Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

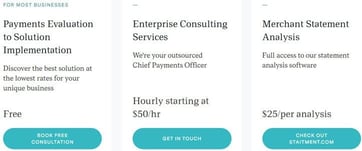

In a Nutshell: Swipesum works with merchants to locate payment processors that can help them achieve their goals. The company engages with prospective customers to understand their businesses before recommending solutions. Swipesum’s services benefit small businesses and large enterprises with thousands of locations. Based in St. Louis, Swipesum values fostering an environment where its employees can thrive.

As technological advances increase the speed of business, companies need to ensure the credit card processing solution they use meets their needs and those of their customers. Businesses using payment solutions that align with their goals can save money and increase efficiency.

Swipesum provides consultative services to help merchants partner with the payment processor that will most benefit them. We spoke with Michael Seaman, Swipesum’s Founder and CEO, to learn how the company works with its clients and helps them succeed.

Prior to founding Swipesum, Seaman worked for a global payment processor where he said he witnessed merchant frustration and pain regarding their experiences managing payments. Seaman said he noticed that merchants didn’t know how to evaluate payment processors and lacked insight into the fees incurred for accepting credit card payments.

He said Swipesum engages with its customers to discover what they desire in a payment processor. Seaman said the company then curates a list of the payment processors that will work best for the merchant.

Merchants may not know how to integrate their systems with those used by their payment processors. Seaman said Swipesum helps merchants implement solutions and integrate technologies. He said Swipesum has grown since opening its doors for business in 2018, and the company now has approximately 25 employees.

Seaman said Swipesum considers itself to be its customers’ chief payments officer. He said the company offers a white-glove approach to its services instead of selling a product and waiting for customers to contact the company with questions or issues.

“A lot of large businesses really want to make sure they have the best solutions,” Seaman said. “They do their due diligence so they can plug in a solution and be as profitable as they can. That really was the service we started with, and then we added more people to help with customer support and account management. We’ve evolved to offer more of a white-glove service than we originally planned to.”

A Consultative Approach Unearths Opportunities

Swipesum offers consultative services to merchants. Seaman said the company seeks to understand what potential customers are trying to accomplish when it first speaks with them. He said Swipesum asks prospective customers questions and gathers supporting data from them to develop a proposal.

Seaman said Swipesum has built one of the only software programs in the industry that audits merchant payment statements to uncover opportunities to reduce expenses. He said after Swipesum’s initial call with a business, the company builds a plan for the prospective customer detailing which payment processors Swipesum recommends the business partner with.

Seaman said Swipesum charges consulting fees of $50 per hour, and its services allow businesses to save money on costs associated with accepting credit card payments.

“It’s not uncommon for us to find hundreds of thousands or millions of dollars of savings,” Seaman said. “The cost is easily justified with what we do. People are paying us to take the research off of their team or the implementation work if they were going to plug a solution in themselves. We’ll just do it for them. It’s not like a typical payments company where we’re fighting to keep rates high so we can be profitable.”

Seaman said Swipesum’s work is comparable to that of a homebuilder who prepares the ground and lays the foundation for a house. He said the company’s team possesses expertise and has the tools to build custom payment infrastructure for its clients.

Swipesum’s evaluative services can also benefit businesses that aren’t open to switching payment processors. Seaman said it’s not unusual for Swipesum to work with businesses that want to keep their current provider but reduce the fees they pay them. He said the company has helped businesses access rates up to 80% lower than those they paid their payment processor before engaging with Swipesum.

Swipesum Wins When Merchants Save on Fees

Swipesum is a diverse business with multiple revenue streams. Seaman said Swipesum has agreements with payment businesses that provide the company with income to supplement the consulting fees it receives from customers. He said Swipesum also includes a clause in its agreements with merchants that entitles Swipesum to a portion of the savings it uncovers for them in its review of their payment processing arrangement.

“If we set someone up and we’re saving them $100,000 each month, then they cut us a check for $25,000 per month for one year,” Seaman said. “We like those deals, and the customers seem to like them because they’re structured in a way that the money they’re paying us is money they didn’t have before. We’re incentivized to actually do what we say we’re going to do.”

Merchants may choose to switch to a different payment processor to access lower costs. Seaman said many large companies work with different payment processors for distinct lines of business, and it’s common for businesses to change payment processors if another option gives them more opportunities to succeed.

Swipesum measures its success by tracking the number of new accounts it works with monthly and how profitable they are to the company. Seaman said Swipesum values being a profitable and sustainable company. He said part of Swipesum’s success includes ensuring its employees experience high levels of job satisfaction.

Seaman said Swipesum doesn’t have significant employee turnover, and the company strives to create an environment where its employees enjoy working. He said as the company grows, it aims to continue following its original mission while working more quickly and more effectively.

Industry Innovations Increase Efficiency

Swipesum extends convenience to its customers by providing a range of payment products. Seaman said Swipesum offers all the software solutions and services a business needs from a payments company, including chargeback monitoring and custom hardware.

“If you’re a business with hundreds of locations spread across the country, we’ll buy hardware from an original manufacturer, inject it with the payment software for your business, and ship it to every location it needs to go,” Seaman said. “We’ll also make sure it goes live and handle any customer support necessary.”

Seaman said Swipesum provides the same quality of service to every customer, regardless of whether they’re a small business or a company with thousands of locations that needs a partner to manage its payments.

As for what the future holds, Seaman said he’s excited about a project Swipesum is working on with its allies in the payments industry that will reduce fees for merchants and accelerate payment deposit times. He said the company is working with card brands and large merchants on network tokens, which will provide merchants with lower interchange rates and more payment authorizations.

Seaman said he is also eagerly anticipating a new payments rail that will expedite the speed at which payments reach merchant accounts.

“We’re really focused on a new payments rail that allows money to go into an account instantly,” Seaman said. “It’s a low-cost option because it takes out all third-party providers. For a lot of B2B clients, it might be a way to replace credit card payments with something that’s more palatable. We’re also actively working in the ACH and account-to-account payments space to find solutions that further reduce fees for merchants.”

![7 Best Credit Cards for Tax Payments ([updated_month_year]) 7 Best Credit Cards for Tax Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-for-Tax-Payments.jpg?width=158&height=120&fit=crop)

![11 Ways to Lower Your Monthly Bill Payments ([updated_month_year]) 11 Ways to Lower Your Monthly Bill Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Ways-to-Lower-Your-Monthly-Bill-Payments.jpg?width=158&height=120&fit=crop)

![25 Fascinating Credit Card vs. Cash Spending Statistics ([current_year]) 25 Fascinating Credit Card vs. Cash Spending Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Fascinating-Credit-Card-vs.-Cash-Spending-Statistics.jpg?width=158&height=120&fit=crop)