In a Nutshell: With credit card utilization rates increasing, consumers are taking on larger amounts of debt than in years past. This can lead to financial pitfalls that may be hard to overcome. One of the biggest barriers to receiving help can be the shame people associate with their mistakes. Bruce McClary of the National Foundation for Credit Counseling discussed these crucial issues with us, noting that consumers shouldn’t feel embarrassed about their missteps. Confronting them and discussing them is the first step to remediating debt issues. Additionally, it is important for adults — regardless of their own mistakes — to discuss the issue with their children, so they can avoid mistakes as well.

As the coronavirus pandemic has continued to impact the economy, more families have turned to their available lines of credit or have considered applying for new credit as a way to stay afloat financially, said Bruce McClary, Senior Vice President of Communications for the National Foundation for Credit Counseling.

“There is certainly potential for more borrowing and use of credit as many of the original stimulus programs expire,” he said. “With many lenders becoming more risk averse in a distressed economy, top credit scores become an important goal for those hoping to borrow affordably. Programs like Ultra FICO and Experian Boost can help consumers make some progress toward an improved score by allowing non-traditional payment activity to reflect positively on their credit.”

While both programs are being framed as an opportunity for consumers on the cusp of good credit standing to access loans and more financial services, McClary’s analysis of the move reveals the underlying nature of the decision. These days, a growing number of consumers have struggled with on-time payments and credit utilization, but lenders are looking for ways to look past traditional algorithms to determine creditworthiness, he said..

Bruce McClary is the Senior Vice President of Communications at the National Foundation for Credit Counseling.

With so many consumers sitting on high credit card balances and in danger of facing prolonged financial hardships, more and more people are likely falling behind on payments and succumbing to other financial pitfalls.

McClary and his colleagues at the NFCC strive to help consumers through credit counseling, financial education, and many other valuable resources.

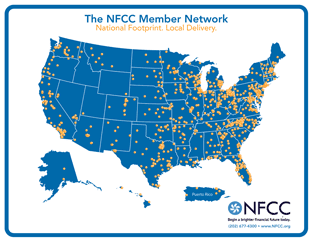

Founded in 1951, NFCC is the nation’s largest and longest-running nonprofit financial counseling organization. NFCC member agencies assist more than 1 million consumers each year with a plethora of free or affordable services, including credit and debt counseling, bankruptcy counseling, student loan debt counseling, debt management plans, and credit report reviews.

McClary said a lot has changed in the consumer finance world since the NFCC’s inception.

“In 1951, very few people had access to credit cards or lines of credit,” he said. “First, you had to be a man. You had to have all the right credit references. There were no fair credit guidelines, so lenders could pretty much come up with arbitrary reasons to approve or reject your line of credit.”

He explained how the credit card industry has evolved over the years, with the first credit card boom coming in the late 1960s when companies, including American Express, Master Charge (now Mastercard), and Diners Club, became prevalent. Another explosion in the 1980s opened up even more conduits for consumer credit lines, which eventually led to today’s landscape where credit card options can seem limitless.

McClary shared some of his credit counseling expertise with CardRates by addressing some of the most crucial debt issues facing consumers today and offering some sound advice for the next generation as well.

Financial Mistakes Should Be a Starting Place for Discussion, Not a Point of Shame

McClary said consumers who are using credit cards with confidence are generally carrying larger balances these days, but for many consumers, once the balance reaches a certain point the alarm bells start going off. That’s when people start thinking about the long-term cost of carrying that high debt and the short-term impact that those payments are having on their budget.

That’s also when people start looking for the best ways to clear that debt off the books and reduce or eliminate their balances, he said.

But successfully tackling debt is easier for some consumers than others. People who struggle to bring down their credit card debt often fall behind in other financial areas as well, leading to a snowball of financial difficulties. This is especially true when there is no savings and increasing uncertainty regarding future employment.

But successfully tackling debt is easier for some consumers than others. People who struggle to bring down their credit card debt often fall behind in other financial areas as well, leading to a snowball of financial difficulties. This is especially true when there is no savings and increasing uncertainty regarding future employment.

Sometimes, rather than seek help from the wealth of resources available to them these days, people behind in their debt choose to keep their burden to themselves. This is dangerous because not only can they continue to slide into debt, but they don’t have the tools to avoid similar situations in the future.

“Even for somebody to schedule a session with a counselor, just setting that appointment in and of itself is a tremendous milestone because there is so much shame associated with having discussions about financial mistakes,” McClary said. “People should be proud of taking that step because it can be life-changing in the best ways.”

Too many people are led to feel that it is not appropriate to have discussions with anyone about poor decisions they may have made around personal finance or the struggles they face because of circumstances beyond their control, he said. As an organization, the NFCC seeks to establish a level of trust with each client before they even interact with a counselor in hopes that they can overcome any shame or fear associated with financial missteps and just focus on the future.

“I always tell people that we have helped millions of Americans since 1951, the odds are pretty good that, when they speak to a counselor their circumstances will be something that we’ve worked with before,” he said.

McClary said establishing that bond of trust is crucial to most effectively help consumers. When he was still conducting credit counseling sessions, he said he never passed judgment, no matter how unusual the circumstances. The same goes for the other counselors throughout NFCC.

He said it is also important to note that consumers who come to the NFCC for help can feel secure their information is kept confidential and their story or circumstances will not be shared with anybody else.

McClary said many for-profit debt relief companies tend to skip the important steps of establishing trust to gather the most information about the consumer’s situation. He said this can lead to the consumer being given advice that’s not properly aligned with their circumstances.

For Young People, Learning Financial Basics at Home is Crucial to Future Success

“When you look at how the public systems are providing financial education today compared to 20 years ago, I think we are in a much better place,” McClary said. “But, are we where we should be? Probably not.”

He said financial education in schools is really a mixed bag that can vary from state to state, and some states still fall woefully short. That’s why it is incredibly important to look at what children are learning about financial issues in the household.

“Are parents really engaged in the financial decisions that their children are making?” McClary said. “When you hand your child allowance, does it come with instructions? Or is it just money that you’re giving them, and you’re letting them fend for themselves in making their own financial decisions?”

McClary said it is important to include children in budget conversations in the home.

It is important for parents to have an open dialogue with their children about financial issues, so they can be prepared when they enter the real world, he said.

McClary said he would oftentimes be met with hesitation from parents when he emphasized to them the importance of providing financial education to their children. Similar to the cycle of shame they felt discussing their financial mistakes with outsiders, parents also did not feel they should discuss them with their children, he said.

Not only were they embarrassed, but the parents felt that, because of their less-than-stellar financial track record, they weren’t qualified to educate their own children on financial issues. The parents also didn’t want to pass their bad financial habits to their children.

But McClary said he would push them to talk with their children.

“Don’t be ashamed about the mistakes you’re making, use those as teachable moments,” McClary said he would tell clients. “And not just the mistakes themselves, but the things that you’re doing to try to improve your financial situations. That can go a long way in helping your children to make smart financial decisions for themselves.”

It’s much better to face the issues head on than to gloss over them and treat personal finances like it’s a taboo subject, he said, it just sets the children up for failure in the future.

“Families should have open talks about finances,” McClary said. “The parents should have regular discussions about setting the household budget and the children should be included in some of them so they have a clear understanding of what it means to have a budget and how important it is to set aside savings.”

NFCC Can Help Consumers Confront Difficult Debt Issues and Overcome Fears

“Our core service has been, and continues to be, credit counseling — specifically the credit and budget counseling because it’s really the combination of those two that is important,” McClary said.

The NFCC works with people to help them improve the way they manage their household budget while also helping them overcome any significant obstacles standing in the way of their ability to effectively manage their debt, he said.

The NFCC has member agencies across the U.S.

Overall, the dual objectives of NFCC’s services are to help consumers understand what to do about their debt now and how to keep it under control in the future, according to the NFCC website. Its broad range of counseling services suggests the steps to take toward these objectives through various consultations and financial education tools, depending on the debt area.

For those with considerable debt problems, NFCC may recommend a debt management program that can help significantly reduce or eliminate debt in 30 to 60 months. The plans are a systemic way to pay down outstanding debt with payments directly to an NFCC partner agency. The program may also be able to help consumers procure reduced or waived finance charges and fees.

“The hard part is getting people to the point where they feel comfortable talking about these things,” McClary said. “Talking to a credit counselor who is going to treat your circumstances with respect while at the same time providing you with professional financial guidance — I think that is an empowering moment.”

He said these conversations can really help to boost the confidence of someone who may be feeling bad about the financial choices they’ve made, or someone who may feel stuck in their circumstances.

Boosting Counseling Efforts Around Small Business, Student Loans, and Prospective Homeowners

With credit card utilization and debt not showing any signs of leveling off, McClary said the NFCC will continue to focus intensely on equipping consumers as best it can to address financial issues and avoid future pitfalls.

The organization is also gearing up to bolster its efforts in a few other key areas in the coming months.

This year, the NFCC continues to offer a small business owner financial coaching program, which helps business owners make better financial decisions while learning how to navigate the challenges of launching or growing a small business.

The nonprofit is also continuing to support its student loan counseling program, which is an area of significant demand, McClary said. NFCC can help clients find the most affordable repayment option for their circumstances and help them succeed in completing the program.

Finally, NFCC will be moving forward with the launch and expansion of its Envisioning Home Ownership program, which will help to educate people in low- to moderate-income brackets on the steps they can take toward owning a home.

“There are a significant number of people who could move from renting to homeownership with just a little bit of coaching,” McClary said. “Maybe they’re dreaming of one day becoming homeowners but for some reason, they’re not aware of just how close they are to making that dream possible. Our program will help people do that.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![How to Pay Off Credit Card Debt ([updated_month_year]) How to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/How-to-Pay-Off-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)

![7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year]) 7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Ways-to-Manage-Credit-Card-Debt-When-Interest-Rates-Rise.jpg?width=158&height=120&fit=crop)