Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Knowing their customers in a global marketplace can be challenging for businesses. IDology helps companies verify their customers’ identities and prevent fraud. IDology’s solutions can reduce the time it takes a financial institution to onboard new customers. IDology maintains contact with its clients and proactively recommends new products and services.

The internet isn’t very old. Though online capabilities are ever-expanding, and companies seemingly announce new digital offerings every week, it can seem like the internet has been around forever. But it hasn’t.

As the online ecosystem has evolved to transform vital components of life, such as the way we work and interact with one another, bad actors have looked to exploit the internet’s vulnerabilities.

Fortunately, companies such as IDology are at the forefront of promoting safety for businesses and people transacting online. We spoke with Heidi Hunter, IDology’s Chief Product Officer, to learn more about the company’s innovative solutions that help reduce fraud.

IDology was founded in the early 2000s and initially focused on providing a safe place for children to transact online. Hunter said a private party acquired IDology soon thereafter, and its mission shifted to meet online identity needs.

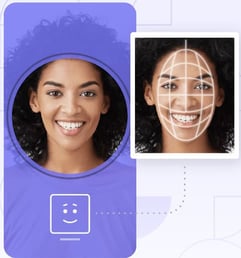

The organization evolved over the years to offer digital identity verification solutions. Hunter said IDology was one of the first companies to provide identity-oriented solutions that included data orchestration, email insights, IP geolocation, and the blending of information from mobile devices.

IDology was acquired in 2019 by GBG. Hunter said GBG realized IDology’s name recognition in the U.S. and decided the company should continue to operate under its name.

“We kept our name in the U.S. because we’ve had more than 20 years of experience here in this space, and our name is more recognized,” Hunter said. “But GBG is a globally recognized organization with very strong solutions and value for customers in every region of the world.”

IDology can establish workflows for businesses that meet Know Your Customer requirements. Hunter said data availability can shift in a digital environment, and IDology’s solutions are agile and capable of making quick assessments.

“Our ability to take in nominal data and very large quantities of payloads to provide an overall outcome is pretty superior,” Hunter said.

Configurable Products Align With Client Goals

IDology offers numerous digital solutions, but its products are not one size fits all. IDology’s clients can configure the company’s solutions to meet their needs. Hunter said IDology’s overarching goal is to take a simplistic approach that provides clients with the configurability they need to transact in the digital world.

Hunter said it’s essential for IDology to offer adaptable products because the market frequently changes, and product enhancements can address concerns such as dark web leaks.

“We’re a solutions provider that understands the complexity of the market we operate in, and we have products that can adapt to changes in the market,” Hunter said. “One of our key differentiators is the combination of our expertise and approach with our flexible technology.”

IDology serves clients that operate in various sectors. Hunter said financial service providers are one of the primary industries IDology works with, and it has provided solutions to financial institutions for many years.

Hunter said the financial services industry was one of the first to digitize, and IDology can help financial institutions address compliance challenges.

IDology also serves clients in the gambling industry. Hunter said online betting businesses and casinos have their own set of regulations to comply with, and IDology can help gambling companies remain compliant.

IDology assists insurance companies in protecting their data and has solutions to help healthcare companies and doctor’s offices onboard new patients.

“Our solutions work well for companies in any industry that need to verify their customers’ identities in a digital environment,” Hunter explained. “We work with our clients to understand what their needs are, and then we recommend proven strategies that will meet those needs.”

IDology helps businesses combat and manage fraud. Hunter said fraudsters traverse industries to take advantage of gaps in digital security.

“Fraudsters use bought, stolen, or synthetically created identities in one industry, and then they’ll move to use the identity in a separate industry if they see an opportunity to do so,” Hunter said.

Helping Financial Institutions Know Their Customers

Many of the solutions IDology provides to financial services companies center around onboarding new customers. Hunter said IDology’s solutions help financial institutions ensure a new customer is legitimate by understanding the customer’s background, including whether they are on any watch lists. Hunter said IDology’s solutions can minimize the time it takes a financial institution to onboard a new customer.

“We can perform a deep authentication that will make a financial institution’s customer enrollment process better,” Hunter said. “Where a customer application may have taken 15 minutes to complete and required multiple pages, we can come in with the details to help simplify the process.”

Financial institutions must communicate with their customers to keep them informed of changes to account terms and conditions and announcements regarding service interruptions and fraud concerns. Hunter said IDology helps financial institutions verify the accuracy of their customers’ emails and phone numbers.

IDology extends flexibility to new clients to enroll them in its programs at the speed the client prefers, Hunter said. New clients first meet with IDology’s sales engineers to outline the details of the solutions they seek. Clients then enter the implementation phase, during which IDology assigns them an implementation success manager who oversees and assists with the client’s onboarding.

After the implementation phase, clients are ready to go live with IDology’s solutions. Hunter said clients receive ongoing support from IDology’s team.

“We have a partnership with our clients,” Hunter said. “Our team of fraud experts pore over our clients’ data every day. If a client has an issue they’re unaware of, you can expect that we’re going to find it. We’re a very data-driven organization, and we provide our clients with a lot of reporting to help them stay on top of risk.”

Hunter said IDology’s ongoing customer support is proactive and makes recommendations to clients based on research and industry observations.

IDology Partners With Clients to Enable Success

IDology holds quarterly business reviews to assess its performance. Hunter said IDology is an analytical company that uses data visualization tools to help evaluate its performance and transform large amounts of data into digestible insights and statistics.

IDology also solicits feedback from its clients to understand whether it is meeting their needs and to learn how it can improve solutions and services. Hunter said IDology’s clients have many avenues to interact with the company.

“A lot of times, our customers become our friends,” Hunter said. “I have many customers that I’ve actually given my personal phone number to, and they’ll text me to let me know how things are going or to tell me something about a product. We also reach out to our customers regularly and check in to make sure things are going well.”

Hunter said she is excited about the future of IDology. GBG is a global organization, and though it plans to continue to have a regional focus, Hunter said multiple phases of GBG Go have been successfully released and more are underway to offer everything the company has acquired or built under one umbrella.

“What’s cool about that is it’s going to give our clients the ability to take advantage of everything that we have to offer,” Hunter said. “Clients will still have access to regional products, but if they want to expand into another country, we’ll be able to make that opportunity available to them through one connection.”

![15 Disturbing Credit Card Fraud Statistics ([current_year]) 15 Disturbing Credit Card Fraud Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_576998230.jpg?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year]) How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/04/complete-guide-to-balance-transfers.jpg?width=158&height=120&fit=crop)

![12 Best Credit Card Offers Now, Per Experts ([updated_month_year]) 12 Best Credit Card Offers Now, Per Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/12-Best-Credit-Card-Offers.png?width=158&height=120&fit=crop)

![Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year]) Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/09/discover-pre-approved.jpg?width=158&height=120&fit=crop)

![Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year]) Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/chase.png?width=158&height=120&fit=crop)

![12 Best Credit Card Signup Bonus Offers ([updated_month_year]) 12 Best Credit Card Signup Bonus Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/credit-card-signup-bonus-offers.jpg?width=158&height=120&fit=crop)

![Compare Credit Cards: 18 Best Offers Today ([updated_month_year]) Compare Credit Cards: 18 Best Offers Today ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/comparison2.jpg?width=158&height=120&fit=crop)