Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Regularly reviewing credit reports is widely considered to be a necessary practice for people seeking personal financial health. But evaluating credit reports can be a laborious and convoluted process. ScoreSense helps consumers understand their credit reports and the factors that impact their credit score. Its team of credit specialists is available for personal consultations and guidance on how to resolve credit disputes with the bureaus. ScoreSense is committed to helping its customers navigate their credit journeys.

Most people don’t have sufficient cash to finance some of life’s more significant expenses, such as purchasing a home, vehicle, or education. When done responsibly, borrowing money can be essential to fulfilling one’s dreams.

Lenders often use credit scores and information from consumer credit reports to inform their lending decisions, so ensuring the accuracy of credit reports is important. Misreported items and mistakes on a credit report, even the ones that may seem inconsequential, may impact a consumer’s ability to borrow money from a lender.

The three credit bureaus — Equifax, Experian, and TransUnion — each provide consumer credit reports. Consumers have the right to review their credit reports and dispute any mistakes they discover. But credit reports aren’t always easy to understand, especially for those examining their reports for the first time.

ScoreSense was created in 2010 to help consumers access and understand their credit reports. Millions of customers have used ScoreSense and its benefits since its inception.

We checked in with Brian Sullivan, ScoreSense’s Vice President of Marketing, to discuss how ScoreSense can help consumers stay on top of their credit profile.

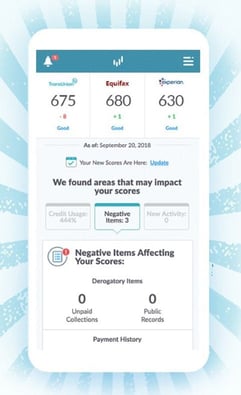

“ScoreSense provides consumers with access to credit reports and scores from all three credit bureaus,” Sullivan said. “We also provide insights and analysis into what’s impacting an individual’s credit score.”

Sullivan said most consumer credit products use one credit report and credit score. But a consumer may not know which bureau’s information a lender is using, so reviewing the information reported by all three bureaus is recommended.

“One in five credit reports have an error of some kind in them,” Sullivan said. “We’ll call out any discrepancies between the bureaus’ reports and show consumers how to dispute any errors that may exist as well.”

Credit Specialists Provide Personalized Guidance

Sullivan said that, in the past, businesses reported consumer credit information to the credit bureau working within a specific geographic region. Smaller businesses may still choose which credit bureau to report consumer information to based on industry relationships. But most corporations report to all three bureaus.

A consumer’s credit score can vary across the three credit bureaus. Sullivan said he’s seen instances of scores differing by as much as 100 points from one bureau to another.

“If there’s a big difference in credit scores, it’s often due to an error — maybe something was reported incorrectly by one of the bureaus,” Sullivan said. “For example, I’ve seen occasions where a customer had a fraudulent account that was in delinquency status on their credit report, but that information was only reported to one of the bureaus. That customer had a significantly lower credit score reported by the bureau that had the delinquent account than the other two.”

Sullivan said many consumers don’t have a thorough understanding of credit — it isn’t a subject that’s usually taught in schools. ScoreSense learned from customer feedback that consumers want to talk about their credit situations with credit specialists.

ScoreSense’s Credit Specialists provide customers one-on-one consultations via phone and online chat. ScoreSense’s live chat service is also available seven days a week.

“Our Credit Specialists start by working in ScoreSense’s call center, which allows them to develop a familiarity with the types of inquiries customers have,” Sullivan said. “Then they undergo training programs before fielding calls as a Credit Specialist.”

Serving Customers at All Stages of Their Credit Journey

Accessing credit reports is one thing, but understanding the information the reports contain is another. ScoreSense’s credit insights help consumers evaluate their credit reports and understand the factors that can impact credit scores.

“If you’ve never looked at a credit report before, it’s difficult to just pick it up and immediately grasp what you’re reading,” Sullivan said.

Sullivan said ScoreSense slices credit reports into bite-sized pieces, categorizing information so it is accessible to consumers. ScoreSense identifies which of a consumer’s accounts have been reported to which bureau, so the consumer doesn’t have to sift through each of the bureaus’ reports to identify any discrepancies.

ScoreSense provides comprehensive information for consumers who have errors on one or more of their credit reports and need to dispute the report(s). ScoreSense’s Credit Specialists are available to provide guidance on the dispute process.

Sullivan said ScoreSense’s customers develop an appreciation for the importance of monitoring their credit every month.

“Regularly reviewing your credit, as opposed to just looking into it every once in a while or when an issue arises, can help consumers stay on top of their finances,” Sullivan said.

ScoreSense customers seek the company’s services for a variety of reasons.

Sullivan said many customers enroll because they are in the process of buying a new home or making another significant expenditure that requires them to apply for a loan.

“Ideally, they are able to review their credit reports and scores before they go to the bank for a loan and receive a loan offer, so they understand their credit situation and can feel comfortable with the process,” Sullivan explained.

Sullivan said victims of identity theft enroll in ScoreSense to alert them of any further reported potentially suspicious activity.

ScoreSense sees an increase in customer enrollment each January.

“The beginning of the year is just some people’s preferred time to pay attention to their credit,” Sullivan said. “It’s also a time that’s leading up to tax season, and maybe it’s some people’s New Year’s resolution to pay closer attention to their finances and get in the habit of keeping an eye on their credit.”

ScoreSense Values Customer Satisfaction

ScoreSense values customer feedback and prioritizes understanding what’s on its customers’ minds, Sullivan said.

“We pay attention to our customers’ needs and conversations between our customers and Personal Credit Specialists is just one example,” Sullivan said. “Listening to our customers helps spur new ideas.”

ScoreSense uses customer surveys to learn which products need enhancements and where the company needs to provide further education to its customers.

ScoreSense devotes a section of its website to customer education on various topics, including credit repair scams and the difference between charge-offs and write-offs.

Sullivan said customer retention is of utmost importance to ScoreSense.

“We take a lot of pride in retaining our customers,” Sullivan said. “We know that customers who continue to use our products are monitoring their credit regularly. We also keep track of online reviews that customers post. That helps us make sure our products are functioning correctly and that consumers are pleased with them.”

A membership to ScoreSense costs $29.95 per month, but the company offers a free trial to consumers interested in trying its products before enrolling in a membership.

As for the future, Sullivan said ScoreSense will continue to personalize the user experience for its customers as much as possible.

“If you’re in the market to buy a new home, and you come to our site, we want to provide you with the steps you should be taking during the home-buying process,” Sullivan said. “And those steps should be specific to your financial situation and your credit circumstances.”

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![How to Freeze Your Credit Reports in [current_year] How to Freeze Your Credit Reports in [current_year]](https://www.cardrates.com/images/uploads/2018/10/CR-Cool.png?width=158&height=120&fit=crop)