Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: If you’re lucky, you had parents who counseled you to save for what you want. Accrue Savings has transformed that practical tradition into a product that pays rewards for saving and purchasing with dozens of merchant partners. Consumers gain satisfaction from a job well done and the financial bonus of avoiding debt, credit, and fees. Merchants acquire new customers and build brand loyalty through incentivization that can be ongoing. Accrue helps consumers purchase from leading brands without tying themselves down financially.

Digital transformation and credit innovation have gone hand in hand in the American economy for 50 years or more. However, new forms of financial flexibility — including credit cards, crowdfunding, and buy now, pay later (BNPL) services — tend to circumvent traditional values such as saving in advance for what you want and need.

Instead of rewarding consumers for sacrificing and putting a little aside every week or month to make a dream come true, financial providers prefer encouraging people to consume without considering the consequences.

That’s a big reason credit card debt keeps increasing. Credit card balances now amount to $1.03 trillion, the highest-ever level and the first time the number has surpassed the trillion-dollar benchmark, according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, released in July 2023.

Accrue Savings exists to direct consumers to a more responsible way of using money that hearkens back to those old ways of doing things. Instead of buying now and (hopefully) paying later, Accrue customers save now and buy later. And to sweeten the deal, dozens of Accrue merchant partners pay rewards for saving and purchasing to make reaching goals easier.

Accrue Founder and CEO Michael Hershfield said the result is a classic win-win scenario. Accrue users gain the ability to purchase without debt, credit, or fees on a flexible platform that puts them in the driver’s seat. Merchants benefit by cementing relationships with new and loyal customers.

These are the benefits consumers gain for sticking to an old and arguably better way of handling money: saving in advance.

“Millions of Americans are actively saving to make purchases right now,” Hershfield said. “Accrue is mission-driven to empower them to partner with retailers and earn rewards for saving.”

Deposit Funds into a Savings Wallet Linked to a Merchant

To top it off, Accrue is simple and intuitive to use. Consumers generally engage with Accrue brand partners at the point of sale or through emails or other marketing materials.

Brand partners run the gamut from jewelry retailers to auto suppliers. Other product categories include health and wellness, home and furniture, toys and electronics, travel, fashion and apparel, and fitness.

Consumers learn from these engagements that if they don’t have the money up front to pay for what they’re browsing for, they can set up an account through Accrue, and the merchant will pay rewards for reaching savings milestones and ultimately making a purchase. Depending on the merchant and product, users may earn hundreds or thousands in rewards to make purchases more accessible, with some retailers paying up to 20% toward a purchase.

“They’re offering these opportunities to consumers who may be discovering brands but are not ready to purchase,” Hershfield said. “They may also offer rewards to boost loyalty, where someone has made a purchase and maybe they’re ready to make a second.”

Transactions then proceed through the merchant’s website. Users sign up for an account and deposit money without visiting Accrue directly. Alternatively, shoppers can engage with Accrue directly through the brand partner page. Dozens of Accrue brand partners are sortable and searchable, and shoppers can use the site to shop for deals that appeal.

Accrue does the heavy lifting behind the scenes, storing customer funds in a wallet backed by a typical FDIC-insured bank account. Users can pay any amount toward their goal, stopping and starting as their financial status and needs change.

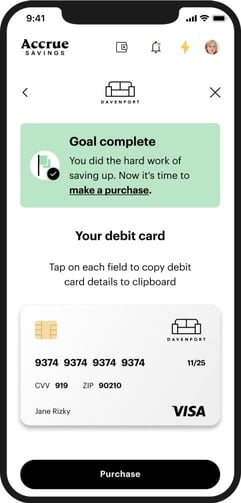

“Ultimately, when the consumer has achieved their milestone, they can purchase with the merchant using an Accrue-branded debit card,” Hershfield said.

Merchants Structure Reward Terms for Optimal Impact

Merchants are free to deploy Accrue in ways that mesh with their goals. Most online shoppers know what it’s like to browse aspirationally and face the dilemma of paying for items with funds they don’t have. Through Accrue, brands can reach those consumers with an entirely different value proposition and an offer to pay part of the cost of the product or service they aspire to.

Wallets on Accrue don’t work like typical savings accounts with funds for general use. Instead, Accrue ties each wallet to a specific retailer, and consumers save with particular retailers ultimately to make the purchase.

Every merchant partners with Accrue differently. They decide which products to offer and how much to reward. For merchants, Accrue becomes a marketing tool that combats cart abandonment and prompts return visits.

“For example, one of the largest online travel agents in the US offers 6%, so if your goal is to save $1,000 for your next trip, every time you save $100, it becomes $106,” Hershfield said. “But another brand offers 20% — it depends entirely on how much that merchant wants to reward the consumer for building that savings wallet experience.”

To help seal the deal with users, Accrue and its partners also allow customers to change goals if their financial status changes. If the original goal was $1,000, a user experiencing financial stress might lower the goal to something more manageable without entirely abandoning the endeavor.

“Along with more than a trillion in card debt in the US, we’re also seeing rising delinquencies and conversation around consumer credit pain,” Hershfield said. “We’re promoting the idea that people can spend what they can afford and avoid the social and retail pressure to make purchases that are not necessarily in their best interest.”

Empowering Consumers to Purchase Within Their Means

It all adds up to a consumer-friendly experience that still manages to promote commerce. Accrue’s mission statement declares that everyone should be able to save for the things they love and live the way they always imagined.

The only difference between Accrue and a credit card is that consumers can do these things through Accrue without putting themselves in a financially precarious position, paying excessive interest, or paying extra fees for the privilege.

“You can set a recurring payment schedule, round up your payment like a traditional savings account, ask your friends and family to contribute, and top up and purchase when you’re ready,” Hershfield said. “Consumers drive the value and excitement of earning rewards, each in their own way.”

Accrue also serves as a financial literacy portal with extensive content to advance consumer understanding of the financial marketplace and strategies for credit card use. Crowdfunding and BNPL services are increasingly significant to millennials and Gen Z consumers, which is why Accrue offers an alternative based on a more traditional way of handling money. Accrue encourages caution in an uncertain economy without discouraging consumption and enjoyment.

Hershfield received permission from his wife to start the company after justifying the business model through market research, drawing on consumers’ natural impulse to save. Now users recommend new brands to the Accrue team, and there’s no practical limit to the number of brands that can benefit from being on the platform.

That’s why Accrue keeps on the horizon new partnerships with brands that believe in the vision and can benefit from new powers of customer acquisition based on tradition. Only about 3% of users withdraw their money without purchasing, a rate that credit-based forms of consumer motivation could never hope to reach.

“Most of our users are actively saving toward their goal,” Hershfield said.

![11 Credit Card Perks For Holiday Shoppers ([updated_month_year]) 11 Credit Card Perks For Holiday Shoppers ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Credit-Card-Perks-For-Holiday-Shoppers.jpg?width=158&height=120&fit=crop)

![First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year]) First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/first-savings-credit-card.jpg?width=158&height=120&fit=crop)