Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Post-pandemic US workers suffer from a decided lack of buying power, with many recent surveys showing most Americans live from paycheck to paycheck. As the nation’s largest financial wellness benefits servicer, FinFit meets the moment with products to help companies from the SMB to the enterprise level reduce employee economic uncertainty. FinFit’s new SafetyNet platform provides employees with fairer access to credit and an on-ramp to savings — which translates into better retention of the most productive hires.

Some say a perfect storm is brewing in the post-pandemic American economy due to inflation, higher interest rates, and other problems, including the end of student loan deferments in the fall of 2023.

Ample evidence exists of American workers’ economic precarity. A November 2022 PYMNTS survey reported more than half of workers earning healthy incomes between $50,000 and 100,000 live paycheck to paycheck. Of course, it’s worse for those on the lower end of the scale. PYMNTS data from June 2023 showed 61% of total adults relying on their next paycheck to pay immediate bills.

Struggling with these burdens in uncertain economic times, many workers are one minor crisis away from spiraling into transportation, food, and housing insecurity, leading to workplace distraction, job loss, and possible social dislocation.

Business owners and managers from the SMB to the enterprise level have a responsibility and an interest in alleviating conditions that impede workers financially. FinFit, the nation’s largest financial wellness benefits servicer, works with business owners and managers, including human resource departments and benefits administrators, to bring a sense of stability into the workplace, boosting workers, employers, and the economy.

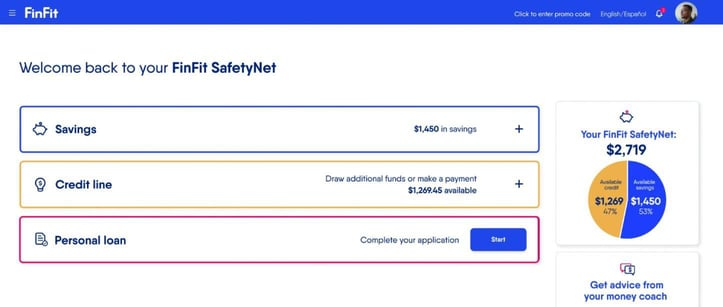

FinFit’s new SafetyNet platform encourages workers to accrue emergency savings and offers access to lower-interest credit, building on an already robust offering to meet the paycheck-to-paycheck epidemic.

Chief Revenue Officer Michael Woodhead told us SafetyNet expands FinFit’s vision that every American worker deserves financial security.

“We’re here to reduce stress on the American worker, increase productivity, and put people on a path from precarity to resilience,” Woodhead said. “The best way to do that is to provide tools and resources already available to financially healthy people that people in financial precarity do not have.”

Financial Support for Paycheck-to-Paycheck Workers

Many studies mirror the above results, attesting that living paycheck to paycheck has been normalized in our society. The Federal Reserve Bank of New York identified another symptom in November 2023, reporting total household credit card debt at a record $1.08 trillion.

Woodhead said it’s evidence that the financial services industry has historically underserved the paycheck-to-paycheck worker.

“We saw a bad problem that was just getting worse,” Woodhead said. “We saw an entire industry dedicated to financial wellness that was falling flat and failing to serve the American worker in ways that made a meaningful impact.”

FinFit’s SafetyNet addresses these concerns in several ways. SMB to enterprise employers that offer FinFit’s SafetyNet to their workers put them on a path to fairer banking, with prime-level credit, emergency savings, and longer-term savings for retirement. SafetyNet’s proactive approach builds worker loyalty and increases engagement, productivity, health outcomes, and ROI.

FinFit’s SafetyNet makes access to fairer credit, including prime credit to many subprime borrowers, possible by looking beyond traditional credit score criteria. As the country’s largest provider of payroll-integrated credit services, FinFit can assess risk and underwrite transactions based on more data than anybody else.

“Our data robots for underwriting are just sharper,” Woodhead said.

FinFit’s SafetyNet also provides an on-ramp to emergency savings through its no-credit-check emergency credit solution, making establishing and building emergency savings push-button easy for American workers. By filling the gaps left by recent federal legislation, SafetyNet also allows workers to begin saving productively for retirement.

These solutions are possible because FinFit integrates with the employer’s payroll system, allowing workers to access credit, pay back through their paycheck, and optionally, save money into an emergency savings account, all at the same time.

“Because it’s held like a Roth IRA, it gives you unlimited access to liquidity,” Woodhead said.

A Privacy-Focused Employee Benefit

SafetyNet bolsters FinFit’s already robust resource toolkit, which provides workers access to free one-on-one financial coaching, financial literacy courses, and budgeting and cash flow management tools — all presented through a dashboard-based, mobile-enabled online platform that supports push notifications.

As an employee benefit that requires payroll integration, FinFit is a product built on partnerships with employers. But it doesn’t shine a light on workers’ sensitive personal data because interactions with the platform occur outside that partnership. Workers create their logins and can access the platform anytime, anywhere.

“There’s an impenetrable barrier between FinFit services and employees that employers can’t cross,” Woodhead said. “Transactions between the employee and FinFit are private and secure and do not involve the employer.”

That’s important because many employees would be embarrassed for their employers to know the details of their financial situation. Despite the reports above indicating most workers experience challenges today, FinFit respects cultural preferences against revealing personal financial data in the workplace.

“It’s nothing to be embarrassed about, but frequently employees are, and so the transactions they do on the FinFit platform are safe, secure, and 100% private to the employee,” Woodhead said.

That allows employers to offer a necessary benefit that supplements overall employee wellness programs by focusing on financial well-being, which is today’s number one cause of employee stress.

FinFit’s SafetyNet solutions alleviate employee concerns with ongoing transportation, food, and housing security so they can focus on job security. Because financial precarity threatens employment stability, FinFit solves that problem for employers in a way that allows for direct-to-employee interactions that do not obligate the employer in any way to have financial responsibility for the solutions employees choose.

“We help the employer reduce that stress and drive productivity in their workforce,” Woodhead said.

Boost Acquisition, Retention, and Productivity

Founded in 2008, FinFit currently serves more than 185,000 clients across the US. Holistic financial wellness services include personalized assessments, money management tools, and a member rewards program. The company strives to create positive, healthy financial behaviors with products that support behavioral change.

These outcomes are as valuable to employers, the economy, and society as they are to employees. FinFit benchmarking data shows that companies that adopt the company’s solutions increase employee retention by 25% or more. Employers offering FinFit solutions reduce employee 401(k) borrowing by more than 50%.

Woodhead said helping workers establish more secure circumstances also reduces absenteeism.

“If you have a significant automobile issue and need a $1,200 repair, you can come to FinFit, and we can give you affordable access to money to get you back on the road again and maintain uninterrupted transportation to and from work,” Woodhead said.

FinFit also reduces presenteeism — lost productivity due to distractions like illness and financial stress.

“Employees don’t have to worry about their finances because we’re establishing a financial safety net for them — which involves access to affordable credit and emergency savings funds,” Woodhead said.

FinFit facilitates and underwrites loan transactions as a loan servicing company, guaranteeing repayment to the lender. It’s solely responsible for defaults, so employers signing on with FinFit can rest assured they’re secure.

The company’s proprietary technology underwrites transactions to less than a 5% default rate, although the average borrower’s credit score may be in the 550 range. That’s a borrower demographic that major lending institutions cannot provide access to.

Workers steadily report positive outcomes to FinFit, disclosing that FinFit helped them avoid evictions and other counterproductive consequences while building confidence in their financial futures.

“It’s gratifying for us to know we can help folks in a tough spot,” Woodhead said.

![17 Best Credit Cards for Business Expenses ([updated_month_year]) 17 Best Credit Cards for Business Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/expense.png?width=158&height=120&fit=crop)

![12 Best Personal Cards For Business Expenses ([updated_month_year]) 12 Best Personal Cards For Business Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/BusinessPersonaCard1.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Wedding Expenses ([updated_month_year]) 12 Best Credit Cards for Wedding Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/weddings.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for Pet Owners & Expenses ([updated_month_year]) 9 Best Credit Cards for Pet Owners & Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Best-Credit-Cards-for-Pet-Owners.jpg?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)

![How to Pay Off Credit Card Debt ([updated_month_year]) How to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/How-to-Pay-Off-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)