In a Nutshell: Valley National Bank takes an active role in the communities it serves, which include areas of New Jersey, metropolitan New York, and Florida. This means recognizing the special banking and financial needs within each area — and striving to meet those needs. As a part of this commitment, Valley offers free financial education events and seminars aimed at helping residents make more informed financial decisions on topics like personal finance, building good credit, and small business financing. It’s all part of a greater belief that helping improve the financial lives of individuals is good for everyone and helps to build stronger and more vibrant communities. //

Financial habits are developed in each of us by observing the monetary practices of the people who surround us. If we’re raised in an environment where an emphasis is placed on spending within your means, saving a percentage of your earnings, and using credit wisely, then we’re more likely to develop those same smart financial practices. But if we happen to grow up in a community where economic hardship and poverty are the norm, then these good financial habits may not be as easily learned from observation.

As a community-based bank,Valley National Bank has a proud tradition of serving the needs of local neighborhoods that dates back more than 90 years. With a commitment to providing banking access for underserved neighborhoods, Valley is helping to build stronger and more financially secure communities.

One way the bank facilitates this is through free financial education events and seminars arranged through partners or offered to individuals and small businesses that want more information so they can make informed financial decisions. Data shows that by learning the basics of good credit and money management, individuals and families can improve their lives.

We recently spoke with Geraldine Flach, Community Development Program Manager and Vice President at Valley National Bank, who told us about the importance of providing applicable information to assist families and businesses with their financial decisions.

“Financially aware individuals are better able to access opportunities and contribute to their communities,” she said. Helping communities grow and prosper speaks to Valley’s corporate citizenship philosophy.

Good Financial Habits Are a Learned Behavior

Many high schools, and even colleges, in the United States don’t offer courses in money management or budgeting, and as such, rely on the volunteer efforts of financial organizations like Valley to supplement their financial literacy curriculum. Similarly, households burdened with debt need access to financial best practices.

“The ease of purchasing with plastic versus cash, and the prevalence of online shopping, can challenge any budget,” Geraldine said. “And keep in mind that having good credit has a major impact on day-to-day needs, from setting up a utility account to renting or buying a home.”

Maintaining healthy credit is so important, but somehow not prioritized in traditional education programs. However, when personal finance education is made available, positive results can follow. For instance, three states (Georgia, Idaho, and Texas) saw increased credit scores and lower delinquency rates three years after including personal finance in its required curriculum.

Through Valley’s educational events, it shares information on the importance of good credit, how and why to build savings, best practices in financial decisions such renting vs. buying, and other personal financial considerations.

Educational Seminars Designed to Meet Community Needs

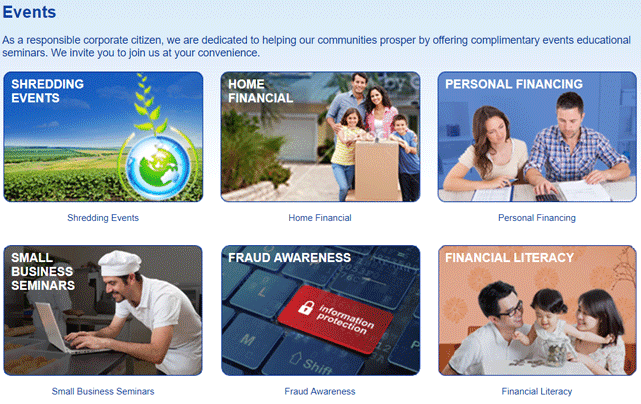

Valley National Bank regularly posts its latest events online. In addition, residents of areas served by Valley can stop into any branch to find out what specific events and seminars are being offered in their neighborhoods.

Valley National Bank’s events are designed to educate and inform residents about improving their finances.

Other ways in which Valley gets the word out regarding financial information offerings is through its partner network. Whether schools, nonprofit housing organizations, or Community Development Financial Institutions, “partnerships are key to the success of Valley’s educational programs.”

Geraldine expanded a little more on this. “Community-based organizations allow us to reach people that have the greatest need for the information we have to offer,” she said. “Improving financial outcomes for clients is a shared goal as is building organizational relationships.”

Some of the seminars and events recently offered by Valley to area residents include:

Personal Finance and Financial Literacy — The seminar covers budgeting, cash flow, savings, debt management, and life-cycle financial planning. The curriculum can also be tailored to children and is offered through partnerships with schools and regional nonprofits, such as Junior Achievement.

Buying vs. Renting & First-time Homebuyer — These seminars, often led by residential mortgage experts, help attendees understand the processes required to achieve the “American Dream” of homeownership. Valley highlights the costs associated with buying a home, the information that potential homeowners must gather for income and expense verification, and the impact of credit. Some seminars also cover down payment assistance opportunities and other available resources, including working with one of Valley’s authorized Housing Counseling Agency partners to get started.

Building a Better Credit Report — This seminar stresses the importance of being aware of one’s credit score. It explains how to obtain and read a credit report, and what’s considered a good vs. a bad credit score, as well as how to rectify errors on one’s credit report. It also gives tips on how to improve credit and knowing your credit limits.

Guide to Better Banking — This seminar discusses the benefits of having a bank account and the benefits of building a positive relationship with a financial institution. It explains the importance of saving, and how to access bank products. It also describes a variety of basic banking products, and touches on identity theft and using credit cards wisely.

Why Smart Money Habits Benefit Everyone

Valley recognizes the benefits of sharing smart money habits. When families and individuals within a community feel financially stable and secure, they are in better position to give more back to local neighborhoods and causes. They also take more pride in the neighborhoods where they live. This can lead to more vibrant, abundant, and safer communities.

Valley National Bank takes steps to improve the lives of people in the communities it serves.

Solid financial habits can also lead to greater opportunity for subsequent generations, including a greater chance of attending college. Also, since financial habits are largely a function of environment, these traits can be learned from families and communities by observing the positive results.

Valley National Bank is committed to offering financial education seminars and working with community members toward positive changes, one person at a time.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Free Prepaid Credit Cards ([updated_month_year]) 8 Free Prepaid Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Free-Prepaid-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Free Car Rentals ([updated_month_year]) 8 Best Credit Cards For Free Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Credit-Cards-For-Free-Car-Rentals--1.jpg?width=158&height=120&fit=crop)

![12 Free Prepaid Debit Cards ([updated_month_year]) 12 Free Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Free-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)

![How to Get Free Flights With Credit Cards ([updated_month_year]) How to Get Free Flights With Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Get-Free-Flights-With-Credit-Cards.jpg?width=158&height=120&fit=crop)