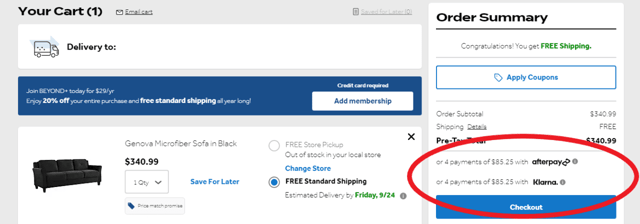

Buy Now Pay Later (BNPL) sounds simple: You get what you want now. You pay for it later.

Great! Right? Well, maybe. The answer isn’t as simple as the concept.

If you’re thinking about using a BNPL service — or maybe you already have — you may have some questions. And we have the answers.

What Is BNPL?

BNPL is a short-term financing arrangement that allows you to split a purchase price into multiple payments known as installments.

The first installment is typically due at the time of purchase. The other payments are spread over a set number of weeks, months, or years for larger purchases.

For example, a $200 purchase may be split into four $50 payments, one upfront and three over time.

BNPL payments are usually deducted automatically from your bank account or debit or credit card.

Popular BNPL services you may have come across include Klarna, Affirm, AfterPay, Zip (formerly QuadPay), Sezzle, and PayPal’s Pay in 4.

Is BNPL More Convenient Than Credit?

BNPL can be used online or in person, but only at certain places that specifically accept this form of payment. In-person purchases usually require that you use a BNPL app you can sign up for in advance or at the time of your purchase.

Most BNPL pioneers are retail stores that sell tangible products like clothing, shoes, eyewear, electronics, furniture, housewares, mattresses, sporting goods, or tires.

Cards can be used online, with a payment app, or in person, and they’re much more widely accepted. In fact, cards can be used just about everywhere to pay for just about everything.

That includes not only everyday expenses, but also large purchases like medical bills, rental cars, major appliances, weddings, airline flights or hotel stays, where BNPL may not be an option.

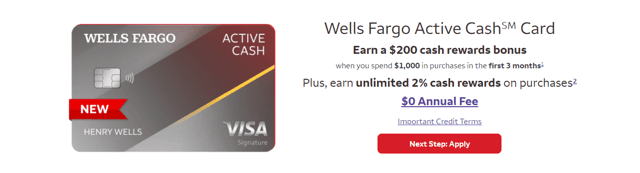

Does BNPL Offer Better Rewards Than Cards?

BNPL services generally don’t come with rewards programs that rival what cards offer.

Depending on the types of cards you may have, you may get cash back, airline miles, free or discounted hotel stays, shopping points, or other rewards for purchases you make with your cards.

Your cards may also offer welcome bonuses (e.g., cash back, points, miles, or other rewards) or annual statement credits (e.g., for food purchases, travel expenses, or your referrals of friends who are approved for a card). The more you use your cards, the more rewards you may earn.

Does BNPL Have More Fees Than Cards?

BNPL services typically don’t charge annual fees, but some do charge interest for purchases, and most charge late fees if you miss one or more payments. BNPL interest expenses and late fees can be quite costly and may not be clearly disclosed when you sign up for a BNPL plan.

Making multiple BNPL purchases may seem like a good way to manage your budget, but with different timelines for installments, BNPL may make it harder for you to keep track of when your payments are due.

To get around that problem, BNPL purchases are often set up with autopay, which deducts your installment payments directly from your bank account. If your balance isn’t sufficient, your bank may charge you overdraft fees. A late fee plus an overdraft charge could turn a hypothetical $100 purchase into a $165 purchase.

Cards tend to charge fees and interest, but if you use them in a smart way, you’ll never pay a penny more than your purchase amounts. All you have to do is choose cards with no annual fee and pay off your balances in full and on time every month.

These financial habits can save you money and help you earn rewards at zero cost.

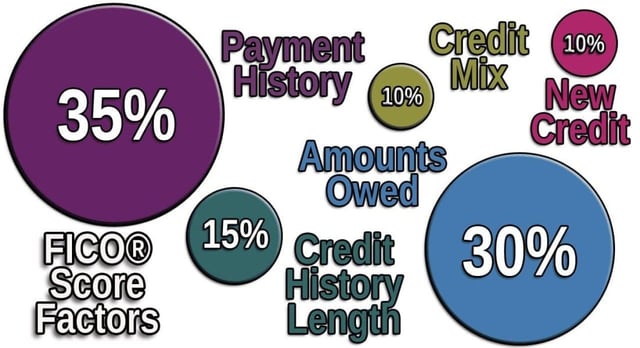

Does BNPL Help Your Credit Scores More Than Cards?

Some BNPL services report your installment payments as on time or late to the major U.S. credit bureaus — Equifax, Experian, and TransUnion. These bureaus keep record of the information that’s used to calculate your credit scores. That means BNPL can affect your scores.

Late BNPL payments will likely have a negative effect on your credit scores, just as a 30-day late credit card payment would.

A Credit Karma survey of 1,038 adults in December 2020 found that 42% surveyed said they’d used a BNPL service. Of those who had, 38% surveyed said they’d missed at least one payment, and 72% of that group reported that their credit scores decreased afterward.

Card companies also report your payments as on time or late to the major U.S. credit bureaus. That means how you use your cards can also affect your scores. Higher scores can help you rent an apartment, get a car loan, buy a home, set up utilities or a cellphone plan, or even land a job.

Cards generally have higher credit limits than BNPL services. Higher limits give you an opportunity to demonstrate that you can handle more credit responsibly. Managing your card utilization ratios (i.e., not “maxing out” your cards) could also help boost your credit scores.

Are BNPL Services Better Than Credit Cards?

If your primary objective is to split a purchase of, say, $100 to $2,000, into a set number of predictable payments, BNPL may, at times, be a good option.

That said, there are some risks: You may be tempted to overspend. You may be hit with interest charges or late payment fees. Your credit scores may not benefit as much as they could if you used a card for the same purchase.

If you miss a BNPL payment, you may be banned from making future purchases with that BNPL service. You may also run into problems if you need to return or exchange a product you bought with BNPL service. Getting a refund may prove quite difficult.

Cards are likely to be a better option if your primary objectives are to:

- make shopping and payments more convenient

- earn rewards and other perks and benefits

- avoid late fees and interest charges by paying your balance in full and on time every month

- build your credit scores

Many good cards also give you a 0% promotional APR when you sign up for a new card. And you may receive a longer period to finance the purchase interest-free than you would with a BNPL service.

Cards also come with government-mandated consumer protections, including $0 fraud liability.

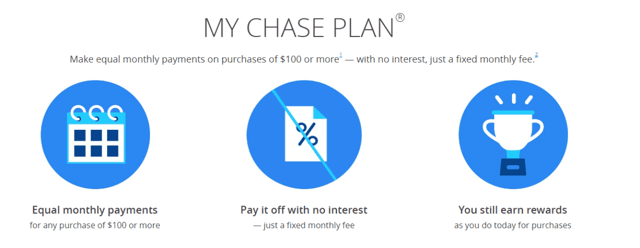

Credit Cards Now Offer BNPL

Credit card companies haven’t ignored BNPL services. In fact, some even offer BNPL options for their cardholders. These BNPL plans are put in place after the sale, rather than when it occurs, but they still offer consumers the benefit of an installment plan within the framework of a credit card.

The American Express Plan It® option lets you combine up to 10 purchases of $100 or more into an installment plan with a fixed monthly payment.

The My Chase Plan® service allows you to convert card purchases of $100 or more into equal monthly payments with a fixed monthly fee and 0% interest.

The Citi® Flex Pay feature lets you split card purchases of $75 or more into predictable monthly payments. This plan is offered for certain purchases on Amazon.com if the order total is $75 or more. Interest will be charged, but there’s no fee for the service itself.

All three of these programs qualify for the same rewards as card purchases and automatically include the payment plan in your minimum payment for each month, making your installments easier and more convenient to repay.

BNPL Isn’t a Substitute For Credit

The bottom line is that BNPL services are no substitute for credit cards. Most cards are accepted almost everywhere, come with perks and rewards, and can be used without paying late fees or interest. Credit cards can also help you build your credit history and raise your credit scores so you can access other financial opportunities in the future.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Ways to Use Credit Card Rewards to Buy Airline Tickets ([updated_month_year]) 5 Ways to Use Credit Card Rewards to Buy Airline Tickets ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/How-to-Use-Credit-Card-Rewards-to-Buy-Airline-Tickets.jpg?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![11 Best Credit Cards to Pay Off Debt ([updated_month_year]) 11 Best Credit Cards to Pay Off Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-to-Pay-Off-Debt-Feat.png?width=158&height=120&fit=crop)

![9 Best Apple Pay Credit Cards ([updated_month_year]) 9 Best Apple Pay Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Apple-Pay-Credit-Cards.jpg?width=158&height=120&fit=crop)

![How to Pay Your Credit Card Bill in [current_year] How to Pay Your Credit Card Bill in [current_year]](https://www.cardrates.com/images/uploads/2021/11/How-to-Pay-Your-Credit-Card-Bill.jpg?width=158&height=120&fit=crop)

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![How to Pay Bills With a Credit Card ([updated_month_year]) How to Pay Bills With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Pay-Bills-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)