In a Nutshell: Many Americans don’t realize that their existing medical coverage does not protect them when they travel abroad. Yonder Travel Insurance works with leading insurance providers to help card rewards travelers choose a comprehensive policy that provides peace of mind during their adventures. The company follows up with seamless customer service for filing claims and handling any emergencies that arise. The company’s founders also want to give back to the world, which is why every policy sold on Yonder generates a week’s worth of meals for a refugee child in Nepal or Southeast Asia.

As international travel begins to increase again, card rewards travelers are ready to experience new adventures abroad. However, if the future is anything like the past, most won’t have travel insurance when they venture over the border.

That can be a mistake because health insurance obtained in the U.S. most likely won’t cover international health care costs. And health insurance doesn’t even begin to address lost trip investments when emergencies arise.

Medical expenses and costs associated with travel interruptions can add up, yet 4 out of 5 Americans board planes and cruise ships without any protection.

Yonder Travel Insurance set out to change that. The company works with top providers to simplify the process of choosing the most beneficial travel insurance policy. The Yonder team is on a mission to make travel insurance a routine part of trip planning for more Americans.

Because Yonder curates policies tailored for specific business and leisure travel niches, customers can rest assured that plans will protect them without costing more than their budgets allow.

Trained and friendly Yonder agents are available to address customer concerns and assist with claims. That support can reassure travelers who often spend thousands of dollars for a nice trip.

“We’re a comparison site, so our job is to find policies with the coverage our customers are looking for at a price point they’re comfortable with,” said Beckah Morris, Yonder Operations and Marketing Manager.

Expert, unbiased recommendations from Yonder also come with a social commitment that arose when Co-Founders Terry Boynton and Ryan Skoog helped distribute food relief to refugee children while traveling in Myanmar. That experience had a lasting impact and guides Yonder’s focus today.

“With every policy we sell, we donate a week’s worth of meals to a child in Nepal or Southeast Asia,” Morris said. “We work closely with both projects.”

Policies Designed for Every Travel Style

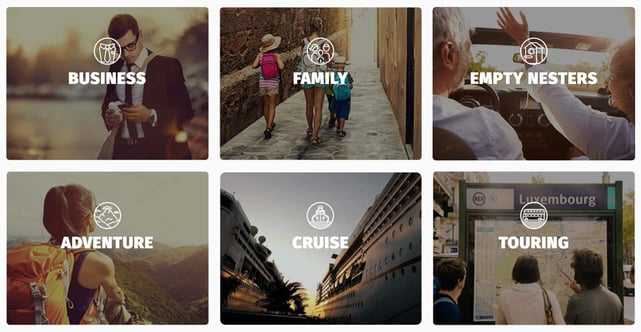

Insurance is often about the details, and travel insurance is no different. That’s why Yonder works with a range of providers to supply card rewards travelers with policies that suit a variety of travel styles.

Policies for businesses, families, and senior travelers carry distinct coverage details and recommendations from Yonder, as do policies for adventures, cruises, tours, and student excursions. Yonder even includes policies for journalists who need coverage for sudden evacuations.

“Certain policies that have preexisting condition waivers are priced well for seniors, and then there are policies priced for families that include children under the age of 18 at no additional cost,” Morris said.

Yonder breaks down coverage into three pillars and policies into three types to help customers understand the nuances between different types of travel insurance.

Comprehensive policies are the most popular and cover all three pillars — trip cancellation and interruption, medical expense and emergency evacuation, and travel loss and delay.

“People may think travel insurance only protects trip costs or medical emergencies,” Morris said. “You want to have peace of mind that if you have to cancel or a big emergency comes up, the insurance you’re buying provides the coverage you think it does.”

Its comprehensive travel loss and delay pillar covers relatively minor headaches, including missed flights and cruise departures. And the medical emergency pillar encompasses everything from sudden prescription needs to serious issues where evacuation services are required. All of those situations can prove costly without insurance.

“Our providers can save people hundreds of thousands of dollars,” Morris said.

Offering Tips for Choosing the Best Coverage

Just because a policy is considered comprehensive doesn’t mean it covers everything. Last year’s COVID-19 pandemic influenced Yonder to work with customers and providers to clarify common travel insurance exclusions. The results promise to bring lasting improvements to how card travelers purchase policies.

“Spring 2020 was a steep learning curve for some of our customers,” Morris said. “Some believed that their policies would cover a global pandemic — and there is indeed a specific type of coverage called Cancel for Any Reason that would have covered people in those circumstances.”

When policies include Cancel for Any Reason, coverage generally protects travelers for a brief period after making a first nonrefundable payment or deposit toward a trip. The coverage generally requires ensuring all nonrefundable expenses and canceling the trip at least two days before the departure date.

Some Yonder customers were surprised to learn that their policies did not cover COVID-19 pandemic-related shutdowns and closures unless Cancel for Any Reason coverage was explicitly included.

“We invested time this past year educating customers and talking with our providers about using clearer language on their websites and in the policy documentation,” Morris said. “And we’ve definitely seen some good progress on both sides.”

That’s important even though the COVID-19 pandemic is still covered as a medical event through trip interruption benefits.

“Customers are now considering travel insurance a lot earlier than they previously did because of that specific benefit,” Morris said. “As soon as they make a deposit, and even during planning before they’ve made any payments, they’re reaching out.”

Yonder: Insurance Excellence and Social Commitment

Yonder can’t influence insurance costs for card rewards travelers because it is an aggregator working with independent providers in a highly regulated industry.

“Pricing is based on age and trip cost — as with any insurance, the older you are, the higher the risk,” Morris said. “But providers price things out in different ways, and that’s why we started the company — to encourage people to compare.”

That’s where the Yonder promise comes in, differentiating the company with its focus on helping every customer travel with peace of mind.

The team holds itself to the highest standards in selecting providers and onboarding new ones after a careful vetting process. It doesn’t hesitate to remove providers with recurring claims issues. The team is also always prepared to go the extra mile to help customers decide which policies work best for them and open and follow up on claims.

“Especially in a stressful situation, you want someone to take the majority of the work off your plate,” Morris said. “We have contact with senior claims representatives at each of our providers, so we can push if things ever get stalled.”

It’s a set of values that Yonder’s co-founders instilled at the outset and that carry over to the company’s continued commitment to its social mission.

“Even through COVID-19, we’ve maintained our support for our child refugee food programs in Nepal and Southeast Asia — Ryan and Terry committed to that for our company,” Morris said. “A few years ago, I traveled to Nepal with Terry to see the impact of what we were doing, and it was an amazing, life-changing experience.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![5 Best Credit Cards For Paying Car Insurance ([updated_month_year]) 5 Best Credit Cards For Paying Car Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-for-Paying-Car-Insurance.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards With Travel Insurance ([updated_month_year]) 7 Best Credit Cards With Travel Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Best-Credit-Cards-With-Travel-Insurance.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards With Car Rental Insurance ([updated_month_year]) 9 Best Credit Cards With Car Rental Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-With-Car-Rental-Insurance.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Young Travelers ([updated_month_year]) 12 Best Credit Cards for Young Travelers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-for-Young-Travelers-Feat.jpg?width=158&height=120&fit=crop)

![3 Steps for Maximizing Credit Card Perks & Rewards ([updated_month_year]) 3 Steps for Maximizing Credit Card Perks & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/12/maximizing-credit-card-perks-and-rewards-1.png?width=158&height=120&fit=crop)

![Game Over: Here’s Why the Best Credit Card Rewards May End Soon ([updated_month_year]) Game Over: Here’s Why the Best Credit Card Rewards May End Soon ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/game-over-credit-card-rewards.jpg?width=158&height=120&fit=crop)