Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Credit cards have come a long way from their start in the late 19th century, when stores and hotels began offering metal and celluloid charge cards to stamp account numbers on sales slips.

It was a decidedly analog beginning for an industry transitioning from chip and PIN cards, where a metallic chip holds payment data on a plastic card, to virtual cards and global digital payment systems.

Nowadays, Americans are so accustomed to using physical and virtual credit and debit cards online and at the point of purchase that many don’t know any other way. Here are 18 revealing credit card ownership statistics to give you the current lay of the land.

1. Active US Credit Card Accounts to Reach 638 Million by 2025

Let’s start with the basics. It should come as no surprise that credit card ownership rates steadily increase year after year. But the numbers may astonish you: In 2022, 82% of American adults owned at least one credit card, amounting to an estimated 565 million cards.1

By 2025, that number will have increased to 638 million. Given that the Census Bureau projects the US population to reach 335 million that year, that’s nearly two cards for every living American and almost two and a half for every adult if the current ownership percentage holds.

2. Only 57% of Households Earning Less Than $25,000 Own a Card

But all things are not created equal, and household prosperity significantly skews ownership rates. That said, the differences grow less stark as income increases.

Families earning less than $25,000 a year hold credit cards at a rate of 57%.2 The number jumps to 83% for families earning up to $50,000 and 93% for those earning up to $100,000.

There’s another slight increase to 98% for households bringing in more than $100,000, but the takeaway is that if you’re not struggling to meet basic needs, you probably own at least one credit card.

3. More Than Two-Thirds (67%) of People Aged 18-29 Own a Card, With Ownership Rates Increasing Steadily with Age

One prominent aspect of the American Dream is that wealth increases with age, and credit card ownership bears that out: The older you are, the more likely you are to own at least one credit card.

With a card ownership percentage of just 67%, consumers emerging into adulthood are significantly less likely to carry cards than those approaching retirement age and beyond.2

| Age | Ownership percentage |

|---|---|

| 18-29 | 67 |

| 30-44 | 79 |

| 45-59 | 86 |

| 60+ | 92 |

Lots of factors play into this. Many young people struggle to build a sufficient credit score to qualify for an affordable interest rate. Card issuers and financial technology firms have introduced various credit-building tools to remedy that.

With people establishing permanent households and marrying later, there’s less need for the financial flexibility credit cards offer. And with home prices ballooning, there’s a reduced imperative to build permanent households.

4. More Than Half (54.3%) of People Obtain Their First Card at Age 18-20

In the above table, members of the Generation Z cohort, born between 1997 and 2012, own only 1.7 credit cards on average, reinforcing our age-related observations. However, considerable nuances around card acquisition among young people warrant further exploration.

For example, 54.3% of cardholders acquire their first card when they emerge into adulthood, between ages 18 and 20.3 That number includes authorized users with access to cards their parents and guardians own.

Adults aged 21-24 constitute the next largest group of card acquirers, at 30%. The pattern in American culture is for parents to grant card access or for young adults to apply for their first card soon after they leave high school.

5. Baby Boomers Own an Average of 3.4 Cards, The Most of Any Generation

Interestingly, those numbers obscure counterintuitive data between members of the baby boomer and Silent generations.

Baby boomers, born between 1946 and 1964, own 3.4 cards on average, while members of the Silent Generation, the cohort born between 1928 and 1945, own only 2.7.4

| Generation | Average number of credit cards |

|---|---|

| Baby boomers (1946-64) | 3.4 |

| Generation X (1965-80) | 3.3 |

| Millennials (1981-96) | 2.7 |

| Silent Generation (1928-45) | 2.7 |

| Generation Z (1997-2012) | 1.7 |

Generation Xers are slightly behind the baby boomers at 3.3, which means the Silent Generation is the only outlier in the gradual increase in ownership numbers. Those folks came of age before cards were ubiquitous, and people may have less need for multiple cards as they age.

6. More Than One-Third (36%) of People Gain Card Access Before Age 18

Moreover, those who take the authorized user pathway tend to skew younger: 36% of cardholders who acquired their first card as an authorized user did so before age 18.3 That tells us something good about the financial services industry: Many young cardholders learn to use credit while living at home.

With stories of increasing credit utilization, card debt, and debt delinquency common in the media, at least some young adults learn best card practices from more experienced users before going out on their own.

Schools, credit unions, and community banks increasingly take some of the burden of providing financial education. Good things happen when parents and institutions build sound community money practices as part of the same team.

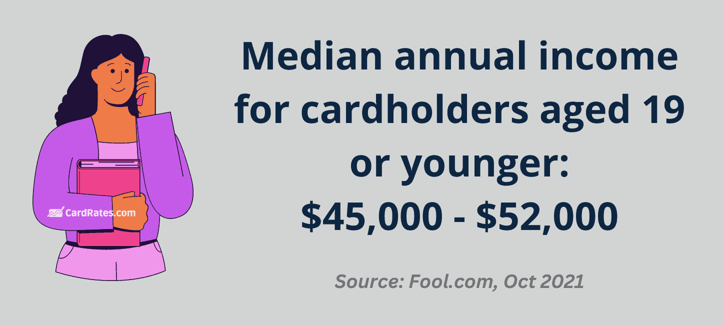

7. Those Who Obtain Their First Card at 19 or Younger Earn at Least $45,000 a Year

Income is a factor here: Young people with higher annual incomes tend to gain earlier credit access, while those earning less tend to skew older when they obtain their first card.3

Individuals receiving their first card at 19 or younger earn between $45,000 and $52,000 annually, but folks who wait until age 24 or later to get into the card game earn $40,000 or less.

It’s evidence of a maxim in financial services that the affluent enjoy greater financial flexibility through credit access than those with fewer resources. If you think it ought to work the other way around, remember that business fundamentals lead financial firms to extend the most credit to consumers with the best chance of paying it back.

8. Women (78%) and Men (81%) Near-even Cardholders

Gender is one credit card ownership demographic metric where racial, ethnic, and income differences don’t seem to have much effect. In contrast to stark differences expressed elsewhere, there are almost no credit card ownership distinctions based on sex, with 78% of women and 81% of men owning cards.5

It’s a testament to American consumerism that gender differences in card ownership are largely a thing of the past. The Equal Credit Opportunity Act prohibiting discrimination against credit applicants based on gender — freeing women to apply for and own a credit card in their name — only became law in 1974.

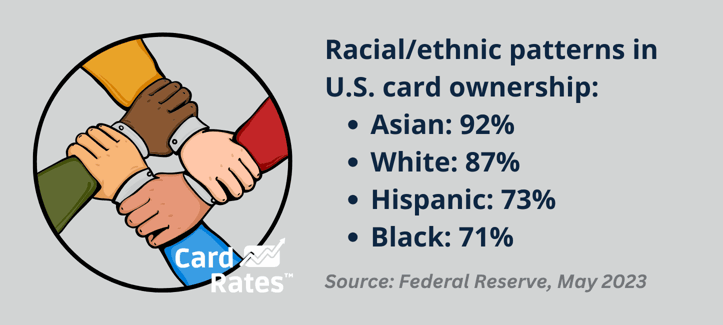

9. Ownership Among Asians Stands at 92%, The Highest of Any Major Racial or Ethnic Group

Race is another matter, with card ownership rates according to broad racial and ethnic categories following common socioeconomic patterns. Asians and whites top the list at 92% and 87%, respectively, and Hispanics and Blacks lag at 73% and 71%.6

That meshes with recent data from the Institute for Economic Equity, a research organization within the St. Louis Federal Reserve, which shows that Black and Hispanic families own about 24 cents on average for every $1 of white family wealth.

10. Superprime Consumers Own 48% of Total Cards

Age, race, ethnicity, and prosperity are significant card-ownership determiners. That means credit-score status also indicates levels of card ownership: Superprime (760+ credit score) and prime (680-759) borrowers hold 72% of all open accounts.7

The COVID-19 pandemic had a deleterious effect on ownership rates among subprime consumers, and ownership numbers dipped to 64 million in Q4 2020. But there are signs of a rebound, with the subprime ownership number increasing to 86 million in Q4 2021 and 99 million in 2022.

Banks and fintechs continue to devise more inclusive methodologies for assessing creditworthiness. We expect a more even playing field if the economy remains in growth mode.

11. New Jersey Residents Own the Highest Average Number of Cards, Mississippians the Lowest

State-based card ownership trends follow the same prosperity patterns observed in socioeconomic data, with states generally regarded as more prosperous leading the list and states with more economically struggling individuals listed further behind.

| State | Average number of credit cards |

|---|---|

| New Jersey | 3.49 |

| New York | 3.34 |

| Rhode Island | 3.26 |

| Hawaii | 3.25 |

| California | 3.23 |

| Connecticut | 3.23 |

| Massachusetts | 3.21 |

| Florida | 3.19 |

| Nevada | 3.18 |

| Maryland | 3.16 |

New Jersey residents own the highest average number of cards at 3.49, with New York, Rhode Island, Hawaii, and California close behind.8 At the bottom is Mississippi, where residents own only 2.57 cards on average. States close to Mississippi at the bottom of the card ownership list include Iowa, Oklahoma, Alabama, and Arkansas.

12. Only 39.5% of Cardholders Favor Their Credit Card Over Their Debit Card

By now, readers should understand that consumers are increasingly turning to credit cards to make routine and non-routine purchases. But the card-ownership landscape hasn’t stopped changing, with a recent shift in the relative use of debit and credit cards bearing that out.

In 2021, more than half of consumers (54.6%) reported favoring credit cards as purchasing instruments over debit cards.9 But in 2022, consumer purchasing inclinations shifted slightly to 56.2% saying they preferred debit, and only 39.5% credit.

Debit cards are less flexible because of hard spending limits but don’t carry credit score hazards. Some debit cards now offer rewards, and the rise of convenient apps and digital payment systems for monitoring card balances is a factor.

13. Almost Half (46%) of Americans Own a Cash Back Card

That said, many consumers use credit cards to earn extra cash. Americans are more likely to own a cash back card than any other type, with 68% reporting they hold a card that gives something back.10

Travel rewards cards are the next most common type, with a 32% ownership rate. Americans also report owning cards that pay for gas and groceries and balance transfers to lower-interest environments.

| Type of card | % respondents |

|---|---|

| Cash back | 68 |

| Travel rewards | 32 |

| Gas and groceries | 27 |

| Balance transfer | 27 |

| 0% APR | 25 |

| Secured | 22 |

| Signup bonus | 20 |

| Store or brand-specific | 15 |

| Student | 11 |

A significant percentage report owning zero-interest cards. And another percentage reports holding secured cards, which function as credit-score builders.

14. People Who Own a Crypto Rewards Credit Card: 13 Million

Consumers continue to explore ways to earn money through credit use. Although cryptocurrencies such as Bitcoin and Ethereum remain outside the financial mainstream as mediums of exchange, a minority of Americans consider crypto a valid investment class.

Evidence is that 5% of Americans, approximately 13 million people, own a credit card that allows them to earn cryptocurrency rewards or redeem reward points on cryptocurrency.11

It’s sound advice to diversify your portfolio to weather downturns in a particular investment class. Whether crypto establishes itself as a stable alternative investment class remains an open question. But at least some Americans consider it legitimate enough to serve as a source of walking-around money.

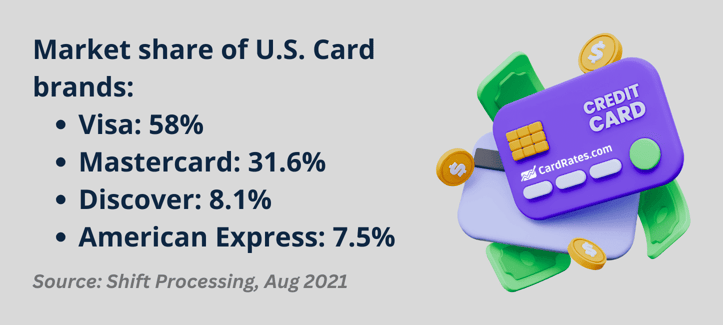

15. Visa Tops US Card Brand Market Share at 52.8%

Another trend in card ownership is toward fewer card brands. Although store brands dominated the early stages of charge card history, most US consumers today select cards from only four major brands: Visa, Mastercard, Discover, and American Express.12

Visa is the largest US card brand, with Mastercard, Discover, and American Express trailing significantly. In effect, the Visa brand is becoming interchangeable with the generic idea of a credit card.

It’s a function of digital transformation and economies of scale. Just as most Americans prefer banking with one or more of the too-big-to-fail enterprise-level institutions, they prefer cards they can count on wherever they purchase.

16. Chase is the US Top Issuer, With 93 Million Cards

Likewise, Chase is the clear leader among card issuers, supplying nearly twice as many cards in the marketplace as Citi, the next most popular issuer.12 Considering Discover and American Express employ a different structure where they act as their own bank, the five biggest banks have almost 250 million cards in the market.

These five banks have the numbers and resources to offer cards to fit many use cases, which allows them to build on their success and continue to become more successful. They function like many other types of enterprises that grow and grow.

17. The US is Ninth in National Card Ownership at 66.7%

Looking at card ownership globally, the US is among world leaders, but America is too economically and socially diverse to match a few other nations.

Card ownership among Americans aged 15 and above stands at 66.7%, an impressive figure considering US population variability.13 But above the northern US border, 82.7% of Canadians aged 15 and above hold a card. At 79%, Israel is also a top performer.

Other top card-ownership nations include Iceland, Hong Kong, Luxembourg, Japan, Switzerland, South Korea, and Norway.

18. Global Card Ownership Stands at 24.5% and is Steadily Increasing

Meanwhile, it’s unlikely the US will ascend to a higher ownership percentage relative to the global population because credit cards are increasingly popular worldwide, with a total global card ownership rate of 24.5%.14

As in the US, global gender disparities in card ownership are relatively insignificant, and total ownership rates are trending upward. The 2011 rate was only 14.9%. By 2014, the number had increased to 17.5%, and by 2017 to 18.1%.

Increasing global prosperity is the cause. If the world grows more stable and prosperous, we expect card ownership rates to follow suit.

Card Ownership Trending Positive

In the US and globally, card ownership rates are a cause and an effect of social and economic patterns and trends. When politics are stable, economies grow and become more interconnected.

Because credit cards facilitate consumer exchange, they allow positive trends to build on themselves and become more significant. Monitoring the card ownership landscape reveals and reflects these trends.

Sources:

1 https://www.federalreserve.gov/publications/files/2022-report-economic-well-being-us-households-202305.pdf and https://capitaloneshopping.com/research/credit-card-ownership-statistics

2 https://www.federalreserve.gov/publications/files/2022-report-economic-well-being-us-households-202305.pdf

3 https://www.fool.com/the-ascent/research/study-when-does-average-american-get-their-first-credit-card

4 https://images.go.experian.com/Web/ExperianInformationSolutionsInc/%7Ba3ff8e50-5e52-4920-9a37-397bb0244d32%7D_SOC2021_09012021.pdf

5 https://www.stlouisfed.org/institute-for-economic-equity/the-state-of-us-wealth-inequality

6 https://www.federalreserve.gov/publications/files/2022-report-economic-well-being-us-households-202305.pdf

7 https://upgradedpoints.com/credit-cards/credit-card-ownership-statistics

8 https://www.experian.com/blogs/ask-experian/which-states-have-the-most-credit-cards

9 https://www.nasdaq.com/articles/debit-cards-are-now-more-popular-than-credit.-are-you-maximizing-your-credit-cards

10 https://www.fool.com/the-ascent/research/how-gen-z-millennials-gen-x-baby-boomers-use-credit-cards

11 https://www.finder.com/crypto-credit-card-statistics

12 https://shiftprocessing.com/credit-card

13 https://genderdata.worldbank.org/indicators/fin7-t-a?gender=total

14 https://genderdata.worldbank.org/indicators/fin7-t-a?view=trend

![Credit Card Ownership By Age, Income, Gender & Race in [current_year] Credit Card Ownership By Age, Income, Gender & Race in [current_year]](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1524276980.jpg?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![15 Disturbing Credit Card Fraud Statistics ([current_year]) 15 Disturbing Credit Card Fraud Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_576998230.jpg?width=158&height=120&fit=crop)

![21 Startling Credit Card Data Breach Statistics ([current_year]) 21 Startling Credit Card Data Breach Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Credit-Card-Data-Breach-Statistics.jpg?width=158&height=120&fit=crop)

![11 Surprising Teen Credit Card Statistics ([current_year]) 11 Surprising Teen Credit Card Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Teen-Credit-Card-Statistics.jpg?width=158&height=120&fit=crop)

![21 Eye-Opening Student Debt Statistics ([current_year]) 21 Eye-Opening Student Debt Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_674141887.jpg?width=158&height=120&fit=crop)