Unwanted credit card debt can feel overwhelming. Having a plan to pay it off and knowing which card you should pay off first can help you feel more in control of your finances and improve your financial situation.

The first step is to make a list of your cards with your current balances and the annual percentage rates (APRs) you’re currently paying. If you don’t know your APRs, check your most recent monthly statements or contact your card companies for this information. You may be surprised to discover how high your APRs are, especially if you haven’t looked at them for a while.

Once you’ve made your list, you’re ready to identify which card to pay off first.

Pay Your Highest-Rate Card First

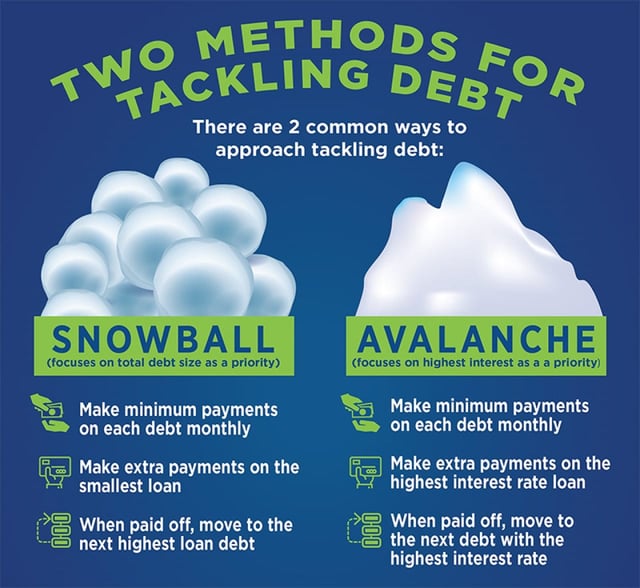

Conventional wisdom offers two approaches to make that decision. They’re known as the snowball and the avalanche methods.

The snowball approach advises you to pay off your lowest balance card first. Once that card is zeroed out, you move on to your next smallest balance, then the next smallest, and so on.

This approach gives you the satisfaction of repeated successes as you pay off your relatively smaller balances. Those easier wins can be enticing. The downside is that you’ll likely pay more interest with this approach.

The avalanche approach advises you to pay off your highest APR card first. Once that card’s zeroed out, you pay off the card with the second-highest APR, then the third-highest, and so on.

If you have higher balances on your higher APR cards, this approach may take longer before you achieve your first, second, and third wins. If you’re willing to forgo that enticement, this approach can save you a significant amount in interest expenses.

Which method is best to pay off card debt? The snowball gathers speed over time, but in the long run, the avalanche should help you pay off more debt sooner. That’s because paying less interest by eliminating your higher APR cards first frees up additional money you can use to pay off your lower APR card balances faster.

In terms of your finances, the avalanche’s lower interest expense is worth more than the snowball’s early motivational boost.

Combine the Snowball and Avalanche Methods

If you’re still not sure which card you should pay off first, you may want to try a combination of the two approaches. You alternate between the snowball (smallest balance) and avalanche (highest APR) with this option.

For example, you may want to start with the snowball method to score a quick win or two, then switch to the avalanche method to eliminate your highest APRs. You can then continue to switch between the strategies or stick with whichever method you prefer.

The pitfall of this third way is that giving yourself additional flexibility may result in you not having a plan at all or not being able to stick with whatever plan you devise. Don’t let flexibility become an excuse to make random higher payments on multiple cards or abandon your specific goal of paying off one or more of your cards.

Make a plan you feel you can stick to even if a little flexibility is built into it.

The Peril of Only Making Minimum Payments

Regardless of which card you choose to pay off first, you should always make at least the minimum payment for every card you have and pay it on time. This helps you avoid late payment charges and higher penalty rates.

If you don’t make your minimum payments on time, the charges and rate penalties could slow or derail your plans to pay off specific cards.

Keep in mind that paying only the minimum due will extend the time you’ll need to pay off those cards and the total amount you’ll have to pay to zero out your balances. That’s because minimum payments typically aren’t enough to cover all the interest you owe or any of the balance.

The interest you don’t pay doesn’t go away. Instead, it’s added to your balance.

That means your balance will go up even though you paid the minimum due and even if you don’t make any new purchases. You’ll also be charged additional interest on the unpaid interest from the previous month.

This minimum payment pitfall adds weight to the argument that the avalanche method (highest APRs first) has a clear advantage over the snowball method (smallest balances first).

Before You Start Paying Off Your Cards

Once you’ve identified which card to pay off first, you’ll need to figure out how much more than the minimum amount due you can afford to pay each month. To determine that, take a look at your income and expenses, including all of your minimum card payments.

If you don’t have much extra, try to identify new sources of income, such as a pay raise, a higher-paying job, or a side hustle. Selling stuff you no longer use online may also bring in some extra cash. Look for expenses you can cut back, such as takeout meals, streaming services, impulsive fast-fashion purchases, or pricey vacations.

Don’t put off necessary medical appointments or maintenance to your home or car that, if neglected, could cause more expensive problems in the future. Emergency savings should also be a high priority so you won’t have to borrow when a crisis occurs.

You’ll also have to commit yourself to stop using your credit cards because using them will pile on debt while you’re trying to do the opposite. Make a pact with a friend or family member you can call to top up your motivation if you’re struggling with not using your cards.

If you’re experiencing a severe but temporary financial hardship, such as unemployment, short-term disability, or the death of a close family member, you may want to contact your credit card companies and ask for a lower payment, lower rate, or forbearance program until you recover from your hardship.

If your hardship is permanent or you simply don’t have enough income for essentials, emergency savings, or the minimum debt payments, you may want to ask your card companies about debt repayment plans.

Typically, your card accounts will be closed and your credit scores will be lower for a while, but a repayment plan can make sense for some people.

If your debt feels overwhelming, don’t ignore it. Make a plan to start paying it off in whatever way you can.

Transfer Balances to Avoid Interest

Balance transfer cards can help you avoid expensive interest charges. As the name implies, these cards allow you to transfer an existing card balance from one card to another. The transfer usually comes with a lower or even 0% interest rate for an introductory period that may last a year or longer.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% – 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% – 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

That lower rate lets you free up cash to pay off debt sooner. And, this benefit works with either the avalanche or the snowball method. A balance transfer card may also give you a rewards program or other valuable card perks or benefits.

There are a few caveats:

- You’ll typically need good or excellent credit to get approved for a balance transfer card.

- Opening a new balance transfer card account can lower your credit scores.

- If you close the account from which you transferred the balance, your credit scores may drop due to a higher credit utilization ratio.

- Balance transfer amounts are usually capped, so you may not be able to transfer your entire existing balance (or balances) to one new balance transfer card.

- Balance transfers usually involve a fee.

- Your balance transfer card’s APRs will go up when the lower or 0% rate period ends.

- You may have to make large payments to pay off your balance within the introductory period, even with a lower or 0% rate.

Despite these conditions, balance transfer cards can help you consolidate debt, pay less interest, combine multiple payments, and pay off debt sooner. Be sure to shop around and compare offers before choosing a balance transfer card.

The Choice Is Yours

With multiple strategies to pay off card debt, choosing which card to pay off first may ultimately turn out to be a personal decision. The most important point isn’t which card to tackle first, but having a plan to tackle that first card and then all your cards, one by one, until you achieve debt payoff.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year]) 5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/loans2.jpg?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)

![How to Pay Off Credit Card Debt ([updated_month_year]) How to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/How-to-Pay-Off-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![How to Pay Bills With a Credit Card ([updated_month_year]) How to Pay Bills With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Pay-Bills-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![9 Best Apple Pay Credit Cards ([updated_month_year]) 9 Best Apple Pay Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Apple-Pay-Credit-Cards.jpg?width=158&height=120&fit=crop)