The best prepaid cards for tax refunds are prepaid cards that accept direct deposits. This allows the government to deposit your federal tax refund directly onto the card, which helps you receive your money faster and more efficiently than through snail mail.

Once your tax return is deposited, you can use the card to spend the money just as you would with any other debit or credit card. These cards all work on the Visa, Mastercard, or American Express payment networks, and can be used everywhere those cards are accepted.

Best Overall | More Top-Rated Prepaid Cards | FAQs

Best Overall Prepaid Card For Tax Refunds

Our top-rated prepaid card is the PayPal Prepaid Mastercard®. This card is especially handy if you have a PayPal account because you can transfer funds directly from your PayPal account to the PayPal Prepaid Mastercard®.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

If you choose to have other income streams deposited to your PayPal Prepaid Mastercard®, such as employment income or government benefits checks, you’ll receive your payment up to two days faster than with a traditional bank account. If you need to load cash onto the card, you can do so at more than 130,000 nationwide reload locations.

Any funds loaded onto this card are FDIC-insured for up to $250,000, so you need not worry about anyone else getting their hands on your refund.

More Top-Rated Prepaid Cards For Tax Refunds

While we highly recommend the PayPal Prepaid Mastercard®, other prepaid cards are available that may provide you with just what you need — a means to receive your tax refund check electronically. All of the following prepaid debit cards are direct deposit compatible and free to apply for online.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The Brink’s Armored™ Account allows for mobile check deposit, so even if you were to receive your tax return in the mail, you could deposit the funds to your Brinks Mastercard via the card’s mobile app. You can personalize your card with a family photo or other unique image, or choose from one of the four card images offered.

The NetSpend® Visa® Prepaid Card is similar to the NetSpend Prepaid Visa Card in the number two position. You can choose your card design, earn Payback Rewards, and receive account alerts, among other features. As with any prepaid or credit card you agree to, review the cardholder agreement and fees associated with the account so you’re not surprised when you go to look at your transaction history.

Our first prepaid card from American Express, the Serve® American Express® Prepaid Debit Account is refreshing in that it doesn’t charge many of the fees other prepaid cards on this list charge. If you’re worried about acceptance, rest assured knowing that American Express is accepted at 99% of places that take credit cards.

The next Amex card on this list, the Bluebird® American Express® Prepaid Debit Account is a great bank account alternative. You’ll enjoy free ATM withdrawals, free online bill pay, and 24/7 customer service with a live agent, among other valuable features you’d expect from one of the world’s largest banks. In addition to accepting your refund check, this card can serve as an EIP card — which means you can receive economic impact payments on it as well.

If you plan to save your tax refund, this is the card for you. What differentiates the The Mango Prepaid Mastercard® from the other prepaid cards on this list is its ridiculous savings account that lets cardholders earn up to 6.00% APY. The maximum allowable savings account balance is $5,000.

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

*Please see site for full terms and conditions.

And in our final spot, we have the Walmart MoneyCard®, a perfectly fine option for anyone who wants to receive their tax refund check electronically. It is also the best prepaid card for Walmart purchases, thanks to its generous cash back rewards. And your savings will earn 2% interest.

Can You Recieve Your Tax Refund On a Prepaid Card?

For the 5.4% of unbanked U.S. households, a prepaid debit card is a perfect solution for quickly and safely receiving their tax refund. Any prepaid debit card that is direct deposit compatible can accept an electronic tax refund transfer.

Every prepaid card that accepts direct deposits has a routing number and an account number — just like a bank account. When you file your taxes, one of the last steps is to indicate how you’d like to receive your money. Enter your prepaid card account number and routing number into the appropriate fields and choose “checking” as the account type to receive your refund to your card.

You can log in to your online prepaid card account to find your routing number. If you have a NetSpend card, you can also text DIRECT to 22622 to have your routing number texted to you.

What Fees Do Prepaid Cards Charge?

Unfortunately, prepaid cards charge several fees, which can make them an expensive way to access your money. Alas, charging fees is how many prepaid card companies stay in business, considering they don’t charge interest like credit card issuers do.

Here’s a list of fees that some prepaid cards charge:

- monthly fee

- per-transaction fee (each time you use the card to pay)

- ATM withdrawal fee

- ATM balance inquiry fee

- Cash reload fee

- monthly inactivity fee (usually after 90 days with no transactions)

- card purchase fee (if purchased in a store)

- expedited mobile check load fee

- foreign transaction fee

- declined transaction fee

- card replacement fee

- custom card fee

- expedited card delivery fee

The silver lining: Not all prepaid cards charge these fees. The Bluebird® American Express® Prepaid Debit Account skips many of these fees — you won’t pay an ATM fee or any of the other charges that just seem unfair.

The bottom line is that having a bank account is the cheapest way to receive your refund quickly and affordably, but a prepaid card will still get the job done. Be sure to read over the cardholder agreement and understand its fee structure before signing up for any prepaid card.

How Long Does It Take to Get Your Tax Refund On a Prepaid Card?

The IRS generally issues refunds within 21 days of accepting your return. Once the payment is initiated, your money will be available in your prepaid card account up to two days faster than if you’d elected to deposit your refund into a bank account.

Some cards limit the amount you can have deposited at one time. For example, the Netspend Visa Prepaid Card limits deposits to $7,500. If you’re expecting a larger return, you’ll need to contact the bank beforehand.

Can You Get an Advance On Your Tax Return?

Yes, there are two ways to get an advance on your federal tax refund.

A tax refund loan, not to be confused with a refund advance offered by some tax preparation services, is offered by small lending companies that usually charge a flat fee to give you a loan you repay when your tax refund arrives. The terms of a tax refund loan are not unlike a payday loan and can be very expensive.

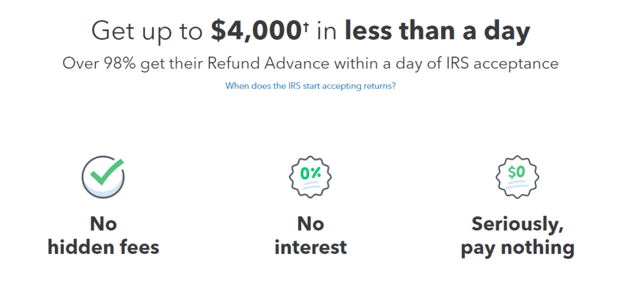

But a tax preparation service like Intuit TurboTax, Jackson Hewitt, and H&R Block can usually give you access to part of your refund (based on the amount of your refund) via a tax refund card. TurboTax issues its Turbo® Visa debit card to provide its customers with an advance on their return once their return is accepted by the IRS.

Tax services like TurboTax can provide you with an advance on your federal tax refund.

We recommend avoiding tax return loans, but if you’re working with a reputable tax filer, it may be worth asking your tax preparer if they offer refund advance options. Most do these days.

Compare the Best Prepaid Cards For Tax Refunds Online

We’ve shown you eight options that are all a good fit for anyone needing a way to receive their tax refund. Whether you don’t have a bank account or just want to keep your refund separate from your personal checking account, one of these cards will serve you well.

If you’re a PayPal account holder, check out the PayPal Prepaid Mastercard®. If you plan to save your refund for a rainy day, check out the The Mango Prepaid Mastercard®. If you plan to use the card for regular spending, check out the fee-free Bluebird® American Express® Prepaid Debit Account that has many of the same features as a bank account from a financial institution.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards for Tax Payments ([updated_month_year]) 7 Best Credit Cards for Tax Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-for-Tax-Payments.jpg?width=158&height=120&fit=crop)

![6 Best Prepaid Debit Cards with No Fees ([updated_month_year]) 6 Best Prepaid Debit Cards with No Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/prepaid--1.png?width=158&height=120&fit=crop)

![3 Prepaid Cards Without SSN Requirements ([updated_month_year]) 3 Prepaid Cards Without SSN Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/Prepaid-Cards-Without-SSN-Requirements.jpg?width=158&height=120&fit=crop)

![“Do Prepaid Cards Work On OnlyFans?” ([updated_month_year]) “Do Prepaid Cards Work On OnlyFans?” ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/Do-Prepaid-Cards-Work-On-OnlyFans.jpg?width=158&height=120&fit=crop)

![“Do Prepaid Cards Work For PayPal?” ([updated_month_year]) “Do Prepaid Cards Work For PayPal?” ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/09/Do-Prepaid-Cards-Work-For-PayPal.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)

![6 Custom Prepaid Debit Cards ([updated_month_year]) 6 Custom Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Custom-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year]) 7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Prepaid-Debit-Cards-With-Mobile-Check-Deposit.jpg?width=158&height=120&fit=crop)