Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

Americans have accumulated record debt on their credit cards, as credit card balances increased by $50 billion to $1.13 trillion over the quarter (Q4 2023). Our latest consumer survey revealed that three-quarters (76%) of Americans surveyed have voiced concerns about running up balances on their credit cards this year.

The numbers are strikingly consistent between genders, with female respondents (74%) slightly less concerned about credit card debt compared with males (77%). But concern among different generations revealed more differences, with Gen Z (89%) respondents expressing the most concern about running up their credit card balances, followed by millennials (80%), Gen Y (77%), and finally baby boomers (65%).

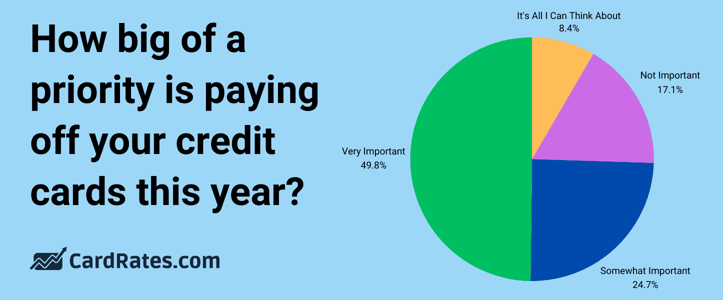

83% of Respondents Say Paying Off Card Debt This Year is Important

The survey of 1,015 U.S. American adults reports that the majority of respondents (83%) agree that paying off their credit cards is a priority this year, and nearly 1 in 10 respondents (8%) said it’s all they think about. While we normally see significant differences in personal finance priorities between different generations, only baby boomers (76%) said they were less concerned about paying off their credit cards.

The survey also found that nearly one-quarter (22%) of Americans have missed a payment on one of their credit cards in the last six months (20% of females vs. 24% of males). From a generational perspective, that breaks down to 31% of Gen Z respondents, 28% of millennials, 23% of Gen Xers, and 10% of baby boomers making late credit card payments.

13% Have Used ChatGPT for Credit Card Advice

Recent data shows that a significant number of U.S. adults have started using ChatGPT for financial guidance, including on their recent tax filings, but it doesn’t stop there. The survey revealed that 13% of those surveyed have used ChatGPT to find a new credit card. Nearly 1 in 5 respondents (19%) who said they have used ChatGPT for new credit card recommendations were male, while just 7% were female.

We then asked respondents which card they chose based on the AI’s recommendation. Visa was the top payment network, and Chase was the top issuing bank.

The number of young adults using ChatGPT for credit card advice jumps even higher, while older generations aren’t engaged in chatting with AI bots for that kind of advice:

- 25% of Gen Zers

- 26% of millennials

- 7% of Gen Xers

- 2% of baby boomers

“The findings that more Americans are making late credit card payments support the Fed’s report that late payments significantly rose in 2023,” said Ashley Fricker, Senior Editor with CardRates.

“If you make a late payment, call your bank and ask if they can waive the late fee. Most banks will allow a one-time courtesy waiver if it’s your first offense and can save you up to $30 — the maximum amount a bank can legally charge for a first late payment. That amount balloons to $41 for recurring late payments, though the CFPB has taken legal action to drastically lower late payment fees beginning in May 2024,” she continued.

Methodology

A national online survey of 1,015 U.S. consumers ages 18 and older was conducted by Propeller Insights on behalf of CardRates.com in February 2024. Survey responses were nationally representative of the U.S. population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year]) 8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-20-to-30-Year-Olds-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year]) 9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Credit-Cards-For-16-17-Year-Olds.jpg?width=158&height=120&fit=crop)