The Merriam-Webster dictionary defines synergy as “a mutually advantageous conjunction or compatibility of distinct business participants or elements.”

Bank of America understands the synergies among credit cards, bank accounts, and investment brokerage. The bank created its lucrative Preferred Rewards program to entice consumers to open Bank of America accounts for credit, checking, savings, and investments, the latter through its Merrill arm.

A fee-paying customer with several Bank of America accounts is potentially a steady source of revenue for the bank. The Preferred Rewards Program recognizes the synergistic value of these customers by providing an array of benefits, including enhanced credit card rewards.

If you’d like to climb aboard the bank’s synergy bandwagon, check out our review of its best credit cards eligible for Preferred Rewards.

-

Navigate This Article:

Bank of America Cards Eligible For Preferred Rewards

Bank of America credit cards offer many benefits to enhance what matters most to you — from cash back to dining and travel rewards.

The following are the top unsecured reward cards from Bank of America. They offer rewards in the form of cash back or travel points that gain 25% to 75% more value when you join the bank’s Preferred Rewards Program and satisfy its requirements.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don’t expire as long as your account remains open.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

5. Bank of America® Premium Rewards® Elite Credit Card

- Earn unlimited 2 points per dollar spent on travel and dining, unlimited 1.5 points on all other purchases

- Get up to $550 in automatic statement credits

- Airport lounge access

- $550 annual fee

(The information related to the Bank of America® Premium Rewards® Elite Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

In addition to enhanced rewards, these cards offer all manner of perks, including promotional 0% intro APRs on purchases and balance transfers, free FICO credit score updates, account alerts, signup bonuses, and contactless card technology.

Technically, the bank’s student and secured credit card offerings also are eligible for Preferred Rewards, but the target audiences for those cards are less likely to satisfy the program’s requirements.

Other Credit Card Programs That Amplify Rewards

Bank of America isn’t the only player in the super-rewards sweepstakes. The following programs enhance the value of the rewards you’ve already earned.

Chase Ultimate Rewards

Chase rewards credit cards, even those that appear to be cash back, pay Ultimate Rewards points. But only the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card, and Ink Business Preferred® Credit Card exploit the full potential of Chase Ultimate Rewards points.

The Reserve card bumps up the value of your points by 50% when you redeem them through Chase Travel. The Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card boost point values by 25%.

You can redeem your points for other perks, including Chase Experiences, Chase Dining, and cash. You also can transfer them 1:1 to the bank’s travel partners’ loyalty programs and use them for flights and hotel stays.

Here’s a little-known tip: If you have another Chase credit card and add a Sapphire card, you can transfer your points to the Sapphire card and enjoy the same value enhancement.

American Express Amex Offers

Amex Offers is a program that saves money or earns points on shopping, dining, and other spending. You can choose offers from brands you love and get discounts in the form of statement credits on your account or as extra points added to the rewards account associated with your American Express card account.

In 2021, eligible US cardmembers earned more than $392 million in statement credits on qualifying purchases after adding and redeeming Amex Offers. These offers are available from participating brands for eligible travel, dining, shopping, and entertainment purchases.

You can see and add offers to your account in the American Express App or your online account and watch your earnings increase over time.

Citi ThankYou Points

Citi credit cards earn ThankYou Points on eligible purchases. The value of your rewards varies according to which card you own and how you redeem your points.

From time to time, Citi ThankYou Points offers special redemption promotions. Some previous promotions have included gift card sales and point transfers. Through the bank’s Shop with Points program, you can redeem your ThankYou points for online, in-store, and gas purchases.

Discover Cashback Match

With Discover Cashback Match, new cardmembers earn twice the mile or cash back rewards they’ve posted throughout the first year after account opening. Cardmembers collect their matched cash back or miles after the first year ends. There is no limit on the amount you can have matched during Year One.

The Cashback or Miles-for-Miles Match is automatic — you don’t need to sign up. You can redeem your Discover rewards for cash, gift cards, travel, charitable donations, Amazon purchases, and PayPal payments.

What is the Bank of America Preferred Rewards Program?

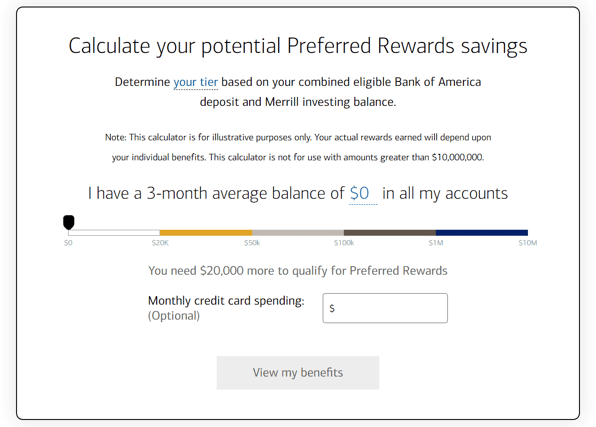

The Bank of America’s Preferred Rewards Program offers benefits and rewards for your everyday banking and investing. Your benefits grow as you increase your qualifying Bank of America deposit accounts and/or Merrill investment balances.

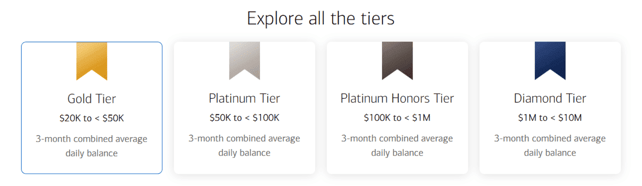

The program operates through reward tiers — your tier determines your benefits. The bank assigns your tier by combining your qualifying balances in your Bank of America deposit and/or Merrill investment accounts.

Preferred Rewards members keep their program benefits for at least one year, even if their balances dip temporarily. In addition, the bank reviews Preferred Rewards member balances monthly to see who qualifies for an automatic upgrade to the next rewards tier.

You’ll get a three-month grace period if you no longer meet the balance requirement after one year elapses. For those who still don’t meet the required balance, the bank will move you to a lower tier or, if you no longer qualify, revoke your Preferred Rewards benefits.

How Do You Qualify For the Preferred Rewards Program?

You can enroll in the program with an eligible Bank of America personal checking account and a three-month, $20,000+ combined average daily balance in qualifying Bank of America deposit accounts and/or Merrill investment accounts.

Program enrollment is straightforward. You’ll pay no fees to join or participate in Preferred Rewards. You need an eligible Bank of America Preferred Rewards credit card to receive the program’s bonuses.

Preferred Rewards benefits usually become active within 30 days of your account opening and enrollment unless the bank indicates otherwise. Some benefits immediately activate when you enroll and need no action by you.

Note that some rewards may require you to open a new account or take other steps to enjoy all the program’s benefits.

How Much Are Bank of America Preferred Rewards Worth?

Your benefits from the Bank of America Preferred Rewards program depend on how much you have on deposit with the bank, including the combined balances in your eligible Bank of America and Merrill accounts.

You earn 25% to 75% more rewards on every eligible purchase you make with a participating Bank of America Preferred Rewards credit card once you become a program member. For example, a $1.00 cash reward may become $1.25 to $1.75, depending on your Preferred Rewards tier.

By increasing your qualifying account balances, you can move to a higher Preferred Rewards tier — and enjoy better perks. The bank reviews your three-month average daily balance every month, and if it’s high enough, you’ll receive an automatic tier upgrade.

For example, suppose you became a Gold Tier Preferred Rewards member six months ago, with an average $30,000 daily combined balance in your qualifying accounts. Your average balance reaches $60,000 in Month Seven and $90,000 in Month Eight. Because your three-month average daily balance is now $60,000, you qualify for the Platinum Tier.

You’ll also benefit from credit card rewards bonuses, interest rate discounts, no-fee ATM transactions, and Merrill Guided Investing Program discounts. You can log in to Online Banking or visit My Rewards on the bank’s mobile app to view program information.

My Rewards shows you the value of all your rewards in one convenient place. It tracks in a single location your credit card rewards, three-month average daily balance, Preferred Rewards benefits, and BankAmeriDeals. My Rewards lets you quickly review your status and explore other available benefits that may be new to you.

What is the Highest Preferred Rewards Tier?

The highest of the Preferred Rewards Program’s five tiers is Diamond Honors. Each tier (Gold, Platinum, Platinum Honors, Diamond, and Diamond Honors) has its own requirements and benefits.

Gold Tier

The Preferred Rewards Program’s Gold Tier requires a three-month combined average daily balance of $20K to <$50K. Benefits include the following:

- Auto Loan: 0.25% interest rate discount for new car loan applications you submit directly to Bank of America

- Banking Services: No fees on select everyday banking services

- Credit Card: 25% rewards rate bonus on eligible Bank of America credit cards

- Deposits: No monthly maintenance fees on up to four eligible checking accounts and four savings accounts

- Foreign Currency: 1% foreign exchange rate discount for mobile and online orders, plus free standard shipping

- Home Equity: 0.125% interest rate discount on a new home equity line of credit

- Merrill Guided Investor: 0.05% annual program fee discount

- Mortgage: $200 reduction in the origination fee on a new purchase or refinance mortgage

- Savings: 5% interest rate booster on your Bank of America Advantage Savings Account

Gold is the starting tier, requiring the smallest account balances and delivering many benefits.

Platinum Tier

The Preferred Rewards Program’s Platinum Tier requires a three-month combined average daily balance of $50K to <$100K. Benefits include the following:

- Auto Loan: 0.35% interest rate discount for new loan applications you submit directly to Bank of America

- Banking Services: No fees on select everyday banking services

- Credit Card: 50% rewards rate bonus on eligible Bank of America credit cards

- Deposits: No monthly maintenance fees on up to four eligible checking accounts and four savings accounts

- Foreign Currency: 1.5% foreign exchange rate discount for mobile and online orders, plus free standard shipping

- Home Equity: 0.250% interest rate discount on a new home equity line of credit

- Merrill Guided Investor: 0.10% annual program fee discount

- Mortgage: $400 reduction in the origination fee on a new purchase or refinance mortgage

- No-Fee ATM Transactions:12 per year (up to one per statement cycle at non-Bank of America ATMs)

- Savings: 10% interest rate booster on your Bank of America Advantage Savings Account

Platinum is the second tier, requiring an account balance higher than Gold’s while delivering a benefit increase of about 100%.

Platinum Honors Tier

The Preferred Rewards Program’s Platinum Honors Tier requires a three-month combined average daily balance of $100K to <$1M. Benefits include the following:

- Auto Loan: 0.50% interest rate discount for new loan applications you submit directly to Bank of America

- Banking Services: No fees on select everyday banking services

- Credit Card: 75% rewards bonus on eligible Bank of America credit cards

- Deposits: No monthly maintenance fees on up to four eligible checking accounts and four savings accounts

- Foreign Currency: 2% foreign exchange rate discount for mobile and online orders, plus free standard shipping

- Home Equity: 0.375% interest rate discount on a new home equity line of credit

- Merrill Guided Investor: 0.15% annual program fee discount

- Mortgage: $600 reduction in the origination fee on a new purchase or refinance mortgage

- No-Fee ATM Transactions: Unlimited no-fee transactions at non-Bank of America ATMs

- Savings: 20% interest rate booster on your Bank of America Advantage Savings Account

Platinum Honors is the third tier, requiring an account balance higher than Platinum’s while delivering a benefit increase of about 33% to 100%.

Diamond Tier

The Preferred Rewards Program’s Diamond Tier requires a three-month combined average daily balance of $1M to <$10M. Benefits include the following:

- Auto Loan: 0.50% interest rate discount for new loan applications you submit directly to Bank of America

- Banking Services: No fees on select everyday banking services

- Credit Card: 75% rewards bonus on eligible Bank of America credit cards

- Deposits: No monthly maintenance fees on all your checking and savings accounts

- Foreign Currency: 2% foreign exchange rate discount for mobile and online orders, plus free standard shipping

- Home Equity: 0.625% interest rate discount on a new home equity line of credit

- International Travel: You never pay an ATM or foreign transaction fee

- Merrill Guided Investor: 0.15% annual program fee discount

- Mortgage: 0.250% interest rate reduction when you establish a PayPlan

- No-Fee ATM Transactions: Unlimited no-fee transactions at non-Bank of America ATMs

- Savings: 20% interest rate booster on your Bank of America Advantage Savings Account

Diamond is the fourth tier, requiring an account balance of at least $1M with only a few benefit increases (e.g., mortgages, home equity lines of credit). This tier adds lifestyle benefits that provide access to unique experiences and premium offers.

Diamond Honors Tier

The Preferred Rewards Program’s Diamond Honors Tier requires a three-month combined average daily balance of $10M+. Benefits include the following:

- Auto Loan: 0.50% interest rate discount for new loan applications you submit directly to Bank of America

- Banking Services: No fees on select everyday banking services, including standard check orders, incoming domestic wire transfers, and more

- Credit Card: 75% rewards bonus on eligible Bank of America credit cards

- Deposits: No monthly maintenance fees on all your checking and savings accounts

- Foreign Currency: 2% foreign exchange rate discount for mobile and online orders, plus free standard shipping

- Home Equity: 0.750% interest rate discount on a new home equity line of credit

- International Travel: You never pay an ATM or foreign transaction fee

- Merrill Guided Investor: 0.15% annual program fee discount

- Mortgage: 0.375% interest rate reduction when you establish a PayPlan

- No-Fee ATM Transactions: Unlimited no-fee transactions at non-Bank of America ATMs

- Savings: 20% interest rate booster on your Bank of America Advantage Savings Account

Diamond Honors is the fifth and highest tier, requiring an account balance of at least $10M with benefit improvements for mortgages, home equity lines of credit, and banking services. Bank of America added the Diamond Honors Tier in December 2021.

This tier adds exclusive lifestyle benefits that provide access to unique experiences and premium offers, including:

- Indagare luxury travel experiences to Paris, Jordan, and beyond: You can experience the world’s most special travel destinations with unique insider access through Indagare’s team of experienced travel planners.

- Golf club and course privileges with the WORLDVantage membership program: You enjoy special access to more than 600 of the nation’s most exclusive golf clubs and courses.

- Moët Hennessey Private client wine and spirits services: You can acquire extraordinary rarities from the Moët Hennessy portfolio of exclusive brands directly from your dedicated Moët Hennessy private client advisor.

Only Bank of America Private Bank clients can enroll in the Diamond Tier and qualify for the Diamond Honors Tier based on their balances. There is no fee to join.

Are Preferred Rewards Worth It?

The benefits from the Bank of America Preferred Rewards Program may be worth the amount you must keep on deposit. The answer depends on how much you deposit, the interest you earn on your deposit, your average monthly credit card spending, and the relevance of your tier’s various fee discounts.

For example, suppose you join the Gold Tier by keeping an average bank account balance of $20,000 for three months. This tier enhances the value of your credit card rewards by 25%.

If your average monthly credit card spending is $5,000, the potential annual value of your Gold Tier benefits could be:

- Credit card rewards bonus: $190.50

- No-fee banking services: $8

- Mortgage origination fee reduction: $200

- Home equity interest-rate discount: $75

- Auto loan interest-rate discount: $52.90

- Merrill Guided Investing: $10

The total value of potential benefits is $784.40 for the year.

Of course, many customers will not take advantage of all the tier’s benefits. The Bank of America website allows you to measure the relevant savings based on your financial goals, which the bank enumerates as:

- Budgeting and starting to save

- Buying a car

- Buying a home

- Improving credit

- Renovating

- Saving for a big purchase

- Saving for retirement

- Traveling

The $190.50 rewards bonus alone could be well worth the deposit for some customers.

You may also earn interest on your deposit by putting the money into the bank’s high-yield savings account. Assuming a 3% annual percentage yield, the accumulated interest on $20,000 is $600, bringing the potential value of the entire package to $1,384.90.

To finish your analysis, estimate your potential return on a $20,000 investment made elsewhere. For example, you could use your five-year average annual rate of return on your investments as a point of comparison. You would have to earn a 7% return on the $20,000 (i.e., $1,400) to approximate the potential package value (ignoring taxes).

Of course, any cost-benefit analysis must contend with multiple uncertainties, including:

- The actual return you would earn on a $20,000 investment

- Your actual monthly credit card spending

- Your ability to take advantage of all the tier’s benefits

- Your probable tax bracket

The stakes get higher as you climb the tier ladder. For example, suppose you joined the Platinum Honors Tier by depositing $100,000 into a Bank of America High-Yield Savings Account. The total value of potential benefits would be $2,069.61 for the year. Adding a 3% return on $100,000 (i.e., $3,000) gives you a potential package value of $5,069.61.

The analysis changes if you invest your deposit in a Merrill brokerage account. Doing so replaces your insured 3% high-yield savings account interest with an unknown investment return.

Is the price right? The bottom line is that you must consider all the facts and risks to know whether the Bank of America Preferred Rewards Program is worth the price of admission.

How Do Bank of America Preferred Rewards Compare to Chase Ultimate Rewards?

Bank of America Preferred Rewards and Chase Ultimate Rewards are loyalty programs that incentivize and reward customers for their banking activities. They differ in their focus and the benefits they provide. Let’s compare them:

Eligibility:

- Bank of America Preferred Rewards: To qualify, you need an eligible Bank of America personal checking or savings account and to maintain a three-month average combined balance of $20,000 or more in Bank of America and/or Merrill accounts.

- Chase Ultimate Rewards: You must have a Chase credit card that participates in the Ultimate Rewards program. You need a good credit score (670+ FICO) to get these cards.

Rewards Structure:

- Bank of America Preferred Rewards: The program offers five tiers based on your average three-month combined balance. The tiers range from Gold ($20,000 minimum deposit) to Diamond Honors ($10 million). The higher the tier, the more rewards you earn. Those include increased cash back, bonus rewards, and fee waivers on select banking services.

- Chase Ultimate Rewards: Chase offers a points-based rewards program. You earn points on purchases you make with your participating Chase card. The number of points you earn depends on the specific credit card and the spending category.

Redemption Options:

- Bank of America Preferred Rewards: You can redeem the rewards you earn through Preferred Rewards as cash back or credits to your eligible Bank of America or Merrill account. You can use the cash back rewards for gift cards or statement credits to pay for dining or travel purchases, including flights, baggage fees, hotel stays, and car and vacation rentals.

- Chase Ultimate Rewards: You can redeem Ultimate Rewards points for travel purchases through Chase Travel. The value of the points you redeem this way may increase by 25% to 50%, depending on the card you own. You also can transfer points to airline and hotel partners at a 1:1 ratio, use them for cash back or statement credits, or redeem them for gift cards and merchandise.

Additional Benefits:

- Bank of America Preferred Rewards: In addition to rewards, Preferred Rewards offers benefits that include no-fee transactions when traveling abroad, waived ATM fees for non-Bank of America ATMs, mortgage origination fee discounts, interest rate discounts on auto loans, and increased rates on eligible savings accounts.

- Chase Ultimate Rewards: Chase provides various benefits, depending on your specific Chase credit card. These benefits may include travel insurance, purchase protection, access to airport lounges, transfer bonuses, etc.

Bear in mind that the top Chase card, Chase Sapphire Reserve®, charges a hefty annual fee to go along with its high spending limit. But you can earn that fee back and more through various discounts and credits (e.g., annual travel credits, Global Entry and TSA Pre Check fee reimbursements, among other credits).

Many Bank of America cards that participate in the Preferred Rewards Program have no or low annual fees, but you must deposit at least $20,000 to qualify.

Bank of America Preferred Rewards Enhances Your Earnings

If you’ve got at least $20,000 available for deposit, you can enhance your Bank of America credit card rewards by joining the bank’s Preferred Rewards Program. The more you use your card, the more you’ll benefit from the program’s 25% to 75% reward boost. The icing on the cake is the money you may save on various banking fees.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Bank of America Cash Back Credit Cards ([updated_month_year]) 5 Best Bank of America Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Bank-of-America-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Best Bank of America Credit Cards for Travel ([updated_month_year]) 3 Best Bank of America Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Bank-of-America-Credit-Cards-For-Travel.jpg?width=158&height=120&fit=crop)

![5 Bank of America Contactless Credit Cards ([updated_month_year]) 5 Bank of America Contactless Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/Bank-of-America-Contactless-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Bank of America Cards By Credit Score Needed ([updated_month_year]) 7 Bank of America Cards By Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Bank-of-America-Cards-By-Credit-Needed.jpg?width=158&height=120&fit=crop)

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![12 Bank of America Credit Card Limits ([updated_month_year]) 12 Bank of America Credit Card Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Credit-Card-Limits.jpg?width=158&height=120&fit=crop)

![5 Best Bank Bonus Credit Cards ([updated_month_year]) 5 Best Bank Bonus Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/bankbonus.png?width=158&height=120&fit=crop)

![8 Credit Cards with No Bank Account Needed ([updated_month_year]) 8 Credit Cards with No Bank Account Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-with-No-Bank-Account-Needed.jpg?width=158&height=120&fit=crop)