Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

Of the survey participants who expect to carry card debt, 78% said they hope to pay their balances off in one to three months or less.

We know credit card debt is already at an all-time high, with balances reaching $1.08 trillion in the third quarter of 2023, according to the Federal Reserve Bank of New York. And with the holiday shopping season upon us, balances are expected to grow even higher in Q4.

We commissioned a survey of more than 1,000 people to see whether they plan to use credit to finance their holiday purchases, what they’re buying, and how they plan to manage the debt.

Men Ages 35 to 44 Are Most Likely to Incur Card Debt

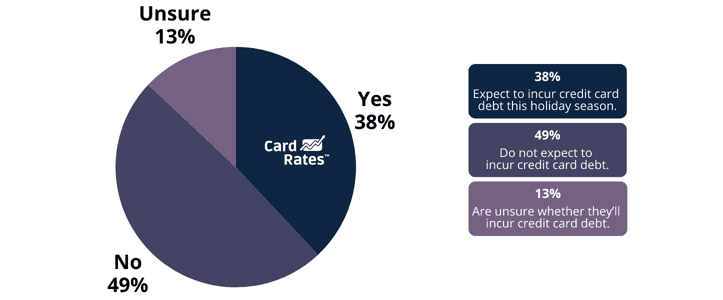

When survey respondents were asked whether they expected to carry credit card debt after the holidays this year, about 38% said they did, while 49% said they did not, and 13% said they were unsure.

Of those figures, 46% of men surveyed said they expect to incur credit card debt, compared with just 29% of women. When broken down by age, those between ages 35 and 44 were the most likely to carry a balance into the New Year (57%), followed by those between the ages of 25 and 34 (48%). Consumers ages 55 to 64 were the least likely (21%) to say they would incur holiday card debt.

When it comes to paying off that debt, nearly 4 in 10 Americans (39%) surveyed said they would settle that debt immediately, while the remaining folks with holiday credit card debt said they would pay it off:

- within 1 month (17%)

- 1-3 months (22%)

- 6 months (10%)

- 6-12 months (6%)

- more than a year (6%)

The Holiday Expenses Resulting in Credit Card Debt

More than half of Americans (51%) surveyed said they have less to spend on holiday shopping this year, while 29% said they have more to spend for the holidays this year, and 20% said they have about the same to spend as last year.

While holiday gifts this year are the main holiday expense (53%), Americans’ second biggest holiday expense is food and beverages (18%), followed by:

- holiday travel (10%)

- decorations (6%)

- holiday party attire (5%)

- holiday events (4%)

- charitable giving (4%)

Additionally, more than half of Americans (54%) surveyed said they plan to buy new holiday decorations this year.

Forty-three percent of those surveyed said they would pay more for the same item to purchase it from a small business vs. a big-box retailer, while 42% said they would not, and 15% said they didn’t care where they buy from.

The Things Americans Want This Year

Finally, the survey found that next to clothing (51%), the most popular items on Americans’ personal wish lists are gift cards (50%) and/or cash (41%). Other wish-list items include:

- Electronics (32%)

- Jewelry (27%)

- Vacation/Trip (23%)

- Gaming consoles and accessories (21%)

- Tools/Home improvement (17%)

- Sporting goods (14%)

- Car (13%)

- Exercise equipment (13%)

- Gym membership (6%)

Tips to Help Manage Credit Card Debt

For those who cannot pay off their holiday debt right away, here are five important tips to help them maintain good credit and mitigate expensive interest charges going into the New Year:

- Make all the payments on time: this is the most important thing you can do to maintain a good credit rating.

- Keep card balances low: If you can avoid it, don’t continue to charge purchases on the same card carrying your holiday debt. This will help keep your credit utilization low, which is the percentage of used credit versus how much credit you have available to spend.

- Make more than one payment a month: Credit card interest rates are very high right now. Paying your debt off sooner will help decrease how much interest you’ll pay to finance your holiday purchases.

- Open a new credit card: This only applies if you have a single credit card with a balance. Opening a second credit card will increase your available credit, thereby lessening your credit utilization ratio and improving your credit mix.

- Transfer high-interest debt to a 0% card: If you have good credit, you may qualify for a credit card with a 0% interest rate. You can avoid expensive interest charges by taking advantage of one of these offers.

Regardless of whether holiday spending creates more or less credit card debt than in years past, it’s encouraging to see that a large percentage of credit card users plan to eliminate that debt right away. For others who cannot pay off their holiday debt right away, they must remember to pay at least the minimum monthly charge by the due date.

Setting up automatic payments can help ensure they don’t miss a payment and incur expensive late fees, or worse, damage their credit score.

Survey Methodology

A national online survey of 1,036 U.S. consumers, ages 18 and older, was conducted by Propeller Insights on behalf of CardRates.com in October of 2023. Survey responses were nationally representative of the U.S. population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.

![7 FAQs: The Different Types of Credit Cards & Which to Carry ([updated_month_year]) 7 FAQs: The Different Types of Credit Cards & Which to Carry ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/types.png?width=158&height=120&fit=crop)

![11 Credit Card Perks For Holiday Shoppers ([updated_month_year]) 11 Credit Card Perks For Holiday Shoppers ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Credit-Card-Perks-For-Holiday-Shoppers.jpg?width=158&height=120&fit=crop)

![How to Choose a Credit Card For Holiday Spending ([current_year]) How to Choose a Credit Card For Holiday Spending ([current_year])](https://www.cardrates.com/images/uploads/2021/11/How-to-Choose-a-Credit-Card-For-Holiday-Spending.jpg?width=158&height=120&fit=crop)

![7 Best Holiday Loans ([updated_month_year]) 7 Best Holiday Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Holiday-Loans.jpg?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)