The word “balance” generally represents stability, whether referring to an equal distribution of weight or your mental well-being. This, of course, doesn’t have quite the same meaning in regards to your credit card. So, what is a credit card balance?

When you get a new credit card, you’ll receive a monthly statement summarizing the previous month’s purchases, even if there were none. In bold letters, usually somewhere near the top of the statement, you’ll see the word BALANCE — this is what “credit card balance” means – the amount you owe to the credit card company for any transactions made using the card.

While some might not be able to avoid carrying a balance, most can avoid paying interest on a balance with the right card offers, and we’ll show you how. In this article, we’ll take a closer look at credit card balances, how to transfer balances from one card to another, and explore some of our top choices for balance transfer cards on the market today.

Definition | Balance Transfers | 0% Intro Offers

Your credit card balance can be positive, negative, or zero. A positive balance reflects any amount owed to the credit card company while a negative balance reflects a balance owed to you. This can happen when you make a payment that is larger than what you owe, for example, having a $1,000 balance and making a $1,200 payment. The remaining $200 will be applied to your next purchase(s) until you’ve been credited the full $200.

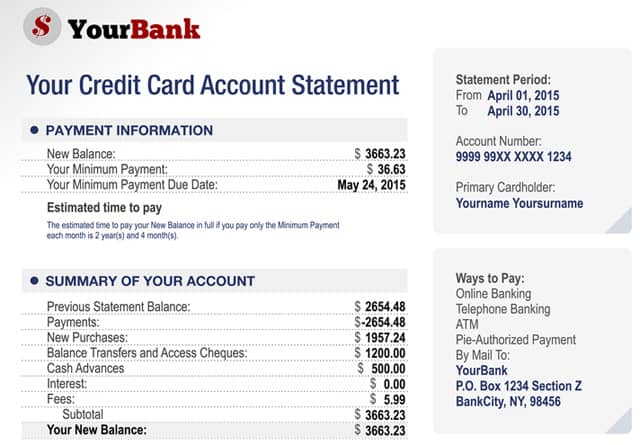

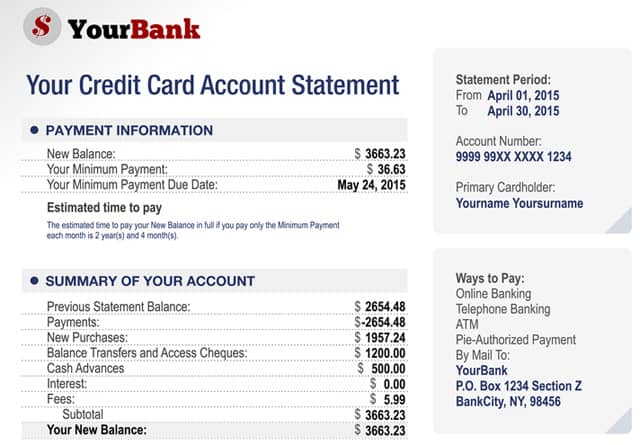

Your balance includes a few things, not just purchases made with the card. There are interest charges — determined by your creditworthiness at the time of applying — and fees, such as an annual fee or late payment fees, that can be added to the amount you owe.

This sample credit card statement is a summation of any previous balance plus new purchases, fees, and interest charges that equate to a new balance.

The good news is there are cards that don’t charge interest for an extended period when you transfer an existing balance and/or on new purchases; cards with no annual fees; and even cards that charge no interest or annual fees, like the ones we’ll cover below.

A balance transfer lets you transfer an existing balance from one card to another with a lower – oftentimes 0% — interest rate. This helps you pay off your balance much faster, as more of your payment is going toward the amount you owe rather than continually accruing interest.

The accruing interest is what makes it so difficult to pay off a credit card in the first place if you have a high balance with a high interest rate.

A balance transfer calculator can show you how much you could potentially save by getting a card with a 0% interest rate. These promotional APRs are generally good for 12 to 18 months, though some cards will periodically offer longer terms.

Below are the best balance transfer offers currently available, all with no annual fees and extended 0%-intro APR periods. Some even come with additional perks, like cash back and free FICO scores, but you must have good credit to qualify.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

|

|

|

|

|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

0% BALANCE TRANSFER RATING

★★★★★

4.8

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

|

|

|

|

|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

+ See More Balance Transfer Offers

You can save a significant amount of money if you can score up to 18 months paying no interest, particularly if you carry a large balance. Just watch out for balance transfer fees, which are generally 3% to 5% of the amount being transferred.

Also, a balance transfer can be done with more than one card. For example, if you have two cards with balances that are being charged interest, you can request to have both balances transferred to the new card, so long as the credit limit you’re approved for accommodates it – just know that you’ll be charged a balance transfer fee per balance transferred, and you likely will not earn rewards for transferred balances.

Even if you don’t have a current balance that would benefit from a 0% interest rate, everyone can benefit from a card that doesn’t charge interest on new balances.

Just as balance transfer cards allow for an extended period of interest-free payments, 0%-intro APR cards allow new cardholders to pay no interest on all qualifying purchases for an extended period. It’s essentially a free loan, which you certainly can’t get from any bank.

Below are our expert’s favorite 0%-intro APR offers currently available. The offers include cash back and free FICO scores, among other perks and protections only afforded through a credit card.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+ See More 0%-Intro APR Cards

Cards with 0% introductory APRs offer a great way to make purchases without having to pay interest fees, but be sure to understand when the 0% APR period ends or else those interest fees will start stacking up.

One of the most important factors in calculating your credit score is your credit utilization ratio. This ratio represents how much debt you have (your balances) in relation to your credit limits. Most experts recommend keeping your balance below 30% of a card’s available limit, so, for example, if you have a credit card with a $3,000 limit, keeping your balance below $900 will help ensure your debt doesn’t negatively impact your credit score.

When you’re able to keep your credit card balances low, and even pay no interest on said balances, you can keep your credit cards and your financial well-being, well, balanced!

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year] How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year]](https://www.cardrates.com/images/uploads/2017/06/how-to-transfer-credit-card-balance.jpg?width=158&height=120&fit=crop)

![What is a Balance Transfer Credit Card? ([updated_month_year]) What is a Balance Transfer Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/What-is-a-Balance-Transfer-Credit-Card-Feat.jpg?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)

![9 Best 0% Balance Transfer Credit Cards ([current_year]) 9 Best 0% Balance Transfer Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_1495481012.jpg?width=158&height=120&fit=crop)

![7 Balance Transfer Cards With High Limits ([updated_month_year]) 7 Balance Transfer Cards With High Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Balance-Transfer-Cards-With-High-Limits.jpg?width=158&height=120&fit=crop)

![Are Balance Transfer Cards a Good Idea? ([updated_month_year]) Are Balance Transfer Cards a Good Idea? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Are-Balance-Transfer-Cards-a-Good-Idea.jpg?width=158&height=120&fit=crop)

![0% For 21 Months: Balance Transfer Cards ([current_year]) 0% For 21 Months: Balance Transfer Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/04/0-Percent-Blance-Transfer-For-21-Months-Credit-Cards.png?width=158&height=120&fit=crop)