Medical students often have to contend with high student loan debt, little or no income, and a thin credit history. The best credit cards for medical students support their unique needs by offering acceptance despite scant credit history.

These cards come with relatively moderate interest rates, no annual fees, and even some rewards. Read on to learn about the five best cards for busy medical students.

Best Overall Card for Medical Students

The Discover it® Student Cash Back card offers several security features that medical students will appreciate, especially if they have little experience with credit cards. For instance, the card monitors the dark web to provide free Social Security number alerts.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

In addition, the card has a feature lets you switch your account on or off in seconds to prevent misuse. The card monitors every purchase for suspicious activity, offers U.S.-based customer service, and provides contactless tap-to-pay convenience.

Other Top Cards for Medical Students

These cards help students build a credit history by reporting their payments to at least one of the three major credit bureaus. They also charge no annual fee and provide cash back rewards on purchases.

In addition, each card provides account alerts and other valuable credit protection tools.

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

Additional Disclosure: Bank of America is a CardRates advertiser.

What is the Best Credit Card for a Student?

Our top choice is the Discover it® Student Cash Back card, thanks to its many student-friendly features. But it really stands out by offering the highest cash back rewards in the student-card space.

Students can earn a statement credit when a referred friend is approved for their very own card. Combine these benefits with the card’s many security and convenience features, and it’s good enough to earn our top recommendation.

You may prefer the Discover it® Student Chrome card for its limited cash back rewards on restaurant and gas station purchases, two key expenses for students. In all other respects, the two Discover cards are the same.

Can You Get a Student Credit Card with No Income?

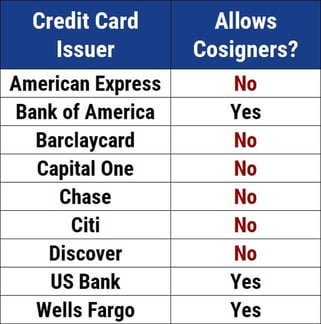

The 2009 CARD Act sets the minimum age for acquiring a credit card to 21 unless you meet certain requirements. If you are between ages 18 and 21, you can’t get a credit card unless you have a verifiable income or a qualified cosigner.

In this context, money your parents send you doesn’t count as income. That’s why obtaining a cosigner is so important — you can get a credit card with a cosigner even if you have no earned income.

If you are a medical student, you’ve probably reached age 21 (unless you are a Doogie Howser type), which means you may be able to get a credit card without an earned income or a cosigner. But you must be able to demonstrate how you could afford your monthly credit card payments.

Therefore, cosigners are the best solution for students of any age who lack earned income. However, before you recruit a friend or family member to cosign your application, be sure you understand the implications.

Cosigners guarantee credit card payments if you are unable to pay. That puts the cosigner’s credit in jeopardy, and they will almost certainly not appreciate having to step in and pay your bills. That can have negative consequences on your relationship with your cosigner.

If you miss payments, derogatory items will appear on both your credit report and your cosigner’s report. That will hurt your cosigner’s credit score and surely land you in the doghouse.

So, make sure your cosigner understands his or her obligations before signing the credit card application. Your credit score can recover from negative events given enough time — can you say the same about your relationship with your cosigner?

How Long Does it Take to Build Credit?

The way you build credit is to use credit and have that use reported on one or more of your credit histories at the three major credit bureaus Experian, TransUnion, and Equifax. You can obtain a FICO score within six months of obtaining your first credit account.

Don’t expect a high initial score, but you should start to see improvement after a few months of using your credit card responsibly. That means paying your bills on time and not overusing your credit.

There are a few steps you can take to build your credit faster:

- Secured credit card: It’s much easier to get a secured credit card than an unsecured one. That’s because you deposit an amount equal to your credit limit in a bank account that acts as collateral for your card balance. The issuer will use the account if you are late making a payment. Often, if you make all your payments on time for six to 12 months, the issuer will offer to upgrade you to an unsecured card and refund your deposit.

- Credit builder account: These are secured loan accounts offered by banks and credit unions. You deposit an amount into a special account and then take a loan against the account. You then repay the loan in monthly installments. Once repaid, your deposited money is released. The institution reports your payments to the credit bureaus, which allows you to build your credit via timely payments.

- Authorized user: A person with good credit can make you an authorized user on his or her credit card. You can use the card as if you owned it, and your payment activity will appear on both your credit reports. By making timely payments, your credit score should improve without hurting the account owner’s credit.

Remember, it takes a while to build credit, but only an instant to ruin it. Don’t be delinquent paying your bills and avoid bounced checks, defaults, collections, and bankruptcy. If you take your credit seriously, so will the credit bureaus.

Attractive Offers Students will Appreciate

We’ve explored the five best credit cards for medical students and gave top honors to the Discover it® Student Cash Back card. However, all five cards are attractive options and offer special features that students will appreciate.

In most cases, you must demonstrate a steady income to qualify for a credit card but can overcome this restriction by recruiting a cosigner when you apply for a card. Once you have a credit card, you can use it to build your credit by paying your bills on time and always paying at least the minimum due.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Medical Credit Cards ([updated_month_year]) 12 Best Medical Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/08/medicalcards.png?width=158&height=120&fit=crop)

![8 Best Credit Cards for Students with No Credit ([updated_month_year]) 8 Best Credit Cards for Students with No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-4.jpg?width=158&height=120&fit=crop)

![6 Credit Cards for Students with Fair Credit ([updated_month_year]) 6 Credit Cards for Students with Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-for-Students-with-Fair-Credit.jpg?width=158&height=120&fit=crop)

![8 Credit Cards for Students with Bad Credit & No Deposit ([updated_month_year]) 8 Credit Cards for Students with Bad Credit & No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/12/Credit-Cards-For-Students-With-Bad-Credit-No-Deposit-4.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Students ([updated_month_year]) 7 Best Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2013/07/crfeatured1.jpg?width=158&height=120&fit=crop)

![8 Best Travel Credit Cards for Students ([updated_month_year]) 8 Best Travel Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Travel-Credit-Cards-for-Students-1.jpg?width=158&height=120&fit=crop)

![9 Best Study Abroad Credit Cards for Students ([updated_month_year]) 9 Best Study Abroad Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/Best-Study-Abroad-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Grad Students ([updated_month_year]) 5 Best Credit Cards for Grad Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/gradstudent.png?width=158&height=120&fit=crop)