Sports fans are special people. They’re loyal and enthusiastic, and they love being associated with a winning team.

Whether you’re a fan of football, basketball, golf, car racing, or all of the above, there’s probably a credit card that can help you show your team spirit and earn rewards whenever you open your wallet and use your card.

Here are five of the best credit cards for sports fans:

- Best Overall: Citi Custom Cash® Card

- Runner Up: Capital One SavorOne Cash Rewards Credit Card

- Best For Football Fans: NFL Extra Points Visa® Credit Card

- Best For Basketball Fans: The Platinum Card®

- Best For Golf Fans: PGA TOUR® Customized Cash Rewards credit card

Best Overall: Citi Custom Cash® Card

The Citi Custom Cash® Card is our top draft pick thanks to its generous 5% cash back in the category of your choosing, one of which is Live Entertainment. This includes ticket purchases to live sporting events.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The nice thing about this card is that the highest reward rate automatically applies to your top eligible spend category — there’s no need to log in and change categories or worry about rotating categories.

Note that sporting camps, sports complexes where you participate in the sport, public and private golf courses, and bowling alleys are excluded.

Runner Up: Capital One SavorOne Cash Rewards Credit Card

With 3% cash back on entertainment purchases, including professional sporting events, the Capital One SavorOne Cash Rewards Credit Card is another big win for sports fans.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

You’ll also receive generous cash back rewards for other spending categories, such as dining out, entertainment, streaming services, grocery purchases, and everything else you buy. The card comes with a bonus welcome offer, a balance transfer offer, and no annual fee.

Note that collegiate sporting events do not qualify for the 3% return with this card.

Best Card For Football Fans: NFL Extra Points Visa® Credit Card

The NFL Extra Points Visa® Credit Card is a co-branded offering from the National Football League (NFL) and Comenity Capital Bank. This Visa card lets you choose your favorite NFL team’s logo to display proudly every time you take it out of your wallet.

- Earn $100 cash back after you spend $500 on purchases in the first 90 days

- Earn 3% cash back on qualifying NFL purchases, 2% on grocery store, food delivery, restaurants, gyms, and sporting goods purchases, and 1% back on all other purchases

- As an Extra Points Cardholder, you can earn points and redeem them for gift cards or unique NFL experiences, tickets, merchandise and more!

- Special Financing on NFL Tickets when you spend $250 or more at NFL Team Ticket Offices, Ticketmaster, StubHub, and SeatGeek with your NFL Extra Points Visa Credit Card

- Enjoy 20% off at NFLShop.com

- $0 Annual fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24%, 25.24%, or 30.24% (Variable)

|

$0

|

Good

|

The card offers a welcome bonus opportunity, a rewards program with bonus points for NFL or authentic team purchases, and a discount for league and team merchandise purchased at NFLShop.com. There’s also a special financing opportunity for NFL tickets purchased from participating NFL team ticket offices using an NFL Extra Points Visa® Credit Card.

Rewards points with this card can be redeemed for exclusive NFL experiences, ticket purchases, memorabilia, gift cards, or cash back. And there’s no annual fee.

Best Card For Basketball Fans: The Platinum Card®

The Platinum Card® is a pretty well-known card that offers some of the most premium perks for cardholders. It’s our top choice for basketball fans thanks to its Jersey Assurance program, which will replace the jersey of any NBA player who changes teams within 90 days of purchasing your jersey with your Amex card.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$695

|

Excellent

|

And those who enjoy attending basketball games will benefit from the extensive travel perks and benefits afforded to Platinum cardholders, including annual hotel and airline reimbursements.

Of course, Platinum card ownership doesn’t come cheap, charging a hefty annual fee. However, the value of the perks offered by this card easily exceeds that fee, which makes it a solid option for anyone who can qualify for this premium rewards card.

Best Card For Golf Fans: PGA TOUR® Customized Cash Rewards credit card

This card is no longer accepting new applicants.

The PGA TOUR® Customized Cash Rewards credit card comes with exclusive perks for golfers and golfing fans. Upon account opening, there are two bonus opportunities: a cash welcome reward and a choice of two single-day grounds tickets to a selected PGA TOUR sporting event (tickets must be reserved at least three weeks before the tournament start date).

5. PGA TOUR® Customized Cash Rewards credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to PGA TOUR® Customized Cash Rewards credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

Cardholders also get special perks at participating PGA TOUR Golf Course Properties (TPCs) across the country. Perks may include preferential booking windows or booking window access, discounts for greens fees, range balls, and cart fees, and discounts for regular-priced merchandise purchased with the PGA Tour card at TPC Shops. (Some TPC properties require a minimum golf handicap.)

There’s no annual fee for card membership. TPC also sells gift cards for the golfer in your life.

What Is a Co-Branded Sports Card?

A co-branded credit card is any card that’s issued by a credit card company in partnership with a non-credit-card company. The partnership enables the card company to offer its cardholders rewards that are specific or exclusive to the non-card company.

The partner may offer airline miles, (e.g., American Airlines, Delta, JetBlue, Southwest Airlines, or United Airlines), hotel stays (e.g., Hilton, Hyatt, or Marriott), or other types of rewards (e.g., Amazon, AARP, Costco, or Uber).

A co-branded sports card means the card’s partner is affiliated in some way with a pro or college sports organization, such as the NFL, NHL, PGA, or NASCAR. Individual pro or college teams may offer their own co-branded credit card as well.

If you’re a fan of a specific organization, check out your favorite team’s website for details.

Co-branded cards may not offer the lowest rates or fees or the most flexible rewards programs, but they do give you access to those special perks and a way to show your team spirit when you use your card.

Apart from the brand-specific rewards and perks, co-branded cards are essentially the same as any other type of credit card. The application process is similar. The card functions the same way. The fees and benefits may be similar.

How Do I Apply For a Sports Credit Card?

The process to apply for a sports credit card is generally the same as the process to apply for any other type of card.

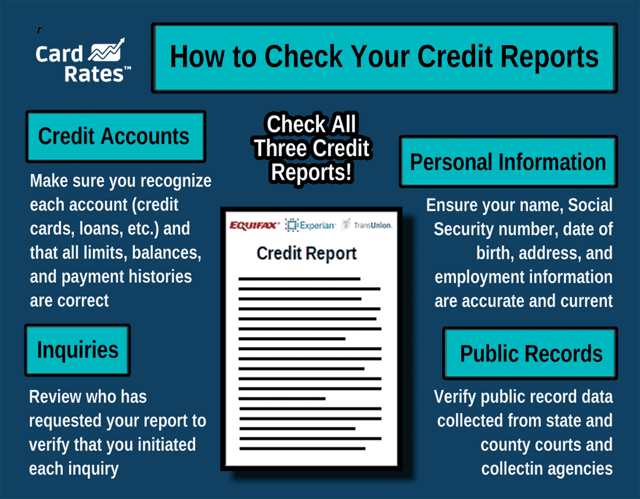

The first step is to review your credit reports and credit scores and try to get a sense of whether you’re qualified for the card you’re interested in.

If your credit is good or excellent, you may be better qualified to obtain some of the top card offerings, including premium and co-branded cards. If your credit is so-so, your ability to qualify for the top cards may be somewhat lessened.

With fair or poor credit, you may want to shop for a card designed for people with low credit scores.

After you find the card you want, the next step is to apply online or by phone. If you want to apply for a card that’s issued by a credit union, you’ll typically have to join the credit union before you can be approved for that card.

If you’re approved for the card, you’ll normally receive it by U.S. Mail within 10 business days, sometimes sooner.

What Benefits Will I Receive as a Cardholder?

Cardholders generally receive a wide variety of benefits from co-branded sports cards.

In addition to a rewards program and sports-related perks, this type of card may include a balance transfer offer, a cash advance option, a mobile app, $0 fraud liability, fraud text alerts, or online account management services.

A balance transfer may help you consolidate your card balances with a lower rate that can save you money while you pay down the amount you owe. This may make sense for you if you want to pay down higher-rate debt with a lower or 0% interest rate, lower your minimum monthly payments, or make one payment instead of multiple payments each month.

A balance transfer could help or hurt your credit, depending on how well you manage your new payment and whether you continue to add to your debt, among other factors.

Balance transfers typically involve balance transfer limits and may involve fees as well. You should do some research and shop around for a balance transfer card before you pursue this opportunity.

Mobile apps and online services can be used to track your card purchases, payments, rewards, and statement credits.

Fraud text alerts and $0 fraud liability help to protect you from financial loss if your card is used without your permission. Even with alerts and $0 liability, you should still notify your credit card issuer as soon as possible if your card is lost or stolen or you suspect fraudulent activity on your card.

Show Your Team Spirit With a Sports Credit Card

Sports cards may not offer the lowest interest rates or best rewards programs of the vast universe of cards. But they come with plenty of heart for fans who want to show their colors or score discounts when they purchase team tickets or merchandise from participating outlets.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for No Credit ([updated_month_year]) 9 Best Credit Cards for No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/nocredit.jpg?width=158&height=120&fit=crop)

![7 Best Secured Credit Cards: No Credit Check ([updated_month_year]) 7 Best Secured Credit Cards: No Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/Best-Secured-Credit-Cards-with-No-Credit-Check.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)