Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Businesses can increase their revenue by accepting more types of payments from customers. Clearly Payments is a payments processor that prides itself on its service and transparent pricing. The company responds quickly to customer questions and relies on referrals for new business opportunities. Clearly Payments offers solutions to companies with brick-and-mortar locations and web-based businesses.

Payments are the lifeblood of the business world. After all, a business won’t be economically sustainable if it can’t accept remuneration from its customers, regardless of how revolutionary the product or service it offers is.

Clearly Payments is a payments processor based in British Columbia, Canada. We spoke with Kalle Radage, the company’s Founder and Chairman, to learn more about how the company facilitates payments acceptance for businesses.

Radage said the idea for Clearly Payments started in 2017, and the company began operating in 2018. He said Clearly Payments serves customers across North America, offering curated payments products and world-class customer service to small and medium-sized merchants.

Radage said Clearly Payments first focused on growing its market share in Western Canada before organically expanding to the eastern part of the country and the U.S. He said the company has grown since its inception in a manner he expected it to — similar to the growth of other payment companies he worked with in the past.

Radage said Clearly Payments has enhanced its ability to provide services to healthcare benefits organizations and healthcare software companies since its founding. He said the company works with doctors’ and dentists’ offices to meet their payment needs.

“We’ve done integrations to software companies that are in the medical space,” Radage said. “Doctors’ offices and dental offices are a big sector for us. We seem to really speak their language and help them out quite a bit, but we also work with boutique retailers up to large manufacturing companies that want to accept credit card payments. But healthcare seems to be where we’ve been able to create a little bit of demand. We get a lot of inquiries in that space.”

Radage said members of the Clearly Payments team previously worked for a software company that served dental offices. He said Clearly Payments leverages its team’s experiences to make inroads with dental offices and the software companies that partner with them.

Merchant Churn Rates in the Low Single Digits

Though many companies offer payment services to merchants, Radage said a handful of large processors own a significant portion of the market. He said customer churn rates are high in the payments arena, regardless of whether a merchant works with an established payments processor or a relative newcomer to the industry.

Radage said merchants choose to leave their payments processor for various reasons, including service levels that don’t live up to a merchant’s expectations and a lack of transparency in pricing.

“Businesses will receive a quote for pricing, but then it won’t add up to what they thought they were getting in the first place,” Radage said. “Whether that started right at the beginning of an agreement or if it happened over a 12 or 18-month period, the price they pay has gradually increased. Either way, that’s resulting in significant churn.”

Radage said Clearly Payments combats churn by prioritizing the support and service it provides merchants and by offering clearly outlined pricing plans. He said merchants calling Clearly Payments can expect a representative to answer their call within the first few phone rings, and merchants emailing the company with inquiries receive a response within 10 minutes.

Radage said the company’s commitment to customer service and transparent pricing help it keep its churn rates low.

“We see ridiculously low churn rates — like, in the single digits,” Radage said. “When customers do leave, it’s often because they’re shutting down or maybe they’ve decided not to accept credit card payments because it doesn’t fit their business model at the moment.”

Radage said Clearly Payments receives a substantial number of leads for new customers from current customer recommendations. He said the company doesn’t spend any money on advertising but relies on referrals to access new business opportunities.

Radage said because Clearly Payments saves money on advertising expenses, it can offer more attractive pricing options to merchants which can lead to more referrals.

Payments Solutions That Meet Clients Where They Are

Clearly Payments employs a measured approach when working with new customers. Radage said the company engages with new customers to determine what products they need and doesn’t push prospects to enroll in its solutions before understanding what will most benefit their businesses.

Clearly Payments offers smart terminals and point-of-sale systems. Radage said 90% of the company’s merchant customers who manage a brick-and-mortar business use terminals and point-of-sale systems from a handful of brands.

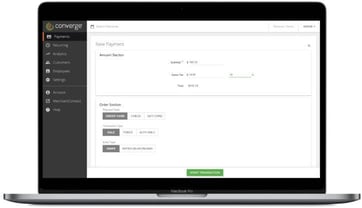

Virtual terminals enable companies to transform their computers or tablets into secure payment terminals. Radage said web-based merchants are a growing segment of the company’s customer base and use its virtual solutions.

“We have a couple of API sets for software businesses, websites, and apps to integrate payments into them,” Radage said. “We provide integration expertise, and we have a second and third level of support to provide even more expertise around integrating our software. We also have a number of partners and merchants that integrate their software into our hardware so they can build their own custom in-house point-of-sale system.”

Clearly Payments uses metrics to assess its performance. Radage said the company focuses on decreasing the percentage of customers who call the company with questions or issues each month. He said Clearly Payments desires its customers to be empowered to overcome any obstacles they encounter or not to experience problems when working with the company’s solutions.

Radage said Clearly Payments analyzes why customers terminate their services with the company and works with departing customers to learn what it can do to convince them to continue their business relationship. He said Clearly Payments treats experiences working with departing merchants as opportunities to improve.

Education Helps Merchants Grow Their Businesses

Clearly Payments offers its customers pricing options to suit their needs. Radage said most of the company’s customers enroll in interchange plus pricing, which is the company’s most merchant-friendly pricing plan.

Clearly Payments also offers membership plans. Radage said customers enjoy membership plans because they give them more input into pricing. He said Clearly Payments receives lower margins on solutions it offers customers enrolled in membership plans, but customers in membership plans require less support from Clearly Payments.

“Membership plans can work in our favor because those merchants are a little more hands-off,” Radage said. “They’re not the ones we hear from very often — they’re just running their business and doing their thing. They’re happy with the membership pricing they receive, but we also offer flat-rate pricing and things like that for merchants that are better suited for it.”

The payments industry may be confusing to merchants who are new to it. Clearly Payments provides its customers with research and articles to help them understand the industry and its terminology. Clearly Payments hosts educational content on its website, including a section devoted to merchants new to payments.

“One of the things we want to do is just ensure this kind of stress-free environment,” Radage said. “That‘s part of our company culture and strategy — that we’re not here to bring pressure in any way. It’s more about education and making it seamless for people, whether they’re just learning about the industry itself or actually signing up for a merchant account.”

![11 Ways to Lower Your Monthly Bill Payments ([updated_month_year]) 11 Ways to Lower Your Monthly Bill Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Ways-to-Lower-Your-Monthly-Bill-Payments.jpg?width=158&height=120&fit=crop)

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![What Is Credit Card Refinancing? 6 Ways to Lower Rates ([updated_month_year]) What Is Credit Card Refinancing? 6 Ways to Lower Rates ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/What-Is-Credit-Card-Refinancing.jpg?width=158&height=120&fit=crop)

![4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year]) 4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/charts.png?width=158&height=120&fit=crop)

![6 Best Prepaid Debit Cards with No Fees ([updated_month_year]) 6 Best Prepaid Debit Cards with No Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/prepaid--1.png?width=158&height=120&fit=crop)

![7 Credit Card Fees & How to Avoid Them ([updated_month_year]) 7 Credit Card Fees & How to Avoid Them ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Credit-Card-Fees.jpg?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)

![9 Best Debit Cards With No ATM Fees ([updated_month_year]) 9 Best Debit Cards With No ATM Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Debit-Cards-With-No-ATM-Fees.jpg?width=158&height=120&fit=crop)