Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: California’s Bay Area is home to some of the most inventive technology companies in the world. Technology Credit Union, headquartered in San Jose, California, shares the region’s innovative spirit. The credit union’s members can access banking services via its virtual branch and control their credit and debit cards from an app. Technology Credit Union is expanding its operations to extend convenience to its members throughout the U.S.

Innovation can level the playing field in business. Though a company may have a track record of solid earnings and be dominant in market share in its region, it may be vulnerable to its competition if it isn’t innovative.

Technology Credit Union has a history of innovation in the credit union space. We spoke with Robert Reed, Technology Credit Union’s Executive Vice President and Chief Retail Banking Officer, to learn how the credit union’s innovative approach positions it for growth and best serves its members.

Reed said Technology Credit Union (Tech CU) is the first credit union in the U.S. to offer asset-based lending and was the first credit union to partner with Tesla.

“We’re also one of the first credit unions to offer its members access to a virtual branch,” Reed said.

Tech CU has physical branches throughout Northern California, but members can use the credit union’s virtual branch from anywhere they can access the internet. Reed said Tech CU’s virtual branch allows members to use the same personalized banking services they’d have access to in the credit union’s brick-and-mortar branches.

Members can meet with a virtual banker and execute banking transactions via Tech CU’s virtual branch. Reed said Tech CU scheduled more than 2,300 appointments in its virtual branch in 2023, an increase of 32% over 2022.

Tech CU serves more than 170,000 members across the U.S. and provides personal banking, wealth management, private banking, commercial lending, and business banking services. Reed said the credit union’s service differentiates it from its competitors.

“We work hard to wow our members,” Reed said. “We often cite our Yelp reviews as a benchmark as to whether we’re really exceeding our member’s expectations and delivering a good member experience. As proud as we are of our five-star reviews, we’re probably even more proud when we’re able to turn the occasional review awarding just two or three stars into a five-star review because of our speed to correct issues.”

Personalized Services Meet Members’ Needs

Reed said Tech CU doesn’t incentivize its member-facing employees to cross-sell products and services.

“Our employees make product and service recommendations to members based on the member’s needs and overall financial situation,” Reed said.

Tech CU prioritizes providing members with a single point of service. Reed said any Tech CU employee in a member-facing position has the authority to navigate interactions comprehensively.

“We allow our members to resolve their concerns without having to speak with multiple credit union employees,” Reed explained. “The less we need to refer someone to another department, the better. This approach provides a much more seamless member experience. It also enables employees to feel entrusted to make decisions and handle interactions in a way that they feel is truly best for the member.”

Tech CU offers members credit cards that merchants worldwide accept. Tech CU’s rewards credit card allows members to earn points for every dollar spent on purchases. Reed said members can redeem points for gift cards, merchandise, and travel rewards. Members can also earn bonus points when they shop with select local and national merchants.

Reed said Tech CU designed its secured credit card to help members establish and repair their credit. The credit union’s unsecured card offers the lowest interest rate among Tech CU’s credit cards.

Tech CU enables cardholders to access card security and control features via its card management system. Reed said members can use the credit union’s app to access various components, including controlling where cardholders can use the card, establishing per-transaction spending limits, locking and unlocking the card, and viewing real-time transactions and alerts.

Partnering With Sports Teams Forges Community Bonds

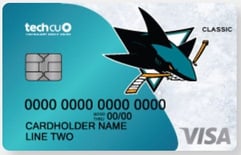

Tech CU enjoys partnerships with two professional hockey teams in California — the National Hockey League’s San Jose Sharks and the American Hockey League’s San Jose Barracuda. Members can show their support for the hockey teams by having their Tech CU debit and credit cards feature the logos of either the Sharks or the Barracuda.

Reed said Tech CU is proud of its partnerships with the Sharks and the Barracuda.

“There is a synergy between how these organizations focus on community development,” Reed said. “Our cards are competitively positioned, and we provide branding options that appeal to a wide variety of people. Our co-branded credit and debit cards featuring the logos of the Sharks and the Barracuda give members the unique satisfaction of knowing their support of their favorite team is on display each time they use their cards.”

Tech CU cardholders gain early entry to Sharks games held at the SAP Center and Barracuda games at the Tech CU Arena. In November 2023, the credit union announced a promotion for its cardholders offering them the opportunity to win access to the teams’ pregame warmups from the team bench or the penalty box.

Tech CU provides products and services to help members grow their credit and improve their financial health. The credit union partners with SavvyMoney to provide members with their credit scores. Reed said Tech CU is committed to helping members gain insight into establishing and building credit.

“Our tools help members understand the factors that can influence their credit score and how they can improve their scores,” Reed said. “Members can monitor their credit report for any changes, which can help them prevent identity theft. We also offer a program for people who are new to the country or the workforce to help them establish their credit.”

Wealth Management Solutions Help Members Plan

Tech CU’s Family Banking accounts are for children under the age of 18. A parent or guardian who links their account to their child’s account through Tech CU’s app can monitor their child’s banking activity. Reed said the product helps parents teach their children about money management in an environment that promotes accountability.

Tech CU’s wealth management solutions help its members plan their financial futures. Reed said the growing sophistication of financial markets offers consumers complex financial instruments for investing.

“We’ve built out a full wealth management offering designed to help our members meet their financial objectives — from starting a business to planning for retirement,” Reed said. “Our members receive advice and access to digital investing tools to help them make informed financial decisions that align with their goals.”

As Reed looks toward Tech CU’s future, he said he is excited about the credit union’s plans to expand into new markets and serve new members. Reed said that, since 2017, geographic expansion has been one of Tech CU’s most important strategic initiatives.

Tech CU opened a new branch in Austin, Texas, in January 2024. Reed said the credit union plans to open its first branch in Boise, Idaho, during the fourth quarter of 2024.

“Both our Austin and Boise locations are especially important to us — not only are those cities dominant in the tech sector but we have current members residing in those areas,” Reed said. “We’re eager to serve them with an actual physical location. We’re considering future expansions in additional technology-centric regions where our members may move. Our goal is to be where our members are.”

![12 Credit Cards that Offer Free Checked Bags ([updated_month_year]) 12 Credit Cards that Offer Free Checked Bags ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-that-Offer-Free-Checked-Bags.jpg?width=158&height=120&fit=crop)

![11 Banks That Offer Secured Credit Cards ([updated_month_year]) 11 Banks That Offer Secured Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Banks-That-Offer-Secured-Credit-Cards.jpg?width=158&height=120&fit=crop)

![Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year]) Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/refer.png?width=158&height=120&fit=crop)

![9 Best Credit Cards For Streaming Services ([updated_month_year]) 9 Best Credit Cards For Streaming Services ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Best-Credit-Cards-For-Streaming-Services.jpg?width=158&height=120&fit=crop)

![Credit Cards vs. BNPL Services: What to Know in [current_year] Credit Cards vs. BNPL Services: What to Know in [current_year]](https://www.cardrates.com/images/uploads/2024/02/Credit-Cards-vs.-BNPL-Services.jpg?width=158&height=120&fit=crop)