Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Digital banks are inherently more efficient than legacy brick-and-mortar institutions. Consumers appreciate the economies of digital financial services, yet they yearn for the community connection of traditional banking. Quontic‘s combination of adaptive digital banking and charitable giving achieves that balance by creating a local presence nationwide. Quontic delivers cutting-edge personal banking and mortgage products and supports communities as a U.S. Treasury-designated Community Development Financial Institution, proving to consumers that new-style banking can live up to traditional ideals.

Digital transformation means the world is more interconnected than ever — in theory. Yet people still crave the physical proximity of their local communities. For better or worse, our desire to live and work together is essential to our humanity.

That sets up a contradiction in financial services that institutions seek to resolve in many ways. Some banks and credit unions remain stubbornly provincial, wedded to the tradition of neighborhood brick-and-mortar branches at the expense of competitiveness. Others go all-in with digital but pare down their community presence to a few nice words on a webpage.

Quontic is distinctive as a community bank in the era of digital transformation because it hasn’t let its move to an all-digital footprint compromise its commitment to making the world a better place. Instead, it has embraced innovation to build a much more substantial community commitment than it could have achieved as an old-style bank.

Customers gain the cost advantages of secure digital banking without losing the convenience of top-notch service. Meanwhile, Quontic leverages digital connectedness to positively impact local communities nationwide.

Chief Marketing Officer Aaron Wollner said more banks don’t follow Quontic’s footsteps because it isn’t easy. Building an all-digital community bank takes a dedicated team focused on adapting to change as the only constant.

“We closed our branches and created a smooth, frictionless online experience that balanced compliance and security needs — all the things financial institutions going online need to figure out,” Wollner said.

Meeting those challenges included leaning into some new realities stemming from branchless banking.

“People belong to local communities wherever they may be,” Wollner said. “Our goal is to commit to communities across America.”

A National Digital Bank With Innovation At Its Core

Making that happen requires meeting the bank’s primary mission of delivering elite products and services. Quontic calls its approach banking human — banking locally with a national digital bank.

Best-in-class customer service is the foundation. Sophisticated automation and chatbots at the initial contact point become bridges to human connections.

“It’s easy for customers to get to a human at Quontic — someone who cares, someone who’s pleasant to deal with, someone we take pride in,” Wollner said. “We put people and technology together in the right way.”

Next comes leveraging the advantages that spurred Quontic to go digital in the first place. Quontic practices adaptive digital banking, leading with innovation in meeting customers where they are as financial consumers.

Doing away with overdraft fees, including monthly maintenance service fees, exemplifies the philosophy because it signals business is decidedly not usual at Quontic. Innovation extends to novel product lines, recognizing that incoming financial consumers may not view banking as their parents and grandparents did.

A spectacular example is the Quontic Pay Ring, Quontic’s foray into wearable banking. The ring packs a ton of technology into a device that allows Quontic Checking Account customers to pay for goods and services simply by waving their hand over a payment terminal.

“It looks like a ring, but it serves as your debit card,” Wollner said.

Quontic customers love the Pay Rings, viewing them as a differentiator and an indicator that they’re banking somewhere fun and innovative. Phones and cards stay in pockets and purses.

“We like to say we do things with a wink, and the ring is a fun idea,” Wollner said. “We balance our innovation with things that bring joy to customers but have some purpose too.”

Products That Address Changing Customer Needs

Not surprisingly, Quontic’s customer base leans toward the younger side. The bank’s demographics may appear conventional on average, but it speaks to more youthful consumers through powerful “go your own way” messaging. While other banks may say no, Quontic finds a way to say yes.

“We have very serious underwriting and due diligence processes, but we can be flexible, because people are more flexible now than they’ve ever been,” Wollner said.

Flexibility comes to the fore most prominently in Quontic’s approach to homebuying. On the mortgage side of Quontic’s business, the bank reaches out to an up-and-coming audience.

“Especially since the pandemic, everything’s gotten a little weirder — in a good way,” Wollner said. “There’s been a reshuffling of society.”

The rise of the gig economy provides an example, as does the entrepreneurial explosion characterizing the past few years. The homebuying economy has frozen as long-time owners hold on to inventory in today’s higher-interest-rate environment.

Quontic goes to great lengths to do its part to thaw the market and provide more and better opportunities.

“The average W-2 person who works at a company for 30-plus years is increasingly rare,” Wollner said. “We lend to many of today’s outside-the-box households.”

Most Quontic mortgage recipients are non-qualified, meaning they don’t qualify for standard loans under today’s over-rigorous restrictions even though they clearly may have the ability to pay.

“A strong example of what we can do is qualify people for a lite-doc loan, one of our bread and butter mortgage products, if they can provide a 12-month P&L statement,” Wollner said. “That’s fundamentally different from some of the documentation you need to provide for a conventional loan.”

Empowering People and Communities to Compete

Quontic is also working on a lite-doc second mortgage product, scheduled to arrive in 2024. The product acknowledges that despite the paralysis in the current market, people still need to pull money out of their equity. The product will again apply Quontic’s more flexible lite-doc approach, managing risk appropriately.

“We’re excited to be rolling out this unique second mortgage,” Wollner said.

Much of the bank’s work in the mortgage space stems from its status as a U.S. Treasury-certified Community Development Financial Institution (CDFI), which empowers it to extend credit with a social purpose by drawing on federal resources. CDFI allows Quontic to underwrite more flexibly, extend more favorable loan terms, and provide loans for family and economic impact.

That commitment underscores Quontic’s community commitment, which draws on its pre-digital roots to generate charitable support. Quontic generates community impact through a partnership with the Spiral service platform.

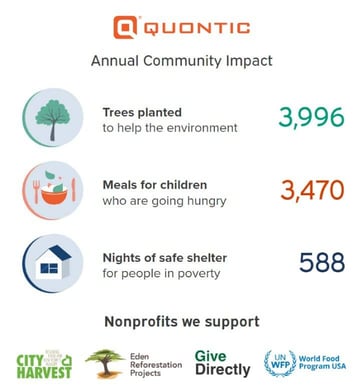

Quontic supports initiatives such as City Harvest, which assists people experiencing food insecurity; Eden Reforestation Projects, which works with local communities and provides jobs to restore natural landscapes; Give Directly, which provides direct cash resources to impoverished people; and the UN’s World Food Program USA, which delivers meals to people in need.

These Quontic-enabled charitable nonprofits plant trees to help the environment, supply meals to hungry children, and provide shelter to people experiencing homelessness.

Meanwhile, the bank reaches out to customers, consumers, and communities with tools and resources to encourage intentional, results-oriented financial services consumption. Quontic earns positive customer reviews and industry awards as a national digital bank prioritizing the personal.

Wollner even encourages customers who may not want to discard their primary banking relationship to try a product or two at Quontic.

“If you only have one banking relationship, you’re probably missing out,” Wollner said. “Give us a try, and we think you’ll agree.”

![5 Best Bank of America Cash Back Credit Cards ([updated_month_year]) 5 Best Bank of America Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Bank-of-America-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Best Bank of America Credit Cards for Travel ([updated_month_year]) 3 Best Bank of America Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Bank-of-America-Credit-Cards-For-Travel.jpg?width=158&height=120&fit=crop)

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![12 Bank of America Credit Card Limits ([updated_month_year]) 12 Bank of America Credit Card Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Credit-Card-Limits.jpg?width=158&height=120&fit=crop)

![5 Bank of America Contactless Credit Cards ([updated_month_year]) 5 Bank of America Contactless Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/Bank-of-America-Contactless-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Bank of America Preferred Rewards Cards ([updated_month_year]) 5 Best Bank of America Preferred Rewards Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/Best-Bank-of-America-Preferred-Rewards-Cards.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in America in [current_year] Average Credit Card Debt in America in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtInAmerica-1250X650.jpg?width=158&height=120&fit=crop)