The Mastercard Black Card™ began life as a Visa card in 2008 before Black Card LLC reassigned it in 2016. Formally known as the Mastercard® Black Card™, it and the Mastercard® Gold Card™ and Mastercard® Titanium Card™ constitute the Luxury Card collection. Barclays Bank is the card issuer.

The card may be worth the steep annual fee if you like to travel first class. But this Mastercard Black Card review reveals fierce competition from a handful of premium cards offering the luxury card experience with similar or superior benefits.

-

Navigate This Article:

Benefits of the Mastercard® Black Card™

The Mastercard® Black Card™ includes 24/7 luxury card concierge, free Priority Pass Select membership, and reimbursement for the Global Entry application fee, among other travel benefits.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

Black Card LLC devotes much marketing effort, including an “unboxing video,” to tout the metal card’s physical weight and appearance. Many premium cards are metal heavyweights, so a reasonable assessment of the card’s cost/benefit tradeoff should focus on its other characteristics.

The card deserves praise for its $0 foreign transaction fee, competitive reward redemption rates, long list of travel perks, and introductory balance transfer promotion (a balance transfer fee applies).

As a World Elite Mastercard holder, you get special deals with select vendors, discounts on movie tickets, curated experiences in more than 40 cities worldwide, and global emergency assistance.

Non-travel benefits include Mastercard ID Theft Protection, cellphone protection, an exclusive subscription to Luxury Magazine, and a mobile app. But it is the card’s travel benefits that justify its annual fee.

How to Get the Mastercard® Black Card™

To get the Mastercard Black Card, you must be a US resident with a 700+ credit score. While the credit card issuer doesn’t publish income requirements, it’s safe to say you must be able to afford the annual fee and monthly bill payments.

To apply online, you must provide:

- Basic data about your identity (including Social Security number)

- How long you’ve lived at your permanent address

- Your monthly housing payment (rent or mortgage)

- Your bank account information

- Your source of income and total annual gross

The card does not offer a prequalification step. Your credit score may suffer a minor ding when the issuer does a hard credit check. The drop in score of up to five points evaporates after one year, but the hard pull remains on your credit reports for two years.

Alternatives to the Mastercard® Black Card™

The list of alternatives to the Mastercard® Black Card™ includes premium cards with sizable annual fees, including the two other cards from the Luxury Card collection.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Chase Sapphire Reserve® quickly pays for itself through its generous rewards, travel credits, lounge access, and extensive protections and conveniences. You earn Chase Ultimate Rewards points on eligible purchases. Those points gain 50% more value when you redeem them at Chase Travel. The Chase Sapphire Reserve® is one of the best credit cards you can get.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

The Capital One Venture X Rewards Credit Card offers excellent benefits while charging an annual fee below that of many competitors. It ticks the boxes for lounge access, travel reimbursements, a large signup bonus, and generous bonus miles on select purchases. Other benefits include dining and entertainment perks, no foreign transaction fees, and cellphone insurance.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® from American Express is a good choice for flight and hotel rewards. Its annual fee is high, but it offers lucrative perks such as credits for select hotel stays, airline and baggage fees, and digital entertainment, among other services. It also insures you against trip delays, cancellations, and lost baggage.

4. Citi® / AAdvantage® Executive World Elite Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Citi® / AAdvantage® Executive World Elite Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Citi® / AAdvantage® Executive World Elite Mastercard® rewards you most for purchases made with American Airlines. You can redeem your miles for flights (on American Airlines and its partners), seat upgrades, vacation packages, car rentals, and hotel stays. You can’t redeem your miles for cash back or gift cards.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 2% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $200 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Gold Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Made with 24K Gold: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $995 ($295 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$995 ($295 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Gold Card™ is the highest-tier option offered by Luxury Card. It charges the highest annual fee, but also offers the highest rewards and annual credits. Why choose black when you can have 24-karat gold?

- Ideal for those seeking an introductory premium travel card that provides exceptional airfare redemption, access to hotel privileges and elevated service beyond the ordinary. Find peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Members-only LUXURY MAGAZINE®.

- Brushed Metal Card Design: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual fee: $195 ($95 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$195 ($95 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Titanium Card™ is the most affordable Luxury Card option. But that also means it has the lowest rewards rate and doesn’t come with the annual travel credits its two siblings do. Still, it’s a premium card with features that every jetsetter can enjoy.

Which Card Is the Best Alternative to the Mastercard Black Card?

Chase Sapphire Reserve® sets the pace for premium travel cards. It recently prevailed when we compared it to the Mastercard Gold Card, which is the Luxury brand’s most expensive offering.

But the Mastercard Black Card™ (MBC) costs less, so how will it perform on a cost/benefit basis against Chase Sapphire Reserve® (CSR)? Let’s see:

Feature, Winner, and Notes:

Lounge Access: Tie – Both offer Priority Pass Select

Annual Airline Credit: CSR – CSR annual credit is higher

Baggage Delay insurance: Tie – CSR: six-hour delay, five-day limit. MBC: four-hour delay, three-day limit.

Cellphone Protection: MBC – CSR does not offer cellphone protection

Emergency Roadside Assistance: CSR – MBC does not reimburse roadside assistance

Extended Warranty Coverage: CSR – MBC does not offer

Global Entry/TSA Pre-Check Credit: Tie – both reimburse equally

Hotel Benefits: MBC – MBC offers more hotel benefits

Lost Luggage Reimbursement: CSR – MBC does not offer

Purchase Protection: CSR – MBC does not offer

Rental Car Insurance: CSR – CSR car rental coverage is primary

Return Protection: CSR – MBC does not offer return protection

Travel Accident Insurance: CSR – CSR has higher caps

Travel and Emergency Assistance: Tie

Trip Cancellation/Delay Insurance: CSR – CSR has higher caps

Although the Mastercard Black Card’s annual fee is lower than that of the Chase Sapphire Reserve®, the opposite is true when you include the cost of adding an authorized user.

Given these results, we again find the Chase Sapphire Reserve® is the best credit card for first-class travel benefits, and is one of the world’s best credit cards, period.

What Are the Differences Between Cash Back, Points, and Miles Rewards?

The world is full of credit cards for every pocketbook and taste. You can get a credit card even if you have bad, limited, or no credit. You can spend nothing on annual fees and get a reasonably good credit card, but plenty of cards offer you greater benefits at the cost of a higher yearly charge.

Premium credit cards offer rewards in several ways:

- Purchases: You earn rewards for eligible purchases. Some cards offer a flat reward rate on all purchases, while others offer two or more reward tiers based upon the merchant type.

- Signup bonuses: Many cards offer a reward when new cardholders spend a set amount on purchases during a specified introductory period (typically three months) following account opening.

- Promotional APRs: This is another popular benefit to new cardholders, consisting of a 0% intro APR on purchases and/or balance transfers for a set period after account opening. A balance transfer fee applies despite the 0% interest rate.

- Redemption bonuses: Some cards enhance the value of your rewards when you redeem them for specific uses, such as the arrangements you make through the card’s travel agency.

- Referral bonuses: Your credit card issuer may pay you rewards when you recommend new cardholders.

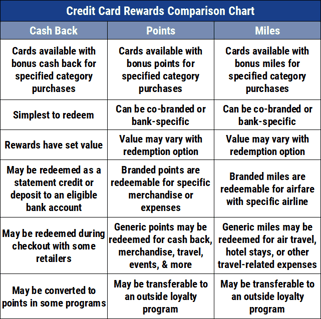

Credit cards can dole out their membership rewards using three schemes:

- Flat Rewards: The card pays a fixed reward rate, typically between 1% and 2%, on all eligible purchases. Flat rewards are unlimited.

- Tiered Rewards: The card pays two or more reward rates, typically between 1% and 5%, on eligible purchases from designated merchant categories. Some tiers may limit the rewards available within a set period.

- Rotating Rewards: A special reward tier in which the merchant category changes each quarter. You must register for each new category. Rewards are subject to quarterly limits.

Card companies cleverly apply limits on tiered and rotating rewards, so you may need a spreadsheet to figure out the best deal.

The three types of credit card membership rewards are:

- Cash back: Everyone loves cash. A cash back reward is a rebate equal to a percentage of eligible purchases you charge on the card. Cards may distribute cash back redemptions as a check, gift card, statement credit, direct deposit to your bank account, or bill payment.

- Points: This is a versatile reward you can redeem for cash, travel, or to purchase goods and services. Typically, you receive one to five points (i.e., 1X to 5X points) for each dollar you spend on eligible purchases, although some tiered rewards may offer 10X or more. Some cards let you transfer points to partner reward programs. Co-branded cards may offer their proprietary points as rewards.

- Miles: These are rewards you can use to pay for travel activities, such as buying an airline ticket or renting a car. Some cards offer general-purpose miles (typically in the 1X to 5X range) that you can use for airfare redemption on any airline. Alternatively, co-branded miles cards reward you with the associated airline’s frequent flyer miles you can use to buy an airline ticket. Many cards do not allow you to exchange miles for cash or gift cards.

The value of cash back redemptions is straightforward — a $1 reward is worth $1. But point and mile values may vary with a credit card’s reward scheme, especially among co-branded cards where airfare redemption values depend on the carrier’s frequent flyer program.

The rewards from virtually all credit cards that provide cash back or points do not expire while the account remains open. Some mileage cards require you to redeem your miles within a specified number of months or lose them.

What Is the Mastercard Black Card’s Credit Limit?

As a World Elite Mastercard, the Mastercard® Black Card™‘s minimum credit limit should be $5,000, although Mastercard does not enforce this.

The forums have a lot to say about the Mastercard Black Card, but I haven’t found any suggestions for a maximum credit limit. Given its characteristics, I would estimate that limits above $30,000 are rare.

Are Black Cards Worth It?

The shiny Mastercard® Black Card™ delivers a lot of bling. The PVD-coated metallic card weighs 22 grams, almost twice that of Chase Sapphire Reserve®. You’ll love the heft, but the annual fee may weigh you down, as several competitors offer better value.

Mastercard® Black Card™ ownership isn’t about value. It’s about prestige. It belongs to a group of exclusive black credit cards that supposedly imbue status upon their owners.

These cards have a reputation for exclusivity, available only to the ultrarich. Some black cards are available only by invitation, carry high annual fees, and offer five- or six-digit spending limits.

The archetype of this genre is the American Express Centurion Card. Also known as the American Express Black Card, it’s not for you if you have to ask about its fees. The American Express Centurion Card serves the ever-growing population of multimillionaires who charge hundreds of thousands per year on their credit cards and demand the luxury card experience.

In reality, black cards don’t have to be black. The JP Morgan Reserve Card contains precious metals and is available only to customers of the bank’s wealth management brokerage (with a rumored $10 million account requirement).

Neither of these cards offer better benefits than the Chase Sapphire Reserve® except for their extraordinarily high spending limits. In this light, the Mastercard® Black Card™ seems pale. It is not hard to get and does not routinely offer six-figure spending limits.

(Non-Monetized. The information related to JP Morgan Reserve Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

Ultimately, choosing which credit cards to carry is a personal decision. We don’t judge cardholders’ motives but only seek to provide the information you need to make a knowledgeable selection.

Consider Your Alternatives Before Getting the Mastercard® Black Card™

This Mastercard Black Card review describes a compromise between cost and benefits. Well-heeled consumers may prefer the Mastercard® Gold Card™ with its higher rewards values and annual credits.

If you’re dying to own a Luxury Card but have a frugal streak and would rather put your money in a savings account, the Mastercard® Titanium Card™ costs the least. It also delivers the least.

If you are looking for a solid premium credit card, consider the Chase Sapphire Reserve®, Capital One Venture X Rewards Credit Card, and the other alternatives reviewed above. They favor value over dazzle.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Costco Credit Card Benefits & Alternatives ([updated_month_year]) 7 Costco Credit Card Benefits & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Costco-Credit-Card-Benefits.jpg?width=158&height=120&fit=crop)

![How to Get a Black Card – American Express® Requirements ([updated_month_year]) How to Get a Black Card – American Express® Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/03/How-to-Get-a-Black-Card-2--1.jpg?width=158&height=120&fit=crop)

![7 Best American Express Card Alternatives ([updated_month_year]) 7 Best American Express Card Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/amexalt.png?width=158&height=120&fit=crop)

![Mercury Credit Card: Review & 5 Alternatives ([updated_month_year]) Mercury Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Mercury-Credit-Card-Review.jpg?width=158&height=120&fit=crop)

![Instacart Credit Card: Review & 5 Alternatives ([updated_month_year]) Instacart Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Instacart-Credit-Card.jpg?width=158&height=120&fit=crop)