In a Nutshell: Digital transformation in financial services has led to an explosion of innovation in the payments industry. But until fast-growing Primer arrived in 2020, taking advantage of it was a challenge for merchants. Primer manages multiple providers and services on a single platform, enabling merchants to build custom payment flows and maintain a unified checkout for customers. Plus, actionable data generated by the secure Primer platform helps merchants choose the best payment strategies to drive business value.

All over the world, the payments process is converging on digital forms. From the merchant’s perspective, digital payments are more secure and efficient and offer greater control and visibility with lower overhead. And it’s always in the merchant’s interest to give customers and partners more freedom to use the cards and other payment methods they prefer.

The problem for merchants is that now there’s so much choice. In addition to the plethora of payment service providers competing for business are companies offering fraud protection services, loyalty programs, and chargeback management services, among many other services. Another merchant objective is to leverage payment data to achieve more significant accounting and enterprise management goals.

For every merchant, there’s a best-case payments pathway — or maybe several that can work together to maximize flexibility for customers and improve returns. But merchants can’t choose the best plan if they don’t know what it is.

In their roles at global payment processor PayPal, Gabriel Le Roux and Paul Anthony worked every day with mid-market and large enterprise companies facing that sort of dilemma. Those companies understood the advantages of choosing from among different solutions, but there wasn’t a tool for efficiently assessing the available alternatives and placing them in seamlessly constructed, end-to-end payment flows.

So, in 2020, Le Roux and Anthony created Primer, the world’s first automation engine for payments. Primer enables merchants to construct an ideal payments experience by combining services to create unique and sophisticated payment flows — with no coding expertise required. Attraction and adoption have been rapid, by both merchants and payment services companies in locations across the US, the UK, Europe and Asia. In October 2021, Primer announced a $50 million Series B funding round that valued the 20 month old business at $425 million.

“Merchants can treat payments as a first-class product area they can use to drive business value and customer loyalty,” Le Roux said. “They can just flip a switch and incorporate any new provider or solution as part of their payment stack.”

Universal Checkout Across Platforms and Markets

Before Primer came on the scene, accomplishing that was essentially a cut-and-paste job for developers building from scratch. From the customer’s perspective, that could mean a different checkout experience depending on the payment method, platform, market, or country in which the transaction occurred.

Different regulatory or security regimes in different markets are a particular source of friction.

“Services need to work together to provide value to merchants and consumers,” Le Roux said. “But it’s no good to present an amazing experience to customers on your website, and then when they arrive on your checkout pages, it’s suboptimal, with the checkout you have in the U.K. different from the one you have in the U.S.”

Primer solves that with Universal Checkout, its development toolkit that creates seamless checkouts across a company’s payment landscape.

“In industries that are highly saturated with a lot of competition, you can use payments as a way to differentiate yourself,” Le Roux said.

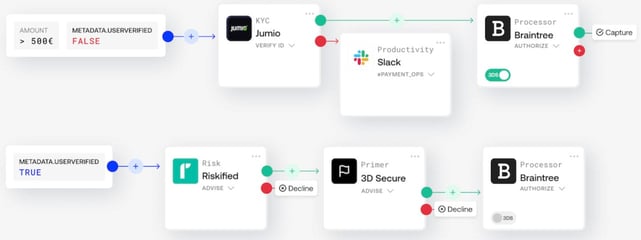

Within Universal Checkout, dynamic payment flows provide merchants with a fully customizable and consolidated checkout that works across platforms, ensuring different payment pathways always boil down to the same look and feel.

“As a merchant, you want to make sure you can adapt to what your customer wants to have as part of the checkout experience,” Le Roux said.

One important consequence of this innovation is a reduction in customer authentication requests through unified 3D Secure 2.0 protocol implementation across all processor connections.

“A card transaction may go through a fraud provider and a KYC engine before the merchant proceeds with authorization,” Le Roux said. “All of that is possible today.”

Data Integration Offers Actionable Insights

Payments are critical for business operations, but they also present an opportunity to learn about customers and drive loyalty. By unifying payment flows on a single platform, Primer delivers valuable data to businesses as it facilitates transactions.

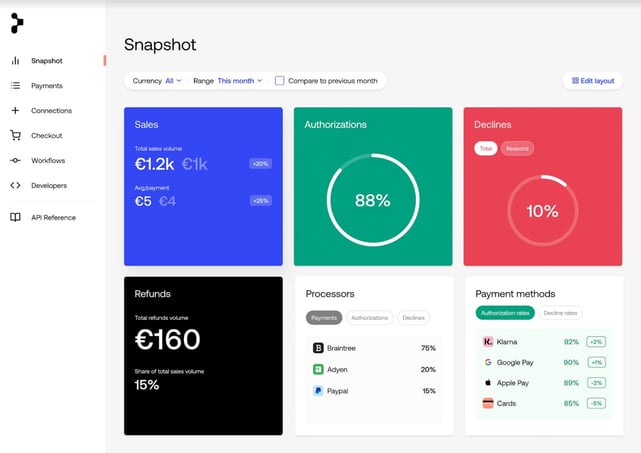

“When you use a multitude of individually integrated services, you have to log on to dashboard number one and understand what’s going on there, and then dashboard number two, and so on,” Le Roux said. “With Primer, you can have visibility across your payment stack, on one single dashboard, revealing which services are used when, by whom and – critically – how well.”

Merchants can then define how they want to use that data. Being able to assess authorization and decline rates for different providers and methods, for example, enables merchants to make data-informed decisions based on performance.

The platform consolidates nonstandard payment decline codes into a single list, helping merchants understand the reasons for card declines and integrate soft declines when practicable.

Primer also provides actionable insight on why customers abandon the checkout process, detecting such friction points as slow responses from processors and service providers, payment methods that don’t convert well, and frictional payment flows through 3D Secure.

“Merchants have told us that they have difficulty understanding their payment data,” Le Roux said. “With Primer as the underlying payments infrastructure, merchants receive a consolidated stream of data for making more intelligent decisions on how they want to proceed with their payment strategy.”

And that means more responsiveness for companies looking to respond to marketplace changes quickly.

“Imagine you’re on a marketing team, and you know Venmo would be an amazing product to have because your company wants to attract millennials,” Le Roux said. “With Primer, you just flick a switch, create a workflow, define when Venmo should be used, and that’s it.”

Leveraging Payments to Drive Business Value

As the global card and payments ecosystem continues to diversify, more merchants choose to work with Primer because it offers a platform for changing with the times.

Primer Connect, for example, offers payment providers an open app framework for building connections, further simplifying the development process for merchants.

“We’re bringing on some amazing brands — the likes of Klarna, Worldpay, Stripe, GoCardless, and Sift,” Le Roux said. “They’re making Primer a truly open payments infrastructure, which means that any payment service can now connect to Primer directly.”

Meanwhile, merchants on Primer can turn on a dime and stay ahead of the changes in industry and consumer preferences, all while monitoring and tweaking systems for better performance.

“Companies all have these amazing services they want to add in order to launch in new markets, optimize fraud protection, attract new customers, and more,” Le Roux said. “But the fact of the matter is that it’s a massive challenge.”

They need to prioritize which services to add and when, learn how to use them, and ensure they can work in conjunction with all the other services they’ve added previously.

“The point of Primer is to compress that payments road map,” Le Roux said. “You integrate Primer, and now you have access to all these services in just a few clicks.”

And that turns the payments process into a growth driver for businesses instead of a cost center.

“For us, it’s exciting to be on the side of the merchant, helping them build unique payment flows and accelerate their payment strategies,” Le Roux said. “Primer helps merchants create new commerce experiences.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year]) Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Is-It-Bad-to-Apply-For-Multiple-Credit-Cards-At-The-Same-Time.jpg?width=158&height=120&fit=crop)

![7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year]) 7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Ways-to-Manage-Credit-Card-Debt-When-Interest-Rates-Rise.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Tax Payments ([updated_month_year]) 7 Best Credit Cards for Tax Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-for-Tax-Payments.jpg?width=158&height=120&fit=crop)