Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Your credit scores play an important role in your financial life. That’s certainly no secret. But credit scoring systems are complicated, and there is no shortage of mystery behind those three-digit numbers.

Since 1991, I have been a part of the consumer credit industry with time spent at both Equifax and FICO as an employee and at dozens of other credit-related entities as a contractor and expert witness. If I’ve learned anything in my more than 30 years in the credit business, it’s that there is no shortage of credit-related secrets.

Below are 17 of what I’ve determined are among the most common, which have been identified and solved. Now you’ll better understand how credit scores work and how to earn and maintain great credit scores for yourself.

1. You Have Hundreds of Credit Scores Used For Different Purposes

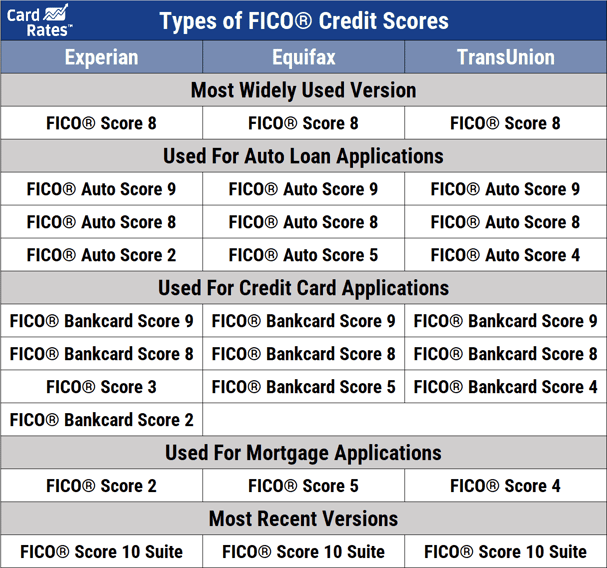

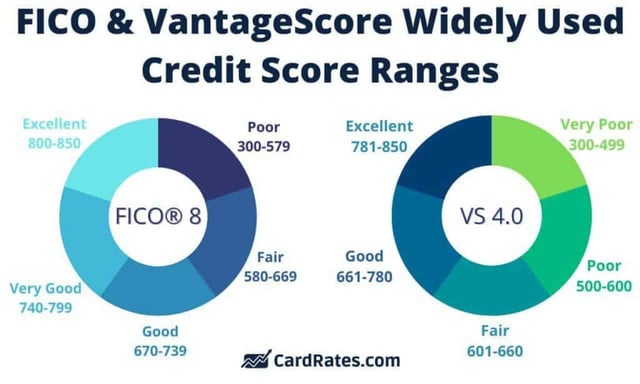

It’s not uncommon to read advice articles about how to improve your credit score. But that suggests that you have just one credit score, which is certainly not true. There is no single credit-scoring brand or model. In fact, you have dozens of FICO credit scores, which doesn’t include other brands of credit scores such as VantageScore.

You actually have hundreds of credit scores, not just one, each calculated differently and used for specific purposes.

2. You Don’t Have the Right to Free Annual Credit Scores

An amendment to the Fair Credit Reporting Act (FCRA) passed in 2003 entitles you to a free copy of your credit reports once every 12 months. You can access these free reports through AnnualCreditReport.com.

If you’ve claimed your credit reports from that website, you may have noticed that credit scores are not included. That’s because credit scores are not actually part of your credit reports but are, rather, an optional add-on product.

Federal law doesn’t give you the right to free annual credit scores as part of your free annual credit reports.

3. Most People Have Good Credit Scores

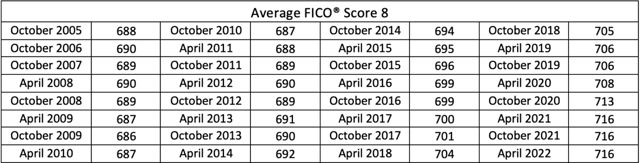

In 2022, the average FICO score in the United States was 716. And while the ultimate arbiters of what is and what is not a “good” credit score are your lenders, most people would consider scores above 700 to be good scores.

Having said that, you need FICO scores of at least 760 to guarantee you receive the best deals across all forms of credit.

4. Credit Scores Are Not Used For Employment Screening

Employers in most states are allowed to check your credit reports, with your written permission, for screening purposes when you apply for a job. But your credit scores are never included in those reports.

The type of credit report provided for employment screening is not the same as that provided to lenders. Credit scores are not included with the type of reports provided by the credit bureaus for employment screening. As such, your credit scores are not influential in an employer’s hiring decisions.

5. Credit Scores Don’t Combine When You Get Married

The credit bureaus don’t merge your credit reports with that of your new husband or wife when you say “I do.” And just as you won’t have joint credit reports when you get married, you won’t have joint credit scores with your spouse either.

In fact, the only way you’ll share any credit obligations with your husband or wife is if you decide to apply jointly for loans or credit cards. In that case, your credit reports will contain similar liabilities as those belonging to your spouse.

6. Credit Scores Don’t Consider Your Income and Wealth

Credit scoring models do not take into account your income, how much money you have in the bank, or any other wealth metrics. And these details do not appear on your credit reports. That means they cannot affect your credit scores because credit scores only consider information on your credit report.

7. FICO is Not the Only “Real” Credit Score

FICO is a credit score brand, just like Chevrolet is an automobile brand. FICO invented credit scoring, and according to the company, some 90% of top lenders use FICO scores.

Yet lenders in the United States use other brands of credit scores too, including VantageScore branded credit scores, which the Federal Housing Finance Agency (FHFA) recently approved the use of for mortgage applications.

8. Credit Scores Don’t Have a Memory

Credit scoring systems, including FICO and VantageScore, only evaluate the information that’s on your credit report at a given point in time. A credit score is only calculated when a lender or some other party purchases it from a credit reporting agency.

So if a credit bureau has removed a negative item from your credit report, that detail no longer counts the next time your credit scores are calculated. Credit scoring models do not remember what used to be on your credit reports and are calculated as a snapshot in time.

9. FICO Scores are Not Owned by the Credit Bureaus

FICO is a data analytics company independent of the three major credit bureaus — Experian, TransUnion, and Equifax.

FICO is a public company traded on the New York Stock Exchange under the symbol FICO. You can buy shares of the company, which is not owned by any of the credit bureaus, as are none of their scoring models.

10. FICO Doesn’t Calculate Your Credit Scores

To calculate a credit score, you have to marry a credit report to a credit scoring model. FICO is not a credit bureau, which means they do not store your credit reports. The credit bureaus, through a license agreement with FICO, are the parties that calculate your FICO scores.

11. VantageScore Credit Scores are Popular with Lenders

Lenders and other companies in the US use billions of VantageScore credit scores every year. In a 12-month period between 2021 and 2022, more than 3,000 companies used 14.5 billion VantageScore credit scores. This number represents close to 18% growth in the use of VantageScore credit scores compared with a similar study conducted in 2019.

The bottom line is this: If you’ve been led to believe VantageScore credit scores are fake or don’t mean anything, you’ve been misled. In fact, by late 2024, all mortgages guaranteed by Fannie Mae or Freddie Mac will have to be underwritten using both FICO and VantageScore credit scores.

12. Insurance Companies Do Not Use the Same Scores Used by Lenders

Insurance companies use credit scores to predict risk — the risk that customers will file a claim that could cause the company to have an insurance loss. FICO introduced these specialty scores, called credit-based insurance scores, in the early 1990s.

FICO estimates that around 95% of auto insurance providers and 85% of homeowners insurance providers use credit-based insurance scores in the insurance underwriting process (in states where their use is permitted).

While they’re commonly referred to as credit scores, they’re actually very different from the scores sold to lenders.

13. You Can Have Poor Credit Scores Even if You Always Pay Your Bills on Time

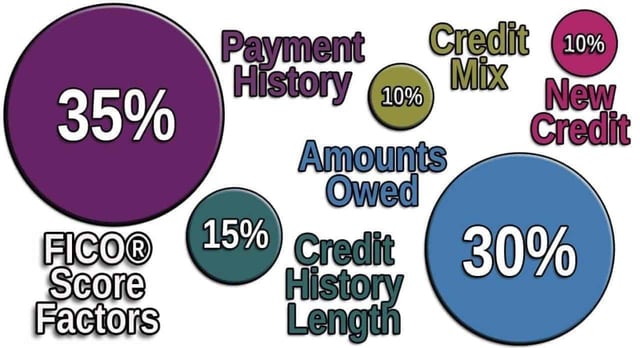

Your payment history represents the largest — 35% — factor in determining your FICO Score. That number includes the presence of late payments on your credit reports. That means a whopping 65% of your FICO score points have nothing to do with whether you pay your bills on time.

If you want to earn excellent credit scores, learn about the other factors that impact your credit score, like keeping your credit utilization ratios low and not applying for too much new credit at once, among other things.

14. You Can’t Dispute Your Credit Scores with the Credit Bureaus

The Fair Credit Reporting Act allows you to dispute inaccurate information on your credit reports, like accounts you don’t recognize or incorrect late payments. But your credit score isn’t part of your credit report. It’s an ancillary product that lenders can purchase alongside your credit report to assess your level of credit risk.

Since credit scores are not part of your credit reports, you cannot dispute your credit scores as you would dispute accounts or collections.

15. A 1% Utilization Ratio is Better than a 0% Utilization Ratio

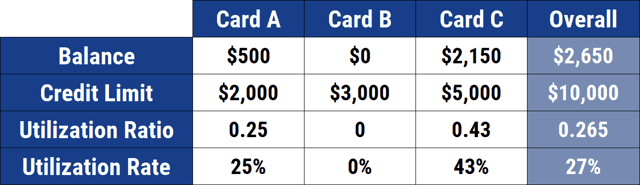

The credit utilization ratio — the relationship between your credit card balances and your credit limits — can have a meaningful influence on your credit scores. As a rule of thumb, a lower utilization ratio is better than a higher ratio.

But the optimal credit utilization rate is 1%, not 0%, since 1% utilization shows you’re using credit cards responsibly. The data shows that 1% utilization predicts slightly less risk than no credit card utilization at all.

That being said, 1% is a fantastic credit utilization ratio. Think of it this way… lower is better than higher, but some is better than none.

16. You Can be Denied Even with Excellent Credit Scores

An excellent credit score alone doesn’t guarantee you’ll qualify for all types of financing. There are other factors lenders consider when you apply for loans.

For example, if you apply for a mortgage loan of $250,000 but the home only appraises for $150,000, then it doesn’t really matter how high your credit scores are when you apply. Also, if your income only allows you to comfortably afford a monthly payment of $1,000, but your loan would require a monthly payment of $2,000 then, again, it doesn’t really matter how high your credit score is when you apply.

17. You Can be Approved Even with Poor Credit Scores

Qualifying for financing tends to be more difficult when you have poor credit scores. But even with bad credit, you may find subprime lenders willing to work with you. Additionally, you may be able to qualify for exceptions (called a “low-side override”) where a lender approves you for a loan or credit card for which you may normally be ineligible based on your credit score.

This may occur if you have multiple other financial relationships with the lender. It could also occur if you put down a large down payment on a loan, thus fully securing any extension of credit made by a lender.

In Summary

There are many secrets associated with credit scoring models. The aforementioned 17 are among the most common. Now that the secrets have been exposed, hopefully, you’ll know how to better navigate the credit scoring environment.

Your goal is to have a credit score of 760 or higher. If you can get there, you’ll best position yourself to get competitively priced approvals.

![Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year]) Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/capital-one-pre-qualify-1.png?width=158&height=120&fit=crop)

![3 Secrets: Get Frequent Flyer Miles Without Flying – ([updated_month_year]) 3 Secrets: Get Frequent Flyer Miles Without Flying – ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/frequent.png?width=158&height=120&fit=crop)

![7 Best Credit Cards By FICO Score ([updated_month_year]) 7 Best Credit Cards By FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/fico.png?width=158&height=120&fit=crop)