According to the Federal Trade Commission, credit card fraud is among the most common types of fraud.

The FTC received over 416,000 reports of fraud in 2023 for either newly opened credit card accounts (formally, “true name fraud”) or existing credit card accounts (formally, “account takeover”), with almost half of those complaints coming from people younger than 40. The number of credit card fraud complaints to the FTC exceeds every other form of fraud. The point being, you’re not alone.

Common Methods of Credit Card Hacking

Fraudsters are very creative, if not flat-out ingenious. There are several known methods used by hackers to gain access to your credit card data, and who knows how many unknown methods that law enforcement hasn’t yet figured out. The methods are a combination of old-school and cutting-edge tech.

Here are a small number of examples:

Family fraud – Family fraud or “familiar” fraud occurs when a member of your family or someone else with unusual access to your information (think roommate or cleaning service) uses your credit cards without permission. The challenge I see here, especially in my expert witness work, is whether the cardholder is willing to press charges against their family member, which is often required by the card issuer in fraud investigations.

Lost or misplaced credit cards – Yes, this happens a lot. You leave your card at the bar or restaurant only to see suspicious charges the next day. You’ll have to call your card issuer and have them reissue you a new physical card.

Data Breaches – We can’t go more than a few months without reading or hearing about yet another massive data breach. And while credit card numbers aren’t always the subject of data breaches, sometimes they are. And, if enough of your personal information has been stolen by a data breach fraudster, that information can be used to open new credit cards in your name.

Login/Password Exposure – If a fraudster figures out the login and password credentials to your online credit card account, through computer spyware, for example, they can use your credit card, take out cash advances, and perhaps apply for another card from the same issuer.

Indeed, these are just a few common examples of how credit cards can get hacked, as well as how your personal data can be used to procure newly opened fraudulent accounts.

The Issuing Bank is Liable for Fraudulent Charges

I suspect this next part is not going to be terribly popular, but when someone hacks your credit card account, you’re not really the victim. When someone else uses your credit card fraudulently, that’s the bank’s money they’re using, not your money. If someone, alternatively, hacks your debit card, then that’s definitely your money because it’s coming directly out of one of your deposit accounts.

This is why it’s important that you contact your card issuer immediately if you believe your credit card account has been compromised. If you do not, the card issuer is going to reasonably believe you are the person who used the card to make purchases and they’re going to seek payment from you, the cardholder.

When you contact the card issuer to report the fraud, you’re going to be asked to answer a series of questions, likely on a recorded line, and then the card issuer will perform an investigation into your fraud claim. While it performs its investigation, the credit card company will issue a temporary credit to your account in the same amount as the alleged fraud. That means the charge won’t show up on your statement and you won’t be asked to pay it, for now.

If, after its investigation, the card issuer agrees the charges were fraudulent, it will make that temporary credit permanent, and you’ll never have to pay the charge. During this time, the card issuer will also disable your existing credit card for further usage and reissue you a replacement.

If, however, the card issuer does not find that the usage was fraudulent, it will reverse the temporary credit, add it back to your statement, and you’ll be liable for payment. If you don’t make the payment, you’ll be assessed interest and perhaps reported late to the credit bureaus.

Laws that Protect Consumers

There are two Federal consumer protection statutes that include iron-clad protections in cases of confirmed credit card fraud.

Fair Credit Billing Act (FCBA) – The FCBA is the Federal statute that, among other things, caps your liability in cases of credit card fraud to no more than $50. On top of that, all four of the current credit card networks (Visa, Mastercard, American Express, Discover) have zero-liability policies as it pertains to credit card fraud, meaning if you report the fraud in a timely manner (and it’s actually fraud) then you won’t be held accountable for the charges.

Fair Credit Reporting Act (FCRA) – The FCRA is the Federal statute that, among other things, requires the credit bureaus to block the reporting of fraudulent accounts to your credit reports. And the FCRA allows you to place security freezes on your credit reports at no cost, which will prevent any new accounts from being opened without your consent.

Again, these rights are contingent on the alleged fraud actually being fraud, and not an attempt by a debtor to avoid their liability with inauthentic claims of fraud, a common tactic employed by credit repair companies.

Set up Alerts to Catch Fraudulent Charges

Don’t go into credit card paralysis just because you’re worried about credit card fraud. The cost of fraud is already built into the cost of credit, a term known as “fully loaded.”

Check your statements for unauthorized usage and register for your card issuer’s usage alerts, where you’ll receive a text message and/or email each time your card is used. And most important, if you do see unauthorized charges to your credit card, you have to contact your card issuer immediately to stop further fraudulent charges, get your card replaced, and ensure you are not held liable.

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![Understanding Credit Cards: A Beginner’s Guide ([updated_month_year]) Understanding Credit Cards: A Beginner’s Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Understanding-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![The History of Credit Cards: 2000 B.C. – [current_year] A.D. The History of Credit Cards: 2000 B.C. – [current_year] A.D.](https://www.cardrates.com/images/uploads/2020/12/shutterstock_723428044.jpg?width=158&height=120&fit=crop)