Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

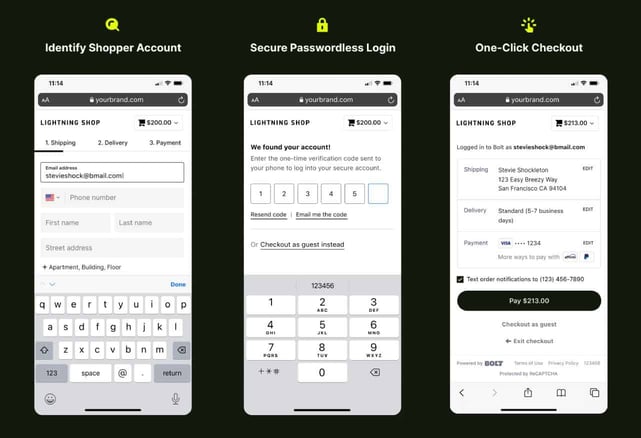

In a Nutshell: There’s a disconnect between what eCommerce customers want and what merchants need at checkout. Customers want a frictionless experience where identities fade into the background — so much so that the vast majority are willing to transact as guests without registering. Merchants want to know their customers to track behaviors and orders, personalize experiences, and encourage return visits. Bolt’s one-click checkout satisfies both sides while protecting transactions. Customers receive seamless checkout everywhere they shop, and merchants gain customer intelligence to increase conversions and add value.

ECommerce checkout needs to be different things to different people. Customers want simplicity, and merchants need information. Bolt’s one-click checkout accomplishes both.

Bolt can improve customer conversions, boost repeat business, and protect transactions for merchants. It can stand alone as a platform or integrate with existing infrastructure. And it can provide the same seamless brand experience everywhere customers shop.

It does these things without getting in the way. Customers may not know they’re accessing a Bolt experience, but they respond positively to optimized checkout with fewer distractions caused by intrusive account signups, usernames, and passwords.

Bolt remembers shipping and payment information, so customers spend less time searching for login credentials and fill carts instead of forms. Merchants recognize who they are, show them what they’re interested in, and reward them when they return.

Bolt customers report faster checkouts, higher order approval rates, increased revenue and conversions, and more new and repeat business.

Greg Greiner, SVP of Product, said Bolt has dedicated itself to reducing friction at checkout since its days as a startup.

“Checkout needed to be more mobile-optimized, with as few fields as possible and the fastest load times possible,” he said. “And we invested in fraud and risk management to ensure we approve as many orders as possible and not let overzealous fraud rules reject good customers.”

Bolt also invested in the ability to easily save and reuse payment and address information. And as it scaled with a hosted payment solution for SMBs and mid-market firms, it focused on building trust and improving value in the space. It continues to offer a hosted solution to hundreds of customers.

“We’re laser-focused on solving every friction point in checkout,” Greiner said.

Global Account Network Enables Enterprise Integration

To grow its customer base and expand upmarket, Bolt has also leveraged shopper data in its merchant network to embed the checkout experience in existing corporate infrastructure. Guaranteed fraud detection covers 100% of chargebacks.

“As we got deeper into our offering, we realized the most unique and highest-impact aspect was our shopper network,” Greiner said. “We see ourselves scaling the most with larger retailers by enabling them to keep their checkout as is but supercharging it with our global account system.”

That creates a technology-agnostic platform. Bolt can now work with various shopping carts and payment processors or supply those tools. The system works with whatever management platform is behind the scenes.

Bolt is also predominantly a gray-label solution, with the merchant’s brand always coming first. Consumers stay on the merchant site at checkout, with no popups or redirects. The consumer completes checkout within the merchant’s interface.

Achieving a frictionless experience is easier for the merchant because Bolt doesn’t need to recreate the entire checkout process — the merchant receives all the benefits of the checkout it already has. That makes Bolt different from solutions like Apple Pay, which circumvent the checkout process and skip the bells and whistles around loyalty and discounts.

Registering for an account with just a checkbox at the end of the checkout flow is also easy. That’s possible thanks to the system’s passwordless login system, with the customer already having entered everything needed to create an account during checkout.

The vast majority of consumers presented with that experience log on instead of choosing to transact as guests, which leads to 35% of all shoppers logging into an existing account and getting one-click checkout on average. Of the remaining, 65% roughly half end up creating an account because of the simplicity of registering via a checkbox.

“That means higher conversion benefits and a better customer experience, with shoppers returning more frequently because they got that good experience the first time,” Greiner said.

Gain Customer Understanding Without Adding Friction

Bolt can also connect its global account and identity system to the merchant’s system. Account information syncs to the merchant’s system when customers create accounts with Bolt at the checkbox point.

That enables merchants to obtain more accounts. But even more critical is that customers use more of the accounts they create.

“People may have an account they created months ago with a retailer, but when they come back to shop again, they don’t remember their credentials, so they just go through guest checkout,” Greiner said.

Retailers need help implementing loyalty and personalization goals and enabling better order management and support processes when guest transactions are the majority.

“In addition to providing that more seamless one-click experience, we’re helping retailers convert those guests into account holders,” Greiner said. In doing so, Bolt helps alleviate a major problem in eCommerce.

The convention in eCommerce’s early days was to force all customers to create accounts. It’s still common practice on apps like Netflix and Uber, where guest checkout isn’t permitted.

But as eCommerce merchants proliferated and consumer options increased exponentially, retailers realized that account creation added too much friction, and the guest account became a secondary option. Soon, consumers caught wind and started choosing guest registration proactively.

Now as much as 95% of a typical eCommerce merchant’s business transacts through guest accounts. The negative side is that merchants don’t get the identities of those shoppers.

“You can’t offer guest shoppers loyalty or personalization, and you have to track every order by order ID,” Greiner said. “You end up trading that short-term conversion for the negative impact of not being able to grow a customer’s lifetime value over the long term.”

Protect Transactions and Tailor Experiences

Having that control is a big reason Amazon has grown its dominance. With Amazon’s default login experience, everything is personalized and seamless. Such platforms can offer loyalty, private-label cards, and many other benefits that are harder to introduce in a guest environment.

But those days are past. Bolt offers the same features through different means.

“We enable that seamless default guest checkout experience along with the benefits of registering many shoppers to accounts holders and encouraging those who already have accounts to log in,” Greiner said.

That’s where chargebacks and fraud enter into the equation. There’s a danger in making checkout so frictionless that it creates more mistakes, chargebacks, and refunds.

“You don’t want a situation where someone clicks a button and doesn’t know they made a purchase,” Greiner said. “We ensure the shopper is 100% aware of their purchase and how they’re making it.”

Bolt’s machine-learning-based model reviews all transactions. Because it recognizes the 30-40% of shoppers who log on, it can do a better job than traditional fraud providers in determining whether transactions are fraudulent.

On the horizon for Bolt is a move toward leveraging even more significant benefits from customers who have and use accounts.

It’s looking to offer more substantive help to merchants looking to add personalization benefits and more tailored shopping experiences. It sees an opportunity to dive deeper into loyalty and membership programs.

And it’s looking to offer additional benefits in the post-purchase experience. Better experiences with store credit are a possibility, as is more seamless order tracking.

“The long-term future we see for Bolt is expanding the value of the customer identity we offer beyond one-click checkout to the broader set of benefits companies like Amazon provide,” Greiner said.

![8 Best Credit Cards Accepted Everywhere ([updated_month_year]) 8 Best Credit Cards Accepted Everywhere ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/Best-Credit-Cards-Accepted-Everywhere--1.jpg?width=158&height=120&fit=crop)

![8 Credit Cards with No Bank Account Needed ([updated_month_year]) 8 Credit Cards with No Bank Account Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-with-No-Bank-Account-Needed.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards Without a Bank Account ([updated_month_year]) 8 Prepaid Debit Cards Without a Bank Account ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Prepaid-Debit-Cards-Without-Bank-Account.jpg?width=158&height=120&fit=crop)

![How to Calculate APR on a Credit Card ([updated_month_year]) How to Calculate APR on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/CalculateAPR-1--1.png?width=158&height=120&fit=crop)

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)