If you can remember when credit card issuers regularly offered fixed interest rates on at least some of their cards, chances are you’re not a millennial. So, what happened to fixed-rate credit cards?

Simply put, the Credit CARD Act of 2009 happened, but more on that in a little bit. For now, you may be glad to hear there are still places you can find the best fixed-APR credit cards, even these days.

Fixed-APR Cards Can Be Found at Select Credit Unions

Credit unions tend to be some of the best places to still find fixed-APR credit cards. Unlike banks, credit unions are member-owned and not driven by profit-minded shareholders, making them more willing to accept less of a return on their loans and credit card offerings.

Members get the benefit of lower credit card interest rates, and the credit unions fulfill their mandate of serving the community.

The interest on a fixed-rate credit card issued by a credit union tends to be lower than that of a variable-rate card. Some credit unions offer fixed-APR credit cards with rates as low as 6.99%, a far cry from the national average credit card interest rate of more than 17%.

However, you still need to have a good credit score to qualify for these low-APR credit cards.

1. UNIFY Financial Credit Union

UNIFY is a nationwide credit union with more than 50 branch locations that are open to almost anyone who wants to join. And, once you’re a member, you can choose from three credit cards with fixed rates as low as 9.49%, and with no annual fee.

There may also be special introductory rates on low fixed-rate balance transfers, also with no fee. Whether you qualify for the Visa® Classic, Visa® Gold, or Visa® Platinum will depend on your credit history and FICO score.

2. First Federal Credit Union

Open to residents of certain counties in Iowa, First Federal Credit Union members can choose between two Visa cards with fixed interest rates.

The First Federal Credit Union Visa® Premium credit card offers a fixed interest rate as low as 6.99%, with no balance transfer fees and no annual fee. This is one of the lowest fixed-APR credit cards on the market, so if you’re able to join this small credit union, it’s worth applying for.

3. Ardent Credit Union

![]()

Ardent Credit Union began under a different name as a credit union for employees of SmithKline Corporation and is now open to most residents of the greater-Philadelphia area. This credit union offers three Visa® credit cards with fixed rates as low as 9.99%.

There are no annual fees and no balance transfer fees for any of the fixed-APR cards, and you can even earn reward points or cash-back with two of them.

Best Low Ongoing APR Cards

A credit card with a fixed APR may not always be the best choice, depending on how you plan to use it. Many variable-rate credit cards have low ongoing APRs, with far more choices and options than those offered by credit unions.

And, in a low-interest-rate environment like the one we’ve been experiencing over the past few years, the rate charged on a variable-APR credit card can be quite competitive. Here are some of the best cards we recommend with a low ongoing APR.

- Get a 0% intro APR for 15 months on Balance Transfers and Convenience Checks that post to your account within 90 days of account opening. After this time, the Variable Regular APR will apply to your balance.

- Our lowest-rate card: Pay less in interest if you carry a balance from month to month

- Travel benefits include Auto Rental Coverage, Travel Accident Insurance, Baggage Delay and Reimbursement, and Trip Cancellation and Interruption Coverage

- No annual fee or foreign transaction fees

- This offer is only open to members of military-affiliated groups and their families

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 15 Months

|

9.15% - 26.15% (Variable)

|

$0

|

Good to Excellent

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

+ See More Cards with Low Ongoing APRs

Best 0% Promotional APR Cards

Credit cards with 0% promotional offers can be effective as part of an overall debt reduction strategy, save you money in interest on a large purchase, or simply help you pay off higher-rate cards faster. Many 0% promo rates extend for 15 and even 18 months in some cases.

Just be sure to use the promotional rate period wisely, as the regular rate on these cards is often higher than you would find on a conventional credit card. Here are some of the top-rated 0% APR cards.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+ See More Cards with 0% Promotional APRs

What is the Best APR Rate for a Credit Card?

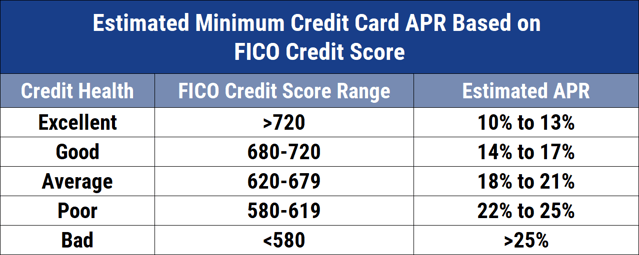

We all want the best APR we can get, but keep in mind that the interest rate you’ll be offered on a credit card is directly related to your credit score and overall creditworthiness.

It’s a function of how likely, in the eyes of the card issuer, you are to default on your debts. The better your credit score and history, the lower your APR is likely to be.

That being said, the interest rates offered by card issuers vary widely. Rewards cards, for example, often come with a higher APR thanks to their perks and benefits. This is especially true of cash back cards.

In most cases, credit cards with no frills or rewards will generally have a lower APR than do rewards cards. Store credit cards, on the other hand, typically charge some of the highest variable interest rates around.

Perhaps not surprisingly, the best credit card interest rates can usually be found at credit unions or small community banks. Rates for some of these cards can be as low as 6.99% fixed. And credit union membership has benefits that extend beyond low APR credit card rates.

Being affiliated with an organization or membership-based group can often get you a low APR on a credit card. For example, veterans of the armed forces and their family members may qualify for the USAA Visa Platinum card that offers rates as low as 8.40%.

What is the Difference Between a Fixed & Variable APR?

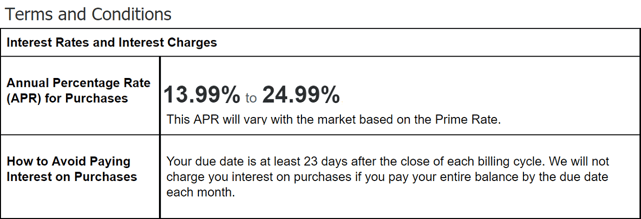

Most credit cards held by American consumers have variable interest rates — but what does that mean exactly? A variable interest rate or APR fluctuates according to the index it follows, usually the prime rate, which is based on the federal funds rate set by the Federal Reserve.

If the prime rate goes up, so will your credit card APR. By contrast, a fixed APR is not based on a fluctuating index rate but is set at a fixed value — at least for a period.

The APR of variable-rate cards fluctuates with the Prime Rate.

Some cards with fixed rates reserve the right to increase the rate, but only after notifying the cardholder and allowing them the option to close the card and continue paying any balance at the previous fixed rate. This consumer protection feature is part of the Credit CARD Act of 2009.

Most credit cards that offer a fixed APR do so for a minimum of one year, and sometimes longer. If the card issuer decides the interest rate is too low based on prevailing market rates, they must give cardholders a 45-day notice of any impending rate increase.

Cardholders can then decide if they want to continue with the new fixed rate or cancel the card. Still, having the security of a fixed-rate card, even if for just a year, can let you pay down debt at a known rate that you can build a budget around.

Even with the not-so-fixed characteristics of a fixed-APR credit card, the actual interest rate tends to be much lower than that of a typical variable-rate card. For example, some of the fixed-APR cards from UNIFY Financial Credit Union have rates as low as 9.49%, with introductory balance transfer rates even lower than that.

Can I Ask for a Lower Interest Rate?

If you’ve had your credit card for a year or longer and not missed or been late on a payment, you may be eligible for a lower interest rate. Of course, this depends on a lot of other factors as well, including your credit score, debt-to-income ratio, outstanding card balance, and even how frequently you use the card.

Credit card companies value and want to keep their best customers. That means consumers who are responsible in their credit card use, and who aren’t deemed to be a credit risk are more likely to be granted a lower APR.

If you choose to ask your credit card company for a lower interest rate, here are some things you can do to improve your chances of success.

First, know what your credit score is by requesting it from all three credit bureaus. Under federal law, you are entitled to a free credit report from each of the three major credit bureaus.

You can get a free copy at AnnualCreditReport.com. If you know your score and whether it has improved over the past year, you can use that information to bolster your case for a lower APR.

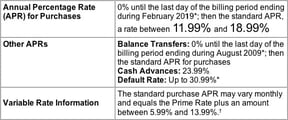

Second, know what your credit utilization rate is. This important ratio represents how much of your total combined credit you’re using, and how much is available.

Your CUR should be no higher than 30%. The lower your utilization rate, the more likely you are to get a lower APR.

Finally, do your research and find competing rates on credit cards that are similar to yours. The landscape for credit cards is very competitive, and if you can show that another card company has a better rate, you may be able to get yours to match it.

Take Advantage of Your Card’s Grace Period

If you’re looking for the best possible APR on a credit card, nothing beats 0% interest. What you may not realize is that almost any credit card can be a zero-interest card if you know how to take advantage of it.

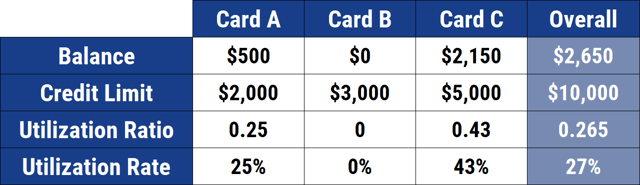

Most credit card companies offer a grace period of around 25 days, during which they charge no interest on purchases made if you carried no balance from the previous statement period. That means if you started the billing period with a zero balance and paid off any charges incurred during the billing cycle, you won’t be charged any interest.

Your credit card’s grace period can be found in your cardholder agreement or terms and conditions.

Since credit card companies are required to send out statements at least 21 days before the payment due date, thanks to consumer protections laid out in the Credit CARD Act, you have around three weeks to pay your balance each cycle and incur no interest.

While credit card companies aren’t required by law to offer a grace period, almost all major card issuers do. Make sure you check your card’s terms and conditions, also known as the fine print, to get the exact details of any grace period offered.

Paying interest on credit card charges can end up costing a lot of money over time. This is perhaps one of the greatest waste of wealth for American consumers.

If you’re unable to pay off your balance each month, then the next best thing is to find a card with a low or fixed APR. Often, the best fixed-APR credit cards are harder to find, but, hopefully, this guide has given you some valuable information on just where to look.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![9 Best 0% APR Signup Bonus Credit Cards ([updated_month_year]) 9 Best 0% APR Signup Bonus Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-0-APR-Signup-Bonus-Credit-Cards-3.jpg?width=158&height=120&fit=crop)

![Mercury Credit Card: Review & 5 Alternatives ([updated_month_year]) Mercury Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Mercury-Credit-Card-Review.jpg?width=158&height=120&fit=crop)

![Instacart Credit Card: Review & 5 Alternatives ([updated_month_year]) Instacart Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Instacart-Credit-Card.jpg?width=158&height=120&fit=crop)