Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Abacus Life purchases life insurance policies to provide its clients with financial flexibility. A client’s life expectancy impacts the amount of money Abacus Life offers for the client’s life insurance policy. The company exercises empathy and respect when discussing solutions with its clients. Abacus Life is committed to providing its clients with services that suit their needs, a commitment that has earned it our Editor’s Choice™ Award for expanding its clients’ financial options.

Most people are familiar with how life insurance policies work. An individual purchases a life insurance policy and selects beneficiaries. If the individual passes away while their life insurance policy is active, their beneficiaries receive a financial payment from the policyholder’s insurer.

You’re not alone if you didn’t know life insurance policyholders can sell their policies. The life settlement industry provides policyholders with options to sell their life insurance policy in exchange for a cash payout or another financial product, such as an annuity.

Abacus Life purchases life insurance policies to help its clients improve their quality of life and maximize the value of their policies. We spoke with Jay Jackson, Abacus Life’s CEO, to learn more about the company’s innovative services.

One of Abacus Life’s primary goals is educating people about life settlements. Jackson said many people aren’t familiar with life settlements due to a lack of education and exposure. It is also in part due to the fact that a life insurance carrier’s business model relies in part on lapsing life insurance policies, Jackson said.

Jackson said nine out of 10 life insurance policies lapse without paying a death benefit. Abacus Life can help people extract value from their life insurance policy.

“There’s a reason life insurance carriers have the biggest buildings in many cities,” Jackson said. “They make an impressive amount of money because most policies never pay a death benefit.”

Abacus Life is regulated to operate in 49 states. Jackson said Abacus Life is the only life settlement company in the U.S. focusing on educating the public about life settlement options in the capacity they are.

“If you look at our advertising, whether it be our television commercials, radio spots, or online ads, the entire core of our model is having conversations with our clients,” Jackson said. “We’re not selling anything or looking to manipulate anybody. We’re here to let people know there’s a really awesome product available to them that they might not have heard about.”

Infusing Client Conversations with Compassion

Abacus Life aims to inform people that their life insurance policy is an asset. Jackson said many people who own life insurance policies have invested in them for many years, and a policyholder may not know their policy’s value.

“People put a lot of money into their homes,” Jackson said. “But one day, when their home doesn’t suit them anymore, they move out and sell it. One of our goals is to let people know they can sell their life insurance policy when it doesn’t suit them anymore.”

Jackson said many clients Abacus Life works with are senior citizens or people experiencing health challenges. Abacus Life seeks clients with life expectancies of 15 years or less.

Jackson said when Abacus Life takes over a life insurance policy, the company pays all of the policy’s future premiums. Abacus Life keeps the policy active until the company can collect the policy’s death benefit. Jackson said Abacus Life works with males aged 75 years or older because a 75-year-old male has, on average, a life expectancy of 15 years.

“A lot of people don’t know this, but our life expectancy changes as we age,” Jackson detailed. “The national average for life expectancy is around 72 years. But if you make it to 75 years as a male, the averages indicate you’ll live for another 15 years.”

Abacus Life also works with people who are critically ill. The company partners with cancer clinics and hospitals across the country to provide financial options to patients with critical illnesses.

Abacus Life seeks to bring empathy to every conversation with clients. Jackson said life expectancy isn’t something everyone feels comfortable discussing, so Abacus Life approaches conversations about life expectancy with compassion and respect.

Life Expectancies Influence Payout Ranges

Not everyone is a prime Abacus Life candidate. Jackson said individual circumstances can vary, but people who are relatively young and healthy should probably not sell their life insurance policy.

“Life insurance makes sense for a lot of people,” Jackson said. “But it stops making sense when you’re 75 years old and your kids have moved out of the house and are supporting themselves.”

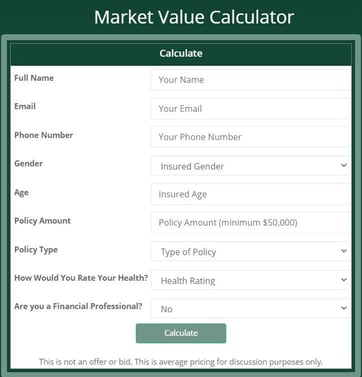

Jackson said the amount of money a policyholder receives for selling their life insurance policy to Abacus Life varies. On average, Abacus Life pays clients slightly more than 20% of their policy’s face value. Jackson said clients with shorter life expectancies may receive higher payouts.

“If someone has a life expectancy of 14 months, we might pay 70% or 80% of their policy’s face value,” Jackson explained. “On the other hand, an individual with a life expectancy of 15 years and high premiums might receive a payout equal to 10% to 15% of their policy’s face value.”

Abacus Life relies on third parties to calculate an individual’s life expectancy. Abacus Life, a HIPAA-compliant business, provides partner institutions that calculate life expectancies with a prospective client’s medical records.

Abacus Life makes a financial offer to purchase a prospective client’s life insurance policy based on the person’s life expectancy and the details of their policy. Abacus Life provides its clients with the information it uses to calculate the value of their life insurance policy.

“We show every single client we make an offer to how exactly we came up with the figure we’re offering,” Jackson said. “We want to make sure people know we’re presenting them with a fair offer.”

Abacus Life Helps Clients Prepare for the Future

Abacus Life offers viatical settlements to clients with life expectancies of less than two years. Jackson said viatical settlements function similarly to other life settlements, but recipients of viatical settlements don’t pay taxes on the proceeds of the sale of their life insurance policy.

Abacus Life offers hybrid settlements, allowing clients to receive a payout from the company while maintaining life insurance coverage.

“Someone with a $1 million policy might approach us and say they want to keep $500,000 of their policy and sell the remaining $500,000,” Jackson said. “We’ll make a cash offer for the portion of their policy they want to sell and facilitate them maintaining coverage for the other $500,000.”

Abacus Life, which went public in 2023, operates a wealth management division, ABL Wealth. Jackson said people who sell their life insurance policy may suddenly have more cash than at any previous point in their lives. ABL Wealth can help clients take the proceeds from a life settlement and create an annuity. It can also assist clients in developing a financial plan.

“Through ABL Wealth, we talk with clients about their financial health holistically,” Jackson said. “We care about our clients from the very first phone call we have with them. When clients sell their policy to us, we don’t just cut them a check and say our goodbyes. We have discussions with them to improve their long-term financial health. And that’s something no one else is doing.”

![3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year]) 3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/carbuy--1.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying a Car ([updated_month_year]) 7 Best Credit Cards for Buying a Car ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-for-Buying-a-Car-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Money Orders ([updated_month_year]) 7 Best Credit Cards for Buying Money Orders ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Buying-Money-Orders-Feat.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards After Buying a House ([updated_month_year]) 12 Best Credit Cards After Buying a House ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Best-Credit-Cards-After-Buying-a-House.jpg?width=158&height=120&fit=crop)

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![5 Best Credit Cards For Paying Car Insurance ([updated_month_year]) 5 Best Credit Cards For Paying Car Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-for-Paying-Car-Insurance.jpg?width=158&height=120&fit=crop)