Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

You get home from a long day at work or a weeklong vacation and you find your mailbox is filled with credit card offers from credit card companies. Does this sound familiar? If so, you are not alone.

Billions — yes, billions — of credit card offers are sent to US consumers every year. Many consumers simply toss or shred the mail, but you actually have a considerably more effective option if you’d like to limit or eliminate the offers altogether.

How Prescreening Works

For decades the credit card industry, and others, have used a practice called prescreening to acquire new customers. Prescreening is the process whereby a credit card issuer provides a credit bureau with selection criteria (we will talk more about that later) and asks the credit bureaus to provide them with a list of names and addresses of consumers who meet the criteria.

If a consumer has successfully met the card issuer’s criteria and their name and address have been delivered to the card issuer, they have been prescreened.

Now, let’s clear up a few misnomers about prescreening that seem to have become a perceived reality.

- Prescreening is 100% legal as long as the card issuer makes a firm offer of credit to a consumer whose name and address has been procured, with some limited exceptions.

- The credit card issuer does not take possession of the consumer’s credit report or credit score. The only thing the card issuer wants or needs is the consumer’s name and address.

- The card issuer is not really taking possession of the consumer’s name and address, but, instead, that information is likely being sent to the card issuer’s mail center for the mass-mailing process.

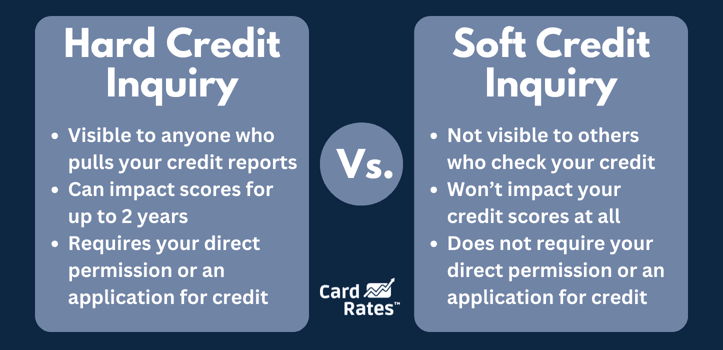

If your name has been delivered to the card issuer or its mail center and you are sent a credit card offer, then a soft credit inquiry will be posted to your credit report by the credit bureau. When you check your credit report, you will see that some card issuer performed a prescreen, you met their criteria, and your name and address were delivered by the credit bureau.

These are often referred to as either prescreen inquiries, promotional inquiries, or preapproval inquiries. As a reminder, soft inquiries are not visible to anyone but you, and they have no influence on your credit scores. They are as benign as it comes.

The Basic Criteria Issuers Evaluate

As part of the prescreening process, the credit card issuer will provide the credit bureaus with selection criteria. Its criteria will set the minimum credit-related standards a consumer will have to meet for their name to pass the screening process.

If a consumer does not meet the selection criteria, their name will not be included on a prescreened list sold by the credit bureaus, they will not receive a firm offer of credit, no prescreen inquiry will appear on their credit report, and they will have no idea any of this ever happened.

Here is a very elementary example of selection criteria:

- FICO Score above 640

- Bankruptcies must be discharged and at least four years old

- No late payments in the last 36 months

- No more than three credit card accounts with balances

- No credit card collections

Real selection criteria are infinitely more sophisticated. This is simply meant to give you an idea of how the process works.

How Can I Prevent Being Prescreened?

If you do not want credit card offers filling up your mailbox or you just generally don’t like the idea of being screened by credit card issuers, you do have control over the process and your involvement. You have the ability to all but eliminate the credit card offers by opting out.

The Fair Credit Reporting Act or “FCRA” is a Federal statute that has been around for well over 50 years, and it defines, among other things, your rights regarding credit reports.

One of your rights is the right to opt out from preapproved credit card offers. If you opt out, the credit reporting agencies will no longer include your name on the prescreened lists they sell to credit card issuers, home equity lenders, insurance companies, or any other type of company that prescreens.

The process of opting out is free and easy. You can opt out by visiting the official FCRA-mandated website, OptOutPrescreen. Or, if you would rather opt out via a phone call, you can do so by calling 1-888-567-8688, which not so coincidentally is the same as 1-888-5OPTOUT.

You can opt out for five years, opt out permanently, or you can opt back in if you ever change your mind.

If you find yourself on a website that is trying to charge you or even asking for a method of payment for opting you out, you are on the wrong website.

Opting Out Will Not Eliminate Credit Card Mail and Won’t Help Your Credit Scores

It has been my experience that when people opt out, they expect their mailboxes to be empty the following day, and for good. Neither is true. What is true is it will take time for the opt out process to permeate the credit reporting system, and there will always be credit card mail in your mailbox.

The prescreening process can take several weeks. What that means is if you opt out, chances are you are already on some card issuer’s list from a prior prescreening program. You may still get a preapproved credit card offer, even after you’ve opted out. That does not mean the opting-out process failed to work, it just takes time for it to become fully effective.

Further, opting out just stops preapproved offers. It does not prevent card issuers from inviting you to apply for their cards. These are called Invitations-to-Apply or ITAs.

Because ITAs are not based on prescreened lists, the card issuer:

- can send them even if you have opted out.

- does not have to make you a firm offer of credit if you do choose to reply to the ITA.

Finally, and I have to get this in here, one of the more ridiculous credit-related myths is that opting out will improve your credit scores. I’ll cut to the chase, opting out does not have any influence on your credit scores. The fact that you’ve opted out is not a scored aspect of your credit reports.

In Sum

If your mailbox is full of credit card offers, it likely means you have been prescreened and passed a credit card issuer’s selection criteria. If you have been prescreened, then the card issuer has to make you what the FCRA calls a “firm offer of credit.” If you find this entire process objectionable, you can opt out.

Opting out, which is entirely free, will prevent the credit bureaus from selling your name to a card issuer via the prescreening process. And while opting out will certainly reduce the amount of mail you receive from credit card issuers, it will not eliminate it entirely. You can opt out online at www.OptOutPrescreen.com or you can opt out by calling 1-888-5OPTOUT.

![12 Best Credit Card Offers Now, Per Experts ([updated_month_year]) 12 Best Credit Card Offers Now, Per Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/12-Best-Credit-Card-Offers.png?width=158&height=120&fit=crop)

![12 Best Credit Card Signup Bonus Offers ([updated_month_year]) 12 Best Credit Card Signup Bonus Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/credit-card-signup-bonus-offers.jpg?width=158&height=120&fit=crop)

![How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year] How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year]](https://www.cardrates.com/images/uploads/2017/06/how-to-transfer-credit-card-balance.jpg?width=158&height=120&fit=crop)

![13 Category Winners: Best Credit Card Offers ([updated_month_year]) 13 Category Winners: Best Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-4.jpg?width=158&height=120&fit=crop)

![7 Longest 0% APR Credit Card Offers ([updated_month_year]) 7 Longest 0% APR Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Longest-0-APR-Credit-Card-Offers-Feat.png?width=158&height=120&fit=crop)

![7 Best Credit Card Offers Right Now ([updated_month_year]) 7 Best Credit Card Offers Right Now ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Card-Offers-Right-Now.jpg?width=158&height=120&fit=crop)

![Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year]) Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/09/discover-pre-approved.jpg?width=158&height=120&fit=crop)