Whether you are a new farmer with 20 acres or a seasoned agricultural veteran with hundreds of acres, the right credit card can offer tremendous rewards for your farming operation. Those may include flexible financing options and beneficial cash back programs.

Continue reading to learn more about the top business cards for farmers, plus the benefits of using a credit card for farming supplies. We also cover the four farm credit funding banks and provide other helpful financing information for farmers.

-

Navigate This Article:

Best General-Purpose Business Cards For Farmers

Although not farmer-specific, general-purpose business cards such as the Ink Business Unlimited® Credit Card and the Capital One Spark Miles for Business are highly versatile. They offer attractive APRs, no annual fee, and cash back opportunities when you spend on select categories.

Here are our preferred general-purpose business cards for farmers:

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

Capital One Spark Miles for Business is a highly rated business credit card that offers unlimited rewards on business-related purchases. Book flights, hotels, and rental cars through Capital One Travel and stretch your points further. It also charges no annual fee for the first year.

This card also offers a travel credit for Global Entry or TSA PreCheck, services that can help travelers breeze through security checkout lines at the airport.

Cardholders are eligible for a one-time miles bonus with a minimum spend on qualifying purchases within the first three months of owning the card. We highly recommend the Capital One Spark Miles for Business for farmers who travel a lot and want to be rewarded for everyday purchases.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

One of Chase’s most popular cards is the Ink Business Unlimited® Credit Card. This card offers several benefits, including a generous cash back bonus after spending a minimum on purchases within the first three months after account opening. The card also provides unlimited opportunities to earn cash back on all other business-related purchases.

With the Ink Business Unlimited® Credit Card, the APR you qualify for depends on your credit. If more than one person needs to use the card, employee cards with individual spending limits can be assigned at no charge.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred Credit Card provides bonus points after reaching a minimum spend on purchases within the first three months. It follows that with a set number of points for every dollar spent on qualifying purchases up to specified minimums.

Another benefit to using this card is the rewards program, through which cardholders can redeem points for gift cards, flights, hotels, and other travel experiences. Points are worth more when booking travel through this portal, stretching your spending power even further. You also have the option to complete a balance transfer from another card, which can take up to 21 days to process.

This card also provides employee cards with individual spending limits free of charge.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card is one of our favorite cash back credit cards, offering new cardholders a welcome cash bonus (as statement credit) after reaching a minimum spend within the first three months of account opening.

But the main draw is its regular cash back program, and you can earn even more when spending on select business categories. Plus, it has no annual fee, which helps maximize your earning opportunities. The APR is also respectable, with exact interest rates depending on your credit score at the time you submit your application.

Best Cards Made Specifically For Farmers

These cards come from banks that specifically support farmers. Here are a few of the best we’ve found:

5. Farm Bureau Bank Premier Business Visa®

The Farm Bureau Bank Premier Business Visa® is an excellent business credit card. It offers a credit limit of up to $50,000 with attractive APRs and an intro APR on purchases and balance transfers for your first three billing cycles. Farmers can use these funds to pay for all types of expenses, such as equipment, machinery, and livestock feed.

With this reward card, you earn one point for every dollar spent on qualifying purchases and are part of its Business Member Rewards program, which offers additional perks.

To qualify for the Farm Bureau Bank Premier Business Card, you must be 18 or older with a two-plus-year-old business. When you request a credit limit higher than $35,000, you may need to produce additional supporting documentation, such as one year’s worth of corporate tax or personal tax returns.

6. AgriBuy Rewards Mastercard

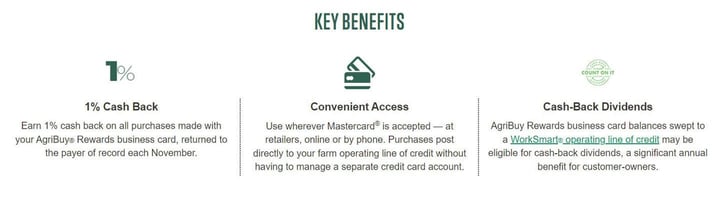

Issued by Farm Credit Services of America, the AgriBuy Rewards Mastercard is one of our favorite farmer’s rewards cards. The card offers 1% cash back on all purchases, which is paid out in one lump payment every November. Balances may post to the brand’s WorkSmart operating line of credit, allowing you to earn cash back dividends.

The AgriBuy Rewards Mastercard has a loyal following and has paid more than $80 million in cash back dividends through the WorkSmart program since 2004.

7. Tractor Supply Credit Card

The Tractor Supply Credit Card is a solid all-around card, offering up to 5% in rewards on everyday purchases in select categories. Cardholders also enjoy 3% rewards when spending at gas stations and grocery stores and 1% on all other purchases.

Another card benefit is inclusion in the Preferred Plus Neighbor program, a loyalty program offering free same-day delivery and full-day truck rental through select partners. It’s a three-tiered program that earns you one point, 1.5 points, or two points per dollar spent, with benefits leveling up as you upgrade based on your spending habits.

This card is ideal if you are looking for generous rewards payouts and a robust loyalty program.

Is There a Credit Card for Farmers?

Yes, farmers have many credit cards available to them. Three of our preferred options include the Farm Bureau Bank Premier Business Visa®, Agribuy Rewards Mastercard, and the Tractor Supply Credit Card.

Also called agricultural credit cards, they align to the specific needs of farmers, offering cash back and additional benefits, such as same-day delivery and full-day trailer rental from select partners (Tractor Supply Credit Card). They also come with additional features, including expense tracking, higher credit limits, and specialized support for farmers.

To qualify, you must meet specific eligibility criteria, depending on the credit card issuer. At a minimum, you should be actively involved in farming with a minimum income, credit score, or number of years in business. Notably, general-purpose cards such as the Capital One Spark Miles for Business do not require a farming background.

Credit cards that cater to farmers may have higher credit limits than regular credit cards. Some go as high as $50,000, which is enough to pay for specialized equipment, machinery, and other farming expenses.

What Is the Best Bank for Farmers?

Every bank has its own agricultural expertise. Local institutions may allow for concessions such as high transaction limits and free waivers for farming-related expenses.

One of the more popular agricultural banks in the US is Farm Credit Services of America. If you belong to one of the Agricultural Credit Associations (ACA), you may qualify for land loans, operating lines of credit, equipment, and other types of loans to maintain or upgrade your farming operations.

Another benefit to enrolling in the Farm Credit Services of America is its popular 5% down payment loan program, which can lower your upfront costs. You can even finance your down payment, depending on your credit profile. With more than $35 billion in loan volume since 2021, it’s one of the more popular farming loan programs.

What are the Benefits of Using a Credit Card for Farming Supplies?

Using your credit card to purchase farming supplies can also have many benefits. Those may include:

- Record Keeping. Paying for your farming supplies using credit cards produces detailed records of all transactions. You can use these records for tax prep, accounting, and other administrative tasks to help streamline your operation.

- Rewards Programs. Credit cards typically include rewards programs that offer cash back for spending on farm-related purchases. For example, the Tractor Supply Credit Card offers up to $50 in rewards with qualifying Tractor Supply purchases for new cardholders, 3% at gas stations and grocery stores, and 1% on all other purchases. If you are a big spender, a credit card designed for farmers is an excellent way to lower supply and equipment costs.

- Building Credit. With responsible credit card use, you can secure more financing to purchase necessary items, such as equipment, down the road. Remember, the higher your credit score, the lower your APRs and the more favorable your loan terms. If your score is low, we recommend building credit as soon as possible.

In short, safe record-keeping, rewards programs, and credit-building opportunities are the most significant benefits of using your credit card for farming supplies.

What Are the 4 Farm Credit Funding Banks?

The four credit funding banks that form the Farm Credit System (FCS) are the Federal Farm Credit Banks Funding Corporation, AgFirst Farm Credit Bank, CoBank, and AgriBank.

These four farm credit institutions play a significant role in financing and supporting farmers nationwide. The Federal Farm Credit Banks Funding Corporation raises funds from investors through debt securities, which are then passed to the AgFirst Farm Credit Bank, CoBank, and AgriBank.

Differences between each bank primarily come down to the region serviced. While Agribank serves the Midwest, AgFirst Farm Credit Bank serves the Eastern and Southern parts of the country. AgriBank specializes more in lending to utility and telecommunications-focused rural businesses nationwide.

In short, all four farm credit funding banks are integral in providing farmers and rural communities access to the funds they need to support general farming activities, agribusiness, and rural infrastructure projects.

Who Lends Money to Farmers?

Many institutions lend money to farmers, including the following:

Farm Credit System Institutions. One of the most popular funding sources for farmers is the Farm Credit System (FCS), a network of cooperative-owned banks that offer loans and other financial support to farmers. Three of the more popular networks are Farm Credit Banks, Agricultural Credit Associations, and the Federal Land Credit Association.

For example, the Florida-based Farm Credit of Central Florida is an agricultural credit association that provides loans to farmers. You can use these funds to purchase equipment and plots. The organization even offers crop insurance programs to help protect against catastrophic losses due to natural disasters.

Credit Unions. Other funding sources for farmers are credit unions. Like Farm Credit System institutions, credit unions offer agricultural lending programs. To qualify, you generally need to have a high FICO score and minimum monthly income.

Farm Credit Cards. Credit cards such as the Farm Bureau Bank Premier Business Visa® and the AgriBuy Rewards Mastercard offer competitive interest rates, credit line flexibility, expense management tools, and other features that help farmers maximize their money. Some of our favorite benefits are statement credit and rewards programs that offer points for every dollar spent on qualifying purchases.

Secure Financing for Your Farm Today

Today, farmers have access to plenty of credit card and lending opportunities that offer quick credit approval, rewards programs, and business credit services. From equipment to livestock, farmers have no shortage of expenses that require a steady stream of funding, and they can secure purchasing power through farmer-specific or general-purpose business cards.

Research and compare a few credit cards on this list to find the ideal credit card for your situation.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![Financing a Business Using Credit Cards ([updated_month_year]) Financing a Business Using Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Financing-Business-Using-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Corporate Credit Cards ([updated_month_year]) 5 Best Corporate Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/corp.png?width=158&height=120&fit=crop)

![17 Best Credit Cards for Business Expenses ([updated_month_year]) 17 Best Credit Cards for Business Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/expense.png?width=158&height=120&fit=crop)

![12 Best Business Credit Cards for Travel ([updated_month_year]) 12 Best Business Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/business-credit-cards-for-travel-feature.jpg?width=158&height=120&fit=crop)

![8 Best Business Credit Cards for Startups ([updated_month_year]) 8 Best Business Credit Cards for Startups ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/Best-Business-Credit-Cards-for-Startups-Feat.jpg?width=158&height=120&fit=crop)

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)

![7 Best Cash Back Credit Cards for Business ([updated_month_year]) 7 Best Cash Back Credit Cards for Business ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_289823318.jpg?width=158&height=120&fit=crop)