Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

It’s one thing to earn credit card rewards and another to redeem them. Americans who let card rewards go unused would kick themselves twice for not cashing in if they considered where rewards come from.

Card companies implement rewards programs to beat the competition. The money comes from the interest and fees consumers pay to use the cards. It’s a fair deal when people use cards wisely and take what’s coming to them.

They shoot themselves in the foot when they don’t. Here are some compelling statistics to get you thinking about consumer decision-making in the credit card rewards marketplace.

Credit Card Reward Redemptions By the Numbers

1. Nearly a quarter (23%) of consumers surveyed in 2023 said they did not redeem card rewards they had coming to them in the past year. But most (51%) said they were waiting for a specific opportunity to use them.1

2. Inflation is a compelling reason to use card rewards. Nearly half (49%) of rewards cardholders surveyed in 2022 claimed to use rewards to offset everyday purchase costs.2

3. Almost all respondents surveyed in 2022 (87%) said they had a rewards card. But 69% of those had unused cash back rewards, points, or miles.3

4. Federal Reserve data published in 2022 showed that the cost of rewards as a share of total credit card transaction volume increased 25% from 2015 through 2021.4

5. Credit card interchange fees are a source of revenue to pay for rewards. A 2023 study found that when rewards increase, so do fees.5

6. The Federal Reserve estimated that credit card rewards redistributed about $15 billion in annual rewards value from poorer to more affluent people in 2022.6 A 2023 New York Times opinion piece characterized that redistribution as “essentially a tax on less affluent consumers.”4

7. More than half (53%) of Americans in a 2021 survey reported that rewards encouraged more frequent credit card use. Millennials (67%) and Gen Xers (66%) were most likely among generational groups to report wanting more frequent card use.7

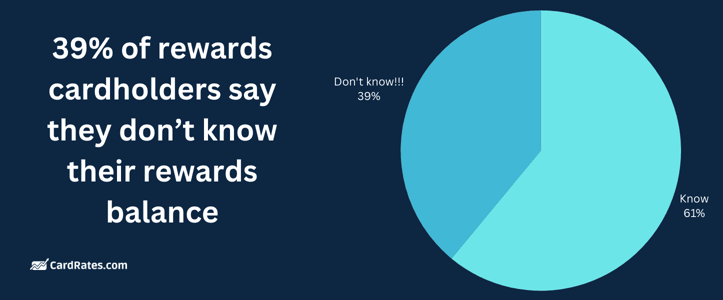

8. More than one-third (39%) of cardholders say they don’t know their rewards balance.8

9. Americans don’t compare rewards card deals frequently. Only 48% shop for a new card every three years or less.9

10. Almost half (47%) of American adults surveyed in 2021 said they used a credit card exclusively to accumulate rewards points. That’s about 119.8 million rewards cardholders.10

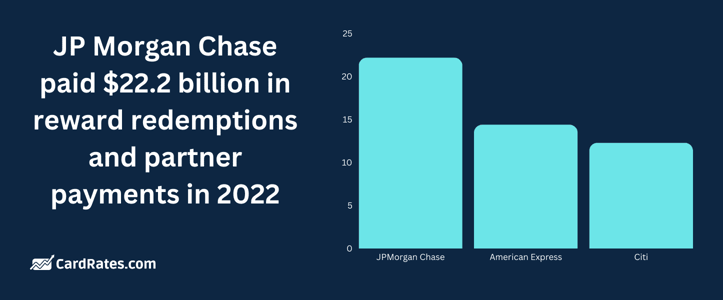

11. The six biggest US credit card issuers spent $67.9 billion in 2022 to pay out reward redemptions and partner payments, up 23.7% from 2021.11

12. More than three-quarters (81%) of American consumers reported in a 2023 survey that earning bonus reward points for travel was important to them.12

13. Almost half (49%) of rewards cardholders surveyed in 2020 who paid their bills in full each month missed out on rewards because they opted to use cash or debit instead of their rewards card to purchase groceries.13

14. Low-income households are less likely to redeem card rewards. About one-third (31%) of households surveyed in 2023 with less than $50,000 in income left rewards unused in the past year. Only 22% of those with incomes between $50,000 and $79,999 and 20% of households with incomes between $80,000 and $99,999 left money on the table. Only 12% of those with incomes of $100,000 or higher left rewards unused.1

15. Women surveyed in 2021 used rewards cards to spend an average of $522.16 yearly on groceries. Men spent an average of $488.90 on groceries per year.10

16. Among the 23% of consumers who reported in a 2023 survey that they didn’t cash in their rewards in the past year, 51% said they were waiting to use them. That left a near majority who planned to leave rewards on the table permanently — including 23% who considered them too low in value, 11% who didn’t know how to redeem them, 9% who considered rewards programs too confusing, and 9% who regarded themselves as too busy to bother.1

17. Americans surveyed in 2021 reported most often using rewards cards to buy groceries (36.31%). Dining out (28.94%) was the next highest spending category, followed by household items (23.30%). The lowest spending category recorded in the survey was literature (10.06%).10

18. Most rewards cardholders in a 2022 survey (53%) said they shopped around before applying for a card. Those who compared offers were less likely to have unused rewards (66%) than those who didn’t (73%).3

19. Americans surveyed in 2021 spent $141 billion using rewards credit cards in 2020 — down roughly 11% from 2019.10

20. Nearly 70% of cardholders surveyed in 2022 reported having unused rewards. Of those, 49% had unused cash back rewards, 13% had unused airline miles, and 11% had unused fuel points. Nearly a third (31%) had saved at least $100.3

21. More than half (57%) of 2021 survey respondents reported they believed they received the maximum possible rewards from their current credit card. But 29% reported difficulty understanding which rewards programs were best for them.7

22. A small number (15%) of rewards cardholders surveyed in 2022 said some rewards expired before they could use them.3

23. Rewards card spending for groceries increases with age. In a 2021 survey, Gen Z members surveyed reported spending an average of $479.89 per year on groceries. Millennials surveyed said they spent $990.95, Gen Xers in the study reported spending $1,170.49 on groceries, and baby boomers spent $1,473.46. Members of the silent generation spent $1,683.58 on average.10

24. Most people consider young consumers less financially responsible than older ones. But a 2023 survey revealed that baby boomers (28%) and Gen Xers (28%) were less likely to have used card rewards than millennials (15%) and Gen Z members (18%).1

25. JP Morgan Chase paid $22.2 billion in reward redemptions and partner payments in 2022. American Express paid $14.0 billion and Citi $12.3 billion.11

26. More than half (55%) of respondents in a 2023 survey preferred cash back and gift card rewards over other perks. Only 17% of respondents earned $300 or more, while 38% earned less than $300.1

27. Among cardholders surveyed in 2022 who redeemed rewards in the past year, 71% redeemed cash back, 21% redeemed points or gift cards, 12% earned a free flight, and 12% earned a free hotel stay.3

28. More than three-quarters (77%) of American consumers surveyed in 2023 reported redeeming travel rewards within a year of accruing them.12

29. While cash back and gift cards were the most popular redemption categories, rewards card holders responding to a 2023 survey reported a lower preference for travel redemptions, with 16% choosing a free hotel stay and 13% a free flight.1

30. Of those surveyed in 2023, more women than men (27% versus 20%) said they failed to use their card rewards in the past year.1

31. Rewards cardholders surveyed in 2020 were most likely to favor using cash or debit cards over credit cards when paying for a meal at a restaurant (57%) and buying groceries (56%). But only 37% said they used cash or debit cards to pay for gas. Figures for hotels and airfare were even lower (16% and 15%, respectively).13

32. Gen Zers (28%) and millennials (26%) were most likely to choose a free hotel stay as a reward, according to a 2023 survey. Gen Xers (12%) and baby boomers (7%) were less likely to do so.1

33. Nearly three-quarters (73%) of American consumers surveyed in 2023 reported actively tracking points earned on travel reward credit and charge cards.12

34. About a quarter (23%) of households with annual earnings above $100,000 reported saving airline miles in a 2022 survey. Only 4% with less than $35,000 in yearly income had airline miles.3

35. Gen Zers (17%) were most likely to redeem rewards at least once a month, according to a 2022 survey. Millennials (11%), Gen Xers (9%), and baby boomers (9%) trailed the youngest generational cohort in redeeming rewards at least once a month.3

36. Large card issuers are deferring more revenue to cover the costs of unredeemed rewards. Credit card rewards liabilities have grown by 52.5% ($11.4 billion) since 2019.11

37. Among nearly half (49%) of cardholders surveyed in 2022 who hadn’t redeemed all the cash back available to them, 11% were sitting on at least $200.3

In Conclusion

Card companies invest heavily in rewards. Consumers leave a lot on the table after earning them. Knowledge is power: It’s only fitting for cardholders to reap the benefit of rewards when the interest and fees they pay help fund them.

Counterintuitively, those most financially well-off gain the most from rewards. These reward redemption statistics reveal compelling demographic tendencies and a pattern of unrealized consumer financial potential.

Data Sources:

1 https://www.creditcards.com/statistics/unused-credit-card-rewards-poll/

2 https://www.businesswire.com/news/home/20220802005244/en/New-Study-Americans-Lean-Into-Credit-Card-Rewards-to-Offset-Rising-Costs-%E2%80%93-Including-Travel

3 https://www.lendingtree.com/credit-cards/study/unused-rewards/

4 https://www.nytimes.com/2023/03/04/opinion/credit-card-rewards-points-poor-interchange-fees.html

5 https://luluywang.github.io/PaperRepository/payment_jmp.pdf

6 https://www.federalreserve.gov/econres/feds/files/2023007pap.pdf

7 https://www.ipsos.com/en-us/majority-say-credit-card-rewards-are-very-important-and-drive-their-card-usage

8 https://www.synchronybank.com/blog/surprising-credit-card-statistics/

9 https://bankbonus.com/statistics/credit-card-statistics/

10 https://www.finder.com/credit-cards/rewards-credit-cards/chasing-points

11 https://www.lendingtree.com/credit-cards/study/reward-payments/

12 https://www.airlines.org/news-update/new-polling-shows-consumers-highly-value-airline-credit-card-points/

13 https://www.bankrate.com/finance/credit-cards/preferred-payments-survey/

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![15 Disturbing Credit Card Fraud Statistics ([current_year]) 15 Disturbing Credit Card Fraud Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_576998230.jpg?width=158&height=120&fit=crop)

![21 Startling Credit Card Data Breach Statistics ([current_year]) 21 Startling Credit Card Data Breach Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Credit-Card-Data-Breach-Statistics.jpg?width=158&height=120&fit=crop)

![11 Surprising Teen Credit Card Statistics ([current_year]) 11 Surprising Teen Credit Card Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Teen-Credit-Card-Statistics.jpg?width=158&height=120&fit=crop)

![18 Revealing Credit Card Ownership Statistics ([current_year]) 18 Revealing Credit Card Ownership Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Revealing-Credit-Card-Ownership-Statistics.jpg?width=158&height=120&fit=crop)

![25 Shocking Credit Card Processing Statistics ([current_year]) 25 Shocking Credit Card Processing Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Credit-Card-Processing-Statistics.jpg?width=158&height=120&fit=crop)

![25 Fascinating Credit Card vs. Cash Spending Statistics ([current_year]) 25 Fascinating Credit Card vs. Cash Spending Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Fascinating-Credit-Card-vs.-Cash-Spending-Statistics.jpg?width=158&height=120&fit=crop)

![21 Eye-Opening Student Debt Statistics ([current_year]) 21 Eye-Opening Student Debt Statistics ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_674141887.jpg?width=158&height=120&fit=crop)