This Capital One Quicksilver card review makes it clear why many folks name this card when asked, “What’s in your wallet?”

In a nutshell, it’s a popular card from a popular card issuer, offering a straightforward rewards scheme and a sign up bonus, all without charging an annual fee. While the card is pitched to consumers with excellent credit, the truth is you can get the card even if your credit score is less than perfect.

Rewards | Benefits | Credit Requirements | Alternatives | FAQs

Earn Cash Back On Every Purchase, Every Day

Any collection of the best credit cards will feature a variety of ways to earn rewards, whether cash back, points, or miles. At one extreme, you’ll find card rewards that are almost Byzantine in complexity, requiring you to activate high reward rates every quarter on a rotating set of merchant types while charging you a steep annual fee.

At the opposite extreme is the Capital One Quicksilver Cash Rewards Credit Card that provides an unlimited 1.5% cash back on all purchases, every day.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Consumers will find this card appealing when they want a simple rewards arrangement that covers every type of purchase without favoring certain merchant types over others. You know you’ll receive a good cash back rate on each purchase, whether you’re at the local grocery store or a three-star restaurant in Estonia.

The Capital One Quicksilver Cash Rewards Credit Card provides features that appeal to many consumers. The simple rewards structure of the Capital One Quicksilver Cash Rewards Credit Card doesn’t favor any category of purchase, whether for travel, dining out, grocery shopping, or filling up the gas tank. All purchases are equally rewarded, and there is no cap on the rewards you can collect.

Moreover, the flat cash back rate is 50% higher than the standard base rate offered by most credit cards for purchases that don’t correspond to a favored merchant type. Your rewards do not expire as long as the account remains open. You can redeem any amount of cash back at any time in the form of a check or statement credit.

If you prefer, you can use your rewards to get a gift card, cover recent purchases, pay for purchases at Amazon.com, or make online purchases using PayPal Pay with Rewards.

The card offers you the option of setting up automatic redemption either at a set time each calendar year or when you earn a specific threshold amount (ranging from $25 to $1,500). Another nifty feature is that you may be eligible to transfer rewards to certain other Capital One credit card products. You can redeem your rewards at the Capital One website or via the Capital One Mobile App.

Capital One and World Elite Mastercard® Benefits

The simplicity of the Quicksilver rewards structure is augmented by the rich collection of benefits the card bestows upon its owners. As a World Elite Mastercard®, the card provides the following:

- Purchase assurance: Covers damage or theft for 90 days.

- Price protection: Receive the lower price from a printed advertisement or non-auction internet ad within 120 days of purchase.

- Extended warranty: Doubles the original manufacturer’s warranty up to a maximum of 24 months, up to $10,000 per covered purchase.

- Cellular wireless telephone protection: Covers loss or repair of your phone when you pay the monthly bill with the card.

- Concierge services: Access to a personal assistant 24/7 for making reservations, planning a trip, getting tickets to unique entertainment venues, and much more.

- Mastercard ID theft protection: Access to several identity theft resolution services.

- Identity fraud expense reimbursement: Coverage of losses due to identity fraud.

- Travel assistance services: Includes card replacement coverage, medical assistance, legal referral, roadside service, and more.

- Car rental coverage: Up to 31 days of vehicle rental insurance.

- Worldwide automatic travel accident, baggage, trip cancellation/interruption insurance: Comprehensive insurance of up to $1 million for you and your family covering loss of life or limb, as well as coverage for trip delay, trip cancellation, and baggage delay, loss, or damage.

- World Elite programs: Receive complimentary and discounted extras for air travel, cruises, hotel stays, tours, nightclubs, and more.

Beyond the rewards that accompany any World Elite Mastercard, the Capital One Quicksilver Cash Rewards Credit Card also provides:

- $0 fraud liability.

- Access to Eno, the Capital One assistant that supports virtual account numbers and reports potentially mistaken, unexpected, and duplicate payments.

- Instant purchase notifications.

- Access to Capital One Shopping to automatically apply coupon codes.

- Instant card lock.

- Gift card redemption.

- CreditWise alerts to credit report changes.

- Visibility of the recurring merchants that store your card online.

- Autopay for automatic card payments every month.

- Tracking of spending by authorized users.

It boggles the mind that the Capital One Quicksilver Cash Rewards Credit Card gives you this cornucopia of benefits for no annual fee.

Good to Excellent Credit is Required (670+ FICO)

The consensus is that you need to have a good to excellent FICO score (670 to 850) to obtain the Capital One Quicksilver Cash Rewards Credit Card. In addition, Capital One credit card products define good credit to mean:

- No payments more than 30 days late in the last year.

- No bankruptcies or defaults in the past five years.

However, the card’s fine print reveals a less stringent bankruptcy requirement: You cannot currently have a non-discharged bankruptcy. Additional requirements include:

- United States residency, excluding correctional institutions.

- Minimum age of 18.

- A valid Social Security number.

- Monthly income that exceeds your rent or mortgage payment by at least $425.

- Having not applied for more than one Capital One credit card in the last 30 days.

- No more than four open Capital One credit card accounts.

- Not exceeding the credit limit on any Capital One credit card.

Despite the indicated minimum credit score of 670, several commentators on the various online forums were approved for the card despite having lower credit scores.

5 Alternatives to the Capital One Quicksilver Cash Rewards Credit Card

Quicksilver is a nice choice for those of you who have good credit and want a cash back card with a simple rewards scheme. However, if the Quicksilver’s credit score requirement or reward structure presents a problem, consider one of these five worthy competitors.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

If you’d like a Quicksilver card but have average credit or fair credit, consider the Capital One QuicksilverOne Cash Rewards Credit Card. Each credit card offer features the same cashback rewards rate, but the QuicksilverOne card charges an annual fee, offers no signup bonus nor 0% introductory APR, and its regular APR is higher than Quicksilver’s top rate. The QuicksilverOne card is not a World Elite Mastercard.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® serves the same cardmember credit scores as the Capital One Quicksilver Cash Rewards Credit Card and offers the same signup bonus, 0% introductory APR for purchases, cash advance transactions, and base cash back rate. However, this Freedom card has a tiered structure with higher rewards for purchases from certain types of merchants. The cards provide similar but not identical benefits so you can’t go wrong with either.

- Earn $200 back in the form of a statement credit after you spend $2,000 in purchases on your new card in your first 6 months

- Unlimited 1.5% cash back on every purchase

- 0% intro APR on purchases and balance transfers for 15 months from the date of account opening, then a variable APR applies

- Rental car loss and damage insurance when you use your eligible card to reserve and pay for the entire rental and decline the collision waiver at the rental company counter

- Find out if you prequalify for the Cash Magnet® Card or other offers in as little as 30 seconds.

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.24% - 29.99% Variable

|

$0

|

Good/Excellent

|

The American Express Cash Magnet® Card mimics Quicksilver in terms of annual fee, required credit score, cash back rewards, and 0% intro APR on purchases. However, the sign up bonus requires twice the spending to earn the same reward as Quicksilver’s, and only the Magnet card imposes a foreign transaction fee.

4. Wells Fargo Cash Wise Visa® Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Wells Fargo Cash Wise Visa® Card is a fairly close match to Quicksilver, as they share the same cash back structure, consumer audience, spending requirement for the signup bonus, and 0% intro APR on purchases. However, you receive a welcome bonus that is 25% less than Quicksilver’s, and Cash Wise charges for foreign transactions. On the positive side, the Wells Fargo card alone offers a 0% intro APR on balance transfer transactions and pays a higher cash back rate during the first year for qualified mobile wallet purchases.

(The information related to the Wells Fargo Cash Wise Visa® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

If your credit isn’t strong enough for a Quicksilver card, consider the Capital One Platinum Credit Card instead. It is a basic card, so it offers no rewards, sign-up bonus, nor 0% introductory APR. On the positive side, the card charges no annual or foreign transaction fees, and it provides $0 fraud liability coverage, access to CreditWise from Capital One, and ATM location services when traveling.

Is the Capital One Quicksilver Cash Rewards Credit Card a Good Card?

The Capital One Quicksilver Cash Rewards Credit Card is highly respected because it offers good rewards and benefits while charging no annual fee. You earn cashback rewards at a flat rate for all purchases, and the amount of cash back you can earn is unlimited. The card offers a modest welcome bonus that is easy to achieve, and you get an intro APR of 0% for 15 months.

Many consumers appreciate the simplicity of the Quicksilver card’s reward scheme. The problem with complicated tiered or rotating rewards is that they favor certain merchant types over others. That’s not much good if you happen to spend your money at other types of merchants because complicated cards will pay only a 1% base rate on everyday purchases.

Many consumers appreciate the simplicity of the Quicksilver card’s reward scheme. The problem with complicated tiered or rotating rewards is that they favor certain merchant types over others. That’s not much good if you happen to spend your money at other types of merchants because complicated cards will pay only a 1% base rate on everyday purchases.

Because Quicksilver pays more than the base rates on everyday purchases from most other cards, it assures you of a higher rate of cash back on everything you buy. As such, Quicksilver’s real competitors are other cards that also provide a higher flat reward on all purchases.

This review compares four rewards cards to Quicksilver, and all are fairly evenly matched. You may gravitate toward Quicksilver for benefits like 0% intro APR on new purchases or a sign-up bonus superior to some others. In addition, Quicksilver impresses with a long list of benefits that seem quite generous for a card that charges no annual fee.

What Type of Credit Card is Quicksilver?

The Capital One Quicksilver Cash Rewards Credit Card is a World Elite Mastercard® that pays cash back rewards on all purchases. We’ve documented above the many benefits that this type of Mastercard provides, and they include security features, purchase protections, travel insurance, and access to exclusive venues.

As a flat-rate cash back card, Quicksilver can provide unlimited cash rewards. That’s an important plus because many cash back cards with tiered or rotating rewards place limits on how much high-rate reward you can collect in a quarter or a year. You earn Quicksilver rewards automatically, without the fuss of quarterly activations.

As a Mastercard, Quicksilver is widely accepted around the world, second only to Visa. This, in conjunction with its travel benefits, makes Quicksilver a good card when you take a trip abroad.

What Is the Highest Credit Limit For the Capital One Quicksilver?

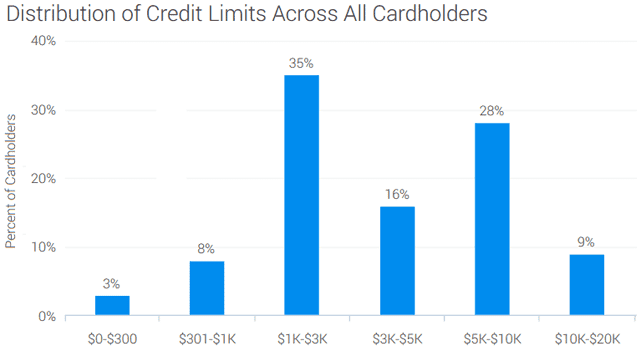

We’ve seen a review that pegged a Quicksilver initial credit limit at $30,000, a number we consider highly unusual. Most Quicksilver cards have credit limits in the $1,000 to $10,000 range, with 35% between $1,000 and $3,000.

The following graph shows the credit limits of reviewers who were approved for the Capital One Quicksilver Cash Rewards Credit Card, as reported by Credit Karma in 2017:

Reviewers have reported that younger cardmembers in the age range of 18 to 24 have, on average, the lowest credit limits. The opposite is true for folks who are 55 and older. Presumably, this indicates how the length of your credit history impacts your credit.

What Is the Difference Between Quicksilver and QuicksilverOne?

Both of these Capital One cards provide the same unlimited cash back flat rate on all purchases. The major difference between the two is that Quicksilver is designed for consumers with good-to-excellent credit, and the Capital One QuicksilverOne Cash Rewards Credit Card competes for folks with average credit, fair credit, or worse.

Given the different audiences, you would expect Quicksilver to offer many features that QuicksilverOne doesn’t, and you’d be right. QuicksilverOne jettisons the signup bonus and 0% introductory APR found with the Quicksilver card.

While it’s not surprising that the QuicksilverOne has a higher regular purchase APR, it also charges an annual fee. The reason for both is the higher risk Capital One accepts when approving QuicksilverOne to bad credit consumers. By charging more interest and fees for obtaining and using QuicksilverOne, Capital One helps cushion itself from loss due to account defaults.

Only the Quicksilver is a World Elite Mastercard®, a designation that comes with a benefits bonanza that QuicksilverOne can’t approach. Think of QuicksilverOne as a card that can help you improve your credit score by allowing you to demonstrate creditworthy behavior — paying your bill on time, keeping your balance low, and not exceeding your credit limit.

Conversely, QuicksilverOne cardmembers can think of Quicksilver as the brass ring they can grab by lifting their credit score. The score improvements they can gain through the responsible use of their QuicksilverOne card will help pave the way to acceptance as a Quicksilver card owner.

Does Capital One Increase Your Credit Limit?

For the most part, Capital One is ready to increase your credit limit if you merit it. By that, we mean that you’ve paid your bills on time for an extended period of time, minimally six months or longer, and you’ve kept your credit utilization ratio — total credit used divided by total credit available — below 30%. It’s also important to refrain from exceeding your current credit limit.

Typically, Capital One won’t increase the limits on accounts that:

- are less than three months old.

- are secured card products.

- received a credit limit increase (or decrease) in the previous six months.

Even if your account isn’t stymied by any of these conditions, Capital One may still deny you a higher credit line. Certain actions are bound to ruin your chances for more credit, such as a late or returned payment — if you’ve ever had a bank account, you know that banks have no sense of humor.

You don’t necessarily have to show higher income to qualify for a credit line increase as long as you continue to observe good credit habits. It helps to actually use your card regularly before asking for more credit and to wait at least six months between requests.

Don’t assume that paying your balance in full each month is the only way to boost your credit limit. Card issuers make money when you cough up a little interest, so stretching repayments over multiple months may endear you to the credit card company more than full monthly repayments. After all, if you don’t use a good portion of your credit line, why should the bank grant you more credit?

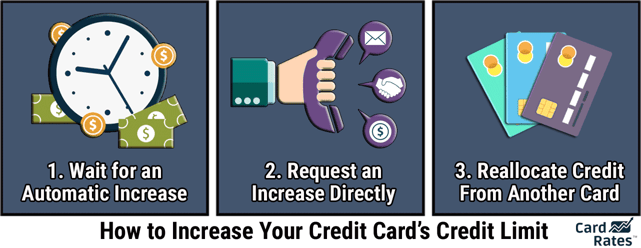

You can approach a credit limit increase in two ways: Wait for it or ask for it.

Wait For an Unsolicited Increase

The sharp folks at Capital One keep track of all the important parameters that impact the amount of credit they are willing to give you. Creditworthy behavior for an extended period coupled with active use of your Quicksilver card may cause the credit card company to raise your credit limit without you asking for it.

This is especially true if your initial credit limit was low. The minimum credit limit on the Quicksilver card is $300, which is the amount assigned to applicants who just squeeze through the underwriting procedure. The problem for Capital One is that it is unlikely to earn much interest income with such a low credit limit.

Therefore, it’s in the bank’s interest (pun intended) to goose your credit limit higher in the hope of getting you to spend more and carry a bigger balance over multiple billing cycles. We’ve come across forum reviews in which new cardholders who started with a small credit limit received a substantial increase in only a few months. That’s a faster increase than you could expect by asking for one.

If you have a secured card, you may be invited to convert it into an unsecured one. If you accept, your deposit will be refunded to you, but the credit limit may not necessarily increase.

Request a Higher Limit

If some time has gone by and you haven’t been treated to an unsolicited limit increase, give the friendly Capital One customer reps a call at 1-800-955-7070. If you make a compelling case, you may get your increase approved right on the spot, but don’t be surprised if it takes a few days to get a verdict.

You’ll receive written confirmation of the bank’s decision electronically or through the mail, depending on whether you’ve agreed to paperless documents. Forum comments suggest Capital One approves many increases without a hard pull of your credit reports. That’s good because hard inquiries can harm your credit score, although the damage is mild and transient.

One argument for a higher credit limit is almost certain to get serious consideration — declaring your intention to transfer balances from other cards to consolidate your credit card debt. The argument is especially potent if the other cards aren’t from Capital One.

So, Is the Capital One Quicksilver the Right Choice For Your Wallet?

We trust that this Capital One Quicksilver Card review has given you the information you need to decide whether Quicksilver is a good addition to your wallet (and digital wallet). You can prequalify for the card by clicking on the See Details link, which will bring you to the card’s website where you can fill out a short request form.

Before accepting an invitation to get the card, avoid surprises by taking the time to read the terms and conditions that the issuer must provide with any credit card offer.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Capital One Quicksilver Credit Limit ([updated_month_year]) Capital One Quicksilver Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/shutterstock_528794008.jpg?width=158&height=120&fit=crop)

![Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year]) Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/recon.jpg?width=158&height=120&fit=crop)

![Citi Credit Card Preapproval Options ([updated_month_year]) Citi Credit Card Preapproval Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Credit-Card-Preapproval.jpg?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![7 Options to Get Cashback on a Credit Card ([updated_month_year]) 7 Options to Get Cashback on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Cashback-Credit-Card.png?width=158&height=120&fit=crop)

![7 Options When Your Credit Card APR Rises ([updated_month_year]) 7 Options When Your Credit Card APR Rises ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/shutterstock_591898394-edit1.jpg?width=158&height=120&fit=crop)

![7 Virtual Prepaid Card Options ([updated_month_year]) 7 Virtual Prepaid Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Virtual-Prepaid-Card.jpg?width=158&height=120&fit=crop)