Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Traditional banks make money by loaning and investing deposits and interact with card providers and trading platforms from inconvenient silos, putting assets at risk. EQIBank is a digital financial platform where deposits aren’t a profit center that offers OTC and custodial services alongside card and loan products. EQIBank dissolves barriers around fiat and digital currencies and financial categories, offering corporate and high-net-worth customers unprecedented transactional and management flexibility. Secure business and private banking services from EQIBank are a click or tap away in 180+ countries.

Many financial services the typical consumer needs, including banking, card, and lending services, coexist in separate silos from each other and from investment, wealth management, digital currency, and other services. As financial planning grows more complex, tools for managing it can’t keep up, necessitating cross-platform jury-rigging to track the numbers and establish a basis for decision-making.

Global consumers who routinely transact outside their home countries, managing multiple fiat and digital currencies and investments, must navigate a tangle of providers and platforms and sometimes even perform error-prone manual calculations to plan their next steps.

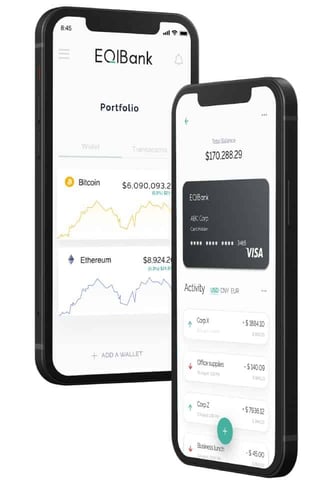

EQIBank fixes those problems by combining the silos into one, converging digital technology with offshore financial services. Corporates and high-net-worth individuals looking for seamless financial experiences across traditional silos turn to EQIBank for an offshore digital institution that unifies their global banking needs.

Director and Co-Founder Christopher Burke said EQIBank serves clients in upper financial echelons who need protections that extend beyond those offered in the traditional banking sector.

“In the US, the FDIC insures deposits up to $250,000 — for a client with $5 million, that’s 5% of holdings covered by insurance,” Burke said. “At that level, people are looking more at the risk the bank takes with its deposits, and maybe that’s a better measure.”

EQIBank, headquartered in Dominica, is committed to transparency and adhering to international standards and works with government and law enforcement entities to combat fraud, money laundering, and tax evasion.

“Customers want to know when they need their money sent somewhere, it will go there,” Burke said. “We provide all clients with a credit capacity statement so they can see the parameters at which we hold their deposits.”

Secure Digital Banking in an Offshore Environment

That detail helps make EQIBank a game changer in digital financial services for corporates and high-net-worth individuals. EQIBank ticks all the boxes for those managing a mix of traditional fiat currencies, crypto, and digital assets, and who are looking to benefit from holding, managing, and transacting with those assets offshore.

EQIBank was incorporated in 2015 on the heels of a derisking initiative in global banking that saw many quality companies pushed aside, at least partly because of the archaic paper data the banks held on those customers. After going live in 2019, excellent founder relationships with corporate service providers led to much of that business filtering to EQIBank.

EQIBank’s private banking service is available in more than 180 countries and offers 24/7 online checking and savings accounts, dedicated Relationship Managers, and more than 100 currency options (including stablecoins).

Business banking services include current and deposit accounts and a fixed-term deposit account. Fully accessible digital money management through the web ensures anytime/anywhere access.

EQIBank offers a line of collateral-backed financing options for additional flexibility. Borrowing and lending begin with financing secured on listed securities or crypto. Working capital financing is available to unlock liquidity in times of need. Supply chain financing minimizes risk across the chain.

Initial uptake at EQIBank was modest, but the bank’s reputation spread quickly, resulting in precipitous growth leading into 2023. Trust is a factor in EQIBank’s financial standing. All banks offering US dollar deposit accounts must house those deposits in a US correspondent bank. EQIBank’s correspondent on deposits is DBS Bank in Singapore, which works with JP Morgan Chase.

“People have confidence in a bank like JP Morgan Chase, that it’s not going to go through something similar to Silicon Valley Bank and the other failed US institutions of 2023,” Burke said.

Card Products Remove Traditional Spending Barriers

Credit cards are integral to linking services and streamlining the customer experience. EQIBank’s Global Secured Credit Card from Visa fits individuals and businesses with spending, travel, and financial access needs that transcend borders.

Counterintuitively, the bank creates that seamlessness by setting up its card product on a secured credit rather than a debit framework. Secured cards put users in the driver’s seat by limiting the system to what they intend to spend. Users load card accounts with deposits that range from $200 to $50,000 for a seamless payment experience everywhere merchants accept Visa. Burke said the decision acknowledged EQIBank’s global client base.

“The credit rail allows for higher limits and makes life much easier for travelers booking a hotel or renting a car,” Burke said. “Of course, credit cards are traditionally more expensive than debit cards, but this program works out best for our client base and their needs.”

EQIBank is also preparing a Mastercard debit card and digital wallet linked exclusively to digital assets. Clients can hold up to five digital asset types on the card and easily arrange their spending order.

For example, a cardholder spending $3,000 might have 1 ETH (Ethereum cryptocurrency) on their card with 5,000 USDT, and have ETH at the top of the priority list. The vendor receives $3,000 at purchase and EQIBank deducts the ETH at the current exchange rate and debits the remainder from USDT.

“You’d be left with about 4,000 USDT on your card at the current exchange rate,” Burke said. “For those who believe digital assets will rise in perpetuity, a better strategy would be to prioritize any stablecoin on the card and let the untethered crypto appreciate.”

Holistic Financial Management on a Unified Platform

As a licensed and regulated offshore bank, EQIBank participates in the digital asset space as an OTC dealer and custodian, although it doesn’t formally custody assets. For example, Mastercard and EQIBank’s card partner will control the wallets on a digital asset debit card it’s planning so the assets are readily available for spending.

A popular client use case for the OTC desk is to put USDT on their cards by sending the USDT to EQIBank’s OTC desk. The bank converts the USDT to US dollars, which appear in the EQIBank account. From there, it’s easy to put any amount they want on their card.

Regarding custodial services, when a bank takes deposits, those deposits are held in the bank’s name with a liability to the client. When the bank holds assets in custody, they register them in the client’s name. EQIBank maintains a custody relationship with Fidelity Investments through its Toronto-based licensed and regulated broker.

“That enables clients holding cash for extended periods to secure it,” Burke said. “Moving assets off a bank’s balance sheet often helps breed confidence.”

These services also enable clients to purchase securities. EQIBank’s OTC team provides insights and expert assistance to help clients navigate crypto while keeping assets safe.

The goal is to create a sticky ecosystem that enables clients to do everything they need financially in a single place and eliminate the siloed approach. EQIBank’s deposit accounts, cards, custody accounts, and OTC desk create a financial ecosystem with a digital foundation.

“Instead of needing an account with one institution if you want access to securities and an account somewhere else if you want crypto assets, and then a bank account on top of that, we put it all together in a single ecosystem,” Burke said.

![Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year]) Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Global-Entry-vs.-TSA-PreCheck-vs.-Clear.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Streaming Services ([updated_month_year]) 9 Best Credit Cards For Streaming Services ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Best-Credit-Cards-For-Streaming-Services.jpg?width=158&height=120&fit=crop)

![12 Best Credit Card Offers Now, Per Experts ([updated_month_year]) 12 Best Credit Card Offers Now, Per Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/12-Best-Credit-Card-Offers.png?width=158&height=120&fit=crop)

![Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year]) Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/chase.png?width=158&height=120&fit=crop)

![How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year] How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year]](https://www.cardrates.com/images/uploads/2017/06/how-to-transfer-credit-card-balance.jpg?width=158&height=120&fit=crop)