Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

The web is a wonderland until it’s not. Credit cards and digital payment technologies are convenient until they result in identity theft and financial loss. Knowledge is the first line of defense against fraudsters stealing personal information.

In card skimming, criminals overlay or insert card-reading devices into point-of-sale terminals, ATMs, gas pumps, and other devices to read the magnetic strips on cards. Card shimming accomplishes the same thing but steals information from EMV chips on cards and is harder to detect.

Card-not-present (CNP) fraud is a blanket term for many forms of identity theft. Fraudsters use stolen information to apply for new cards and assume control of existing card accounts.

Security is becoming more sophisticated, but card fraud remains a threat to consumers. Here are 45 revealing credit card skimming and fraud statistics to highlight the alarming trends of this complex problem.

Credit Card Skimming and Fraud By the Numbers

1. Data from December 2022 indicated global losses from card fraud amounted to $32.34 billion in 2021. The U.S. generated 23.02% of total transaction volume that year but accounted for 36.83% ($20.43 billion) of those losses.1

2. An August 2022 forecast projected total U.S. card-not-present (CNP) fraud losses of $10.16 billion and $3.57 billion in non-CNP fraud losses in 2024.2

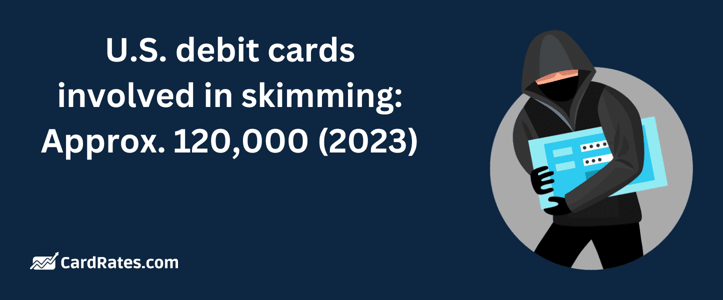

3. Card skimming is in growth mode. The number of U.S. debit cards involved in skimming rose by 77% from roughly 70,000 cards in the first half of 2022 to nearly 120,000 cards in the first six months of 2023.3

4. Authorized payment fraud occurs when a criminal uses social engineering tactics to impersonate a legitimate organization and compel payment. In 2022, consumers reported losing $8.8 billion to various scams, up $2.6 billion from 2021.4

5. Experts often say older people are more vulnerable to card fraud than younger people. However, 2023 data shows that 44% of survey respondents aged 20 to 29 reported losing money to fraud versus 25% of consumers aged 70 to 79.5

6. Card skimming compromises impacted nearly 3,000 unique financial institutions in 2022, a 79% year-over-year increase.6

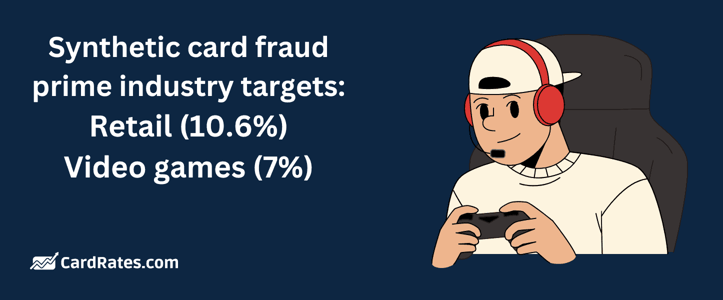

7. Out of $49.149 trillion in total purchase and cash volume, card fraud generated global losses of $33.45 billion in 2022.7

8. Consumers reported 416,582 incidents of credit card-related identity theft in 2023.8

9. According to a 2023 report, 65% of U.S. credit and credit card holders have been fraud victims at some point in their lives, up from 58% in 2022 — that’s about 151 million Americans.9

10. Among American consumers surveyed in 2021 who had purchased gasoline in the last 30 days, 15% said they had been a victim of skimming at the pump.10

11. Card skimming can be an amazingly lucrative crime. In seven months from 2018 to 2019, one team of fraudsters used gas-pump skimmer devices to obtain at least 3,120 credit and debit card account numbers and caused losses of at least $157,695.11

12. Synthetic card fraud — using a real person’s stolen information, such as their Social Security number or date of birth, and combining it with fabricated personal information to create a card account — is a fast-growing financial crime. A 2023 analysis identified the retail and video game sectors as the most common targets of synthetic fraud, revealing that 10.6% of retail and 7% of video game transactions showed signs of fraud.12

13. According to a 2021 news report, one ATM skimming scheme in New Jersey involved more than 1,000 bank customers and generated more than $1.5 million in actual and attempted losses.13

14. A 2023 FBI report states that card skimming costs financial institutions and consumers more than $1 billion annually.14

15. In a 2020 survey, more than half of Gen Xers and consumers with household incomes of $100,000 or more said they were victims of card skimming.15

16. An estimated 9 million Americans experience identity theft annually, according to the U.S. Federal Trade Commission.16

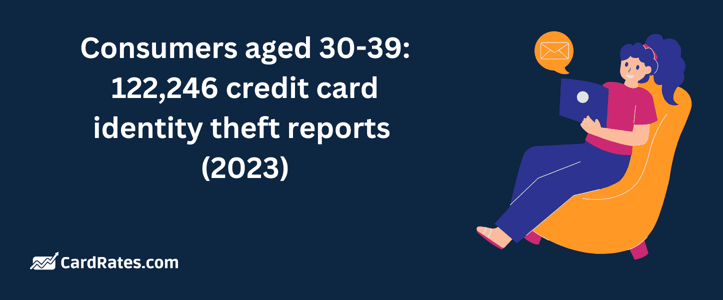

17. The U.S. Bureau of Justice reported in 2023 that about 23.9 million people (9% of U.S. residents age 16 or older) were victims of identity theft during the previous year.17

18. Card fraud criminals constantly look for fresh opportunities. Data from 2023 revealed that 75% of card-skimming compromise sites in 2022 were new locations.6

19. Forecast data from 2023 estimated that total global losses from card fraud would increase from $33.45 billion in 2022 to $43.47 billion in 2028.7

20. Credit-card-based identity theft reports related to new accounts decreased 7% year-over-year to 381,122 in 2023. Reports associated with existing accounts rose 14% to 44,855.8

21. Data from 2023 identified credit cards as the most frequent payment method in fraud report incidents.8

22. Consumers aged 30-39 reported 122,246 credit card identity theft incidents in 2023, the highest number of reported incidents among all age groups. The 40-49 age cohort had the next-highest frequency (84,604). The 20-29 cohort reported 71,900 incidents. Consumers aged 70-79 reported only 10,899 incidents.8

23. ATM skimming statistics have a state-based component. ATM skimming compromise events in Virginia, Texas, New Jersey, Florida, and Colorado rose 50% or more year-over-year from the first half of 2022 to the first half of 2023. Virginia and Texas joined the list of the top-five ATM compromise states.3

24. A 2021 survey revealed that the most common way Americans combat card skimming at gas stations is by paying inside versus at the pump.10

25. Card skimming is a crime of opportunity. Data from 2023 showed that 87% of card-skimming events lasted two weeks or less, and 64% lasted a week or less.6

26. Identity theft reports by state vary widely. In 2023, identity theft reports from Vermont totaled 97, and reports from South Dakota totaled 94; those were the states with the lowest totals.12

27. Some states are seeing decreases in the number of ATM compromises. ATM skimming compromises in California, Washington, and Maryland decreased 50% or more from the first half of 2022 to the first half of 2023. California is still the state with the highest number of ATM skimming incidents.3

28. Auto lenders are most likely to be victims of synthetic card fraud, with losses in the first half of 2023 totaling $1.8 billion. Bank credit cards ($994 million) and retail credit cards ($126 million) are the next-highest categories.12

29. Card compromise reports associated with skimming increased 452% from 2021 to 2022. The total number of compromised cards increased 368% to more than 161,000.6

30. According to a 2021 survey, millennials (48%) are the generational cohort most likely to change gas purchasing habits to avoid card skimming at the pump.10

31. Synthetic fraud attempts in the retail industry grew 183% from the first half of 2019 to the first half of 2023.12

32. Women surveyed in 2021 were more likely than men to change gas-purchasing habits to avoid card skimming at the pump (48% versus 43%).10

33. A total of 44% of credit card users surveyed reported experiencing two or more fraudulent charges, according to a 2023 report. That number was up from 35% in 2021.9

34. Debit card compromise reports rose 20% year-over-year from 525 in the first half of 2022 to 625 in the first half of 2023.3

35. Card-skimming criminals target certain states. In 2022, almost three-fourths (70%) of fraud cases related to skimming occurred in California (38%), New York (16%), Pennsylvania (6%), Florida (5%), and Washington (5%).6

36. The median fraud charge rose to $79 in 2022, up 27% from $62 in 2021, according to a study published in 2023.9

37. Data from 2023 revealed that skimming events impacted 185 cards each on average in 2022.6

38. According to a 2020 survey, men, Gen Xers, and high-income households were most likely to report growing more worried in the past year about gas-pump card skimming.15

39. Identity theft per 100,000 residents increased in Connecticut by 69.9% — the highest rate increase among 18 states — from 2022 to 2023.12

40. An upward trend in debit cards impacted per compromise event indicates criminals are growing more effective in their work. Data from August 2023 shows a 48% year-over-year increase in the average number of cards affected per compromise from the first half of 2022 to the first half of 2023.3

41. Survey data from 2020 indicated that 35% of respondents were more worried about gas pump card skimming than they were a year ago, and another 37% reported being concerned about the same level.15

42. Skimming at bank ATMs rose 109% year-over-year from the first half of 2022 to the first half of 2023. Bank ATMs represented about 33% of compromised locations in the 2023 figures; non-bank ATMs were more likely to be victimized.3

43. Almost half (43%) of Americans surveyed in 2021 reported changing how they paid for gas because of card-skimming concerns.10

44. The Miami-Fort Lauderdale-Pompano Beach Metropolitan Statistical Area reported 729 identity theft cases per 100,000 residents — the highest rate — in 2023.12

45. According to a 2020 survey, only 12% of U.S. consumers with annual incomes less than $25,000 reported being victims of pump skimming in the past 12 months.15

In Conclusion

Criminals have so many ways to siphon data and personal information — from skimming and shimming to card-not-present fraud and beyond — that using cash instead of cards may seem like the best option.

These statistics illuminate the stakes in the continual cat-and-mouse game between criminals out to steal data and personal information for financial gain and security engineers, public stakeholders, and consumers dedicated to stopping them.

Data Sources:

1 https://nilsonreport.com/newsletters/1232/

2 https://www.emarketer.com/content/spotlight-us-card-payment-fraud-losses-forecast-2022

3 https://www.fico.com/blogs/card-skimming-and-other-fraud-types-continue-grow-us-data

4 https://consumer.ftc.gov/consumer-alerts/2023/02/top-scams-2022

5 https://public.tableau.com/app/profile/federal.trade.commission/viz/ConsumerSentinel/Infographic

6 https://www.fico.com/blogs/us-card-skimming-grew-nearly-5x-2022-new-fico-data-shows

7 https://nilsonreport.com/newsletters/1254/

8 https://www.ftc.gov/system/files/ftc_gov/pdf/CSN-Annual-Data-Book-2023.pdf

9 https://www.security.org/digital-safety/credit-card-fraud-report/

10 https://www.lendingtree.com/credit-cards/study/gas-skimming-fraud-survey/

11 https://www.justice.gov/usao-nv/pr/las-vegas-man-sentenced-prison-role-gas-pump-skimming-fraud-scheme-nevada-and-california

12 https://www.fool.com/the-ascent/research/identity-theft-credit-card-fraud-statistics/

13 https://www.mycentraljersey.com/story/news/crime/2021/01/27/romanian-national-sentenced-atm-skimming-scheme-new-jersey/4279259001/

14 https://www.fbi.gov/how-we-can-help-you/scams-and-safety/common-scams-and-crimes/skimming

15 https://www.lendingtree.com/credit-cards/study/gas-pump-card-skimming/

16 https://www.ftc.gov/business-guidance/privacy-security/red-flags-rule

17 https://bjs.ojp.gov/library/publications/victims-identity-theft-2021

![18 Revealing Credit Card Ownership Statistics ([current_year]) 18 Revealing Credit Card Ownership Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Revealing-Credit-Card-Ownership-Statistics.jpg?width=158&height=120&fit=crop)

![15 Disturbing Credit Card Fraud Statistics ([current_year]) 15 Disturbing Credit Card Fraud Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_576998230.jpg?width=158&height=120&fit=crop)

![21 Startling Credit Card Data Breach Statistics ([current_year]) 21 Startling Credit Card Data Breach Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Credit-Card-Data-Breach-Statistics.jpg?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![11 Surprising Teen Credit Card Statistics ([current_year]) 11 Surprising Teen Credit Card Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Teen-Credit-Card-Statistics.jpg?width=158&height=120&fit=crop)

![25 Shocking Credit Card Processing Statistics ([current_year]) 25 Shocking Credit Card Processing Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Credit-Card-Processing-Statistics.jpg?width=158&height=120&fit=crop)

![25 Fascinating Credit Card vs. Cash Spending Statistics ([current_year]) 25 Fascinating Credit Card vs. Cash Spending Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Fascinating-Credit-Card-vs.-Cash-Spending-Statistics.jpg?width=158&height=120&fit=crop)

![21 Eye-Opening Student Debt Statistics ([current_year]) 21 Eye-Opening Student Debt Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_674141887.jpg?width=158&height=120&fit=crop)