My brother decided to get one of the Chase Ink business cards for his LLC when he became self-employed. He knew he had to separate his personal and business spending, and as a longtime owner of a Chase Sapphire Preferred® Card, getting an Ink card was a no-brainer.

Now he earns Chase Ultimate Rewards points in two ways, which means he has no excuse not to visit his big brother.

The Chase Ink cards help owners finance their business purchases while accumulating points redeemable for cash, gift cards, and travel. Each bristle with perks, and amazingly, two charge no annual fee.

-

Navigate This Article:

Best Chase Ink Business Card For General Purchases

Business expenses often don’t fit into stereotypical categories. A flat-rate credit card may be your best bet if that describes your spending.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Chase Ink Business Unlimited® Credit Card pays the same generous rewards rate on all eligible purchases. It’s an excellent choice for small business owners who want a simple, low-cost credit card. The Ink Business Unlimited® Credit Card has no annual fee, and you can authorize employee cards at no additional cost.

Benefits from this card include extended warranty protection, auto rental collision damage waiver, purchase protection, travel and emergency assistance services, and zero liability protection. In addition, you can integrate your card account with bookkeeping software to simplify accounting.

Best Chase Ink Business Card For Travel

Business travel is expensive. If your business requires significant expenditures for flights, hotels, and rental cars, you want a business card that offers generous travel rewards.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card delivers a lot of value for a moderate annual fee. You get a bonus rewards rate on travel and other business combined purchases, a large signup bonus, and a 25% increase in rewards value when you redeem your points through Chase Travel℠.

The Ink Business Preferred® Credit Card‘s elevated bonus reward rate extends to purchases for shipping, online advertising, and connectivity (i.e., internet, cable, and phone services). This Visa card doesn’t charge a foreign transaction fee on international purchases and provides 1:1 point transfers to participating frequent travel programs. For travelers, the Ink Business Preferred® Credit Card is the best credit card with the Ink logo.

Best Chase Ink Business Card For Business Expenses

Businesses often spend money on physical assets, such as furniture and equipment, when they’re first starting up. The ideal business card would offer bonus rewards and an introductory 0% APR after account opening for startup purchases and ongoing expenses.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card offers tiered rewards on several types of business spending. The welcome offer, promotional APR after account opening, and high reward rates help finance frequent trips to office supply stores and restaurants.

The Ink Business Cash® Credit Card‘s post-introductory APR is low, and there is no annual fee. You’ll enjoy peace of mind knowing that the bank monitors your transactions for possible signs of fraudulent activity.

Alternative Chase Business Cards

Chase offers business credit cards that are co-branded with Southwest and United Airlines. They provide frequent flyer points or miles that you can use for airline tickets and seat upgrades.

- Earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

- 6,000 bonus points after your Cardmember anniversary.

- Earn 3X points on Southwest Airlines® purchases.

- Earn 2X points on Rapid Rewards® hotel and car rental partners.

- Earn 2X points on rideshare.

- 1 point per $1 spent on all other purchases.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49% – 28.49% Variable

|

$99

|

Good/Excellent

|

The Southwest® Rapid Rewards® Premier Business Credit Card lets you and your employees fly for less, and your bags fly for free. You can change flights without additional fees and access unlimited reward seats with no blackout dates or restrictions.

In addition to the bonanza of signup points, the card lets you earn points toward A-List status when you meet annual spending thresholds. This Chase business credit card also comes with four upgraded boardings per year.

- Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

- 9,000 bonus points after your Cardmember anniversary.

- Earn 4X pts on Southwest® purchases.

- Earn 3X points on Rapid Rewards® hotel and car rental partners.

- Earn 2X points on rideshare.

- Earn 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49% – 28.49% Variable

|

$199

|

Good/Excellent

|

The Southwest® Rapid Rewards® Performance Business Credit Card is a fine choice for frequent flyers who prefer this carrier. The welcome offer, anniversary points, and generous tiered rewards help subsidize your travel spending. And the impressive travel perks add to the card’s value.

This Chase business credit card offers reimbursement toward Global Entry or TSA PreCheck fees, annual inflight wifi credits, and employee cards at no additional cost. You’ll also pay no foreign transaction fees on international purchases.

- Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $99.

- Receive a 5,000-mile “better together” bonus each anniversary when you have both the United℠ Business Card and a personal Chase United® credit card.

- Earn 2 miles per $1 spent on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting.

- Earn 1 mile per $1 spent on all other purchases. Plus, employee cards at no additional cost – miles earned from their purchases accrue in your account so you can earn rewards faster.

- Enjoy a free first checked bag – a savings of up to $140 per roundtrip (terms apply), 2 United Club℠ one-time passes per year, and priority boarding privileges.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.99% – 28.99% Variable

|

$99

|

Good/Excellent

|

The United℠ Business Card offers solid rewards and benefits that justify its moderate annual fee. You earn bonus MileagePlus miles on purchases from United, including tickets, Economy Plus, inflight food, beverages, wifi, and other eligible purchases.

Another Ink plus: You receive Premier Qualifying Points (PQP) — up to 1,000 PQP per calendar year — when you meet certain spending thresholds. You can apply your PQP toward your Premier status qualification up to the Premier 1K level. The bonus reward rate applies to business expenses beyond flights, including dining, gas, and office supplies.

What Is Chase Bank?

JPMorgan Chase Bank is America’s largest bank, with almost $3 trillion on its balance sheet. As a vast multinational financial institution, it provides its customers with many products and services.

Chase Bank has roots in the Bank of Manhattan Company, which was founded in 1799. Its two centuries of growth through mergers and acquisitions contribute to its status as the leading credit card issuer.

Chase offers market-leading rewards cards for consumers and small businesses alike. Synergies among its credit card, debit card, and other Chase accounts foster brand loyalty that confounds competitors.

The bank spends heavily on banking technology, with an industry-leading tech budget of $11.4 billion in 2019.

How Does an Ink Business Card Work?

Ink business cards serve the needs of small business owners by providing rewards that reduce operating costs. Any business owner can apply for a Chase Ink card by filling out an online form.

Chase’s business cards differ from consumer cards in a few ways:

- Two of the three offer bonus rewards for business-related spending, such as travel, office supplies, and connectivity.

- The cards provide business support through specialized reports and integration with accounting software.

- You can authorize employee cards at no extra cost.

Chase Ink cards frequently offer new cardmembers signup bonuses. You can use the card for in-store, online, phone, and in-app purchases. You don’t incur interest charges If you pay the entire balance each billing cycle.

The cards have grace periods that extend from the end of the billing cycle to the payment due date. You can finance your purchases by paying less than the total amount due, but you must pay at least the minimum each month. The grace period returns after you repay your entire balance.

How Do I Redeem My Ink Business Card Rewards?

Ink lets you earn Chase Ultimate Rewards points on all eligible purchases. You initiate point redemption online at your account homepage, where you choose how to redeem your reward points:

- Cash: Each point is worth 1 cent, and you can cash in as many points as you want at any time. You must choose “Cash Back” on the account screen and enter the amount. You also must indicate where you want the money deposited, including a Chase demand account as one option. It may take up to three days for the funds to appear in your account. Cash is handy but may not be the best value for your points.

- Gift cards: Click on the “Gift Card” link to see the list of those available. Redemption values vary but each point is typically worth 1 cent, and the card may specify the minimum and maximum value for the purchase. The site may offer discounts that increase point values.

- Travel: Perhaps the best use of your points is to redeem them through Chase. Click the Travel link to see all your options, including flights, car rentals, hotels, and cruises. Enter your destination, travel dates, and other search criteria. You can combine points and cash for travel redemptions. In addition, the points from the Ink Business Preferred® Credit Card gain extra value when you redeem them through Chase.

- Amazon.com: Use your points to shop at Amazon by clicking on the store’s link. You must link your card to your Amazon account before using your points. Each Ink point is roughly worth about $0.008 on Amazon. It makes more sense to cash out your points and use the money for your Amazon purchase.

- Combine points from multiple Chase cards: This option is available if you own two or more Chase credit cards that offer Ultimate Rewards Points. For example, you can transfer points from a Chase Freedom Unlimited® card to an Ink card. If the recipient is the Ink Business Preferred® Credit Card, each rewards point will be eligible for the 25% boost when redeemed through Chase.

- Transfer to travel partner: If you own the Ink Business Preferred Card, you can transfer your points on a 1:1 basis to the loyalty program of a Chase travel partner (i.e., a participating airline or hotel brand). You can shift points in increments of 1,000.

You can transfer your eligible Chase Ultimate Rewards points to:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- IHG Rewards Club

- JetBlue TrueBlue

- Marriott Bonvoy

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- World of Hyatt

It’s best if you first work out the value of using your rewards at Chase Travel versus transferring them to a travel partner. Each case is unique, so it’s safest to work out the alternatives before moving your points because once your points have been transferred, they can’t be transferred back to Chase.

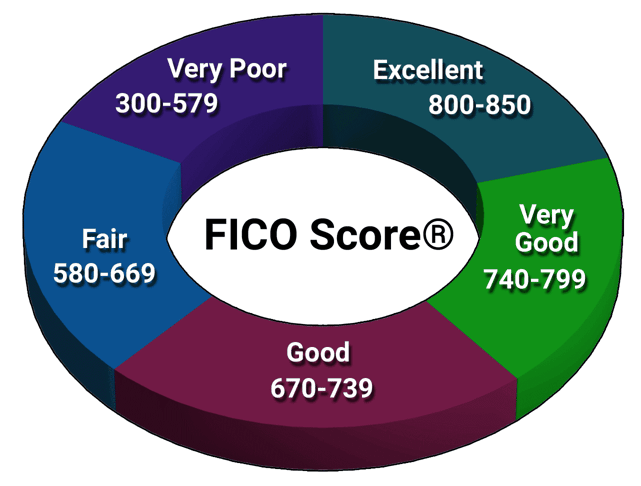

What Credit Score Do I Need For a Chase Ink Business Card?

Chase requires good or excellent credit to qualify for an Ink business card. That translates to a FICO credit score of at least 670 out of 850.

A 670 or greater credit score does not guarantee approval, and you may get a card even if your score is below 670. While your score is important, Chase may consider other factors, including your history with the bank and previous credit mistakes.

What Is the Credit Limit On a Chase Ink Business Card?

The Ink Business Preferred® Credit Card has the highest credit limit among the three reviewed Ink cards. This card reportedly has credit limits between $5,000 and $25,000, depending on credit score, debt level, and income.

You may get a higher credit limit under exceptional circumstances — for example, if you also have a well-funded investment account with JP Morgan.

Can I Prequalify For an Ink Business Card?

Chase may send you a preapproval offer inviting you to apply for one of its Ink cards. Preapproval may facilitate final acceptance, but it doesn’t guarantee it. The bank often mails or emails Ink credit card preapprovals to Chase business checking account owners.

A Chase online tool can prequalify you for select consumer credit cards. While the tool allows you to compare any Chase credit cards, it doesn’t let you prequalify for Ink Business Cards.

Can I Apply For a Chase Ink Card Without a Business?

No, one of the requirements to get a Chase Ink Card is owning a business. But you may be able to work around this obstacle without too much difficulty.

For example, you would qualify if you sold items on eBay for a profit. Another approach is to open a consultancy or some other self-employed business.

You don’t need any fancy footwork, such as incorporating or starting a limited liability company, to establish a business. You can get a Chase business card as a sole proprietor, even if you are the only employee. You do not have to take formal action to create a sole proprietorship, as you automatically gain this status by engaging in business activities.

If you run a business, you can authorize Ink business cards for your employees at no extra charge. Employees get their own cards under your account number. You collect all the rewards for your employees’ purchases with the Ink card.

You’ll want to set up controls and spending limits to ensure employees use the cards properly.

What Is the Chase 5/24 Rule?

Chase limits you to five new cards within 24 months. This notorious Chase 5/24 Rule applies to all new credit cards, not just cards from Chase. Although Chase doesn’t explicitly state the Rule, it does enforce it.

The Rule is supposed to discourage churning — which is acquiring credit cards to earn signup bonuses. The bank will likely reject your application if you run afoul of the Rule, even if you meet all other qualifications. The solution is to wait until the required 24-month period has elapsed and reapply for the Chase card.

Chase Ink Cards Mean Business

Our review reveals why the three Chase Ink business cards are compelling choices for any small business owner. If your company has only one or a few employees, you may prefer the Ink Business Unlimited® Credit Card, which comes with simple rewards and no annual fee.

The Ink Business Cash® Credit Card is also a good candidate for small businesses. Its tiered reward scheme may provide a more significant benefit.

Larger companies may want to pay an annual fee to get the Ink Business Preferred® Credit Card, as it’s the best credit card for perks. You’ll find a lot to like, whichever Chase business card you choose.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Chase’s [card_field card_choice='39321' field_choice='title']: Review & Alternatives ([updated_month_year]) Chase’s [card_field card_choice='39321' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/inkcash.png?width=158&height=120&fit=crop)

![Chase Credit Cards For Students + 8 Alternatives ([updated_month_year]) Chase Credit Cards For Students + 8 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Chase-Credit-Cards-For-Students.jpg?width=158&height=120&fit=crop)

![Surge Credit Card: Review & 5 Alternatives ([updated_month_year]) Surge Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/surgecard.jpg?width=158&height=120&fit=crop)

![7 Best American Express Card Alternatives ([updated_month_year]) 7 Best American Express Card Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/amexalt.png?width=158&height=120&fit=crop)

![9 Comenity Bank Store Card Alternatives ([updated_month_year]) 9 Comenity Bank Store Card Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Comenity-Bank-Store-Card-Alternatives--1.jpg?width=158&height=120&fit=crop)

![Cerulean Credit Card: Review & 3 Alternatives ([updated_month_year]) Cerulean Credit Card: Review & 3 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Cerulean-Credit-Card-Alternatives-Feat.jpg?width=158&height=120&fit=crop)

![7 Costco Credit Card Benefits & Alternatives ([updated_month_year]) 7 Costco Credit Card Benefits & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Costco-Credit-Card-Benefits.jpg?width=158&height=120&fit=crop)

![Mercury Credit Card: Review & 5 Alternatives ([updated_month_year]) Mercury Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Mercury-Credit-Card-Review.jpg?width=158&height=120&fit=crop)