Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Chargebacks can harm businesses — particularly companies that don’t prepare for them. Chargeback Gurus provides solutions and consultative guidance to help merchants prevent chargebacks and protect revenue. Chargeback Gurus offers its services to businesses operating in numerous sectors. The company’s analytics provide merchants with an in-depth look into chargeback data.

When a business sells a product or service, the revenue it receives from the sale may be in jeopardy. Depending on a business’s return policy, customers may return items they purchased and receive a refund or store credit.

Chargebacks can also impact a business’s revenue. Chargebacks occur when a customer disputes a purchase made with their credit or debit card. The chargeback is the monetary amount a merchant or card issuer returns to the cardholder’s card following the disputed transaction.

Chargeback Gurus provides solutions and consultative services to help merchants reduce chargebacks. The company began in 2014, and its management team consists of experts from the payments industry, including veterans of Bank of America and PayPal.

We spoke with Oscar Bello, the Chief Sales Officer for Chargeback Gurus, to learn more about the company and how it serves merchants.

Bello said Chargeback Gurus works closely with credit card issuers and brands and acts on behalf of its merchant partners. He said Chargeback Gurus is different from its competitors because it offers merchants a combination of automated service and access to a team of chargeback professionals.

Bello said Chargeback Gurus monitors its performance to unearth trends that can influence its product packages. He said the company’s analytics allow it to dive deeply into issues its customers encounter and discover solutions that can increase win rates.

“Our analytics allow us to identify issues very quickly,” Bello said. “Then we’re able to make corresponding changes to our packages to address issues in a very dynamic way. From the day we start working with a merchant, and continuing through our time with them, we are constantly improving on win rates. We’re always learning and improving, so our packages align more closely with the issuers’ expectations. And I think that’s something merchants really appreciate.”

Identifying Gaps in Business Processes

Bello said Chargeback Gurus provides consultative services to its merchant customers to help them eliminate chargebacks and reduce debt. He said the company’s customers view Chargeback Gurus as a partner, not just a vendor.

Bello said competitors of Chargeback Gurus promise to recover more of a merchant’s revenue, but Chargeback Gurus aims to eliminate chargebacks. He said the message of eliminating chargebacks resonates with merchants because they want to avoid chargebacks and disputes.

Chargeback Gurus brings a holistic approach to working with new customers. Bello said when the company initiates service with a new customer, it examines the merchant’s business processes before discussing how to fight chargebacks with the merchant. He said Chargeback Gurus can identify gaps in a merchant’s business processes that may increase the number of chargebacks the merchant experiences.

Bello said the number of chargebacks a company experiences varies by industry, but chargebacks can devastate smaller businesses in all sectors.

“If a merchant, particularly a small business, doesn’t have a tool to help them fight chargebacks, then a single chargeback on a high-priced item could mean the end of their business,” Bello said.

Bello said chargebacks transpire for numerous reasons. Fraud chargebacks occur when criminals gain access to an individual’s credit card information and use it without the cardholder’s authorization.

Friendly fraud occurs when a cardholder deceives a merchant to receive reimbursement for a purchase. Bello said incidents of friendly fraud have increased recently, and chargebacks due to friendly fraud account for 40% to 50% of all chargebacks. He said friendly fraud is more of a problem when the overall economy is experiencing a downturn.

“Some people just don’t want to pay for services they contract or buy,” Bello said. “That’s really where Chargeback Gurus stands out. We can come in and help merchants to recover the revenue they’ve earned, and we do it in an honest way.”

Serving Businesses Across Industries

Bello said card brands have instituted rules that limit people’s ability to file for chargebacks. He said he won’t know the impact of the rules until merchants can comply with specific criteria outlined in the rules related to data storage.

Not all chargebacks are related to fraud. Bello said Chargeback Gurus does not fight valid chargebacks, including instances where the merchant made an error. He said it’s vital that merchants conduct themselves in an ethical manner because sometimes people have legitimate reasons to file for a chargeback, and they shouldn’t be discouraged from pursuing them.

Chargeback Gurus works with businesses of all sizes in various industries. Bello said the company works with large car rental companies and counts property management firms, hotel chains, and online software businesses among its clientele.

He said Chargeback Gurus partners with companies that sell tax software to combat instances where consumers purchase tax software, use it to file their taxes, and then file for a chargeback so they don’t have to pay the software provider. Bello said the restaurant industry is also subject to fraud.

“You’d be surprised how many people use a mobile app to order takeout at a quick-service restaurant and then charge it back when they get home,” Bello said. “Some of that could be due to an unauthorized use of a card, but some of it is just people who don’t want to pay for their food.”

Bello said many customers of Chargeback Gurus are merchants operating in the retail sector, including online retailers and brick-and-mortar businesses.

Chargeback Gurus offers alerts to help merchants prevent chargebacks. Bello said alerts can help a merchant become aware of imminent chargebacks and refund transactions before they deliver goods to a customer. He said many Chargeback Gurus customers use the company’s alert products before purchasing the company’s more robust services.

Consultative Services Strengthen Merchant Operations

Chargeback Gurus offers its Smart Chargeback Representment services to dispute chargebacks on a merchant’s behalf. Bello said the company directs merchants to prepare an evidence package containing information card issuers look for in chargeback disputes. He said each issuer looks at different information in chargeback disputes, and Chargeback Gurus knows what each issuer seeks.

“We know for the same merchant and the same chargeback, we cannot send the same package that we sent to one issuer to another,” Bello said. “They’re all looking for different things. And that’s really where we’ve become highly effective over the years. We’re able to send issuers highly customized packages, and we’re able to get very good results.”

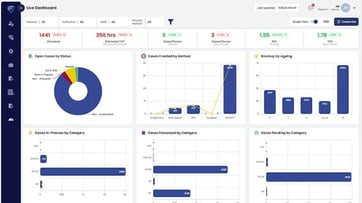

Chargeback Gurus provides analytics and reporting services to merchants, allowing them to access data to learn details about the chargebacks they’ve experienced. Bello said the company’s tools also offer high-level overviews suitable for a business’s senior leaders.

Retailers may desire frictionless payment processes, but Bello said merchants need to acquire information from their customers in case a transaction develops into a chargeback. He said merchants trying to aggressively grow their businesses may not want to create any friction with their customers, but established companies are more open to preventing chargebacks and protecting their revenue.

“It’s a delicate balance,” Bello said. “Some merchants notify us that they have a lot of chargebacks. When we take a closer look, sometimes they’re having a relatively high number of chargebacks because they’re not capturing the information they need to fight chargebacks. We don’t want to overburden merchants, but we do want to let them know that the more evidence they can collect, the higher their win rates are going to be.”

![Financing a Business Using Credit Cards ([updated_month_year]) Financing a Business Using Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Financing-Business-Using-Credit-Cards.jpg?width=158&height=120&fit=crop)

![12 Best Business Credit Cards for Travel ([updated_month_year]) 12 Best Business Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/business-credit-cards-for-travel-feature.jpg?width=158&height=120&fit=crop)

![8 Best Business Credit Cards for Startups ([updated_month_year]) 8 Best Business Credit Cards for Startups ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/Best-Business-Credit-Cards-for-Startups-Feat.jpg?width=158&height=120&fit=crop)

![How to Get a Business Credit Card ([updated_month_year]) How to Get a Business Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/How-to-Get-a-Business-Credit-Card.jpg?width=158&height=120&fit=crop)

![12 Best Personal Cards For Business Expenses ([updated_month_year]) 12 Best Personal Cards For Business Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/BusinessPersonaCard1.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Farmers ([updated_month_year]) 7 Best Credit Cards for Farmers ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Credit-Cards-for-Farmers.jpg?width=158&height=120&fit=crop)