Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

Generative AI tools such as ChatGPT have created another means of obtaining financial guidance, including help with income taxes, and that’s exactly how some people are using the technology.

Our latest survey of more than 1,000 US adults revealed that Generative AI is guiding personal finance decisions more than other influences, and the results show that there’s significant trust in that guidance.

14% of Respondents Have Reviewed Taxes With ChatGPT

The survey of 1,015 US adults reports that 14% of those surveyed said they have used ChatGPT to review their income taxes. That number increases to 24% — or nearly one-quarter — of Gen Z and/or millennials who have now used ChatGPT to review their income taxes.

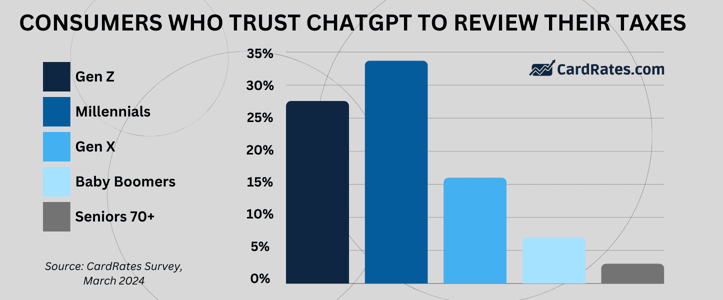

But can Americans afford to trust ChatGPT’s results when it comes to their taxes? Apparently yes for the 19% surveyed who said they trust ChatGPT to review their income taxes. Trust increases among younger generations, with as many as 28% of Gen Zers and 34% of millennials surveyed saying they trust ChatGPT to review their income taxes.

21% of Respondents Trust ChatGPT for Financial Advice

Using ChatGPT for financial guidance doesn’t stop with taxes, but generative AI has yet to become the biggest source of personal finance advice. Humans still have the most power to influence money decisions.

The survey revealed that when seeking personal finance advice, 48% of Americans said they look to friends and family, 38% look to a certified financial expert, 29% use personal finance websites, 17% rely on experts with large followings, such as Dave Ramsey or Suze Orman, and 15% said they use social media platforms like TikTok and Instagram.

While advice from human sources still holds the most influence, more than 1 in 5 American adults (21%) surveyed said they trust ChatGPT to help them make financial decisions.

For example, 20% of survey respondents said they trust ChatGPT to do their household budgeting, and 17% said they have used ChatGPT to create a household budget. Of those who said they trust AI to make their household budget:

- 31% are Gen Z

- 35% are millennials

- 17% are Gen X

- 5% are baby boomers

- 4% are The Silent Generation

“Even though generative AI is still in its infancy, the survey results validate a new movement to rely on AI for financial influence, especially among younger generations,” said Ashley Fricker, Senior Editor with CardRates. “Moving forward, consumers should still corroborate results from AI, just as they should when getting financial information from social media. Plus, asking for human counsel would at least provide consumers with an avenue to go back and dispute that guidance.”

In Conclusion

While ChatGPT and other forms of generative AI are relatively new, people are working to find ways to incorporate them into daily life. Younger generations have been quicker to adopt these modern tools for financial purposes, including budgeting, advice, and even income tax review.

AI doesn’t currently have the same level of accuracy as tax software or guidance from a financial professional, so consumers should still scrutinize the results if they use it. Still, as ChatGPT technology advances, more demographics — and even more Gen Zers and millennials — should feel comfortable using it to free up time spent poring over their financial documents.

Methodology

A national online survey of 1,015 US consumers, ages 18 and older, was conducted by Propeller Insights on behalf of CardRates.com in February of 2024. Survey responses were nationally representative of the US population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.

![9 Best Credit Cards for Students With No Income ([updated_month_year]) 9 Best Credit Cards for Students With No Income ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/noincome.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Low-Income Earners ([updated_month_year]) 12 Best Credit Cards for Low-Income Earners ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/low-income2.jpg?width=158&height=120&fit=crop)

![15 FAQs: Annual Income on Credit Card Applications ([updated_month_year]) 15 FAQs: Annual Income on Credit Card Applications ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_394244284.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year]) 7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_232260670.jpg?width=158&height=120&fit=crop)