Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: As exchange-traded funds (ETFs) have supplanted mutual funds as vehicles for market and asset class diversification, they have diversified to appeal to people with a wide range of investment philosophies. Marshaling decades of experience as a broker, advisor, and money manager, Matthew Tuttle, CEO and Chief Investment Officer of Tuttle Capital Management, designs ETFs for traders who want all the market can give. Tuttle Capital’s forward-looking due diligence produces thematic and actively managed ETFs that balance risk and return in a money-making approach.

Tuttle Capital Management, the brainchild of long-time trader and former financial advisor Matthew Tuttle, exemplifies an exchange-traded fund (ETF) provider that doesn’t try to be all things to all people. Tuttle considers himself an ETF entrepreneur, and Tuttle Capital appeals to traders like Tuttle, who look for more from the market than it commonly delivers.

“My mission is simple: to make you money,” states Tuttle on the Tuttle Capital website. Advice from Wall Street and the financial media adopts a generic, one-size-fits-all perspective to accommodate traders with varying risk tolerance and financial goals. Tuttle Capital, on the other hand, is for self-managed and -motivated retail traders and advisors interested in moving beyond abstract benchmarks and dubious ESG (Environmental, Social, and Governance) metrics to get to what makes the market tick today and how that affects prospects for tomorrow.

Tuttle calls his approach forward-looking due diligence. Tuttle encourages traders to reject the assumption that past returns for an asset class or portfolio manager are necessarily persistent. Forward-looking due diligence embraces and manages uncertainty, requiring contextual understanding and adaptiveness rather than management by statistical tendency.

That requires understanding the origin and cause of a product or manager’s past returns, assessing the likelihood of conditions leading to those returns continuing, considering the worst-case scenario, and making changes as needed.

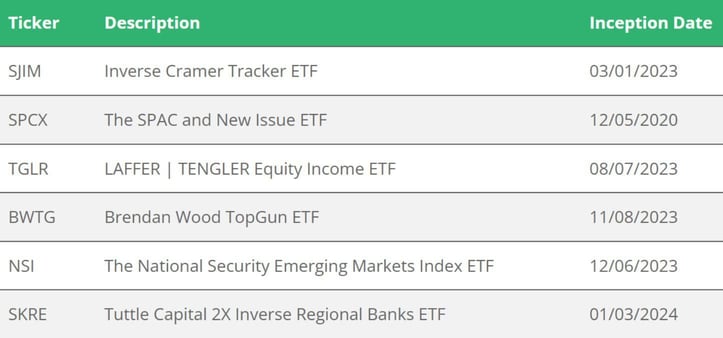

Tuttle is also attracted to products that are decidedly not cookie-cutter. For example, Tuttle Capital is famous for launching the first ETF that shorted another ETF.

“I started trading in the early 80s and have been in love with the market ever since,” Tuttle said. “I like to launch ETFs that I want to trade and have a reasonable degree of certainty that other people will want to trade.”

An Innovator in the ETF Space

Before ETFs began making their long journey into prominence in the 1990s, investors looking for a basket or pool of individual securities usually did so because the relative certainty of diversification was the goal.

The alternative was to endure the ups and downs of investing in individual stocks. Their vehicle was the mutual fund, a vehicle not designed to quickly move in and out of a position in an anytime, anywhere fashion.

“Unlike mutual funds, ETFs are pooled portfolios where the investor knows the exact composition and price of the fund and can use it to make a quick trade in addition to constructing a managed portfolio,” Tuttle said. “They just give you tremendous flexibility and are being opened up to more and more strategies.”

Tuttle Capital’s product strategy is distinctive and twofold. Tuttle argues that his firm’s innovative 2x single-stock ETFs (which seek to deliver double the daily performance of the stocks they track) are a better vehicle than stock shorting because they circumvent the relatively high cost of opening a margin account for leverage, the uncertainty of finding lenders, and the inconvenience of being unable to short an IRA.

Because of their lower cost, they’re also a better bet than trading options. But they’re not for folks interested in holding onto a position for 30 years and letting it grow.

Core Tuttle strategies aren’t quite as unorthodox as its leveraged single-stock ETFs but are as innovative. Core products include the Brendan Wood TopGun ETF, based on the methodology of the famous capital market intelligence provider, and the Inverse Cramer Tracker ETF, which seeks results that are approximately the opposite of those recommended by television personality Jim Cramer.

“We did the inverse Jim Cramer because he’s being brought out as an expert, there’s no accountability, and he’s not an expert,” Tuttle said. “Somebody had to do it, and that somebody was me.”

Independent Thinking for Self-Managed Traders

Those who trade Tuttle’s leveraged single-stock ETFs are individual retail traders. Tuttle frequently communicates with those traders on the Discord platform and X, formerly known as Twitter.

“I’m involved in four distinct Discords — I’m sitting here, trading and communicating with them all day, every day,” Tuttle said. “Those are the types of guys who buy this stuff.”

Tuttle has a great affinity for the retail trader. Having been a financial advisor and broker and worked in insurance, he’s not a big fan of the industry. He loves what the individual investors are doing and how much money they make versus people working with advisors.

“Relying exclusively on Wall Street and the financial media for investment advice can limit your perspective and probably your investment opportunities and potential for success,” he said on the Tuttle Capital Management website.

Tuttle argues that arcane wisdom, such as the importance of global diversification tailored to a custom risk tolerance and benchmarked financial goals, holds investors back. So does buying stocks or ETFs that focus on ESG metrics rather than how owners and managers run their businesses.

“If I can call out some of the hypocrisy out there or go out on a limb and take the other side on something, so much the better,” Tuttle said. “I only work on core products that I think are unique and offer a different exposure that I want to invest in myself.”

Tuttle’s investment philosophy, not surprisingly, combines a mixture of systematic and discretionary strategies. He has systems for buying and selling certain stocks under the right conditions, but he’s also looking at charts on multiple screens in his office, putting gut feelings and emotions into play. In the final analysis, he calls himself a “mean reversion guy.”

“I like to buy fear and sell greed,” Tuttle said. “I buy things when they’re low and sell them when they’re high.”

Risk-Averse But in the Market for Opportunity

Tuttle applies his extensive market understanding to make trades confidently. He doesn’t chase anything in the market, is agnostic about long-term versus short-term holdings, and is quick to acknowledge the advantages and disadvantages of most strategies.

He looks to Federal Reserve interest-rate policy as the prime market mover and tends not to follow what the financial media considers the “smart money.”

“People like to think the smart money is smart because people in the media call them smart — they’re not,” Tuttle said.

Tuttle provides insight into his thinking through ETF model portfolios the Tuttle Capital website offers free to the public. These model portfolios constitute hypothetical groupings of Tuttle and outside ETF products to illustrate his point of view in action.

Tuttle Capital offers several newsletters, including TCM Financial News vs. Noise and The Woke Street Journal, to distribute Tuttle’s observations and investment philosophy and provides whitepapers and insights to address market issues and clarify ideas.

Tuttle also published “How Harvard and Yale Beat the Market” in 2009 to anchor his forward-looking due diligence philosophy in observations about the relative investment success of college endowments.

“Education is key — Wall Street is a very unkind place to the uneducated investor,” Tuttle said. “If you’re not educated, you have no idea whether your advisor is good, so be educated.”

Tuttle also thinks educated investors can do better than those who work with financial advisors or put their money in total-market ETFs and watch it grow over the long term. Tuttle Capital is for those folks.

“That assumes you’ve got the time, the expertise, and the emotional fortitude,” Tuttle said. “I look at investing like I look at poker: There are times when it makes sense to go all in and times when it makes sense to fold. And the best poker players fold 70% of the time.”

![9 Best Credit Cards For Wealth Management ([updated_month_year]) 9 Best Credit Cards For Wealth Management ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-Credit-Cards-For-Wealth-Management.jpg?width=158&height=120&fit=crop)

![6 Tips: Increase Your Capital One Credit Limit ([updated_month_year]) 6 Tips: Increase Your Capital One Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Capital-One-Credit-Limit-2--1.jpg?width=158&height=120&fit=crop)

![Capital One® Cards For Fair Credit in [current_year] Capital One® Cards For Fair Credit in [current_year]](https://www.cardrates.com/images/uploads/2020/09/shutterstock_124031281.jpg?width=158&height=120&fit=crop)

![Capital One Quicksilver Card: Review & Options ([updated_month_year]) Capital One Quicksilver Card: Review & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Capital-One-Quicksilver-Card-Review.jpg?width=158&height=120&fit=crop)

![Capital One Secured Credit Card Reviews of [current_year] Capital One Secured Credit Card Reviews of [current_year]](https://www.cardrates.com/images/uploads/2021/11/Capital-One-Secured-Credit-Card-Reviews.jpg?width=158&height=120&fit=crop)

![Capital One Venture vs. Venture X: Which Wins? ([updated_month_year]) Capital One Venture vs. Venture X: Which Wins? ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Capital-One-Venture-vs-Venture-X-1.jpg?width=158&height=120&fit=crop)