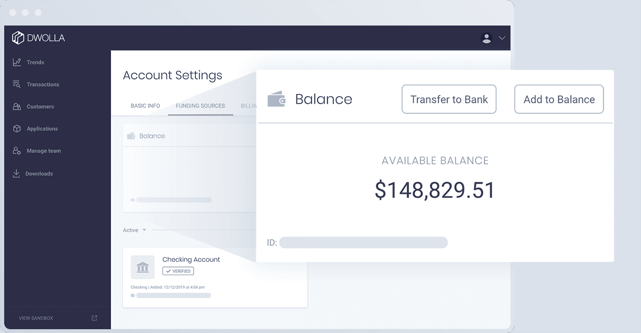

In a Nutshell: The Dwolla payments platform aims to cut out all intermediaries to easily send funds between accounts with no credit card fees. Dwolla uses account-to-account payment technology to help drive the open banking initiatives in the US for connected, fast, and safe payment solutions. Clients can send and receive funds from any payment account that can settle in real-time.

Dwolla has grown substantially as a payments platform since its national launch in 2010, but its history stretches back to founder Ben Milne’s days as a business owner.

Credit card fees consumed a large portion of Milne’s bottom line, so he set out on a mission to do it better. Milne created Dwolla as a system to pay and receive funds account-to-account, bypassing intermediaries and credit card fees. Funds are available to the recipient immediately as payments are delivered instantly.

“Whether it’s paying a vendor or whether it’s paying a gig economy worker, we extend what financial institutions provide to folks that really want to save on costs, but also want the flexibility and the benefits of an accounting account solution,” Dwolla Vice President of Corporate Strategy Adam Steenhard said.

The platform’s newest feature, Virtual Account Numbers, streamlines payment workflows through a unique account and routing number and can allow the movement of funds back and forth between any bank account or digital wallet.

Dwolla said clients like that the payment solutions help them get to market quickly with their idea. Additionally, real-time payments mean users can access their funds near instantaneously. Businesses pay contractors for their services quickly, helping build out their marketplace.

Dwolla has two pricing options for its services. Businesses can elect Dwolla’s pay-as-you-go service, which is a cost-effective approach for low transaction volumes. The other is scale pricing which provides a low-cost option for higher transaction volumes.

Clients can also elect to add API access, faster payment options, and more platform features and support at $250 a month each.

Cutting Out Credit Card Fees

Credit cards are a critical part of owning and operating a business. They provide near-instant payment solutions in exchange for short-term debt. But credit cards can create problems for businesses — by accruing interest and amassing debt — if they’re not used responsibly.

At each step of the credit card payment process, banks, credit card issuers, and other institutions take a share of the payment as a fee. These fees add up, amounting to a sizable portion of a business’s bottom line.

Dwolla solves this issue with account-to-account payments. Businesses do not have to go into debt because they use the money in their account. The funds can be sent to the recipient’s account and can be received almost instantly by the other account. There’s no relying on card transactions where there could be settlements down the line.

Expanding businesses rely on contractors to get a lot of the job done. Dwolla’s technology offers an attractive payment experience for contractors because it provides real-time access to funds for the job that was just done.

Many insurance providers partner with Dwolla for insurance claims. Dwolla’s system allows claimants to receive access to emergency funds for a rental while their car receives repairs or to find a place to stay while rebuilding their home.

“When there are claims, the claims adjuster goes to their car and prints off a check that they give to the homeowner,” Steenhard said. “The issue with that is then they have to wait a few days for that to clear and for them to fix the roof, wasting precious time.”

Another use-case example is rideshare drivers who work over the weekend. Those drivers receive their payments that weekend when completing the job with Dwolla. Funds are deposited in their account without them having to wait for the next business day.

Virtual Account Numbers Provide Banking Compatibility

Dwolla’s payment system focuses on flexibility and accessibility. Virtual account numbers further that mission making it even easier to ensure funds end up where they are supposed to go.

Like most bank accounts, virtual account numbers feature unique payment routing information that provides the ability to easily transfer funds between different payment accounts or digital wallets such as Square. Dwolla’s technology also has wallet functionality that can work similarly to a Venmo but for business payments.

Dwolla has relationships with several different financial institutions to give businesses access to various benefits of account-to-account payments. Businesses don’t have to have an existing bank account with one of Dwolla’s partner institutions.

Clients with a relationship with small community banks can still create an account on Dwolla’s platform. Those clients who work with different institutions can access the different payment features, such as virtual account numbers and real-time payments.

“They can bring the relationships that they work with to the table, rather than being forced to transition their operations to a partner bank,” Steenhard said. “We continue to stay open to those different use-cases.”

Dwolla said its payments system has features through disbursements that credit cards cannot compete with. Real-time payments provide many of the same benefits that cards do today, without costly credit card fees.

“When a transaction happens on a Saturday, that payment through Dwolla will happen on that Saturday,” Steenhard said. “Those funds are irrevocable; the cash transfers to that bank account. There are no chargebacks and no returns. That cash is there. That business owner can find comfort in that it’s there.”

However, this does not mean businesses should ditch their credit card. Dwolla said there’s always a likelihood that businesses will need to use a card to make payments in a pinch.

Building Products That Align With Client Needs

Dwolla sets out to be the ultimate payment resource for its clients. The company encourages customer feedback, and its customer excellence team has quarterly business reviews and actively talks to clients.

Dwolla listens to the problems clients are facing and applies those learnings to the plans they have to grow their business. The company leverages that information to build features that help these businesses scale. Those businesses are brought in during Dwolla’s discovery phase to create new products.

“Rather than building something and missing the mark, we bring clients along for the ride,” Steenhard said. “We dig into the feedback to make sure we collectively build something in the market that people are going to use.”

Dwolla focuses on its clients because if they are not successful, then Dwolla is not successful. The company quantifies this success in multiple ways, including how many clients use its features, the number of transactions made, and the quarterly business reviews.

Dwolla wants word-of-mouth to be the driving force for people joining its services. It wants to provide the best service so clients recommend the company to other clients. The company also goes to events to promote and leverage its digital presence to bring in new customers.

Open banking is at the core of Dwolla’s principles, and the company hopes more of the industry will adopt the systems to support it. The company said giving business owners flexibility in how they use funds is essential to gaining and keeping customers. The company plans to create more features to build up its base.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What Is Netspend? The Company & Its Products ([updated_month_year]) What Is Netspend? The Company & Its Products ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/10/What-Is-Netspend.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Tax Payments ([updated_month_year]) 7 Best Credit Cards for Tax Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-for-Tax-Payments.jpg?width=158&height=120&fit=crop)

![11 Ways to Lower Your Monthly Bill Payments ([updated_month_year]) 11 Ways to Lower Your Monthly Bill Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Ways-to-Lower-Your-Monthly-Bill-Payments.jpg?width=158&height=120&fit=crop)