When the calendar turns to February, taxpayers turn their attention to the annual ritual of preparing their tax returns. A refund may be in store for some people, but if you owe additional taxes, you’ll have to figure out how to pay them.

You may wonder if you can use a credit card to do it. The short answer is yes, you can. The IRS and many state tax authorities accept credit card payments.

The caveat is that “Can you?” may not be as important a question as “Should you?”

-

Navigate This Article:

Yes – Here Are 6 Reasons Why You Should

If you’re looking for good reasons to use a credit card to pay your taxes, you won’t have to look far.

1. Rewards

Rewards cards give you cash back, points, air miles, or other enticing perks for using your card and may be the biggest incentive to use a card to pay your taxes. The more you owe — and the more attractive the rewards are — the more opportunity you may have to collect rewards for your tax payment.

2. Signup Bonuses

Many cards offer attractive signup bonuses for new customers who spend at least a specified minimum with their new card within the first few months after the card account is opened. Paying your taxes with a new bonus card could help you meet that minimum spend requirement and capture the signup bonus.

3. Convenience

The IRS accepts card payments online or by phone. It also allows the use of digital wallets, including PayPal or Click to Pay. These options may be faster and easier than setting up a bank transfer or sending a paper check by US Mail.

To pay with a check, you’ll need not only the check itself but also an envelope, a stamp, an IRS payment voucher, and the correct address to send your payment. You don’t need to use a paper voucher when you pay with a credit card.

4. Security

The IRS also accepts debit card payments. If your balance is high enough to cover your payment, this option may be just as convenient as a credit card, and the fees can be much lower. The risk is that if your debit card is compromised, a thief could empty your entire account.

If you notify your bank quickly, you may get all of your funds back, but the process can take a while. Credit cards are also vulnerable to fraud, but you’ll never face a zero balance in your bank account because of a lost or stolen credit card.

5. More Time to Pay

If you can’t pay your taxes before the deadline to avoid a late payment fee, using a credit card could give you more time at no cost. You’ll typically get an interest-free grace period to make your card payment. If you didn’t carry over a balance, you typically wouldn’t be charged interest for that period.

Even better, a brand-new card with a 0% promotional rate for new transactions could give you a year or longer to pay with zero interest charges.

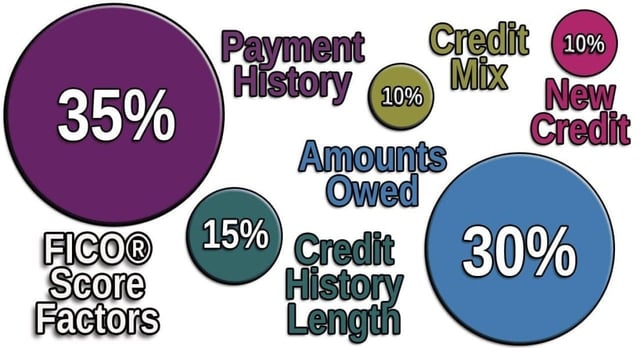

6. Potential Credit Score Boost

Actively using your card and making your payment on time could help you build your credit history and boost your credit scores. Use your card to pay your taxes and then pay off your balance or make regular, on-time payments, and you may see some benefit in your scores.

Higher credit scores may help you borrow money at a lower cost, rent or buy a home, get a job, open a utility account, or sign up for a monthly cellphone plan.

3 Reasons Not to Pay Your Taxes With a Credit Card

Just as there are reasons to use credit, there are also reasons not to use a credit card to pay taxes.

1. Transaction Fees

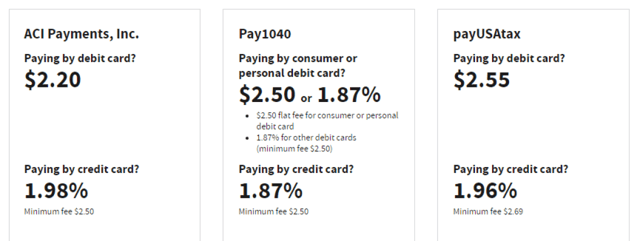

Most card transactions don’t involve transaction-specific fees. Tax payments are an exception. The minimum fee for an IRS payment is $2.50 or $2.69, depending on which payment processor you choose.

However, those minimums may not be typical because the full fee ranges from 1.87% to 1.96% of the payment amount. That can easily exceed the $2.50 or $2.69 minimum. For example, a $500 tax payment triggers a fee of $9.35 to $9.90.

Making larger payments or using multiple cards results in even higher fees.

The IRS doesn’t process card payments. Instead, it uses third-party payment processing companies, referred to as processors. These processors are intermediaries between you and the IRS, which doesn’t control how they operate or set the fees they charge.

The IRS says the process is safe and secure and promises that it won’t use your personal or card information except to process your payment.

The fees each processor charges are listed on the IRS website along with the types of payments each processor accepts. It also lists several telephone numbers you can use to contact the processor if you want to arrange a payment, need to cancel a payment, or need other assistance.

There’s also a handy link to the IRS Taxpayer Bill of Rights, which explains your rights as a taxpayer when you interact with the IRS.

As of February 2022, the IRS offers taxpayers a choice of three payment processors.

- ACI Payments, Inc. accepts Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, PayPal, Click to Pay, and Pay With Cash. The card fee is 1.98% of the payment amount with a minimum fee of $2.50.

- Pay1040 accepts Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel, AFFN, Cirrus, Interlink, Jeanie, Shazam, Maestro, and Click to Pay. The card fee is 1.87% of the payment amount with a minimum fee of $2.50

- PayUSATax accepts Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel, PayPal, and Click to Pay. The card fee is 1.96% of the payment amount with a minimum fee of $2.69.

If you e-file your tax return (electronically) through a tax preparation service, the fees to make a payment with a card may be higher than the fees for the same payment service directly through the IRS. Either way, the IRS doesn’t receive a penny of the fee. The full amount goes to the payment processor and tax prep service.

Processing fees for business purposes may be tax-deductible. When you receive your card statement, your tax payment will appear as “United States Treasury Tax Payment,” “Tax Payment Convenience Fee,” or similar wording.

Payments are generally limited to two per payment period for various tax forms and filings, including Form 1040, Form 1040-ES (quarterly estimates), and Form 4868 (extensions). The frequency limit table on the IRS website outlines the details. To make a high-balance payment or more than $1 million or more than $10 million, depending on the payment processor, you may have to make a phone call to the processor to coordinate your transaction.

Some states, including California and New York, also use third-party payment processors to enable taxpayers to use a card to pay taxes. Fees are typical, and they may be higher than the fees to pay federal taxes.

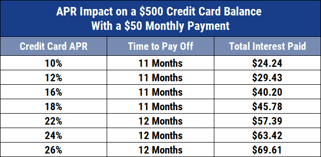

2. Interest Fees

If you carry a balance on your card, the issuer will charge interest that’s compounded daily. Most cards also come with potential fees for late or missed payments. Some cards charge an annual fee.

These interest charges and fees can add up and can do so quickly. If you’re unable to pay off your balance quickly, it may be less costly to request a payment plan from the IRS rather than use a card to pay your taxes.

Shiloh Johnson, CEO and founder of ComplYant, a tax-management platform for businesses, warns consumers that they can be charged interest by both the card company and the IRS.

“Credit card companies charge interest for carrying the balance on that tax payment, and the IRS or state/county/city charges interest when you carry a balance and you don’t pay in full. If you’re unable to pay the bill in full using cash from your bank account, but you could pay it using a credit card, then you avoid getting hit with the interest and penalties (if you file on time) from the IRS,” said Johnson. “But if you are carrying a balance with the credit card company, the credit card interest could be equal to if not more than what the IRS interest would be.”

IRS payment plans of up to 180 days have no setup fees for individual taxpayers. Longer-term plans with automatic bank account debits cost $31 if you apply online or $107 to set up if you apply by phone, US Mail, or in person.

Setup fees for longer-term plans with monthly payments, but no direct debit, range from $43 to $225, depending on the taxpayer’s circumstances and application process. Setup fees may be waived or reimbursed for certain low-income taxpayers. Penalties and interest will accrue for all IRS payment plans until the balance is paid in full.

3. Potential Credit Score Hit

Just as using credit well can improve your credit scores, using it poorly can lower them. If you use a card to pay your taxes and then, for example, can’t afford to make your minimum payment, any missed payments can hurt your scores.

Lower scores generally mean you’ll pay more for credit because lenders perceive you as a riskier borrower. It may also prove harder for you to obtain credit, get a job, or be approved for a rental home if your credit scores are low.

How to Choose Which Card to Use

If using a card — or cards — to pay your taxes makes sense for you, your next question may be: Which card should I use? The answer depends, in part, on your personal tax and credit situations, but factors you may want to consider could include:

- An attractive rewards program

- A lucrative signup bonus

- A 0% promotional rate for new purchases if you plan to delay payment of your full balance

- Lower annual percentage rates (APRs) if you intend to carry a balance after any promotional rate expires

- A low or $0 annual fee or a fee that’s waived for the first year

- A higher credit limit, if that’s appropriate for you

- Other perks and benefits that cards offer

The following three cards offer signup bonuses, 0% APRs, and generous rewards:

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

While no one enjoys paying taxes, using the right card to make your tax payment may be a smart move for you.

But Johnson generally advises against paying with credit.

“It is, in my opinion, not a good idea to pay taxes with a credit card because either way, you’re incurring some kind of fee. You’re incurring fees to process the payment, to carry a balance with the credit card company, or with the IRS if you pay late. It may be better to (just as easily) create a payment plan with the IRS or the state/county/city with much lower fees if you’re unable to pay the balance in full.”

When to Pay Taxes With a Credit Card

Using a card to pay your tax bill can lighten the burden if you’re able to earn rewards, score a signup bonus, or use a 0% promotional rate to extend the time you have to pay without interest charges. And even Johnson can get on board with that advice.

“I can see the argument for paying with a credit card because some people like the idea of getting the points that come with the card, especially if it’s a card that has zero interest for a year,” she said.

Just be sure to calculate the processing fees before you set up your tax payment with a card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year]) 5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/loans2.jpg?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)

![How to Pay Your Credit Card Bill in [current_year] How to Pay Your Credit Card Bill in [current_year]](https://www.cardrates.com/images/uploads/2021/11/How-to-Pay-Your-Credit-Card-Bill.jpg?width=158&height=120&fit=crop)

![Which Credit Card Should I Pay Off First? ([updated_month_year]) Which Credit Card Should I Pay Off First? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Which-Credit-Card-Should-I-Pay-Off-First_.jpg?width=158&height=120&fit=crop)